Earlier this week, General Motors (GM) said it’s suspending its dividend and halting all share buybacks. This is tough to hear but I can’t say this much of a surprise. The auto giant has been taking it on the chin recently.

It’s no secret why. As a result of the novel coronavirus pandemic, car sales have dropped sharply. The automaker has scaled back production.

GM has also temporarily shelved work on at least half a dozen future models.

It’s been a painful time for GM. Last August, the shares were over $40. Today, the stock is hovering near $20.

We can see the impact of the coronavirus across many markets; it’s not just GM.

While some large companies have enough cash to make it through, many smaller firms do not, which means many companies are suffering.

The Gap has stopped paying rent on its stores and furloughed 80,000 employees. Both TJX Companies (parent to TJ Maxx, Homegoods, Marshalls and others) and Macys have furloughed employees as well.

And of course, you were probably watching last week as the oil market went haywire. The price for May crude famously went negative. The Oil ETF (USO) is now close to $2 per share. There’s a good chance that the June contract for West Texas crude will go negative as well, which is really a reflection of how little storage capacity for oil is left. With fewer people driving, all this excess crude has to go somewhere.

Along with the price of crude oil, share prices for many energy companies have dropped to the floor. Shares of Occidental Petroleum Corporation (OXY) are down 80% from their 52-week high. Last month, “Oxy Pete” slashed its dividend by 86%.

How’s this for rough treatment from the market? Occidental’s new lowered dividend yields 3.4%. That shows you how bearish the market is about the company’s future prospects.

Gaining During the Pandemic

But not every stock has been trashed by the coronavirus. Some have actually flourished, and I don’t mean obvious examples like Zoom Video (ZM) or Clorox (CLX).

Here’s a good example. The CEO of Conagra (CAG) said that sales of Chef Boyardee had picked up thanks to the coronavirus. CEO Sean Connolly told Jim Cramer that “Chef Boyardee was growing nicely before COVID. It’s doing very well now.” I suppose that in discomforting times people turn toward comfort food.

Another sector that’s seen business improve is cybersecurity. As unpleasant as it sounds, there are folks who are so crooked that they’ll seize on a disaster to scam people out of their money.

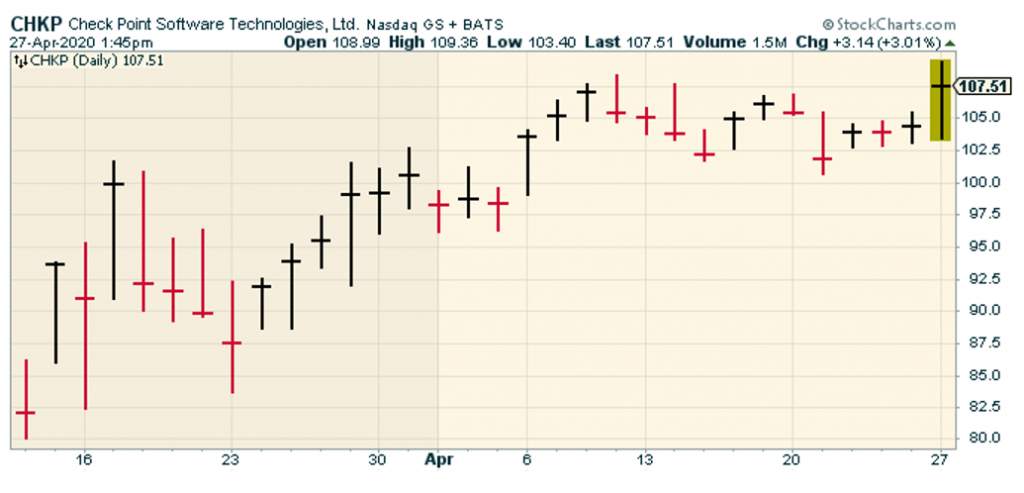

That’s where companies like Check Point Software (CHKP) come in. On Monday, Israeli cybersecurity firm Check Point released its Q1earnings report. If you’re not familiar with CHKP, you should know the company is truly one of the best in the biz.

What struck me were some comments from CHKP’S CEO Gil Shwed, who was a member of Israel’s famous intelligence Unit 8200. Check Point saw a dramatic rise in the number of coronavirus-related cyberattacks—apparently, scammers have had a field day running COVID-19 scams. That kind of behavior is good business for Check Point.

On average, there have been over 14,000 coronavirus-related cyberattacks per day. The attacks reached a peak in April with over 20,000 attacks. Since January, Check Point said that 68,000 COVID-related domain names have been registered, and that the company identified the malicious domains at double the rate of others.

This shows you why businesses and governments need the services provided by Check Point. The firm’s researchers discovered 16 malicious apps, all masquerading as legitimate coronavirus-related apps, containing a range of malware aimed at stealing user data or generating revenue.

It’s not just companies that have been attacked; Check Point found that scammers are targeting governments. The company intercepted an attack on a “public sector entity of Mongolia.” The scammers were impersonating the Mongolian Ministry of Foreign Affairs.

It’s no surprise that Check Point had a very good earnings report. For Q1, CHKP earned $1.42 per share. That beat Wall Street’s forecast by four cents per share. It’s also up from $1.32 per share for last year’s Q1. Quarterly revenues rose 3% to $486 million.

During Q1, Check Point spent over $320 million to buy back three million shares. If you’re looking for a top name in cybersecurity that’s thriving in these difficult times, then Check Point Software fits the bill.

— Eddy Elfenbein

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley