Let’s not assume our retirement savings will benefit from the Federal Reserve’s bout of 2020 money printing. Inflation could be a real problem, as soon as 2021. So let’s talk about stocks that are not only protected but likely to benefit from Jay Powell’s prolific “efforts.”

(In other words, dividend stocks that’ll double while investors are fixated on deflation.)

When it comes to inflation, many folks have a dangerous blind spot.

They recall 2008, and the Fed’s then-extraordinary actions late that year, which gave us a narrow escape from deflation, and no inflation to speak of.

Just think back to that time. We were told that money printing quantitative easing was sure to drive consumer prices higher. Dire warnings of 1970s-level interest rates were common.

Except inflation never materialized:

2009: Money Printer Powers Up, Inflation Shuts Down

As you can see, inflation was mostly stuck at 2% or less. And just like the proverbial generals fighting the last war, investors think the same thing will happen today.

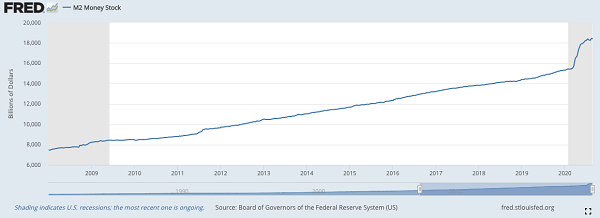

Here’s the problem with that thinking: Ben Bernanke’s fiat-money binge pales next to the $3 trillion Jay Powell’s churned out:

2020 Is Not 2009 Redux

The bottom line: what happened in ’08/’09 is irrelevant—and inflation is a growing threat to your income investments.

I’m not saying we need to take drastic action here, but we do need to prepare. Below we’ll look at two stocks that will ace the inflationary test (and are trading at attractive prices), as well as two companies that won’t be able to take the heat.

But first, if you’re like most folks, the word “inflation” evokes one thing: gold.

Gold: Overcrowded, 0% Dividends

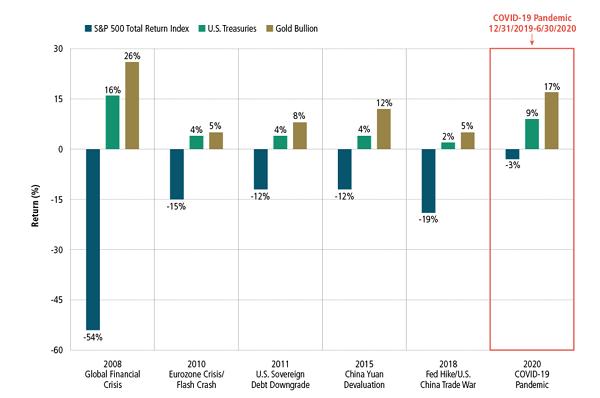

Gold has long been a mainstay in times of inflation or any other crisis. And for good reason: it tends to beat stocks and bonds when a disaster hits, as the folks at Sprott Asset Management remind us:

Gold Outperforms in a Crisis

Source: Sprott Asset Management

Source: Sprott Asset Management

Trouble is, this is the worst-kept secret in investing! Which is why gold recently crushed its 2011 high:

Gold: The Secret’s Out

And gold bullion, of course, pays no dividend. Ditto the funds that track gold, such as the SPDR Gold Shares ETF (GLD) and Sprott Physical Gold Trust (PHYS).

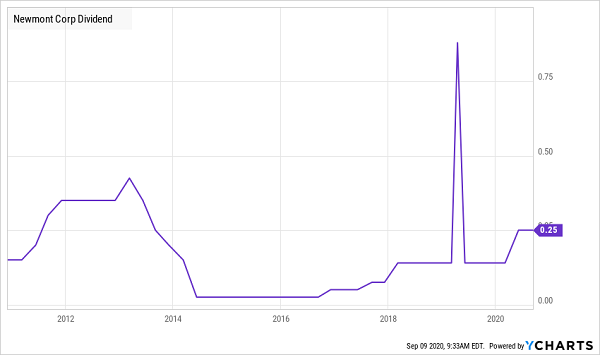

Gold miners? They’re no income panacea, either: Newmont Corp. (NEM), the world’s biggest miner, yields 1.5% and ties its dividend to its financial results, which are, of course, tied to the price of gold. Its payout is all over the map:

Don’t Bank on This Skittish Dividend

Dividend Growers: the Key to Beating Inflation

My take? Forget about gold. If you want to beat inflation you need stocks with growing—and ideally accelerating—payout growth. That enhances your upside because a rising dividend attracts investors. That, in turn, drives up these companies’ share prices. The result: a dividend—and share price—that outrun inflation!

