Imagine getting $100 per month in passive income for every $10,000 you invest. That amounts to a $35,000 annual dividend stream with less than $300,000 saved.

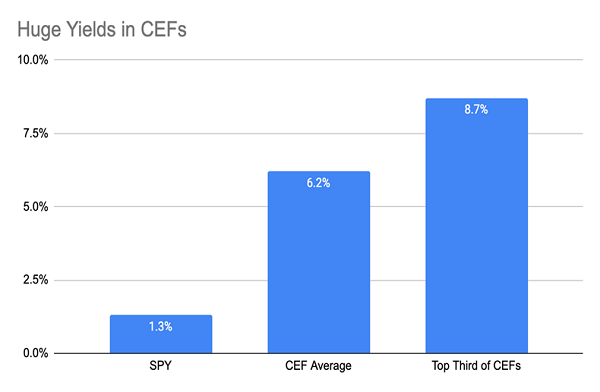

It’s not impossible. In fact, investors do it all the time with my favorite high-yield investments—closed-end funds (CEFs). While the average yield on CEFs is currently 6.2%, a third of these funds yield upwards of 7%, and 17 boast payouts of 10% and higher.

Source: CEF Insider

Source: CEF Insider

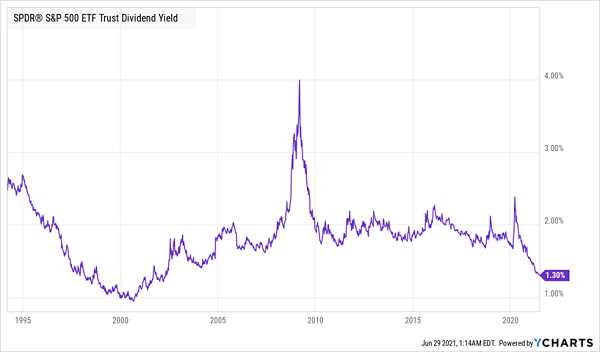

CEFs’ payouts are particularly impressive considering the SPDR S&P 500 ETF Trust (SPY), an index fund tracking the S&P 500, yields a paltry 1.3% today—the lowest yield for the stock market in 20 years.

Income From Stocks? Not Anymore

But don’t take any of this to mean we’re not going to buy stocks! You still want to hold them, because the truth is, stocks have crushed just about every other asset class for years —and their endurance post-COVID-19 proves they can survive just about anything.

What sets us apart from other investors is that we’re not going to buy stocks “direct” or through ETFs. We’re going to take the CEF route instead.

The CEF Trick

The secret behind CEFs’ unusually large payouts is simply deft portfolio management. The best CEF managers buy a basket of assets, sell those assets when they get overvalued, then hand over a slice of the profits to investors as dividends, while reinvesting the rest. By doing this on a rinse-and-repeat cycle, CEFs can transform capital gains from stocks into huge passive income streams.

And for CEF investors, these are truly passive income streams—we have no hassles over buying and selling individual stocks and worrying if we’re making either move at the right time. We “contract out” savvy CEF managers to do this for us.

This is how a fund like the Liberty All-Star Growth Fund (ASG) gets you exposure to companies that don’t pay dividends, like Chegg (CHGG), Amazon.com (AMZN), and Workday (WDAY) while paying a 7.8% dividend yield. ASG simply buys stocks like these when they’re bargains, sells them as they appreciate and hands over a portion of the gains to us as dividends.

Getting 12% Yields From CEFs

ASG is a great fund, but what if you want to push the dividends to the limit? If passive income is your only focus right now, look to the three funds we’ll delve into next.

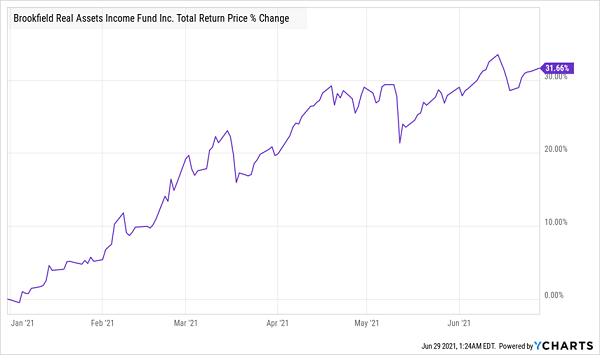

First, you could pick up the Brookfield Real Assets Income Fund (RA), a 10.8% yielder with a diversified portfolio of utility, real estate and infrastructure plays, including shares of NextEra Energy (NEE), one of the strongest utility firms out there, with a timely focus on renewable power; cell-tower landlord Crown Castle International (CCI), which will keep profiting from rising demand for mobile data; and a bond issued by Hilton USA, a firm that’s in line to benefit from the reopening. RA’s smartly constructed portfolio has powered it to a great year so far:

RA Delivers a Solid Return—Much of It in Dividends

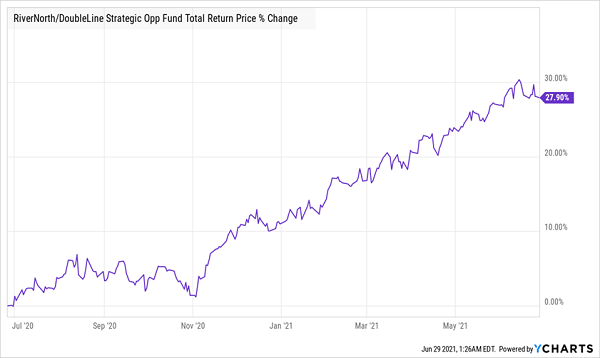

Next we can add the RiverNorth/DoubleLine Strategic Opportunities Fund (OPP), payer of a 12.3% yield. As its name says, OPP looks for strategic opportunities in keeping with where the economy stands at any given time.

These days, OPP sports a well-constructed portfolio of mortgage assets and as a result is riding the housing boom in America, getting income from a variety of mortgages from homeowners and home refinancers around the country. The last year has been great for OPP, too.

OPP Rises With Housing

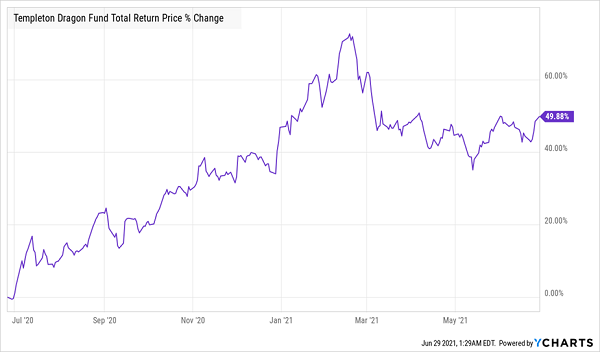

Finally, we can go further afield with the Templeton Dragon Fund (TDF), which focuses mainly on Chinese stocks. TDF has an incredible track record to boast about, as it’s benefited from China’s quick response to COVID-19. In the last 12 months, it has yielded an unthinkable 24.2%, thanks to its massive total return in that time.

Dividend Dragon Roars

With over a 60% total return at its peak, TDF has been unstoppable. While a swath of profit-taking in April, this year took a bite out of that long-term trend, but TDF’s “mere” 50% total return over the last year is still far ahead of most funds’ performance, which is why a 13% yield is extremely likely when all of TDF’s dividends are counted up this year.

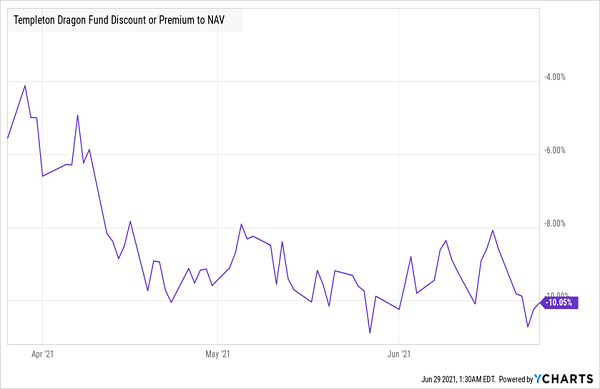

An Attractive Entry Point

Finally, we’ve got a particularly nice opportunity to buy this one, as, thanks to its latest dip, it trades at a 10% discount to net asset value (NAV, or the value of the investments in its portfolio). The discount to NAV is our No. 1 buy indicator for CEFs (and indeed it only exists with CEFs), telling us at a glance when it’s a good time to buy (or sell, if our fund has risen to a healthy premium).

Put these three funds together and you get a diversified portfolio giving you 12% in dividends per year—an income stream that’s unmatchable elsewhere in the market.

— Michael Foster

Get Big Dividends—at Even Bigger Discounts—With These 5 Urgent CEF Buys [sponsor]

The only trouble with these funds is that, apart from TDF, they trade at premiums to net asset value today. That could cap our upside if we were to buy these three funds today.

That’s why I prefer the 5 other CEFs I want to share with you now. They yield a rich 7.3%, on average (with the highest payer among them yielding an outsized 8.3%). Better yet, you’ll be perfectly positioned to augment your big dividends with huge price gains.

How huge? The discounts on these 5 funds are so wide that I’m calling for 20%+ price gains in the next 12 months.

In other words, you could be looking at a healthy 27% return, in dividends and price gains, by this time next year!

You’ll want to climb aboard now, before their ridiculous discounts disappear. Go right here and I’ll share everything I have on these 5 funds with you: names, tickers, dividend histories, my complete analysis of each fund’s management and all the details you need to know before you buy.

Source: Contrarian Outlook