“Money printer go brrrrrrrrr!”

This humorous investor war cry making the social media rounds these days is all you need to know about the Federal Reserve’s tactics to fight off the coronavirus. Jerome Powell is printing money like there’s no tomorrow.

In fact, since March, he’s created more than $3 trillion fresh dollars! This has been the largest money creation event in the history of the planet.

Powell Prints, Money Supply Soars

More money is lousy news for each outstanding greenback. The US dollar is starting to tailspin lower thanks to a flood of supply:

More money is lousy news for each outstanding greenback. The US dollar is starting to tailspin lower thanks to a flood of supply:

More Dollars Means Each One is Worth Less

What dividends do we buy when the dollar is weak? One playbook is gold miners and high-yielding overseas bond funds. But let’s not forget select blue-chips!

What dividends do we buy when the dollar is weak? One playbook is gold miners and high-yielding overseas bond funds. But let’s not forget select blue-chips!

US multinationals that generate significant sales overseas also benefit from a weaker buck, because:

- Their products and services become cheaper (and thus more accessible) in foreign markets. Plus,

- Their reported financials look better because the yen, euros, yuan and other currencies they’re collecting translate into more dollars.

Here, we’re looking for big cash cows that are growing their dividends quickly. With this in mind, here are three stocks likely to benefit from the weak greenback.

Pfizer (PFE)

Dividend Yield: 3.8%

I’ll start with Pfizer (PFE), which is heating up thanks to a pair of drivers:

- Its COVID-19 vaccine, in partnership with BioNTech (BNTX), recently entered late-stage trials.

- An encouraging second-quarter earnings report that saw revenues and profits both decline less than expected on the strength of its biopharma division. More importantly, Pfizer raised full-year profit guidance from $2.82-$2.92 per share to $2.85-$2.95.

Pfizer not only derives more than half of its revenues overseas, but the rest of the globe’s contributions are growing.

International revenues came to $7.2 billion in 2019, or about 57% of total sales, up from 53% in 2018.

It’s a trait you’ll see in a lot of blue-chip pharma stocks, and one that should benefit them if the U.S. dollar continues to wither.

I like the dividend growth story here, too.

While PFE lost Aristocrat status during the Great Recession when it cut its payout in half, it has since rebuilt the dividend past pre-reduction levels.

That includes 6.3% compound average dividend growth in the past five years, which is a generous level for such a mature company.

Pfizer’s Yield Pretty Good by Historical Standards

Philip Morris International (PM)

Philip Morris International (PM)

Dividend Yield: 6.0%

If a weak dollar props up U.S. multinationals, you have to love an American-headquartered company that reports its results in U.S. dollars but doesn’t generate a cent of revenue domestically.

NYC-based Philip Morris International (PM), which was spun off from Altria Group (MO) in 2008, sells cigarettes and other products in more than 180 international markets, where it often holds either the No. 1 or No. 2 position. It boasts six of the top 15 international brands, including longtime leader Marlboro.

It has also invested heavily in heated tobacco, which is yet another cigarette alternative that’s picking up speed. Its IQOS brand boasted 15.4 million users as of the end of the second quarter, up from 14.6 million in Q1, its pace of growth slowed by COVID-19, but not squashed.

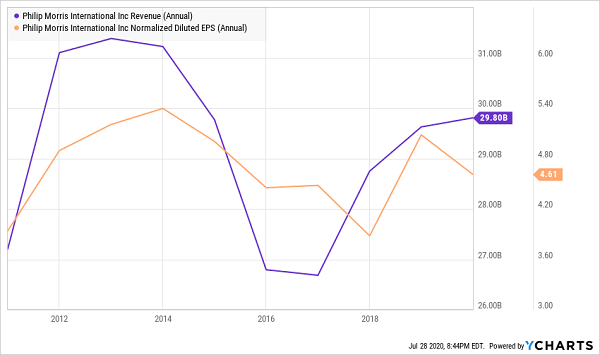

While Philip Morris is fighting many of the same anti-tobacco trends here in the U.S., it has been slowly but surely able to grow revenue for several years without interruption. While 2020 should end that streak, it still appears far better-positioned than its American counterparts.

No yield concerns here, either. At 6%, PM shares are at the high end of what you can expect from traditional blue chips. Its dividend growth rate of 3.2% annually, while modest, outstrips current-day inflation; we’ll see if the Fed’s printing press changes that.

Just be realistic. Tobacco, at best, will provide merely glacial growth. The yield will be most of your returns, so ask yourself: Is 6% enough?

Philip Morris’ Next Decade Could Look Just Like This, Too

Chevron (CVX)

Chevron (CVX)

Dividend Yield: 5.6%

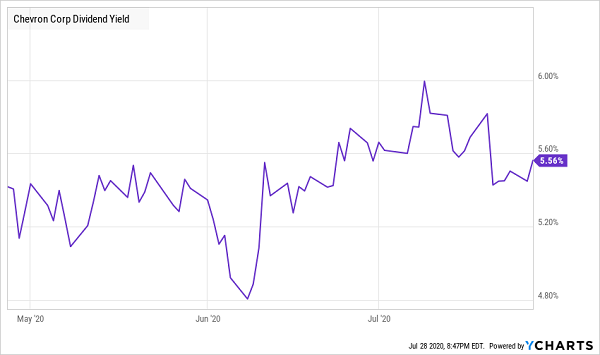

In June, I highlighted Chevron (CVX) as a good yield that we’d soon be able to buy as a great yield. And guess what? We’re getting there.

Chevron’s Yield Is Creeping Back Into Can’t-Miss Territory

You know the story. Oil fell off a pair of cliffs this year—first as COVID-related pressures started to mount, then again as the Saudis started a brief price war that momentarily sent crude prices into negative territory. Several small energy players have been forced into bankruptcy. Blue-chip Royal Dutch Shell (RDS.B) cut its payout, and Wall Street seems to believe BP (BP) will, too.

You know the story. Oil fell off a pair of cliffs this year—first as COVID-related pressures started to mount, then again as the Saudis started a brief price war that momentarily sent crude prices into negative territory. Several small energy players have been forced into bankruptcy. Blue-chip Royal Dutch Shell (RDS.B) cut its payout, and Wall Street seems to believe BP (BP) will, too.

Dividend Aristocrat Chevron, which faced similar conjecture in 2015, has vowed this year to protect the dividend.

We’ll see if that’s the case in Chevron’s latest earnings report, but between killing off share repurchases and slashing capex, as well as recovering oil prices, I tend to think CVX will keep its payout intact. The fact that Chevron felt brave enough to buy Noble Energy in a $5 billion all-stock deal gives me more confidence.

Short-term, however, oil’s rebound has flattened and so has the recovery in Chevron’s stock, which is nudging the yield back toward 6%.

There’s no doubt a weak U.S. dollar could help Chevron. The company’s international segments generated $8.6 billion in earnings when it only earned $2.9 billion total – U.S. Upstream and “All Other” accounted for nearly $7 billion in losses.

But given CVX’s prospects for slow dividend growth in the face of low oil prices, we should wait to see if a bigger bargain presents itself.

— Brett Owens

Score Your “Dream Retirement” With Yields Up to 15% [sponsor]

If blue chips like Pfizer or Chevron happen to “fall down” to us and give us yields we won’t see again for a decade, great.

But if you’re ready to act on stocks that are retirement-portfolio ready right this very minute, you don’t need to wait. My “Dream Retirement Portfolio” offers high yields that have survived the worst of 2020 and still are delivering once-in-a-generation yields of up to 15%.

“Wait, Brett. Isn’t it dangerous to buy high yields when so many companies are cutting or shutting down their dividends altogether?”

Yes. Yes it is—if you buy low-quality high yields. But it’s every bit as dangerous to mindlessly hunker down in stable blue chips that can’t possibly meet your retirement income needs.

My “Dream Retirement Portfolio” is a plan of attack for a market that that’s starving income investors. Retirement planners and retirees alike feel like they’re being forced to put their money to work in 2%- and 3%-yielding blue chips because March’s big dip is over. Because at least they’re safe. Those big, name-brand companies won’t let them down, right?

Well, if you think a big market cap really equals a secure an stable payout, talk to Boeing shareholders…

Or Ford shareholders…

Or GM shareholders…

Or Disney shareholders…

…all of whom stopped collecting dividend checks a few months ago.

Meanwhile, my readers and I are sitting here waiting for our next jumbo-sized dividend check to come in the mail.

It might sound unorthodox in the midst of a recession, but it’s time to get greedy.

Go on the attack with my “Dream Retirement Portfolio” – a three-part set of buys AND sells that will help you clean house and put you ahead of your original retirement timeline.

I’ll show you…

- Why you should dump your blue-chip stocks, and which ones to sell. Well-traveled large caps aren’t the protective plays you think they are, and in fact, I’ll show you a dozen companies you should ditch right now.

- 4 contrarian income plays yielding up to 15%. My four contrarian picks are tailor-made to actually benefit from this crisis…all while delivering enough income to double your nest egg in less than five years!

- How to REALLY invest like Warren Buffett. The financial media always glosses over one of Uncle Warren’s most successful investing strategies because it’s, to be honest, pretty boring. But there’s nothing boring about building real wealth in the midst of a bear market—and I’ll show you how to do exactly that with “Warren Buffett bonds.”

You can put these three steps to work right away, and they’ll immediately transform any underperforming, income-light retirement into a perennial cash machine that will deliver the goods in any market cycle.

Imagine collecting $75,000 on a mere half-million nest egg…

…actually, stop. You don’t have to imagine it. It’s real, tangible income that you can expect to collect from one of these dividend dynamos if you jump in at my buy-under price.

Every day you wait to take action could be another month of retirement that goes unfunded. Click here for details on my Dream Retirement Portfolio. You’ll discover the 12 widely held dividends to sell immediately, 4 contrarian buys paying up to 15%, and the names and tickers of these “Warren Buffett bonds” – absolutely risk free!

Source: Contrarian Outlook