Stock options can be confusing, partly because there are many types of contracts: exchange-traded options, OTC options, and employee stock options that are part of compensation packages. As such, you might be asking, “What are stock options?” In this article, we’ll review all the types of stock options and examine how to include options in your investment portfolio.

What Are Stock Options?

An option is a derivative financial instrument that gives its holder a right to buy or sell a certain number of shares, usually 100, over a specified period of time.

Unlike futures, which require the holder to buy the stock, options give a right but not an obligation. This element of choice is crucial to options.

There are two types of options:

- Call option: the right to buy the underlying stock

- Put option: the right to sell the stock.

Stock options can be traded privately between different parties (also known as over-the-counter) or on exchanges.

Over-the-counter (OTC) options are more exotic and have individual terms designed to suit the needs of both parties. It’s unlikely that, as a regular investor, you’ll ever encounter OTC options.

Exchange-traded stock options have standardized contracts and quoted prices. You can simply put in an order with your brokerage, just like with regular stocks. However, for any stock, there is a wide range of options, so it’s important to know the differences between options contracts.

How Stock Options Work

For each underlying stock, there are dozens if not hundreds of different options trading at the same time.

Each stock option has several defining elements that specify exactly what it does.

- Type: Call or Put, this gives the option holder a right to buy (for calls) or sell (for puts) the 100 shares of the underlying stock.

- Strike price: Also known as the exercise price, it’s the price at which you can sell or buy the stock if you choose to exercise the option. In practice, it’s usually more practical to sell the option instead of exercising it because you can get the same profit but don’t need the capital to buy 100 shares.

- Expiration date: As the name implies, this is the date when the option expires and becomes worthless.

To better understand the options classification let’s look at a real example of options for Tesla Inc (NASDAQ: TSLA) shares.

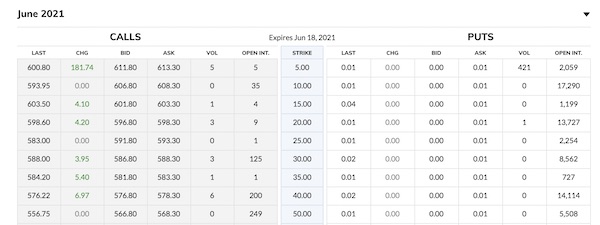

You can check current prices on your brokerage’s website or on financial websites — like the MarketWatch page with Tesla options. The screenshot below shows how options prices typically look.

The table shows some of the stock options for Tesla expiring on June 18, 2021, both Puts and Calls at different strike prices.

You can also see some other columns with key terms, which are worth reviewing:

- LAST: The latest market price someone paid for this stock option.

- CHG: The change from the previous day’s closing price.

- BID: The best market price you can get if you sell this option now.

- ASK: The asking price if you want to buy the option right now.

- VOL: The volume of these specific option contracts that were traded today.

- OPEN INT: Short for “open interest,” the number of options that were traded but not closed by an offsetting option by the same party. For example, if an options seller sold 10 call options and later bought back the same 10 call options, the open interest would be zero.

In the example above, you can see that Call options are expensive while Put options are available for mere pennies.

That’s because in this example, Call options are in-the-money, which means the price of the stock is below the option’s exercise price. At the time of writing, Tesla’s share price was about $617. The strike prices on this screenshot are between $5 and $50. So if you held this option, you could immediately exercise it and buy the shares paying the strike price. This would be an immediate profit.

Meanwhile, Put options are out-of-the-money, or the price of the stock is well above the option’s exercise price. If you exercise your Put option and sell the shares for this strike price, you’ll end up with a loss. These options would likely expire worthlessly.

Stock Options Strategies

Why would somebody even buy these nearly worthless options?

Stock options could be used to speculate on the underlying stock price or to manage risks.

For example, if you bought Tesla for $50 and it’s a big part of your portfolio, you can protect your original investment by buying Put options with a strike price of $50. If the price would crash in a doomsday scenario, you could exercise your puts and sell the shares for $50, getting all the money you’ve put in it.

Options could also give you a way to take on more risk with less capital.

For example, out-of-money Tesla call options with a strike price of $900 cost a grand total of $0.02 at the time of writing. Coincidentally, $900 is Tesla’s all-time high price. If you believe Tesla is set to beat this, you can buy this out-of-money call option.

If the price rises you would profit. Even if the stock price was still below the strike price, the value of your options could double or even triple. For example, out-of-money Tesla calls with $800 strike, already trade at $0.06.

If you simply bought and held Tesla shares, your profit would be $900 – $617 = $283 or 45%. An impressive gain but less than the astronomical triple-digit returns that stock options would deliver.

On the flip side, if by the expiration date when the share price went lower or even stayed at the same level, the money you’ve paid for options would be gone. That’s a 100% loss, which is extremely unlikely with stocks.

While this is just an example, you can see that out-of-the-money call options are a very high risk, high reward strategy. Win big or go broke.

This payoff profile is similar to working on your own business or for a young tech startup.

What Are Employee Stock Options?

Some companies give employee stock options as part of their compensation packages in addition to salaries and benefits.

Early-stage tech startups are a perfect example. They might pay a bit less than large companies and offer fewer benefits, but offer option grants as a form of sharing equity in the business.

These incentive stock options aren’t traded on exchanges and are more similar to over-the-counter options that are arranged between the employee and the company.

In essence, employee stock options are out-of-the-money call options that could be exercised at a grant price defined in the contract. Such option plans align the incentives of the company, its investors, and employees.

If the tech startup’s market value rises dramatically and it turns into a “next Tesla”, then the options would be extremely valuable — worth millions or even billions of dollars. However, if the startup flops, the employee options would be worthless.

One thing that sets employee stock options apart is a vesting period. Usually, the options aren’t available right away. Instead, the employee is required to work for a company over a certain timeframe and then a percentage of the options package is vested every year. If the employee leaves before the vesting schedule is completed, they would only keep the options that already vested.

Including Options in Your Investment Portfolio

Few people get a chance to join a future tech unicorn in the very beginning. Yet anybody can buy options and either manage risks or add more risk and (potentially) more rewards to an investment portfolio.

While options trading is a high-risk high-reward scenario, it could be a great way to boost your portfolio returns and achieve your financial goals faster.

— Investors Alley Staff

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Investors Alley