I’ve been hearing from a lot of readers who are sitting on some nice gains this year—and now they’re wondering if it’s time to sell.

Should you?

As with so many other things in 2020, it depends. What are you planning on selling?

With many closed-end funds (CEFs), this is the time to buy more, as they haven’t fully priced in the vaccine- and stimulus-fueled recovery we’re likely to see in 2021.

But with some CEFs, there are plenty of reasons to consider taking some money off the table.

Today we’re going to zero in on three such funds.

They boast attractive portfolio holdings and high dividend yields—more than 8% in one case.

But if you hold them, now is the time to sell and rotate into other CEFs with more sustainable payouts and less risk of a price drop.

Sell #1: A “Sleepy” Utility Fund That’s Gone Too Far, Too Fast

First on the chopping block is a long-time favorite of mine, the Gabelli Utility Trust (GUT), holder of well-known power providers like NextEra Energy (NEE), WEC Energy Group (WEC) and Duke Energy (DUK), as well as leading telecom provider Verizon Communications (VZ).

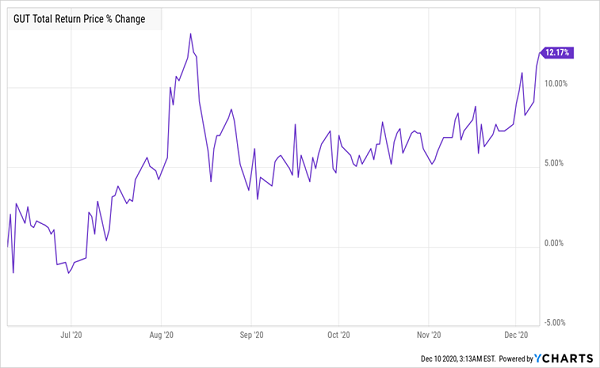

GUT is run by revered value investor Mario Gabelli and has gained a reputation for producing both high dividends (it yields 7.8% today) and price gains. In the last six months, it’s returned a “no drama” 12%, which is exactly what we look to a utility-focused fund to deliver.

GUT Does Its Job

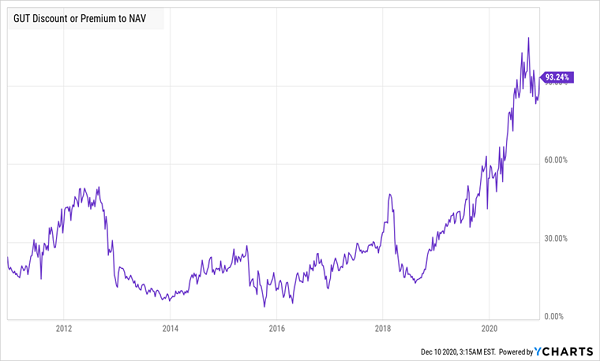

Problem is, volatility-weary investors have bid up GUT to a ridiculous 93% premium to net asset value (NAV, or the value of its portfolio holdings). In other words, they’re paying nearly double!

Problem is, volatility-weary investors have bid up GUT to a ridiculous 93% premium to net asset value (NAV, or the value of its portfolio holdings). In other words, they’re paying nearly double!

Stable Fund Suddenly Looks Anything But

The ironic thing is that by bidding up GUT to such a ridiculous premium, these investors are making the fund more likely to collapse—and undermining their reason for investing in the first place! If you hold this one, it’s clearly time to sell.

The ironic thing is that by bidding up GUT to such a ridiculous premium, these investors are making the fund more likely to collapse—and undermining their reason for investing in the first place! If you hold this one, it’s clearly time to sell.

Sell #2: A Bond CEF That’s Stuck in Neutral

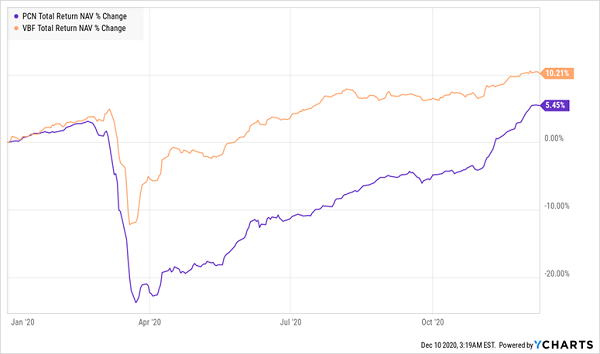

My next target isn’t as overpriced as GUT, but it isn’t cheap, either: the PIMCO Corporate & Income Strategy Fund (PCN), which yields 8.1% and trades at a 23.2% premium to NAV. That premium is actually lower than it has been for much of 2020, but PCN is far from a buy. In fact, it’s nowhere close to earning its high valuation, with portfolio performance that’s been pretty dull.

High Price, Low Profits

The Invesco Bond Fund (VBF), shown in orange above, is one of many corporate-bond funds that’s beaten PCN on a total-NAV-return basis in 2020. Other investors will realize this if PCN keeps underperforming other bond CEFs, so expect its premium to get smaller, and its share price to drop, in the months ahead.

The Invesco Bond Fund (VBF), shown in orange above, is one of many corporate-bond funds that’s beaten PCN on a total-NAV-return basis in 2020. Other investors will realize this if PCN keeps underperforming other bond CEFs, so expect its premium to get smaller, and its share price to drop, in the months ahead.

