My title at Investors Alley is Lead Investment Research Analyst for Income and Dividend Investing. My focus is on helping investors build sustainable, high-yield income streams from their portfolios. I don’t have much use for stocks that don’t pay dividends or bond funds with near-zero yields. However, I do see value in owning precious metals, especially gold and silver.

I have about 5% of my investment portfolio in gold and silver bullion. I currently see two reasons why precious metals could go higher.

One is a fundamental fact that should lead to long-term appreciation.

The other is a short- to intermediate-term technical indicator that points to nice gains for gold and silver over the next year.

The Federal Reserve and U.S. Treasury’s move to print trillions of dollars to pay for the programs passed by the Federal government this year and likely into next (especially if Joe Biden is elected) cannot be without consequences.

Eventually, this will all lead to more inflation and higher interest rates. An increase in rates is especially problematic. With rates now less than 1% for much of the Treasury yield curve, new debt can be issued with minimal cost. However, that debt will mature, and new debt will have to be issued. Even interest rates in the 2% range would double the federal government’s interest expenses. Something will have to give, and the resulting uncertainty will be good for hard assets like gold, silver, and real estate.

On the technical analysis (TA) side, gold and silver recently peaked and are set up for the next up leg. After a two-year rise from $1,200, gold peaked in early August at $2,060 per ounce. It then pulled back, and for the last month, gold has struggled to break back above $1,900. Silver peaked just under $30 per ounce, and for the last month has been trading between $23 and $24 per ounce.

The momentum-based TA service to which I subscribe stated that if gold gets above $1,930 and if silver can sustain above $24, this will be a signal the start to the next upward move for the two metals. Once these price targets are triggered, I expect gold to go to at least $2,400 in 2021, and I wouldn’t be surprised to see silver above $35 next year.

As I noted above, I recommend a small 5% to 10% portfolio weighting in precious metals. It would be best if you looked for a dealer with low costs between the buy and ask prices. It takes a significant price move to overcome a too-wide dealer spread. I regularly share with my Dividend Hunter subscribers the service I use, which has, by far, the tightest spreads from my research.

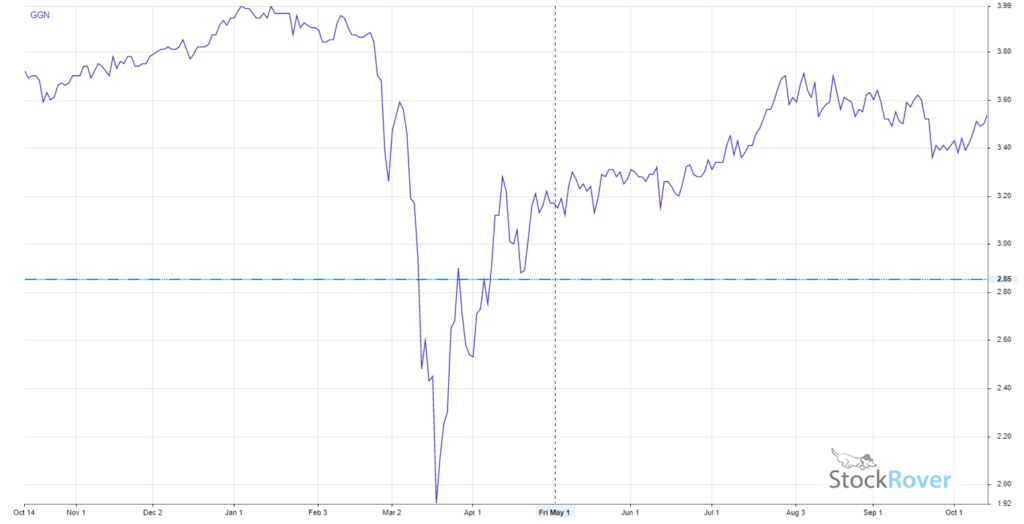

The GAMCO Global Gold, Natural Resources & Income Trust (GGN) offers one way to invest in gold, plus get exposure to other natural resources and earn income from the investment.

The GGN top holdings are a “who’s who” of gold miner stocks.

To boost income, the fund manager uses a covered calls strategy to boost portfolio income.

GGN pays monthly dividends and currently yields 10.2%.

— Tim Plaehn

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley