Pfizer (NYSE:PFE) is in the news lately for the rollout of its Covid-19 vaccine. However, much of the earnings from vaccines is already taken into account by the market in the Pfizer stock price already.

Nevertheless, Pfizer is worth at least 20% more based on its dividend yield history as well as its buyback yields.

Pfizer recently raised its quarterly dividend to 39 cents per quarter, up from 38 cents. This brings its annual dividend to $1.56 per share, a 2.63% gain over the prior year’s dividend per share (DPS).

Pfizer also tends to raise its DPS after every four quarters.

This gives its dividend payments a base of stability. However, there is no consistency of either the increase or the payout ratio.

A Closer Look at Pfizer Stock

For example, this year’s 2.63% hike was much lower than the prior year’s 5.56% DPS rise, which was lower than the prior 5.88% gain. You can see this in the chart I have prepared on the right.

For example, this year’s 2.63% hike was much lower than the prior year’s 5.56% DPS rise, which was lower than the prior 5.88% gain. You can see this in the chart I have prepared on the right.

Moreover, you can see in the chart every year Pfizer was moving the DPS up by 2 cents per year – all up until recently. On Dec. 11, the DPS rose by just 1 cent per quarter. This effectively lowered the 5.90% average annual gain in Pfizer’s DPS.

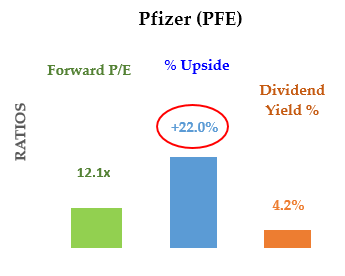

As a result, Pfizer now has a very attractive dividend yield. For example, as of Dec. 22, its dividend yield is 4.2% (i.e., $1.56 / $36.74).

At today’s price (Dec. 22) of $36.74 Pfizer’s price-to-earnings (P/E) is just 12 times analysts’ estimate of 2021 earnings per share (EPS) of $3.04. Pfizer’s Covid-19 vaccine has made PFE stock very cheap.

Pfizer Beyond the Vaccine

This makes PFE stock very attractive. Its vaccine and other earnings will allow the company to make its dividend more secure. It will also help the company hike its dividend consistently as in the past.

For example, even if it raised its payout ratio to 70%, or $2.13 (i.e., 0.7 times $3.04), the new yield will be much higher. At that payout ratio, the new yield would be 5.80% (i.e., $2.13 divided by $36.70).

Moreover, Pfizer’s historical dividend yield effectively raises its stock valuation. For example, over the past 4 years, Pfizer’s average dividend yield has been 3.78%, according to Seeking Alpha.

Therefore, if the yield were to fall to 3.78% from 4.2% today, PFE stock would be worth $41.27. This is seen by dividing $1.56 by 3.78%. The resulting target price is $41.27. That represents a potential gain of 12.3% over the present price.

Pfizer Stock Valued

If you look at PFE stock’s historical price-to-earnings values, you will see that on average they work out to 18.5 times.

If you look at PFE stock’s historical price-to-earnings values, you will see that on average they work out to 18.5 times.

For example, Morningstar has a report on the stock’s historical P/E ratios which has an average of 18.5 times over the past 5 years.

This is much higher than Pfizer’s present forward P/E ratio of just 12.3 times for 2021. It implies that the stock should be at least 53% higher at $56.20 per share (i.e., 18.5 times $3.04 per share).

Moreover, another way to PFE stock is to compare its P/E ratios with a number of its peers. I have done this in the table at the right, as well as shown Pfizer’s historical P/E ratio.

The average P/E ratio of Pfizer’s peers is 12.2 times. This implies that PFE stock should trade at just $37.03, or 1% higher than today.

The average P/E ratio of Pfizer’s peers is 12.2 times. This implies that PFE stock should trade at just $37.03, or 1% higher than today.

Therefore, we have three different value targets for PFE stock. Using its historical dividend yield, the price should be $41.27, or 12.3% higher.

Using its historical P/E, it should be $56.20, or 53% higher. And using a comparison with peers, PFE stock should be 1% higher at $37.03.

The average of these three metrics is $44.83, or a potential upside of 22% from today’s (Dec. 22) price.

What to Do With PFE Stock

Interestingly, PFE stock is still down about 1.0% year-to-date. The distribution of its Covid-19 vaccine could lead eventually lead to a significantly higher stock. My estimate is that it would be 22% higher within the next year.

In effect, this is a value stock with good upside, a decent dividend yield, and a very good buy-in value/bargain price for most investors.

— Mark R. Hake

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place