We just got two powerful signals that the time is right to move into one of my favorite dividend plays: high-yield REITs (real estate investment trusts).

Before we go further, I can understand if you’re leery of REITs. Lots of income seekers were swept up in the “March Massacre,” when investors realized REITs’ April rent collections would be a disaster. And even though REITs have recovered somewhat, most are still underwater on the year.

REITs Sink, Then Bump Along the Bottom

But don’t take that to mean REITs are down for the count, because this is where our opportunity lies. Truth is, when it comes to REITs, most folks think it’s still March, even though the situation today is far better.

Now if you’re like most people, you don’t spend much time reviewing the monthly REIT rent-collection figures (unless you’re looking for a strong sleep aid). But they’re readily available, and the latest installment (for July) tells quite a story.

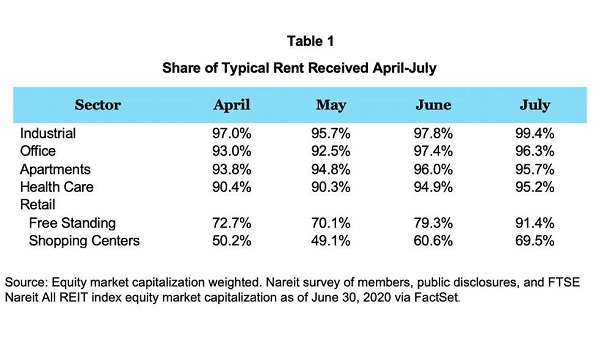

July Rent Collections—Hardly a Disaster

I’d suggest you print this table off so you can pull it out the next time someone tells you REITs will never recover from this crisis!

“Lost” Rents Aren’t What They Seem

Take a look at the left-hand column above: even in April, when we were in the teeth of the lockdowns, things weren’t that bad.

Unless you were running a retail REIT, you were still looking at just a 10% (or less) delinquency rate.

And remember that even those “lost” rents were mostly deferrals. So REITs will still see most of that cash—it’s just kicked down the road (and will come back with interest!).

Now look at the right-hand column. By July, every REIT sector outside retail collected 95% of its rent (or more). Heck, even Amazon.com (AMZN) whipping boys like free-standing shopping centers pulled in 91%!

In other words, the vast majority of REITs, with the exception of enclosed malls (which we avoided before the pandemic anyway), snapped back to normal more than four months ago.

Yet despite this, REITs still trail way behind the S&P 500. This is why I think we’ll look back on this time years from now and see it for what it is: a solid opportunity to buy great REITs cheap!

But don’t take my word for it—the reigning king of value investing tells us it’s time to take another look at REITs, too.

Buffett Just Bought This REIT. Should You?

I’m talking, of course, about Warren Buffett. According to a recent SEC filing from Berkshire Hathaway (BRK.A), Buffett made a move into STORE Capital (STOR), the only REIT in Berkshire’s portfolio, in the second quarter. This was no token buy, either: Berkshire boosted its STORE holding by 31% and now owns a 9.6% stake.

There’s plenty to like about STORE. For starters, it’s diverse, with 2,554 properties in 49 states, and its customers operate in 113 industries (though as we’ll see below, a significant portion are retail-focused). It also sports a sky-high 99.5% occupancy rate.

The company lowers its risk through its “triple-net-lease” model, where the tenant pays all the expenses: insurance, maintenance and taxes among them. STORE simply collects the rent!

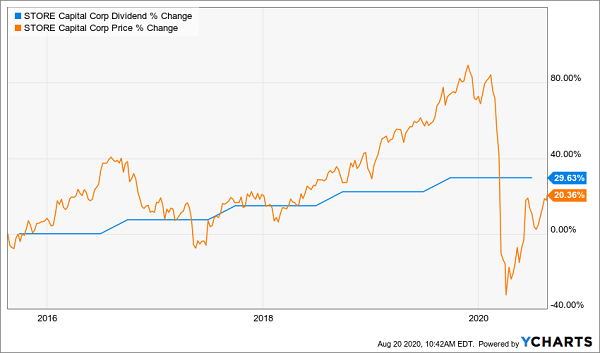

STORE’s 5.4% dividend easily tops the payout on your average REIT (3.9%) and S&P 500 stock (1.7%). And even though its $0.02-a-year hikes are far from exciting, they’ve been enough to pull in some dividend investors, who’ve bid the share price up in lockstep with the dividend hikes, even with the collapse the stock suffered in the spring:

STORE’s Dividend Inflates Its Share Price

STORE also has room to increase its payout in September, when it usually announces hikes (an enviable position for any dividend stock these days). That’s thanks to its payout ratio: STORE’s dividend accounts for 73% of its last 12 months of adjusted funds from operations (FFO, the best measure of REIT profitability). That’s low in REIT-land, where ratios of 90% are common—and sustainable.

But even so, I’m not quite pounding the table on STORE yet, for a couple reasons. First, management says it collected 86% of August’s rent. That’s great, but it’s below what most other REITs collected in July.

