Insurance stocks like AFL can make a great addition to your stock portfolio as the business has the potential to produce excellent long-term returns. It is also a business that works in strong economies as well as during recessions, and anytime in between.

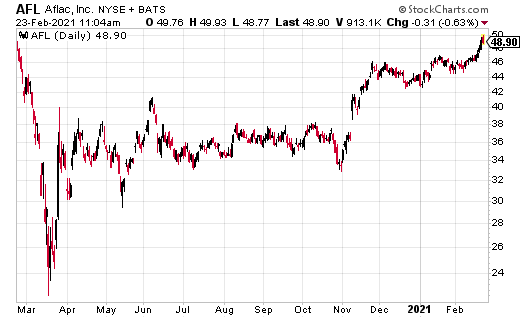

Shares of Aflac (AFL) underperformed the overall stock market in 2020 and remain about 8% off the company’s 52-week peak, just south of the $52 level.

Some of the pressure from the coronavirus pandemic may have worried traders on AFL’s near-term prospects as insurance companies are in the business of pricing risk.

However, the company has topped earnings expectations over the past four quarters by $0.02, $0.25, $0.21, and $0.11.

This shows AFL has managed the pandemic well despite the disruption from the coronavirus.

Additionally, even if its policies were underpriced versus current reality, then AFL has the opportunity to raise its rates on renewals and new policies to reflect that.

The chart shows that key resistance at $47 has been holding since mid-January and a level that has been tested and recently cleared. Continued closes above this level could easily propel shares towards the $50-$52 area and prior levels from January 2020.

AFL also offers investors a well-supported income stream that currently sports a dividend yield just below 3%. The $0.33 dividend paid quarterly – totaling $1.32 annually – consumes only about 25%-30% of the company’s trailing earnings.

AFL also has nearly a four-decade history of increasing its dividends. While the most recent increases have been small, the payout is still rising over time. This long-term commitment to dividend growth also suggests that if the company can continue to raise its dividends over time, it will.

Backing up that modest payout ratio is a balance sheet with over $4 billion in cash and equivalents and over $140 billion in bonds on it. Overall, AFL has nearly $30 billion in net equity on its balance sheet.

For aggressive traders, the AFL April 50 call options are currently going for 85 cents. If shares can make a run towards $51.70 by mid-April, these calls would double from current levels. If shares stall at current levels and fall back below $45 and the 50-day moving average, investors can exit the trade to save the remaining premium.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley