I’ve been investing in high-quality dividend growth stocks for more than a decade. And what’s it done for me? How about allowing me to go from in debt at 27 years old to financially independent at 33.

In just six years, I went from a hole in the ground to the mountaintop. And I did that without a college degree or a high-paying job, after growing up on welfare. I can’t overstate how amazing the dividend growth investing strategy is.

A major reason for this is right in the name of the strategy. Dividend growth. That’s right. I’m talking about not just dividends but growing dividends.

See, passive income is fantastic. But it’s not so fantastic if it isn’t growing. If it’s not growing, it’ll get eaten alive by inflation over time.

Well, dividend growth investing takes care of this. It has built-in inflation protection through dividend growth. That’s the dividend increases high-quality businesses are reliably announcing year after year. These dividend increases are like “pay raises” to shareholders.

Today, I want to tell you about three high-quality dividend growth stocks that just announced dividend increases. Ready? Let’s dig in.

High Quality Dividend Boost #1: Procter & Gamble (PG)

The first dividend increase you should know about came from Procter & Gamble (PG). Procter & Gamble just handed their shareholders a 10% “pay raise” with their recent dividend increase.

Think about how hard you have to work at your job in order to get a 10% pay raise from your boss. You have to work pretty hard, right? Well, Procter & Gamble shareholders did nothing. They only held the stock. And they got a 10% income boost. That’s a sweet, sweet deal.

This marks the 65th consecutive year of dividend increases for the consumer products company.

65 years of higher dividends for shareholders. Think about that. That time frame spans wars, recessions, and even a global pandemic. It’s the stock that takes a licking and keeps on ticking.

Procter & Gamble is a classic dividend growth stock offering a great combination of quality, yield, and growth on the back of a business selling necessary everyday products like toothpaste and soap.

They’ve built one of the biggest and best consumer products businesses on the planet, with 22 billion-dollar brands including the likes of Charmin and Gillette. With a 10-year dividend growth rate of 5.2% on top of the stock’s yield of 2.6%, it’s a solid combination of yield and growth for a very low-risk stock that has great revenue visibility. The stock isn’t cheap, with a P/E ratio of 25.8, but it’s a great stock to hold for a generation once you get your hands on it.

High Quality Dividend Boost #2: Costco Wholesale (COST)

High Quality Dividend Boost #2: Costco Wholesale (COST)

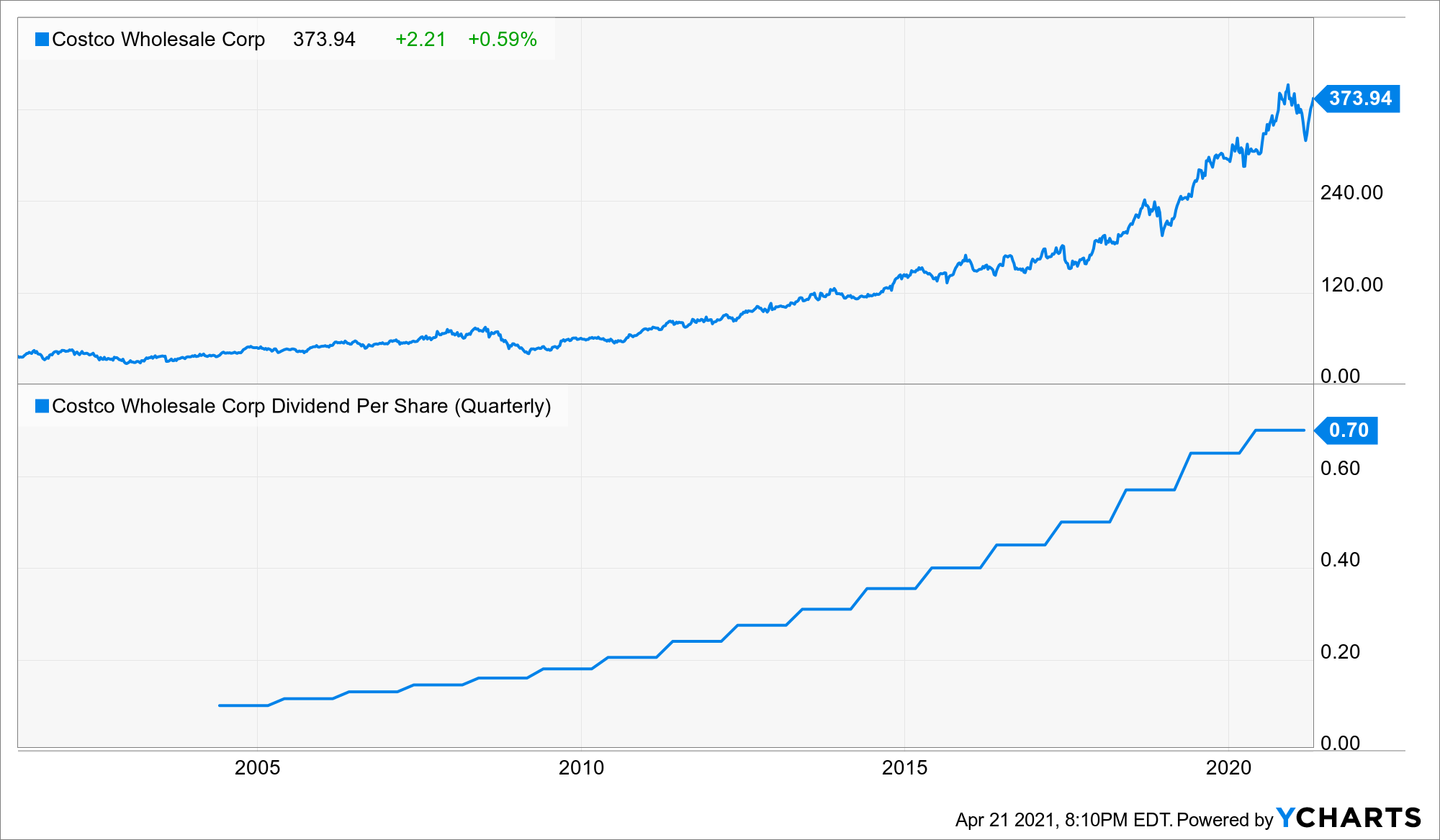

The second stock I want to tell you about is Costco Wholesale (COST). Costco just announced a 12.9% dividend increase.

That kind of dividend growth is what makes Costco shareholders happy. After all, it’s not a big income producer. The stock only yields 0.9%. This is a long-term compounder that’ll just exponentially grow your wealth and passive income. The stock has compounded at an annual rate of 20% over the last 20 years, which is incredible.

Costco has a great one-two punch by offering warehouse retail products at low prices which is underpinned by their valuable membership service.

Locking customers into their low-cost ecosystem has been a very smart move, helping to propel Costco to ever-higher heights over the years. The company’s consistent, double-digit 10-year dividend growth rate of 13.2% shows just how successful the business model is.

This is the 18th consecutive year of dividend increases for the warehouse retailer.

As long as that track record is, and as mature as the business might seem, they’re really just getting started in many ways. With a P/E ratio coming up on 40, it’s not a cheap stock by any means. But if you get the opportunity to snag a small discount on this discount retailer, take it.

High Quality Dividend Boost #3: Southern Co (SO)

High Quality Dividend Boost #3: Southern Co (SO)

The third dividend increase I want to bring to your attention came courtesy of Southern Co (SO). Southern just gave their shareholders a nice 3.1% dividend increase.

Southern is nothing if not consistent. That’s right in line with their 10-year dividend growth rate of 3.5%. And with the stock yielding almost 4%, that’s a pretty solid growth rate.

This is the 21st consecutive year in which the utility company has increased its dividend.

Their dividend growth consistency is predicated on the business model consistency. This is a utility business. And modern-day society cannot live without electricity. The profit and dividend is practically guaranteed.

If you want to make sure your passive income is as reliable as your bills are, a high-quality dividend growth utility stock should absolutely be in your portfolio.

Like the rest of these stocks, and the market as a whole, the stock doesn’t look cheap. The P/E ratio of 22 is elevated, but it’s also not totally unreasonable. If there’s any kind of pullback in the stock, it’s very much worth considering as a long-term investment.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: DividendsAndIncome.com