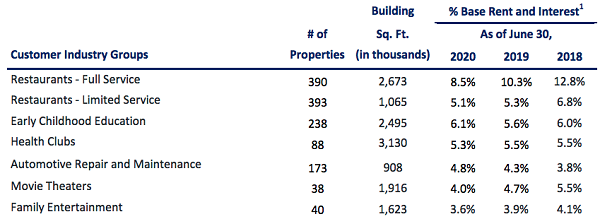

Second, look at STORE’s top tenants by industry. Many of them—restaurants, early childhood education centers, health clubs, movie theaters and family-entertainment businesses—will be crushed if the virus surges in the fall.

STORE’s Pandemic-Sensitive Portfolio

Source: STORE Capital Q2 2020 investor presentation

Source: STORE Capital Q2 2020 investor presentation

Far be it for me to go against the Oracle of Omaha, but I see STORE as a good stock for your watch list, rather than your buy list, right now. So let’s set this one aside and dive into another REIT with better prospects in our “new normal.”

This REIT That Profits From This Crisis (and grew its payout 202%)

Alexandria Real Estate Equities (ARE) owns offices and labs in “innovation clusters”—neighborhoods where companies and government agencies in a particular research area “cluster” together.

The REIT is perfectly positioned to benefit from this crisis, as all 80 of its life-sciences tenants are contributing to the fight against COVID-19, including Abbott Laboratories (ABT), Thermo Fisher Scientific (TMO) and Quest Diagnostics (DGX).

Pandemic aside, tenants love these clusters, and once they’re in, they tend to stay. The REIT boasted a solid 94.8% occupancy rate as of the end of the second quarter, and Alexandria had collected 99% of July rents as of July 24, 2020.

That should dispel any fears that its offices will fall victim to the work-from-home trend. Innovation-focused companies often let their employees work from home anyway, so the current situation is nothing new. And Alexandria’s tenants are paying the rent just fine, and likely have no plans to shed the office.

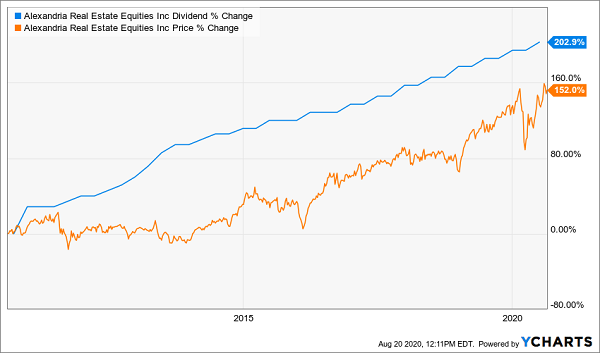

Another area where Alexandria has a big edge over STORE is in payout growth. As you can see below, Alexandria regularly raises its payout twice a year, and the dividend has tripled in the last decade.

Like a faithful puppy, the stock has trotted right up along with payout. (The gap between the two, incidentally, is our upside.)

Alexandria’s Twice-a-Year Payout Growth Drives Its Stock

Let me close off with two other quick points. First, don’t be put off by the stock’s 2.5% current yield, because its soaring dividend growth will boost the yield on a buy made today in short order. If you’d bought Alexandria 10 years ago, for example, you’d be pocketing a 6.1% yield today.

Finally, this dividend growth looks assured, with the REIT paying out just 57% of FFO as dividends in the last 12 months, even lower than STORE’s safe ratio.

— Brett Owens

Beat the Recession. 4X Your Dividends. Here’s How. [sponsor]

Alexandria is a strong REIT, but it doesn’t quite make the cut to qualify for my “Perfect Income Portfolio.” That’s because Alexandria doesn’t yield enough today; even though we’re getting 200%+ dividend growth here, we want more of our cash upfront!

And that’s exactly what I’ve created my Perfect Income Portfolio to give you. While most investors have been scraping by on 2% to 3% payouts, this portfolio (which I’ve been cobbling together in secret for years now) has been returning 10%+ per year!

Smooth and steady, year in and year out.

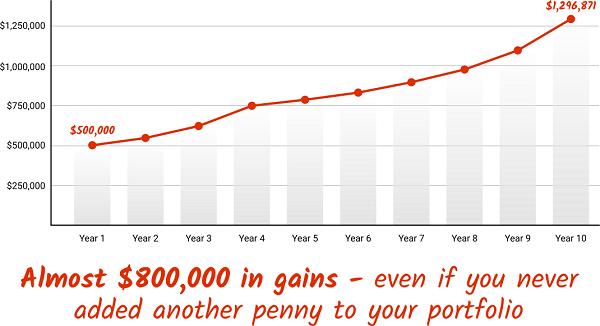

That’s just the opening act. If you’d followed this strategy for the past 10 years, here’s what would’ve happened to your money:

That’s right—an EXTRA $800,000!

This is nothing less than my #1 investing secret, and it works best in a chaotic market like this one. The time to take advantage of it is right now.

I can’t wait to give you this strategy and the specific tickers you need to buy. Click here and I’ll hand it ALL over to you, including the names, tickers, complete dividend histories and my full analysis of every stock in this proven dividend portfolio.

Source: Contrarian Outlook