The dividend-cut parade is starting on Wall Street, and we need to be on the lookout for “payout traps” that could be hiding in our portfolios (often in plain sight).

That task is made tougher because some companies are using unconventional approaches to cutting their payouts. Take the Walt Disney Company (DIS), which released first-quarter earnings last week. Included: news that Disney wouldn’t pay out dividends for the first half of 2020.

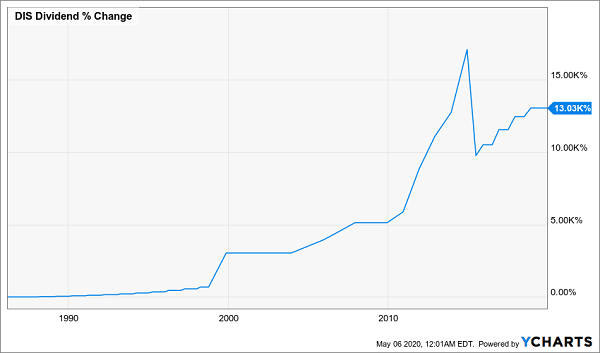

Disney’s Dividend Growth Stalls

After decades of growing its payouts (that dip you see in 2012 above is when the company went from annual to semi-annual payments—annualized payouts actually went up 19% that year), Disney isn’t outright announcing its dividend cut; it’s simply telling investors they may have to wait to get cash in their hands.

While this could be a return to annualized payouts, don’t hold your breath. Disney beat expectations on both revenue and earnings. Even so, management still decided to preserve cash.

Disney CFO Christine McCarthy said the move would help the company keep $1.6 billion in cash that would otherwise go to investors. That sounds like a lot of money, but for the big mouse, it’s chump change.

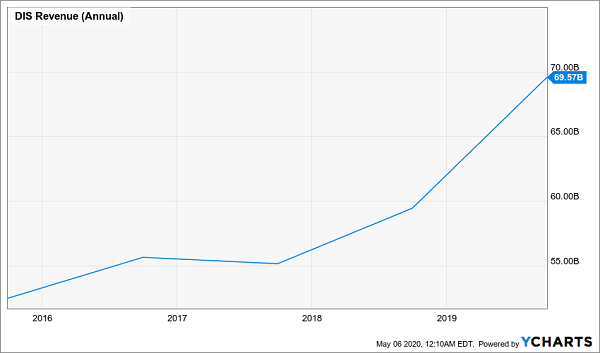

A Huge—and Growing—Pile of Cash

With Disney’s annualized revenue nearing $70 billion, the dividend cut represents just 2.2% of the cash the company receives.

Plus, more money is flowing in thanks to the popularity of Disney+, which, like many streaming services, is getting a boost thanks to lockdowns.

A staggering 54.5 million subscribers are on the platform, while Disney’s Hulu has over 30 million.

So why cut the dividend?

One possibility is that the company is simply hoarding cash—and that’s a new risk to dividends in general, as the crisis prompts overly cautious management teams to keep a lid on payouts, even when they can easily afford them.

Diversify and Get 6%+ Yields: Here’s How

If you’re worried about blue-chip dividend cuts hitting your portfolio, you have a couple alternatives.

One is to temper your income investments with companies that mainly hand us gains in the form of stock-price growth. This would lead you to the tech industry, where revenue growth, thanks to the world’s growing reliance on tech, is a catalyst for investor demand. You can get into tech through something like the Vanguard Information Technology ETF (VGT), which pays a 1.5% dividend, close to what you’d get from Disney. The fund’s top holdings include reliable names like Microsoft (MSFT), Apple (AAPL) and Intel (INTC).

High-Paying CEFs Are Your Best Play

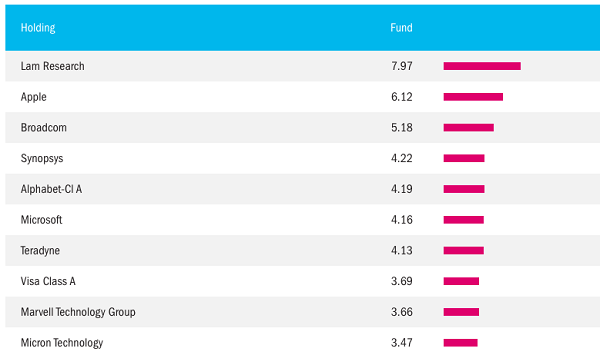

Or you could do better and buy the Columbia Seligman Premium Technology Growth Fund (STK), a closed-end fund (CEF) that pays a tremendous 9% yield while focusing on the best tech companies out there. As you can see below, it holds many of the same names as VGT, plus some faster growers, like Lam Research (LRCX), Teradyne (TER) and Marvell Technology Group (MRVL).

STK’s Portfolio of Reliable Tech Plays

Source: Columbia Threadneedle Investments

Source: Columbia Threadneedle Investments

If you want to focus on a wider variety of companies while still grabbing a high income stream, corporate bonds offer another option, especially if you buy them through a CEF. If dividend cuts continue or accelerate, I expect many investors to bulk up their bond holdings as a hedge. And since the Federal Reserve has begun to buy corporate bonds, effectively guaranteeing the prices won’t fall further, this is an unusually low-risk time to jump into this market.

There are dozens of great corporate-bond funds to choose from, but let me quickly point out the Western Asset Premier Bond Fund (WEA). With a focus on higher-quality bonds, this is one of the most diversified and lower-risk corporate-bond funds. Plus it pays a 6.3% dividend while trading at a discount to net asset value (NAV, or the value of its underlying portfolio) far below its long-term average.

WEA Is On Sale

The key takeaway? You don’t have to rely on the big names to (hopefully) keep their payouts coming. The CEF world offers plenty of safer, higher-paying options—and STK and WEA are just the start.

— Michael Foster

4 MORE Buys That Crush Disney (and yield 8.4%) [sponsor]

If you’re interested in CEFs, your timing couldn’t be better, because I’ve recently released my 4 very best buys in the space. They throw off sparkling 8.4% average payouts! PLUS they sport far bigger discounts than STK and WEA.

Just how cheap are these income titans?

Big enough to ignite 20%+ gains in the next 12 months, even if the market only moves slightly higher from here. And if we do get a downturn, these big discounts help keep our 4 funds’ market prices stable.

And we’ll enjoy their massive 8.4% dividends the entire time!

I can’t wait to show you these 4 “crisis-proof” 8.4%-paying CEFs. Everything you need to know is waiting for you here: names, tickers, buy-under prices, complete dividend histories—the works!

One thing you can count on? If you pass up this opportunity now, you’ll surely be kicking yourself in 12 months. Don’t miss out on the dividends and upside on offer here. Go right here to get everything you need to know.

Source: Contrarian Outlook