Names tied to the novel coronavirus have had ups and downs, but certainly have enjoyed upside throughout parts of 2020. Danaher (NYSE:DHR) is no different, as DHR stock continues to bubble higher.

Many wonder what Danaher has to do with Covid-19, as it’s not mentioned with the biotech players involved in hunting down a vaccine. On top of what is already a great business, Danaher is also finding Covid-19 to be an advantage rather than a disadvantage.

In the words of outgoing CEO Tom Joyce:

We are tackling the challenges and opportunities presented by the COVID-19 pandemic head on and are fortunate to do so from a position of strength…Diagnostic testing has been a critical component of the global community’s attempts to better understand and ultimately curb the spread of COVID-19 and Cepheid has been a leader in this effort.

In March, Cepheid launched the first rapid molecular tests for COVID-19 that provides highly accurate results within 45 minutes. Multiple independent studies indicate that Cepheid’s test performance is best-in-class versus other point of care platforms.

Breaking Down Danaher Stock

As you can see from the statement above, Danaher is not sitting back and hoping things get better with Covid-19. It is out in front and helping to lead to the charge. Its previous acquisition of Cepheid only gives it that much more leverage.

But the company isn’t slowing down and getting complacent.

The Cepheid team is developing a rapid 4-in-1 test that will test for Covid-19, influenza A, influenza B, and RSV with one sample.

The test is designed to be done in 35 minutes and is expected to launch in the third quarter ahead of the flu season.

Again, in the words of Tom Joyce, “The symptoms for each of these viruses are very similar, but the treatments are very different. So, the test is being designed to provide critical answers within 35 minutes to ensure the best patient outcome.”

If you’re an investor, this is the kind of thing you want to hear. With a new CEO set to take the helm in September, there are several catalysts lining up for next month.

This comes after the most recent quarterly report, where Danaher beat on earnings and revenue expectations. Sales of $5.3 billion came in almost $290 million ahead of estimates, the company’s biggest beat in years. Earnings of $1.44 per share topped expectations by 35 cents.

In those numbers, it’s clear where the growth is coming from. Danaher’s Life Sciences division — which is the largest of its three business units — recorded revenue growth of 54.5%. That compares to just 2.5% growth in Diagnostics and a 10.5% dip in Environment and Applied Solutions.

Right now, DHR stock has the right catalysts at the right time.

Trading DHR Stock

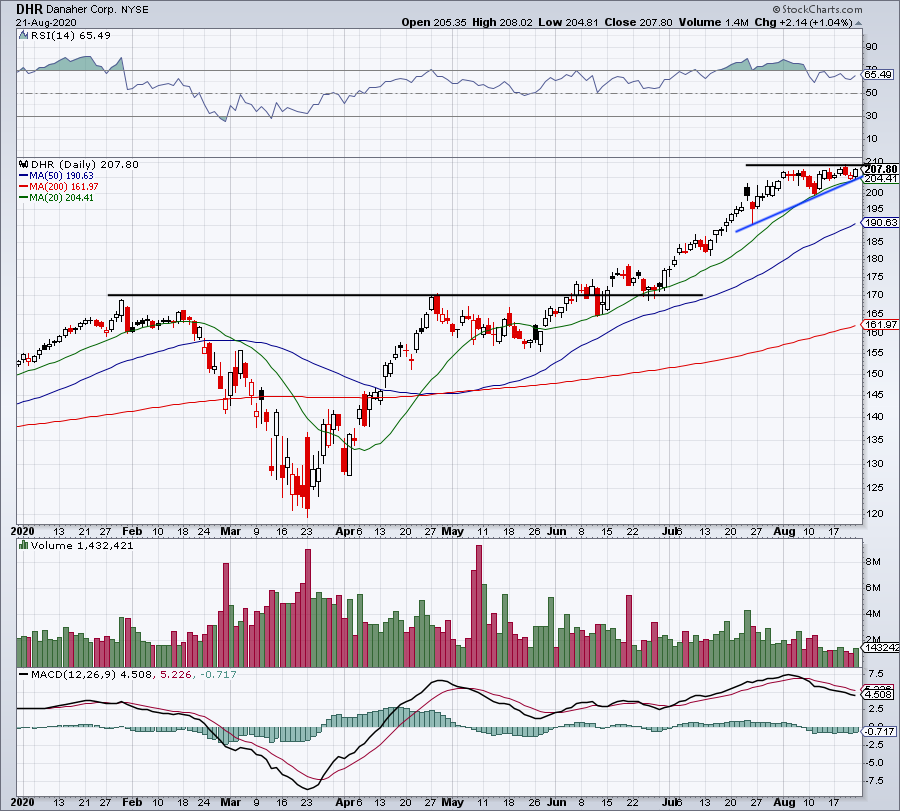

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com

While business is going well, the charts for DHR stock are perhaps the most exciting thing going for it right now.

In June, shares broke out over $170 resistance. While the initial breakout was choppy, bulls bid the name higher with authority a few sessions later. Then, $170 began acting as support rather than resistance, a bullish development.

Since then shares have been on a strong rally, as the 20-day moving average and uptrend support (blue line) continue to push DHR stock into resistance near $208. This has the look of an ascending triangle, with bulls looking for a breakout over $208. A close above puts the two-times range in play at $218.25.

A close below support unwinds some of the bullish momentum, putting the 161.8% extension in play near $199, followed by the 50-day moving average.

— Matt McCall

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place