German digital payments company Wirecard (WDI), which processes payments for companies like Visa and Mastercard, has 6,000 employees in offices around the world. Last year, WDI had revenues of $2.2 billion—four times what they did in 2013. The company has been the toast of Wall Street, and business has been great.

Or so we thought.

After its very successful run as one of the few German tech firms to hit it big, WDI may soon go out of business. What happened?

On Monday, Wirecard released a statement saying that the €1.9 billion ($2.1 billion U.S.) listed in its account did not—what’s the word?—exist. In fact, it never existed.

Wirecard’s auditor had refused to sign off on the account after they couldn’t verify the amount.

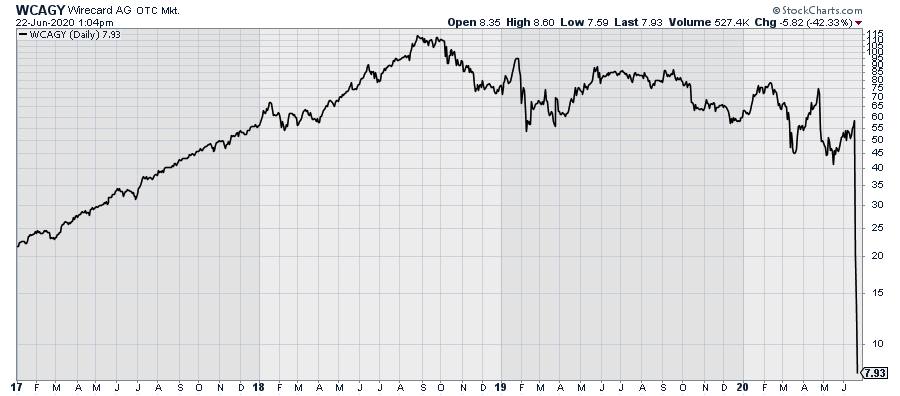

Wall Street has taken notice. Wirecard’s credit rating has been slashed to junk. Over a three-day period, the shares plunged 85%, and it could still get worse.

Here’s a stock chart you don’t see often:

Wirecard has withdrawn all of its financial statements for last year. Leadership is in a scramble to sell off assets in attempt to raise enough cash to stay afloat. I doubt they’ll make it. On Friday, the CEO quit.

One analyst said, “Without a very concise explanation in short order, we fear Wirecard is headed to zero.”

I’ll spoil the ending: the stock is done for, but there are important lessons we can learn.

Lessons We Can Learn from Wirecard

As an investor, it’s natural to wonder: “how can this happen?” How can an ostensibly successful company turn out to be a bankrupt fraud? It seems amazing that this can happen; yet it’s hardly the first time.

The situation is sad and I sympathize. One of our goals is to find great businesses to invest in, but that’s very hard to do if the company is systematically lying to you. I remember being impressed by the numbers from Enron. But their financials looked great because the reports weren’t true.

The most important asset a company has is its reputation. Before I invest in a company, I want to know if I can trust it. That comes before anything else.

One company that has a high degree of trust with me is Ross Stores (ROST), the deep discounter. Why do I trust them? Barbara Rentler, the CEO of Ross, gives periodic updates on the business and guidance for what to expect. The guidance is usually pretty accurate, although Ross tends to err on the conservative side. After several years, I’ve come to trust the company.

As in investor, I appreciate this. The news doesn’t always have to be good. Rentler will be frank if a quarter is weak or below expectations, and it’s always refreshing to hear.

This is an interesting time for Ross, because nearly the entire business was shut down due to the coronavirus. In a few weeks, the stock dropped by 54%. As a value-focused investor, I took notice.

Last month, Ross reported fiscal Q1 earnings and as expected, the report was a disaster. Ross lost 87 cents per share. You really can’t make money when your stores are closed.

But here’s the key fact: Ross said it’s following a phased reopening of its stores, and CEO Rentler said the company has enough liquidity to ride out the storm. Ross will be back and the low share price won’t last—in fact, Barron’s recently highlighted Ross Stores and other discount retailers as solid investments, because consumers have become more value oriented.

Shares of Ross are still well below their highs from earlier this year. But I trust the company. I trust its business model, I trust its management, and I have great trust in its future. As the economy gradually gets back on its feet, I expect to see shares of Ross Stores rally from here.

— Eddy Elfenbein

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley