Have you read the latest? The media says municipal bonds, our favorite plays for safe, tax-free dividends, are facing a surge in defaults.

That, of course, sounds like terrible news for “munis,” which are issued by local governments to fund infrastructure. Munis’ government backing is a big reason why their default rates are microscopic: typically around 0.01%.

So are our rich, tax-free dividends really about to be stolen away by a wave of defaults? No way! In fact, now is a great time for us contrarians to move into these stout dividend plays.

And when you buy your munis through another income favorite of mine, closed-end funds (CEFs), you get something truly special: 5% yields that, due to their tax-free-nature, work out to much more: if you make, say, $150,000 a year, your “true” payout on a 5% muni-CEF is a sky-high 6.9%.

Beyond First-Level Fears

Let me say upfront that the media reports haven’t been false. There have been 50 municipal-bond defaults in the first half of 2020, the highest number since 2011.

Unfortunately, this is where most “first-level” investors stop—and panic. But we’re going to dive deeper and work these unjustified worries to our advantage.

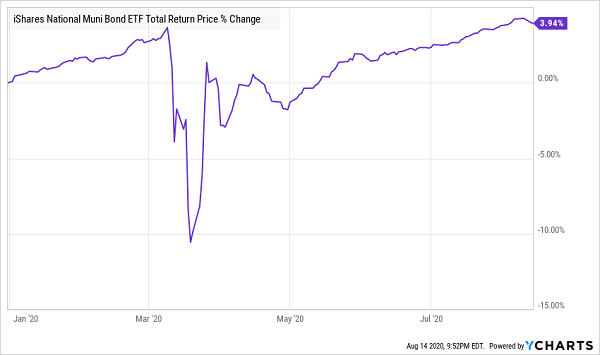

Let’s start by evaluating how municipal bonds are performing as a group. We can do that by looking at the most popular index fund tracking the sector, the iShares National Muni Bond ETF (MUB). As you can see, it’s gone up in 2020:

Munis Rise Despite Default Reports

So we’ve got muni defaults rising, and investors are still bidding their prices up. The natural question follows: are munis a crowded trade?

Nope.

Because while defaults are up, investors who watch this market closely know that 50 defaults is tiny compared to the total number of muni bonds issued in 2020: 5,105 in total. In other words, less than 1% of those issuances are at risk of default.

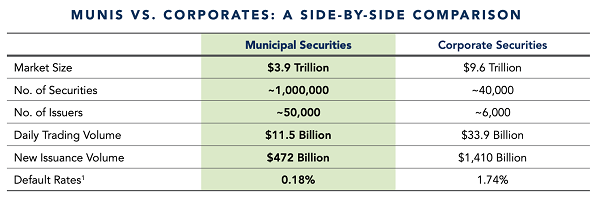

But even this is misleading, because while there were that many issuances in the first half of 2020, there are currently one million outstanding muni securities in a market worth nearly $4 trillion.

Source: Municipal Securities Rulemaking Board

Source: Municipal Securities Rulemaking Board

Those 50 defaults are a speck in a huge pool, and they don’t even register above the 0.18% default rate we’ve seen for investment-grade municipal bonds from 1970 to 2016.

Source: Municipal Securities Rulemaking Board

Source: Municipal Securities Rulemaking Board

In other words, default rates may technically be going up, but they’re rising at such a statistically insignificant pace as to be meaningless.

Getting Even Further From Default Fears

The bottom line? Munis are as safe as they ever were, and the pandemic hasn’t changed a thing. And as I said earlier, buying munis through a CEF is your best option.

There are many benefits to doing so, including convenience and liquidity. (As the muni-bond market is tough or individual investors to access, you’re best to go through a fund managed by a seasoned pro.) Instant diversification is another benefit: a muni-bond CEF will get you exposure to hundreds of issuances, lowering your risk of holding a defaulting muni bond to near zero.

CEFs also give you a much higher yield than muni-bond ETFs. And actively managed muni-bond CEFs usually outperform their benchmark, too. That’s because investing in the muni market requires a lot of specialized knowledge, so it’s a snap for human managers to trounce the algorithms that run the ETFs.

This nicely brings us back around to the income angle. I’ve already mentioned MUB, the muni-bond benchmark ETF. Its 2.2% yield is puny compared to a CEF like the BlackRock MuniYield New Jersey Fund (MYJ), which yields 5%. Or you could go for another national fund and get double MUB’s yield—4.4%—with the Blackrock Muniassets Fund (MUA). (And remember, too, that these yields don’t include tax exemptions.)

Both CEFs have crushed the index for years.

Muni CEFs Double Up the Index

These low-risk high yields are ideal for retirees and other income seekers looking for a reliable income stream without the tax burden. And no matter what the fear mongers tell you, they’re great buys now, with municipal defaults still a statistically insignificant concern.

— Michael Foster

The 5 “Crisis-Resistant” 8% Dividends You Must Own Now [sponsor]

My 5 top CEF picks have incredible portfolio managers—whip-smart pros who deftly buy and sell their holdings, then hand the cash over to you in the form of safe 8%+ dividend payouts.

And with the unprecedented uncertainty we’re living through—from the pandemic to a totally unpredictable presidential election—you need to own these funds now.

That’s because these 5 dynamic CEFs not only pay massive 8%+ dividends, they protect your nest egg due to their keen active management and strong diversification.

As you might guess, the cornerstone of this 5-fund “instant” portfolio is a muni-bond fund, due to these CEFs’ legendary stability. The other four come from across the economy, giving you high-yield corporate bonds, real estate, large-cap US stocks and rock-solid utilities with some of the safest dividends out there.

Hire the Same Managers Billionaires Use—for Free

Make no mistake, the folks who run these funds are among the sharpest minds in finance. And we’re going to put them to work for us at this critical time in history—essentially for free!

That’s because each of these 5 cash-rich CEFs trades at a discount so huge it dwarfs the modest fees our pros charge. That means their services are essentially “comped” for us!

So what kind of return can we expect?

My proven CEF-picking model has these 5 funds pegged for 20%+ price upside, on average, in the next 12 months. That’s in addition to the huge 8% average dividend you’ll pocket!

These 5 CEFs are the answer to the crisis we’re living through. Don’t miss your chance to get in at a bargain. Go here for full details on these 5 ironclad funds—and start tapping their incredible 8%+ payouts today!

Source: Contrarian Outlook