One of the most common complaints I hear from investors is that their advisors or brokers like to tell them when to buy, but never tell them when to sell. Whether those criticisms are fair or not, the sell decision is certainly the most vexing decision that investors face. Nevertheless, there are several clichés that people often turn to help with this puzzling decision.

One of my favorites is “do not pick the flowers and water the weeds.” Or another good one “let your winners run.”

Although there is an element of wisdom, even profound wisdom within those clichés, they do present challenges.

For example, how can you recognize the winner from the loser in advance?

The same goes for distinguishing between a flower and a weed. With stock investing, most people consider a rising stock a flower, and a falling stock a weed. However, quite often it turns out to be just the opposite.

Legendary investor Peter Lynch in his best-selling book “One Up On Wall Street” said it like this: “Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock, and it goes down does not mean you are wrong.” The point is that a rising stock may be dangerously overvalued, while the falling stock price may indicate that the company is becoming a rare opportunity on sale.

Understanding this comes down to realizing, without questioning, that the market is not always right nor is it always efficient. On the other hand, it would be more correct and accurate to say that the market, although not always efficient, is always seeking efficiency.

That last statement is why I rely on valuation so much. Over the years I have learned that the price of the stock will inevitably align itself with the intrinsic value of the business. Unfortunately, the timing of that occurrence is unpredictable. Sometimes, the movement back to intrinsic value (up or down) can be very swift, at other times the valuation anomaly can continue for a tortuously long time.

Therefore, you simply cannot predict how high is up or how low is down. On the other hand, you can recognize too high and too low when you see it. Once that is accomplished, you can make a rational long-term decision. And more importantly, if you give that decision time to work itself out, it will also be a profitable decision.

Furthermore, the prudent intelligent value investor also understands that all investments, especially investments in common stocks, derive their value from the amount of cash they provide their stakeholder. Therefore, many support discounted cash flow analysis as a sound approach to assessing valuation. However, without getting too technical, you are simply attempting to determine if the business can generate enough cash to compensate you for the risk and provide you an adequate return.

So How Do You Know When To Sell A Tech Stock?

As I established above, the honest and the correct answer is you simply cannot answer this question with perfect precision. Instead, all you can practically expect to do is make a prudent or a rational decision. Investing is not a game of perfect. Sometimes you can sell a little early, sometimes you can sell very early. In other times you can wait too long to sell and lose big as a result.

Nevertheless, they do not ring a bell at the top or bottom of the market. Therefore, for sanity sake you must accept that you can only make rational and intelligent sell decisions. In many ways, the same can be said about the buy decision. However, in truth and fact, the buy decision is a little more straightforward.

Apply Prudent and Sensible Strategies Instead

Instead of distressing over trying to make a perfect sell decision, try applying rational strategies instead. For example, you can place an overvalued stock on a “sell watch list” like I often do. This does not mean I immediately sell, instead, it means that I am cognizant of my risk and prepared to sell quickly if the situation warrants.

However, the point is, since I know I am in dangerous territory, I watch my overvalued stocks more closely than the ones I hold at sound valuation. In other words, I am willing to ride out some volatility when I have attractive value. On the other hand, when I have “false profits” I try not to let the windfall simply dissipate into thin air. To add another cliché, “a bird in the hand is worth 2 in the bush.”

Additionally, once I place a stock on my “sell watch list” I simultaneously begin looking for suitable replacements at more attractive valuations. This can help combat seller’s remorse when I believe I can keep my money working with less risk and hopefully better long-term return potential. Therefore, short-term volatility like the stock I sell continuing to go up does not bother me as much as it would if I were only holding cash.

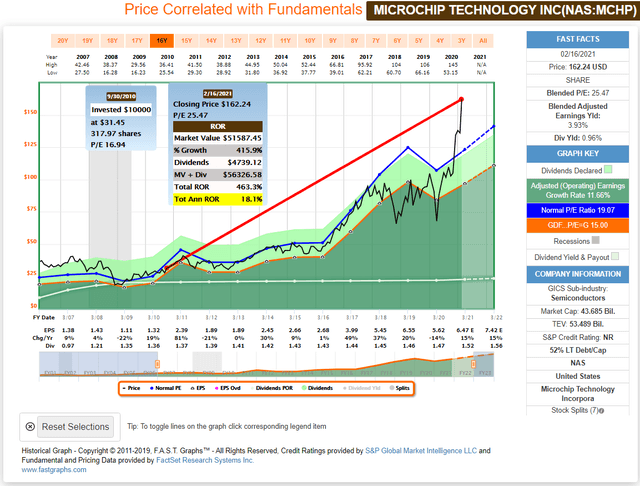

Another strategy I often implement is partial selling or trimming. I especially like doing this when I can take a substantial profit above my original investment and therefore only take risk with house money. I am currently implementing this strategy with Microchip Technology Inc. I have been long this semi -conductor company since September 2010 with a cost basis of $31 per share and change. I recently sold half my position where I more than doubled my original investment.

Microchip Technology Inc. (MCHP)

As you can see by the performance calculation in the following earnings and price correlated FAST Graph, Microchip Technology has increased fivefold since it was originally purchased. However, by selling half of the position, I locked in a profit more than twice my original cost. Moreover, and perhaps the best part is that I still am letting some of my winner run.