Sell #3: The Ultimate Yield Trap

The Cornerstone Total Return Fund (CRF), holder of blue chip stocks like Apple (AAPL), Microsoft (MSFT) and Johnson & Johnson (JNJ), has plenty of fans, who inevitably point to charts like this:

A Great Return in a Short Time

Undoubtedly, CRF has beaten the index in 2020. But if you buy CRF for a reliable dividend, you’re in for a big surprise.

Undoubtedly, CRF has beaten the index in 2020. But if you buy CRF for a reliable dividend, you’re in for a big surprise.

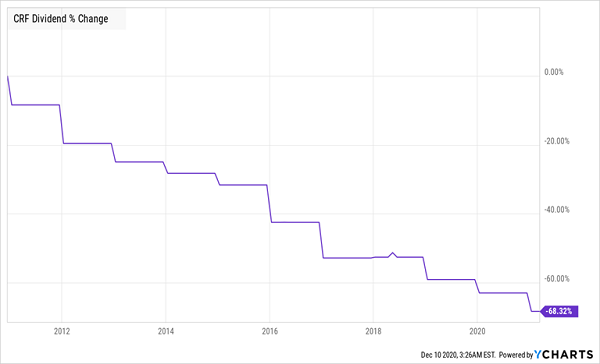

What CRF Gives in Price Gains, It Takes in Dividend Cuts

CRF has cut dividends constantly over the last decade because it pays out too much, with its dividend yielding 18.8% now. That ridiculously high yield means the fund simply can’t afford its payout. And in extremely volatile years like 2020, those payouts become a huge burden that drags down returns.

CRF has cut dividends constantly over the last decade because it pays out too much, with its dividend yielding 18.8% now. That ridiculously high yield means the fund simply can’t afford its payout. And in extremely volatile years like 2020, those payouts become a huge burden that drags down returns.

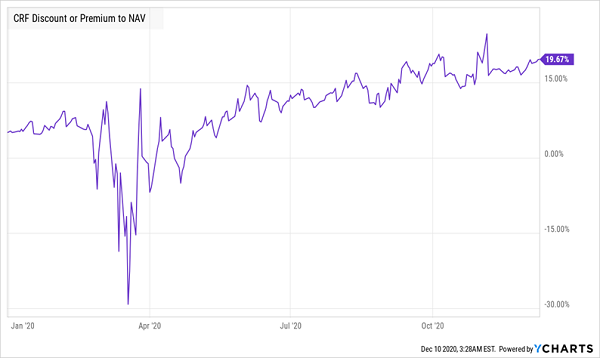

From a Big Discount to a Big Premium

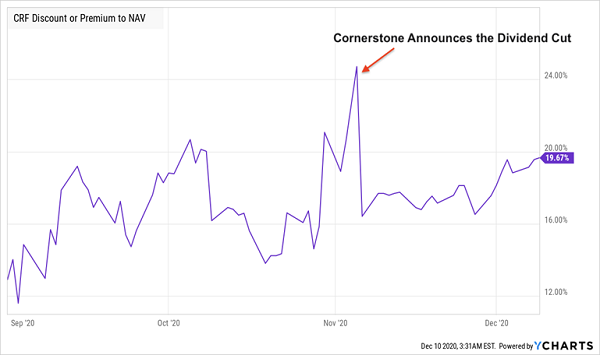

Investors took notice earlier this year, and CRF traded at a huge discount to NAV. That’s recovered to the point that CRF now trades at a bigger premium than it did before the crash. That rich premium makes little sense, since CRF is going to cut dividends again and, when it does, its premium will drop, as it did in November.

Investors took notice earlier this year, and CRF traded at a huge discount to NAV. That’s recovered to the point that CRF now trades at a bigger premium than it did before the crash. That rich premium makes little sense, since CRF is going to cut dividends again and, when it does, its premium will drop, as it did in November.

How CRF Loses Investors’ Money

Holding CRF is like holding a time bomb; its premium will drop when the fund announces a payout cut, and it could do so at any time.

Holding CRF is like holding a time bomb; its premium will drop when the fund announces a payout cut, and it could do so at any time.

— Michael Foster

5 “Must Buy” CEFs Set to Deliver $29,100 in Gains and Cash Payouts in 2021 [sponsor]

What if I told you I’ve found 5 funds set pay you a rock-solid 8% dividend in 2021? And they’re spring-loaded for fast 20% price gains, too.

After the kind of year 2020 has been, I’m guessing you’d be interested.

One of these 5 funds even pays a 9.1% monthly CASH dividend! Invest $100K in and watch $9,100 in cash boomerang straight back to you every year. That’s a cool $758 a month.

That’s not all. I ran each of these 5 tickers through my proprietary dividend-stock-picking system and it came back with the same answer every time:

These 5 dynamic funds are spring-loaded for 20% gains in 2021—no matter what happens with the rest of the market.

Add that to your 8% dividends and you could be looking at 28% in gains in dividends here, or $28,000 on every $100K invested.

The post-election rally has already sent these 5 funds higher, so you don’t have much time! Go here now to get the full story on these 5 funds and sign on for your first big monthly payout.

Source: Contrarian Outlook