I think almost everyone out there has a dream of one day becoming a millionaire. Certainly, if you’re reading this and actively investing your money, it’s at least on your mind. While a million dollars doesn’t go as far as it used to, it’s still a very nice chunk of change.

What if this is your dream, but you don’t have much money? Fear not.

The cool thing about becoming a millionaire is that it’s not as hard as you might think. It does require overcoming some challenges. And it’ll take time.

Building real, sustainable wealth doesn’t happen overnight. But the behavioral traits you build on your way to getting there will stay with you forever, and they’ll help you to stay wealthy.

Two of those traits are consistency and patience. And I’m going to show you how applying them in a very simple and straightforward way can allow you to turn just $100/month into $1 million.

Let’s dig in.

So how can $100/month possibly turn into $1 million? Well, it’s not as hard as you might think. Let’s talk about how this happens.

Investing $100 per month consistently, month in and month out, for years of your life can turn into $1 million. But you’ll need to be patient enough to let the process of compounding do its magic for you.

Yes, I said magic. Compounding is like magic.

Compound interest is interest on top of interest. It’s where old money makes new money, and then that new money makes more new money. It’s as if money is cloning itself, creating an army of money for you.

Albert Einstein once said compound interest is the 8th wonder of the world. If you ask me, he was underselling it. Saving your money is good. But compounding your money can completely transform your life. Compounding multiplies your money at an exponential rate. This supercharges your savings in a way that’ll blow your mind.

First, let’s break the math down.

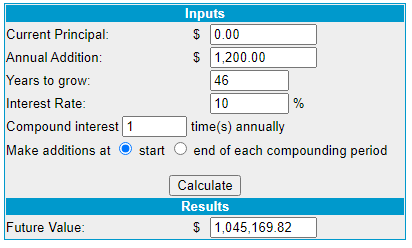

I’m assuming you’ll be starting with $0. You’ll invest $100/month consistently, month in and month out, for years of your life. And I’m assuming a compound annual rate of return of 10%, which is in line with the long-term average of the US stock market.

These are low hurdles to clear. $100/month isn’t a lot of money. And I’m not assuming any outperformance in your investments.

Yet, over the course of 46 years, that $100/month compounding at 10% per year adds up to… drumroll, please… 1,045,169.82.

moneychimp.com

moneychimp.com

Yes, it takes 46 years to turn $100/month into $1 million. But we’re talking only $100/month here. And turning that small amount into $1 million. That’s amazing.

Of course, this would allow someone in their late teens to early 20s easily become a millionaire by the time they retire, without really putting in much effort at all. They would simply need to consistently invest that $100/month and remain patient while the process plays out.

If you’re a little older, you’ll need to retire a little later to still end up with that $1 million off of $100/month. This is why it’s so important to start investing early in life.

But you can invest more than $100/month. I know you can. And you will. Because when you see what only $100/month can do, you’ll start to imagine what $500/month or $1,000/month or more can do.

Getting back to Einstein’s point, $100/month over 46 years adds up to only $55,200 in invested capital. That means 95% of your ending value of $1 million was the result of compounding.

Better yet, it’s certainly possible to achieve a compound annual rate of return higher than 10% over the long run.

We’re regularly putting out videos on high-quality dividend growth stocks. These stocks represent equity in world-class enterprises that pay reliable, rising cash dividends to their shareholders.

They’re able to pay reliable, rising cash dividends because they’re producing reliable, rising profits.

And those reliable, rising profits are being generated because these businesses are providing the products and/or services the world demands.

Many high-quality dividend growth stocks have done better than the market’s 10% compound annual rate of return over the long run.

Think stocks like Apple (AAPL), Lockheed Martin (LMT), and Nike (NKE). These are three examples of many.

And it’s not just outperformance we’re talking about. Many of these high-quality dividend growth stocks also pay out market-beating dividends, which means you could one day live off of totally passive dividend income rather than having to slowly sell off your assets.

What’s better than becoming a millionaire? Staying a millionaire. Investing just $100/month can turn into $1 million. But I think you can do much, much better than ending up with $1 million.

Apply patience and consistency to a thoughtful saving and investing plan. Let the 8th wonder of the world do its magic for you. And seriously consider putting your capital to work with high-quality dividend growth stocks for the long term to give yourself the chance to outperform the market and provide market-beating passive dividend income.

Then watch your wealth and passive dividend income sustainably grow as the compounding numbers become larger and larger.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: DividendsAndIncome.com