But most importantly, I continue to monitor this remaining position closely to not give away as much of my excess profit as possible. In other words, if the stock price takes a drastic turn for the worse, I am poised to finish harvesting the entire position. Unrealized gains can quickly turn into unrealized losses if you are not diligent. Once again, I do not expect to execute my sell perfectly, but I take solace in the fact that I am already well rewarded regardless.

Additionally, note that the stock is currently trading at a historically high valuation. Therefore, even though this holding has great momentum, I am fully cognizant of the valuation risk that it possesses. In other words, I am speculating on my remaining shares with my eyes wide open. I am not deluding myself into believing that this stock deserves its current high valuation.

Instead, I recognize that the market simply appreciates the stock more than I do. A dear friend once taught me the true meaning and definition of appreciation. He simply stated that appreciation occurs when someone else appreciates what you own more than you do. I continue to believe this is a great company, but I simultaneously recognize it as dangerously overvalued and therefore, a very poor long-term value from here.

(Source: FAST Graphs)

(Source: FAST Graphs)

Potential More Attractively Valued Replacements

As I stated above, a strategy that makes the sell decision easier is when a suitable but better valued replacement is discovered. Below I present two examples of replacements that would allow me to stay in the technology sector while simultaneously improving my prospects for future returns.

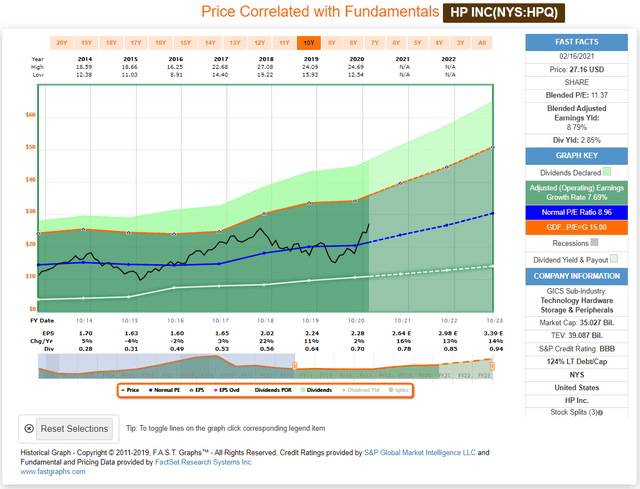

HP Inc. (HPQ): Better Valuation, Higher Dividend and Faster Growth

In searching for a suitable replacement for Microchip I discovered HP Inc. Note that the company is available at a better valuation, offers a higher current dividend yield and consensus estimates expect faster future growth than is currently available from Microchip.

Furthermore, HP Inc.’s stock price also has momentum rising from $15 a share in May 2020 to its current $26 per share price tag today. Therefore, I am not trading a stock that has momentum to the upside for one that has been sinking to the downside. Both the one I sold and the one I would buy currently have momentum going for them.

(Source: FAST Graphs)

(Source: FAST Graphs)

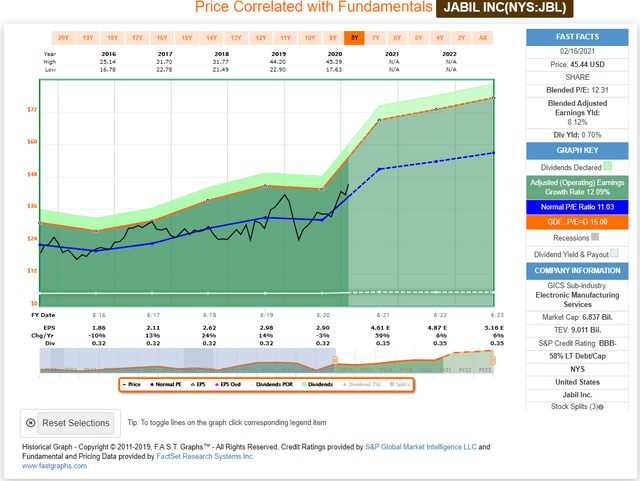

Jabil Inc. (JBL): Better Valuation, Similar Dividend Faster Growth

Jabil Inc. represents a second option that also has momentum that I could possibly switch to. Although I have not made a definitive decision on either of these two companies, my point is that I do have options to turn to after leaving Microchip. My original mentor used to say that investing in stocks is analogous to a horse race. However, the only difference is that you can change horses at any time during the race even up to the finish line. Nevertheless, whether you agree or disagree, I hope this gives you something to think about regarding executing a sell decision.

(Source: FAST Graphs)

(Source: FAST Graphs)

FAST Graphs Analyze Out Loud Video on Microchip, Jabil and HP Inc.

In the following video I elaborate on how to deal with the difficult decision on when to sell a stock.

Summary and Conclusions

If you realize and accept the reality that you cannot make perfect sell – or buy decisions for that matter, the decision becomes a lot less stressful and confusing. You simply do the best you can, you make your decisions based on rational assessments of valuation and you move forward. The prudent value investor confidently makes sound and prudent investing decisions and does so without stress or remorse. In the long run, value investing pays handsomely. You simply must exercise what I call intelligent patience and trust fundamentals over stock price. Investing is not a game of perfect, but it is a rational pursuit if engaged in properly.

— Chuck Carnevale

Source: FAST Graphs