With the S&P 500 yielding just 1.8%, and 10-Year Treasuries paying a pathetic 0.7%, many folks are getting desperate for income—and they’re falling for dangerous dividends like exchange-traded notes (ETNs).

Note I said “ETN” here, and not “ETF.” It’s a critical distinction—and overlooking it could cost you a fortune in gains and dividends.

A Crippling 70% Loss

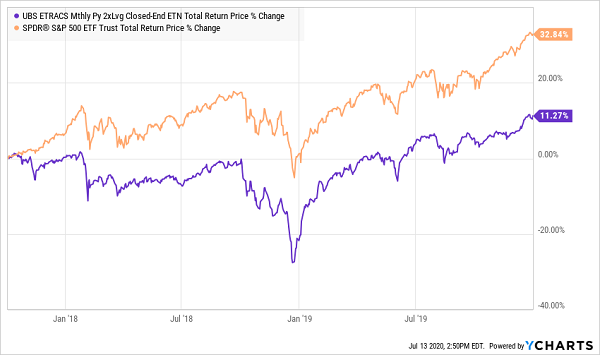

To see how dangerous ETNs can be, consider the (now defunct) UBS Etracs Monthly Pay 2x Leveraged Closed-End ETN (CEFL), which I first warned readers about in October 2017.

CEFL went on to be crushed by the S&P 500 from that first warning until the start of 2020.

Not the Best Place to Invest

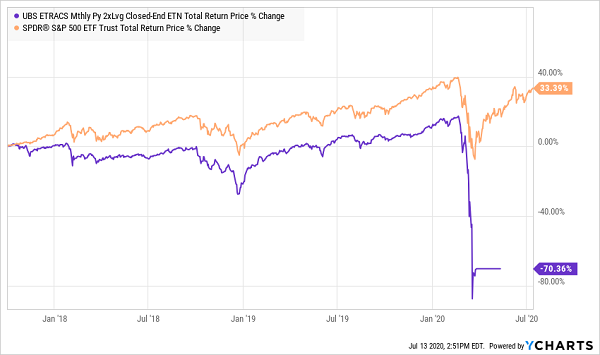

Fast-forward into the March crash and things got far worse: if you happened to buy CEFL the same day I warned against it, you’d have been down 70%!

Bad Dream Becomes a Nightmare

There’s a simple reason why investors fell into CEFL’s trap: its massive dividend yield. For most of its lifetime, the ETN yielded more than 15%, sometimes as much as 20%.

The immediate appeal of a payout like that is obvious: invest $150,000 in CEFL and you’d get $30,000 in yearly dividend income from this fund alone, enough to retire on in many places.

But that’s cold comfort to CEFL investors now—they won’t ever get their money back. In March, the fund was shut down and liquidated, so even if you wanted to try to wait it out and recover your investment, that’s now impossible.

The Problem With ETNs

ETNs are similar to ETFs except for one key difference: the issuer doesn’t actually buy the assets in the ETN. Instead, the issuer tracks an index of the market value of those assets and promises to buy back the ETN at that value. This has the effect of keeping ETNs’ market prices close to the value of the index they track.

In good times, this isn’t a big deal, but there’s a condition that’s often overlooked: the issuer can shut down the ETN and redeem it for cash when it goes below a certain value. When CEFL’s value crashed, its issuer cashed it in and shut it down. If you held CEFL when that happened, you got pennies on the dollar.

CEFL wasn’t the only ETN to suffer this fate. So far this year, 38 ETNs have been discontinued, with many offering dividends of 12% or more. Those big payouts lure investors into holding the ETN for too long, leaving them open to being wiped out when it crashes in a market panic.

A Cautionary Tale in a Rising Market

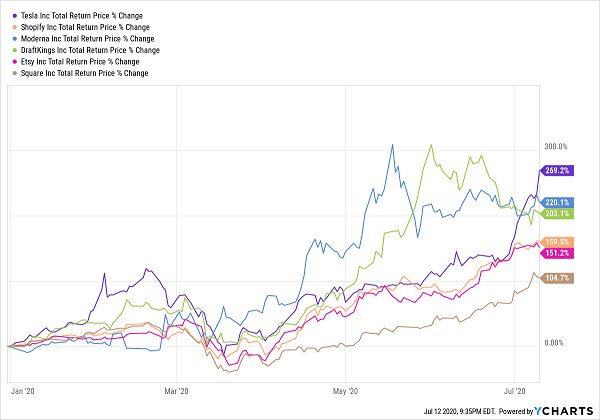

The tale of CEFL is important now, because the market’s swift recovery is encouraging a lot of risk-taking. I’m sure you noticed Tesla (TSLA) stock reaching stratospheric levels, in addition to Shopify (SHOP), Moderna (MRNA), DraftKings (DKNG), Etsy (ETSY) and Square (SQ).

These Stocks Are Off the Charts

All of these companies are massive outperformers, getting way ahead of their pre-COVID-19 valuations, despite the deep recession we’re seeing around the world.

Those strong gains are great for investors who love high-risk stocks, of course, but they also show that we’re at a point where greed is driving investors much more than fear. And that’s usually the situation we see right before a big selloff.

— Michael Foster

Reliable 7%+ Payouts Perfect for a Crisis [sponsor]

One thing we’re not going to in response to this heightened appetite for risk is to sell and go to cash. After all, we still need our dividend income! And of course, we never know when the rebound will come: investors who held on in March (or in previous crashes) ended up recovering most of their losses in short order.

Unless they were in ETNs, of course.

Because of the ETN structure, you simply can’t recover your losses, because these investments will disappear when their value hits its lowest. That’s why we look to top-quality closed-end funds (CEFs) for the part of our portfolio we devote to high-yield investments. As members of my CEF Insider service know, many CEFs yield 7% or more, and a few very good ones yield over 10%.

These 4 CEF Bargains Yield 8.4%+ (with upside)

Here’s the best part about CEF investing: no matter what the rest of the market is doing, you can always find top-notch CEFs trading at a discount!

That’s because CEF investors tend to be just a little slower to respond to events than the rest of the crowd. That’s a delay we can exploit for big dividends (and upside).

I’ve got 4 of my very best CEF buys waiting for you right here. I’ve personally safety-checked and hand-picked these 4 funds, which offer safe 8.4% average dividends now and trade at outrageous discounts, setting us up for some nice upside, as well as downside protection if the market falls out of bed again.

The highest payer among these four yields an outsized 10.4%. So in other words, you can hang onto this one for a decade and get all of your upfront investment back in dividend cash alone! But unlike with dangerous ETNs, you don’t have to take heart-stopping risks to make that happen.

I can’t wait to share these 4 cash-rich CEF picks with you. Simply click right here and I’ll give you full details on each one: names, tickers and my full analysis of each one (including a full breakdown of their dividend histories). Don’t miss out.

Source: Contrarian Outlook