Dividend growth investing has been like a miracle for me. It created the foundation for my financial independence. That’s because I live off of the passive dividend income my dividend growth stock produces for me.

That totally passive income allows me complete freedom. I was able to retire in my early 30s and essentially buy my time. But this foundation is better and stronger than it sounds.

That’s because this is dividend growth investing I’m talking about. It’s not just dividends I live off of – it’s growing dividends.

High-quality dividend growth stocks increase their dividends to shareholders year in and year out. And they often do this for decades and decades.

Today, I’m going to show you this process in action.

I’ll tell you about three dividend growth stocks that just announced dividend increases.

Let’s dig in.

Recent Dividend Boost #1: Bank OZK (OZK)

The first dividend increase you should know about is from Bank OZK (OZK). Bank OZK just gave their shareholders a 0.9% pay raise via their dividend boost. 0.9%? That’s all? Actually, no. That’s not all. Check this out. Bank OZK tends to increase their dividend every quarter.

Unlike most stocks that are increasing their dividends once per year, Bank OZK is giving shareholders good news every three months. And that good news adds up – the 10-year dividend growth rate is 21.8%. That’s more like it, right?

This is the 25th consecutive year of dividend increases for the regional bank.

This is the 25th consecutive year of dividend increases for the regional bank.

And with a 2.7% yield, there’s a pretty compelling combination of yield and growth here. Meanwhile, the stock’s P/E ratio of 18 is well below where the broader market is at.

Recent Dividend Boost #2: Lindsay Corporation (LNN)

Recent Dividend Boost #2: Lindsay Corporation (LNN)

The second dividend increase I want to tell you about came from Lindsay Corporation (LNN).

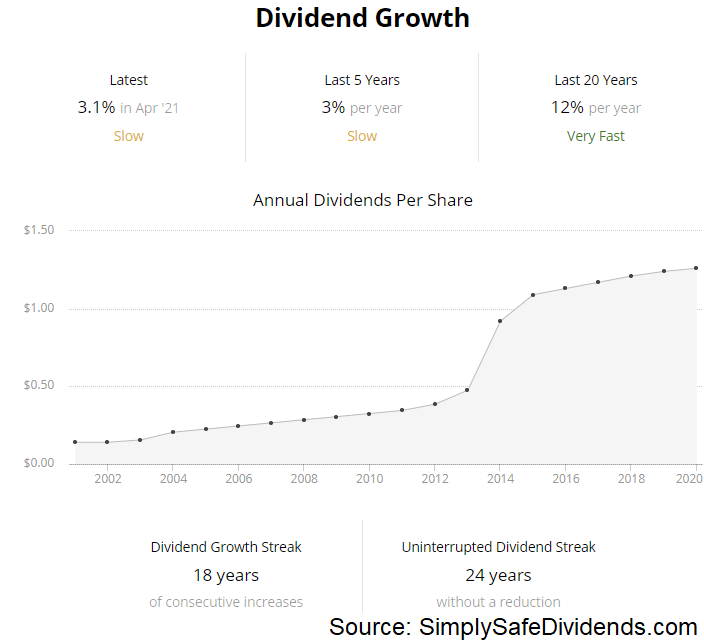

Lindsay just increased their dividend by 3.1%. This manufacturing company out of Omaha, Nebraska just quietly builds increasing wealth and passive income for their shareholders.

This stock is up almost tenfold over the last 20 years. And while Lindsay is a pretty small business, with a market cap below $2 billion, they’re pulling serious weight for their investors. Especially in the dividend growth department.

They’ve increased their dividend for 18 consecutive years.

Who says small companies can’t pay a growing dividend? The 10-year dividend growth rate is 14.4%, which somewhat makes up for the stock’s low yield of only 0.8%. This definitely isn’t an income play. It’s a long-term compounder.

Recent Dividend Boost #3: Watsco (WSO)

Recent Dividend Boost #3: Watsco (WSO)

