“Turn out the Lights, the Party’s Over”

This song, for me and I’m sure many of you, was made famous by Don Meredith on Monday Night Football.

This week, these words came back to me loud and clear as companies that saw major gains during quarantine began to decline.

It’s clear that the “party’s over” for these streaming, food delivery, and home-shopping stocks as the world returns to normal, and I have two ways to play this move to the downside for major profits.

You can get all of the details by clicking here…

Here are the six top Covid-stocks that I’m anticipating further move to the downside…

- Zoom Video Communications (NYSE: ZM)

ZM rose immediately in the face of the virus as money poured into Zoom subscriptions as schooling, business and socializing went remote. The stock has been in decline after topping out at $588.84 and is now trading below both its 50-day and 200-day moving averages (MAs). A few days ago, the 50-day MA crossed below the 200-day MA signaling more bearishness is in the cards forZM.

- Dominos Pizza (NYSE: DPZ)

DPZ was immune to the 2020 market crash and rose immediately as people had food delivered to their doors, and the stock skyrocketed to an all-time of $435.58. The 50-day MA crossed below the 200-day MA in January and DPZ is currently trading beneath its 200-day MA.

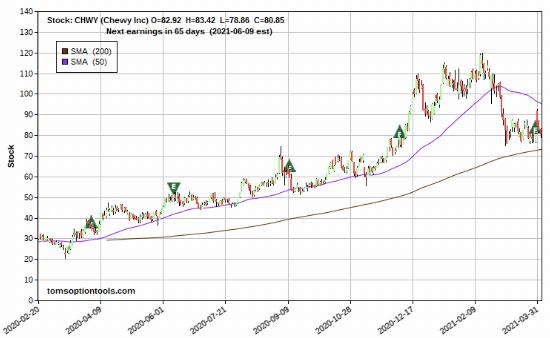

- Chewy (NYSE: CHWY)

CHWY skyrocketed to an all-time high of $120 in the face of lockdowns as pet owners ordered food and supplies for their pets. CHWY has tanked over the past two months and is currently trading well below its 200-day MA.

- Overstock (NASDAQ: OSTK)

Online furniture shopping provider, OSTK was trading below $10 pre-pandemic and rose to an all-time high of $128.50 in six-months. Since topping out, it’s crashed below both its 50-day and 200-day MAs. With OSTK currently trading at $66, further downside is likely.

- Shopify (NASDAQ: SHOP)

E-commerce business solutions provider, Shopify got a boost from an influx of new home businesses driving the stock up from $520 to an all-time high of $1,499.75 during the pandemic. Currently, SHOP is trading below its 50-day MA after bouncing off its 200-day MA, a bounce that is likely to fail.

- Peloton Interactive (NASDAQ: PTON)

Home exercising equipment provider, PTON rose from $25 to an all-time high of $171.09 during the pandemic. Since topping out, it has crashed below its 50-day MA and for the time being has found support at its 200-day MA. Like the rest of the stocks above, it has not participated in the recent market rally and this level is not likely to hold.

- Short the Stock

This is like “putting the battery in backwards”. Sell the stock first (short) and buy it back at a lower price. For example, if you were to sell PTON short at $110 and PTON dropped to $80, you could but it back at $80 and pocket $30 in profit.

- Buy Put Options

This is a less expensive, lower risk way to get yourself a higher ROI. Put options increase in value if the underlying stock drops. Buy 90-day, Out-of-the-Money (OTM) options. (OTM for puts means the strike price is less than the stock price). For example, on PTON you can now buy July 16, 2021 $100 Put options for $9.45. For the 100 shares controlled, that’d cost you $945.

In an uncertain market like this, you can never have too many money-making options… you need a diverse trading and investing plan to maximize your profits.

Talk soon,

— Tom Gentile

Source: Power Profit Trades