Covid-19 has been a big wake-up call about the ultimate importance of what happens in laboratories around the world. Their work can save our bacon when faced with life-threatening ills. And this wake-up call also extends to the financial markets, where we can find biotech stocks to invest in the companies behind the labs.

This, in turn, is driving up the market for the leading biotechnology stocks as tracked by the S&P Biotechnology Index that’s returned 57.89% so far in 2020.

Source: S&P Biotechnology Index Total Return – Source: Bloomberg

Source: S&P Biotechnology Index Total Return – Source: Bloomberg

That’s a return that will open the eyes of most investors, even in this year’s bullish market. But biotechnology is a broad and charged label. Really, all biotech companies are just inventing, developing or deploying drugs and procedures to fix what ails folks and cashing in on treatment costs along the way.

The real rub for investors is to try to understand what’s happening now and what might happen in the future before they buy a single share.

And this gets really troublesome unless you are a clinical scientist, physician, and financially trained professional. New drugs and procedures take lots of time and come with lots of failures.

They start with an idea that something may work for some sort of illness. Then comes lots of lab work, lots of gathering of evidence and maybe, if all goes well, the company will move on to the next phase. That involves not just the formulation of the prospective cure but then testing and more testing and more testing still.

And along each of these tests comes the requirement to draft exhaustive reports on what was done and what worked and what didn’t. And these reports get filed with various organizations for review. And later the U.S. Food & Drug Administration (FDA) is called in, and after lots of fees paid, the FDA says yay or nay to the next phase of testing. And then the process repeats for the following phase.

And in any of the test phases, anything can go wrong. And if it goes wrong, it can mean that all of the work and money could go poof.

Analyzing each and every stage and phase of the development process is just as exhausting as the actual lab work. And there really isn’t a short-cut to this. Sure, you could just trust the company’s press releases and put your money down on its stock – but that’s no better than a pig-in-a-poke.

That doesn’t stop millions of investors from placing blind bets on stocks and funds and as noted — the S&P Biotech Index shows that those bets worked for far for 2020.

For drug and treatment investments, I do read — or at least try to read — through all sorts of scientific journals and even some patent applications, as well as other very dry and very hard-to-decipher papers and reports. But that really only gets me so far. I tend to invest in companies that have a track record of working with existing products while successfully developing pipelines of new products.

And I also like to invest in picks-and-shovels companies that get paid to sell their products and services to the developers. With all that said, here are some of my biotech stocks and investments to take a look at in this charged investment sector.

- Alexandria Real Estate Equities (NYSE:ARE)

- Hercules Capital (NYSE:HTGC)

- Merck (NYSE:MRK)

- Zoetis (NYSE:ZTS)

- Vanguard Health Care ETF (NYSEARCA:VHT)

Alexandria Real Estate Equities (ARE)

Ok, Alexandria Real Estate Equities is a real estate investment trust (REIT), which is probably not the hot tip that you might be looking for — but you should. Every biotech company starts in a lab. And successful biotech companies work in labs and expand their lab space and keep expanding to get their products to the market and then start over on the next product.

Guess who is one of the biggest owners of labs and related space in the U.S.? Yep, Alexandria Real Estate Equities. This is one of the ultimate pick-and-shovel biotech companies to buy right now. Labs are tricky to build. They should be in locations near major university folks that biotech companies need to come up with and prove out new products. And they need to be sterile with controlled water and natural gas and so many other technological requirements.

They can’t just be set up in somebody’s loft in a warehouse district.

ARE keeps a great collection of in-demand properties that drive revenue ever higher, with the trailing year seeing a gain of 15.4%. As a REIT, it is profitable as it has a return on funds from operations (FFO) which measures actual property revenues against cost at a good level of 12.40%.

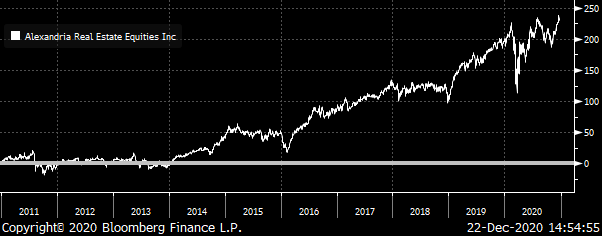

Source: Alexandria Real Estate Equities (ARE) Total Return – Source: Bloomberg

Source: Alexandria Real Estate Equities (ARE) Total Return – Source: Bloomberg

The company has done this for a long time and shareholder have seen a return over the past decade alone of 231.95%. And this includes a tax-advantaged dividend yielding 2.49%.

Buy it as a pick-and-shovel biotech company in a taxable account.

Hercules Capital (HTGC)

Next is a company that, if you search my articles, you’ll find a collection of them about Hercules Capital. I’ve known and followed this company for a very long time. It is set up as a business development company (BDC) that provides the ability to avoid traditional corporate income taxes while providing more cash for the big dividend.

But what you’ll care about it that is operates as a venture capital company (VC). It has specialized teams that know the brainiacs in all sorts of tech fields including life science/biotech. And it provides finance to them along with taking equity stakes so that if and when they have an exit strategy in an initial public offering (IPO) a special purpose acquisition corporation (SPAC) or a plain old buyout — it gets a reward.

Source: Hercules Capital (HTGC) Total Return – Source: Bloomberg

Source: Hercules Capital (HTGC) Total Return – Source: Bloomberg

Investors keep getting paid its monster dividend and reaping gains with the past decade alone seeing a return of 244.80%.

Buy this company as a VC portfolio of well-curated biotechs with lots of income along the way in a taxable account.

Merck (MRK)

Ok, Merck is a biggie company that might not be a nimble as a small-fry biotech. But it has lots of experience in knowing how to fail. And it has deep pockets to fund failures. And it has great products now and a pipeline of stuff in its labs.

Buy Merck because it gets you into this market of brainiacs and proven financial guys that control if and when money gets invested in the potential next new-new thing in biotech.

Revenue keeps climbing, with the trailing year seeing a gain of 10.7%. it has excellent operating margins — meaning that it has controls over costs equating to a level of 24.8%. And this works to feed a remarkable return on shareholder’s actual equity investment running at 41.10%.

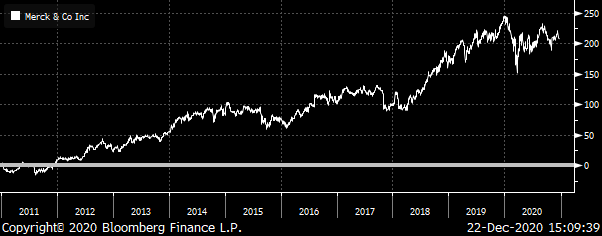

Source: Merck (MRK) Total Return – Source: Bloomberg

Source: Merck (MRK) Total Return – Source: Bloomberg

Shareholders continue to get a good return delivered to them that over the past decade amounts to 207.20%.

With a shareholder-focused dividend yielding 3.28% it is a buy in a tax-free account.

Zoetis (ZTS)

Guess where Covid-19 came from? While not proven, my scientific friends in China contend that it came from a public wet market with wild animals that passed on the virus as it jumped from animal to human. And H1N1 — again a jump from animal to human. MERS? Animal to human. African Swine Flu (ASF) has already jumped from pigs to people and is now spreading.

Zoetisis the go-to company for animal health. It is the leader in vaccines for livestock and pets, along with all sorts of must-have drugs and other products for both companion animals and livestock.

I found this company after lots of journals and figuring out ASF. And since then, I’ve seen it in action helping my little miniature dachshund, Blue, stay healthy.

Source: Zoetis (ZTS) Total Return – Source: Bloomberg

Source: Zoetis (ZTS) Total Return – Source: Bloomberg

Zoetis works well, not just in the field but in the financial markets. It has returned 556.15% over the past decade with its laboratory-developed successes.

Revenues keep climbing and it has a great operating margin at 31.4% that in turn works to feed the return on shareholders’ invested equity of 53%.

With its dividend, it is a buy for the front-line of the next era of viruses in a tax-free account.

Vanguard Health Care ETF (VHT)

Now comes the packaged investment that synthetically provides access to a wide collection of biotech and related health companies — an exchange-traded fund, or ETF. The Vanguard Health Care ETF is a leading, liquid and low-cost way into this market in a very efficient manner.

And the proof of the synthetic index way of investing in a technically challenged market for biotech and health is in the ETF’s return. Over the past decade, it has returned 350.7% for an annual equivalent return of 16.24%.

Source: Vanguard Health Care ETF (VHT) Total Return – Source: Bloomberg

Source: Vanguard Health Care ETF (VHT) Total Return – Source: Bloomberg

While the ETF might not be as exciting as a prospect of an unproven startup with a lab that pitches a promise of big things in the future, it is what is proven to work. Buy it in a tax-free account.

— Neil George

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place