According to people who follow such things, the ancient Mayan calendar predicted that world was going to end on December 21, 2012.

That day came and went, and the world is still here, so perhaps the ancient Mayans got it wrong.

Or maybe not! Someone on the Internet (where else?) ran the numbers and said everyone had their math wrong. As it turns out, the world wasn’t going to end in 2012. No, no, no! Actually, it’s going to end this week—or perhaps next week. Whichever it is, it’s about to happen very soon.

From the New York Post (where else?)

“Following the Julian Calendar, we are technically in 2012 … The number of days lost in a year due to the shift into Gregorian Calendar is 11 days … For 268 years using the Gregorian Calendar (1752-2020) times 11 days = 2,948 days. 2,948 days / 365 days (per year) = 8 years,” scientist Paolo Tagaloguin tweeted last week, according to the Sun. The series of tweets has since been deleted.

I’m a lot more worried about Earth being deleted than a bunch of tweets being deleted. The state of the world in 2020 is a bit unnerving.

We have social unrest, global and domestic tensions, and of course, a pandemic.

So if the world’s going to go kablooey, I suppose 2020 may be the right time.

Still, predicting the end of the world seems a bit too bearish. (By the way, if you do invest based on the world ending, what happens to your counterparty? Hmmm… something to think about.)

Still, I have my concerns. For example, the stock market has rebounded impressively off its March low. In fact, this has been one of the strongest rallies on record. Moreover, the rally has been led by what Wall Street calls “High Beta” stocks. These are the stocks that bounce the most when the market bounces, so it’s not a surprise to see them do what they’re intended to do. Conversely, the High Beta stocks get creamed the most when the market drops.

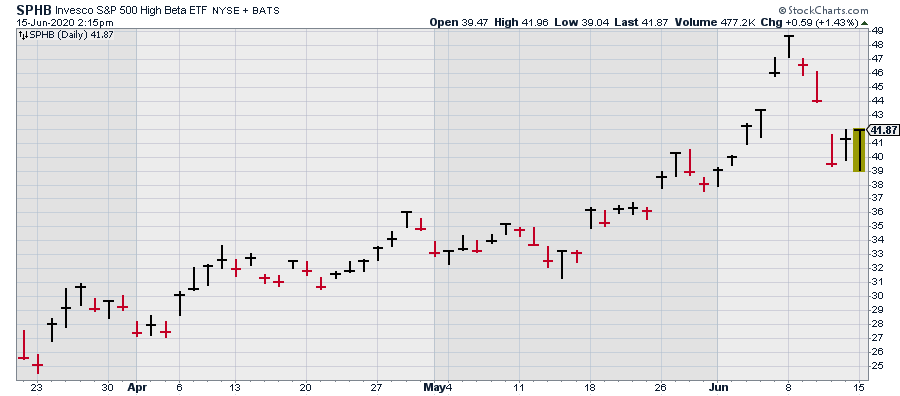

Check out this rally:

The chart above is for the exchange traded fund that tracks the High Beta sector. The Invesco S&P 500 High Beta ETF (SPHB) has nearly doubled off its low from March. I bring up High Beta stocks because of last week’s Federal Reserve meeting.

At the meeting, Fed Chairman, Jerome Powell, said the Fed “isn’t even thinking” about raising rates. The Fed will most likely keep rates on the floor for the rest of this year, all of next year and all of 2022 as well.

That message wasn’t a big surprise. Perhaps it was a surprise to hear the Fed chairman actually say it. Bear in mind that central bankers are trained from birth to speak in measured tones.

Powell’s blunt words clearly spooked the market. The S&P 500 had its biggest one-day loss in several weeks. The Nasdaq busted through 10,000 but the Fed-induced selling reversed that well. I can’t lay all the blame on the Fed. I suspect there are fears of a “second spike” scaring traders as well.

In the above chart, you’ll notice that the High Beta stocks were hit particularly hard during the recent selling. Don’t count the High Betas out. Sure, they may take a near-term hit here and there, but there’s a lot to like.

I think of SPHB as the ETF to own if you think everything will eventually turn out well. I’m not saying we won’t get our hair mussed, but eventually, the economy will return to normal. Factories will reopen and folks will get rehired.

The recent drop in SPHB offers you a good opportunity to pick up some shares. You may want to do it before next week, just in case the Mayans were right…

Or maybe there was another math error. Hey, people make mistakes. It’s not the end of the world.

— Eddy Elfenbein

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley