I nearly fell out of my chair when I saw that Bitcoin was up 30% last weekend. A cryptocurrency that size often leaves clues before adding $250 billion to its market cap — significant whale buys, big influencer Tweets or an announcement that Elon Musk is setting up a crypto mining operation on Mars.

Instead, news outlets were left scrambling for answers. Some pointed to Amazon’s (NASDAQ:AMZN) rumored entry into cryptocurrency, while others blamed Bitcoin (CCC:BTC-USD) bears liquidating short positions. (For what it’s worth, my money’s on Chinese cryptocurrency miners who finally stopped dumping positions after their government’s mining ban two weeks ago).

And then, just as quickly — momentum vanished.

As investors try to predict what happens next, one thing is clear: Moonshot investors need to switch gears and shift their attention to altcoins.

That’s because Bitcoin’s recent rise leaves less room for more growth, not more. A 10x gain would make Bitcoin worth as much as the Dutch East India Company — the most valuable company in history — if that government-sponsored monopoly were still around today. A 100x rise would make Bitcoin worth more than all U.S. real estate combined.

Instead, investors looking for 5x… 10x… 100x gains need to look at smaller altcoins. And if you’re willing to take on a little more risk — as InvestorPlace’s Charlie Shrem also writes — the rewards can be stunning.

Rising Stars: Return of the Quality Cryptocurrencies

Though crypto doubters might roll their eyes at the concept of a high-quality cryptocurrency, these unicorns do exist, at least in relative terms. Scalable coins with efficient, dedicated networks have far more real-world use than copycat tokens that rely on Twitter marketing.

In a sense, this strategy is one InvestorPlace crypto expert Charlie Shrem has been talking about ever since creating one of the world’s largest Bitcoin exchanges. Charlie’s more of a buy-and-hold-for-3,000%-gains investor than a tactical trader.

But I’m following his lead now that quality cryptocurrencies have broken out of their three-month hibernation. So today, I’m adding three more high-quality altcoin plays to my “long-term buy” list.

- Cryptocurrencies to Buy: Internet Computer (CCC:ICP-USD)

ICP remains one of my favorite dark-horse candidates for the “next Bitcoin” crown. The cryptocurrency network retains backing by Andreessen Horowitz, one of the most prestigious venture capital firms in Silicon Valley. And its focus on using blockchain for cloud computing means it’s an altcoin with fascinating and widespread use cases.

It’s hard to forget ICP’s early failures. This former No. 8 cryptocurrency lost nearly 95% of its value after parent firm Dfinity “quietly allowed the treasury and insiders to send billions of dollars of ICP to exchanges,” per crypto analysis firm Arkham Intelligence.

Oops. Dfinity allegedly also made it “extremely difficult for their longtime supporters to access the tokens they were promised.”

Double oops.

But ICP’s early stumbles mean that investors can now climb aboard at a far lower price. Now at a comfortable $6.3 billion market capitalization, ICP is a gamble worth taking.

2. PancakeSwap (CCC:CAKE-USD)

New crypto investors may not know much about PancakeSwap, the decentralized exchange that processes much of the Binance (CCC:BNB-USD) Smart Chain. Yet, try to buy any Binance token — from SafeMoon (CCC:SAFEMOON-USD) to Shiba Inu (CCC:SHIB-USD) — and you’ll quickly learn how essential CAKE is to the BSC network.

That’s because PancakeSwap makes it possible (and relatively easy) to trade tokens that aren’t available on Coinbase (NASDAQ:COIN) or other centralized cryptocurrency exchanges. So instead of buying a flash-in-the-pan token that’s trending on Twitter, you can go the picks-and-shovels route and buy PancakeSwap instead (CAKE’s practically identical, slightly older twin Uniswap does the same for the Ethereum network).

CAKE has also emerged as a popular yield-farming tool for those looking to potentially earn 95% APR from staking CAKE itself. In other words, the market is still so inefficient that you can almost double your money annually by quite literally doing nothing.

Of course, APR returns will come down as markets become more efficient. But as the Binance chain continues to mature, PancakeSwap will likely continue its excellent run.

3. Robinhood (NASDAQ:HOOD)

Wait… how is Robinhood an altcoin play?

Surprisingly, Robinhood Crypto has emerged as one of the most popular Dogecoin trading platforms for the retail crowd. Though people can send Bitcoin via PayPal (NASDAQ:PYPL) and Square’s (NYSE:SQ) Cash App, it’s Robinhood’s intuitive (and often addictive) app that has kept people coming back for more. And if Robinhood installs a more experienced management team post-IPO, there’s a chance the app might one day become a cryptocurrency version of Visa (NYSE:V).

In the meantime, it could be worthwhile to keep tabs on the stock. When the firm goes public this Thursday, analysts expect the market to value the firm at $35 billion, or around $1,500 – $1,600 per account, according to an analysis by Wall Street Journal. Of course, that still isn’t cheap — the average Robinhood account held $4,500 at the end of Q2. But if Robinhood’s management can build on past successes to become a payment gateway, incumbent firms should watch out. This one-trick pony could quickly transform into an altcoin unicorn.

Falling to Earth: Spamcoins

Last week, I wrote about three Spamcoins to ride out Bitcoin’s nuclear winter: HODL (CCC:HODL-USD), WolfSafePoorPeople (CCC:WSPP-USD) and RichQUACK (CCC:QUACK-USD).

As a group, these have performed just as you would expect for Moonshots: HODL doubled in price while WSPP and QUACK lost -17 and -37%, respectively. (Remember, Moonshot investing involves looking for significant gains while understanding that not all will win).

Average gain? 12%. Not a bad week.

But now that energy has returned to higher-quality cryptocurrencies, it’s time to make some room in your portfolio by dumping these short-term tokens.

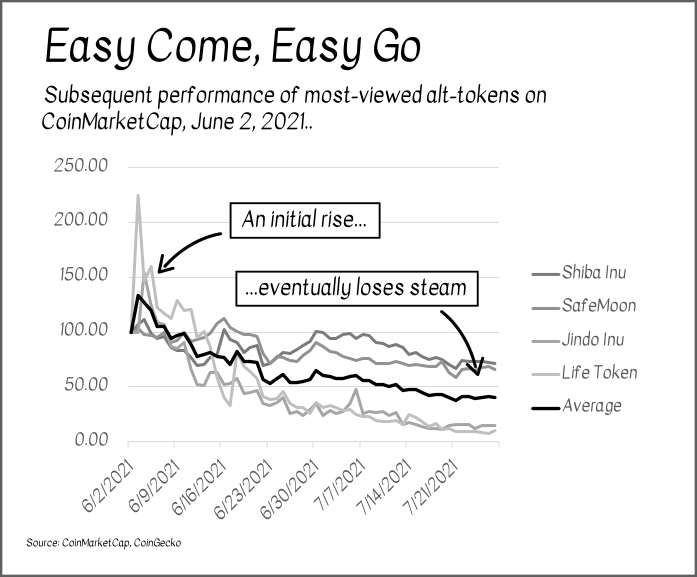

The reason is pretty straightforward. Though lower-quality tokens can generate some attractive short-term returns, they tend to struggle in the long term. (I’m using the word “long term” quite generously too).

Interesting Reads: Zooming Ahead

Joanna Makris’s buy-rated Tesla (NASDAQ:TSLA) posted blowout Q2 earnings — the stock is now up 12% since her recommendation.

Is Nio (NYSE:NIO) still in the game? Here’s why one analyst thinks that the Chinese stock selloff creates a perfect opportunity to buy the “Tesla of China” at a surprising discount.

Could Zoom (NASDAQ:ZM) still be a Moonshot investment? InvestorPlace’s Louis Navellier argues that the firm’s strong fundamentals make it a bet to watch.

On a more somber note, Eric Fry writes that America’s wealth gap is becoming an abyss. But no matter where you are, you can still buy stocks on the right side of that chasm.

By the Numbers: Bitcoin/Stocks vs. Altcoins

Closing Thoughts: Thinking of Buying Bitcoin for Safety?

It Isn’t as Low-Risk As You Think

Most non-crypto investors see Bitcoin as the gold standard for cryptocurrencies. After all, the world’s oldest coin makes up almost half of the crypto market.

But look closer, and Bitcoin has risks that novice investors might overlook.

First, most of the 19 million Bitcoins in circulation never trade hands. A study by blockchain analytics firm Chainalysis found that around a fifth of all Bitcoin addresses are dormant — likely owned by people who lost their passwords or forgot about the account. Another 60% of Bitcoins are held in accounts considered “illiquid,” according to analytics firm Glassnode.

Secondly, many Bitcoin traders are using 100-to-1 leverage or greater for trading. FINRA margin rules don’t apply to cryptocurrency.

Finally, whales, miners and exchanges own over half of all Bitcoins. Ownership is highly concentrated for an asset that size.

In other words, Bitcoin’s value is largely dictated bya handful of traders speculating on just four million coins. On average, BTC moves 3% per day, not far from Dogecoin’s 4.5%. Meanwhile, its upside remains limited for reasons we discussed earlier.

So those looking for “safe” returns are better off buying an ancillary crypto play like PayPal or Coinbase. Because when your cryptocurrency is worth almost twice as much as those two companies put together, it takes a lot of rocket fuel to lift your holdings to ever-growing heights.

— Thomas Yeung

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place