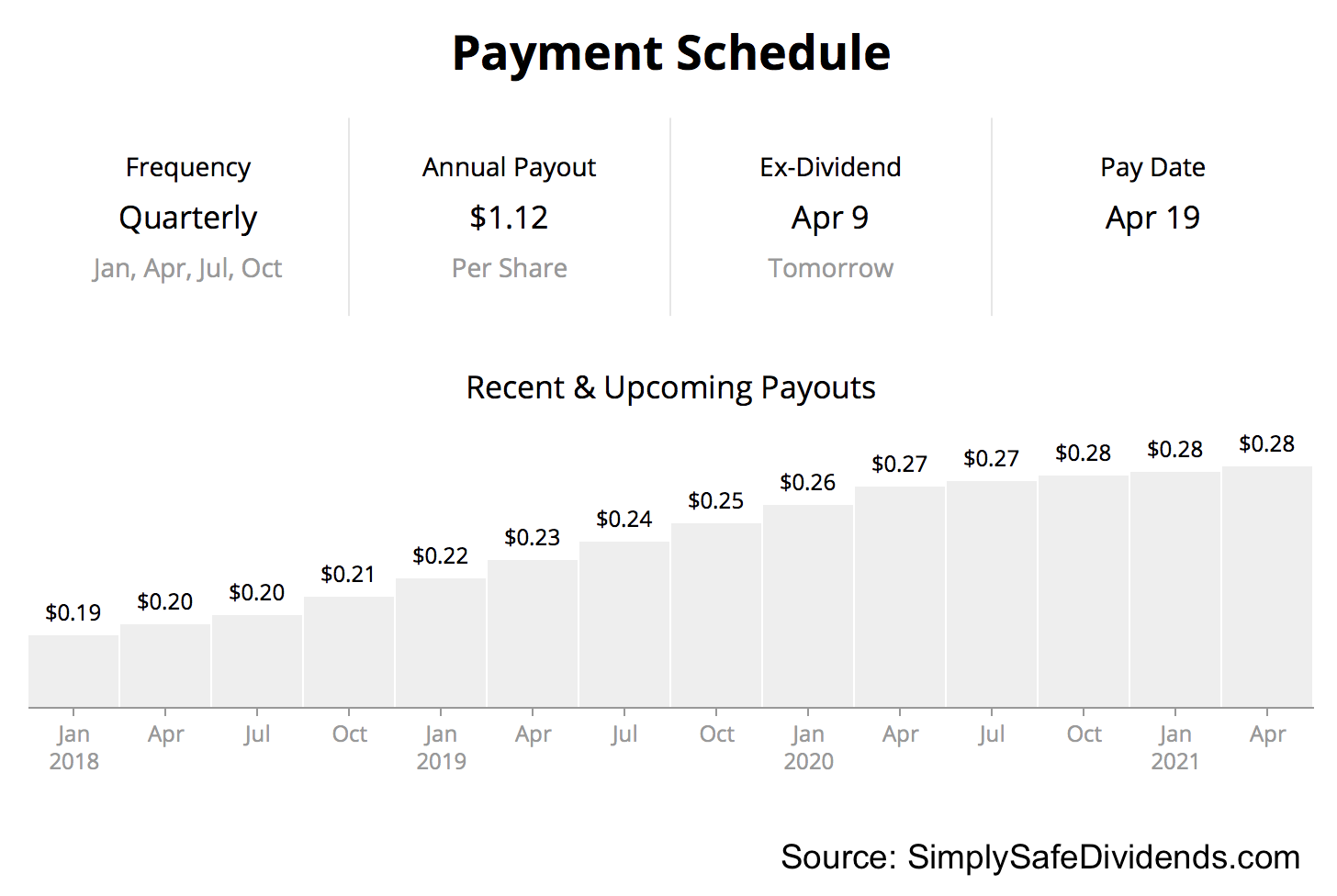

Last but certainly not least, we have the dividend increase from Watsco (WSO). Watsco just increased their dividend by 9.9%.

The HVAC distributor keeps the dividend growth train chugging along, rewarding their loyal shareholders with some of the easiest pay raises they’ll ever get. This marks the eighth consecutive year of dividend increase for the company.

Their 10-year dividend growth rate is 7.2%. And this is a wonderful case where the dividend growth rate is actually accelerating. With a 2.9% yield, we have a pretty remarkable yield and growth story here.

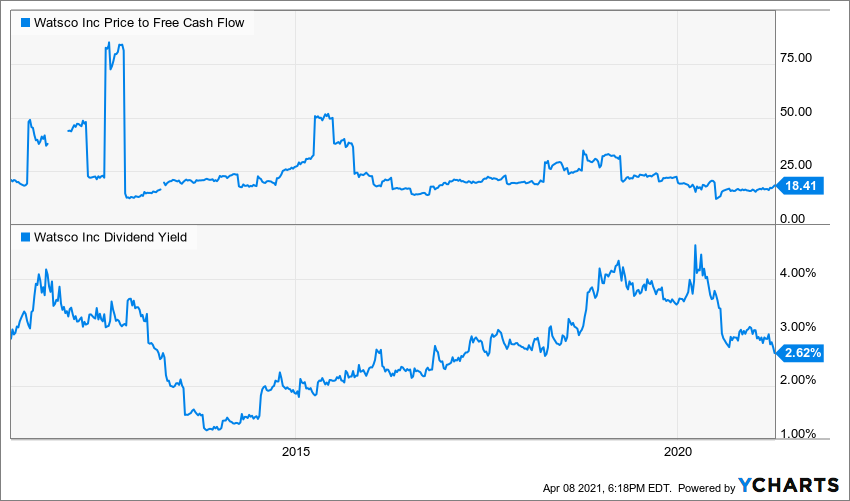

And even after almost doubling over the last year, the stock doesn’t look that expensive.

It’s trading hands for a P/CF ratio of 17.8, which is well off of its three-year average 21.5. With a market-beating yield, big dividend growth, and reasonable valuation, this stock could be worth a good look.

— Jason Fieber

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

This article first appeared on Dividends and Income

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.