2 Inflation-Beaters With 111%+ Dividend Growth

Let’s start with Pfizer (PFE), which continues to see positive test results for its COVID-19 vaccine, which it’s developing with BioNTech SE (BNTX).

But even so, there’s no guarantee Pfizer’s vaccine will be successful, or that, if it is, it will be needed for the long-term if the disease wanes.

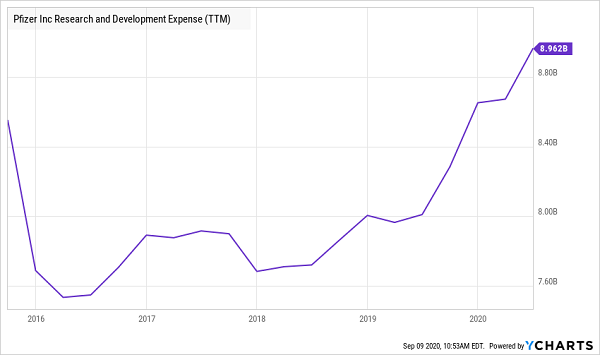

That’s why it’s critical that you invest in pharma firms with rich development pipelines. To be honest, this has turned me off Pfizer in the past: its R&D spending—the lifeblood of any pipeline—had been going nowhere. But that’s changing:

R&D Spend Rebounds

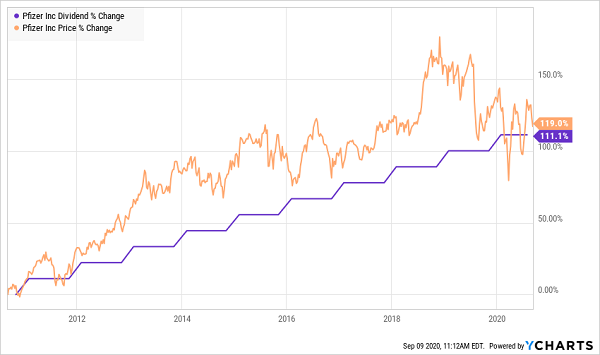

Today, Pfizer has 90 drugs in its pipeline, with about a third in Phase 3 trials or awaiting FDA approval. Meantime, Pfizer has more than doubled its dividend (which currently yields 4.1%) in the last decade. That’s boosted the share price in lockstep.

The Cure for Flagging Upside? Rising Dividends!

The company does sport a higher payout ratio than I’m comfortable with, with dividends accounting for 65% of free cash flow (FCF). But that’s down from 85% at the end of 2019 and should keep improving as COVID-19 comes under control and Pfizer’s salespeople can hold in-person meetings with buyers again.

The Retailer Amazon Fears Most

Best Buy (BBY) shouldn’t be confused with other brick-and-mortar operations that have been run over by Amazon.com (AMZN). The electronics retailer is one of the few to give Bezos & Co. a run for their money!

That’s thanks to its smart business model, including its Geek Squad tech-help desk, which has become a go-to for anyone with a computer mishap. Best Buy has also a strong e-commerce operation that now holds the third-biggest slice of the market for online electronics sales, behind only Amazon and Apple (AAPL).

The second quarter was a testament to Best Buy’s strength: overall sales rose 4%, even though most of its stores were only open for curbside delivery for a large part of that period. Online sales exploded 242%.

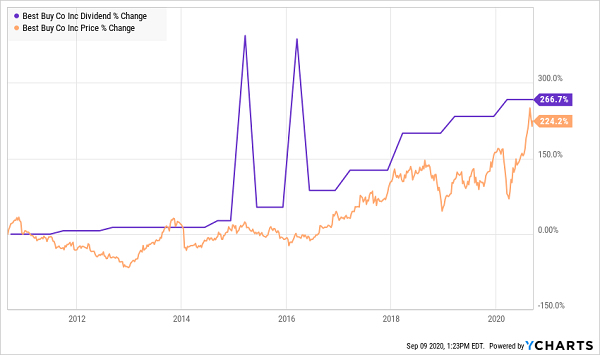

The stock yields 2.1% and Best Buy’s strong dividend growth has pulled the share price higher (with two special dividends thrown in):

BBY: Another Payout-Powered Gain

A couple other things you should know: Best Buy pays out a ridiculously low 11% of its FCF as dividends, so it could increase its payout nearly five times and still be under my 50% safety limit. And, despite a strong gain this year, the stock still trades at a reasonable 15.5-times forward earnings.

2 Laggards to Sell Yesterday

Public Storage (PSA): You may have heard people say that self-storage is a recession-resistant business—when times are good, people buy (and store) more stuff. When times are rough, people downsize—and store more stuff.

But a pandemic-driven lockdown is different: most people are currently doing neither! Meantime, self-storage operators, who are normally blessed with low operating costs, are stuck with the added expense of pandemic-proofing their facilities.

You can see our new environment starting to wear on PSA’s results: rental income dipped 1.8% in the second quarter, while operating costs jumped 6.7%. Core funds from operations (FFO), a critical measure of REIT performance, dipped 6.8%.

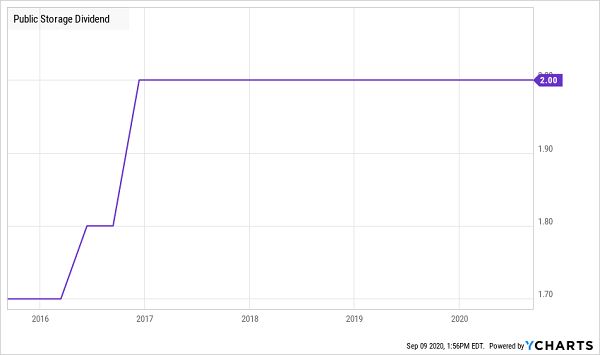

Meantime, you’ve got a stock that yields 3.7% but whose payout growth is a distant memory:

PSA’s Dividend Flatlines

When it comes to REITs, I continue to believe that you should focus on pandemic-resistant areas like cell towers, warehouses and data centers, and avoid disastrous areas like mall landlords. Self-storage falls in the middle, and this is no time to be in no-man’s land!

This 9.1% Dividend Is a Trap Set to Spring

ExxonMobil (XOM): Resource stocks are normally solid inflation hedges, but for that to work, the price of the resource in question—oil in this case—has to go up!

And it’s far from clear that even a sustained bout of inflation could help the goo, which has taken another header, dropping 11% so far this month. As I write this, it trades at just $38 a barrel.

That’s bad news for Exxon, whose share price was butchered in the spring collapse (when oil prices, you’ll remember, briefly plunged deep into negative numbers). Unlike the rest of the market, XOM is still on the mat:

Exxon: A Value Trap in Every Way

That plunge has driven the company’s dividend yield up above 9%. But that’s an illusion, because, XOM has a negative payout ratio, meaning it’s paying a dividend even though its last 12 months of cash-flow generation is in the red! If you haven’t sold this one yet, cut your losses before the inevitable dividend cut arrives.

— Brett Owens

7 Inflation-Busting Buys for 15% Yearly Returns (Forever!) [sponsor]

No matter what happens with inflation, my advice remains the same: buy dividend growers. But not just any dividend growers: we want the elite group of stocks that can hand you a steady 15% every year—forever.

And I’ve zeroed in on 7 specific tickers that can do just that.

These 7 stout income plays are so far off the radar I’ve dubbed them “hidden yield” stocks. They all have one critical thing in common: they’re quietly handing smart investors growing income streams plus annual returns of 15%, 17.3%, 20.8% or more.

These 7 stocks are perfectly positioned to beat back the pandemic and soar on the other side. They ALL boast rising free cash flow, deep order backlogs and healthy balance sheets—a trifecta of inflation-beating strengths few companies can match.

Your next move is simple: buy now and set yourself up for 15%+ annualized returns. That’s easily enough to outrun any inflationary wave we’ll see, because a return like that would double your nest egg every 5 years!

Full details on these 7 standout buys are waiting for you now. Click here to get my complete research: names, tickers, dividend histories and a full breakdown of their operations—everything you need to buy with confidence.

Source: Contrarian Outlook