The COVID-19 outbreak led to the unprecedented shutdown of a large swath of the global economy.

Companies now face the challenges of reduced sales, revenues, and profits.

This new reality has a more significant effect on dividend-paying stocks and the investors that own the shares.

Companies that don’t pay dividends don’t have to think about it.

They can continue not to share the wealth with investors.

Every day since the recent stock market and crude oil price crashes, I see dividend reduction notices cross my screen.

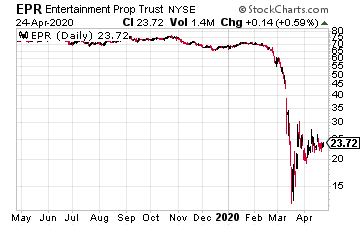

Some companies have seen their businesses collapse. An example is EPR Properties (EPR), a REIT that collected just 15% of rent due in April.

Other companies have continued cash flow that is sufficient to support the current dividend but choose to reduce the payouts to conserve cash.

Other companies have continued cash flow that is sufficient to support the current dividend but choose to reduce the payouts to conserve cash.

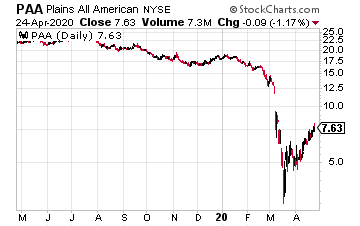

This reaction is the result of reduced certainty about the economic future. Plains All American Pipelines LP (PAA) is one such company.

PAA could continue paying dividends at the 2019 rate but has chosen to reduce the payment to investors by 50%.

Income/dividend-focused investors loathe and fear dividend cuts.

The COVID-19 bear market has pushed share values of income stocks down 30%, 50%, and more.

The COVID-19 bear market has pushed share values of income stocks down 30%, 50%, and more.

The capital losses have investors hoping that the next step will be dividend affirmations and not dividend reductions. I recently sent out a list of such stocks to my Dividend Hunter readers.

We can use recent dividend cuts as “canaries in the coal mine” to show us which sectors are at the most risk of additional dividend reductions.

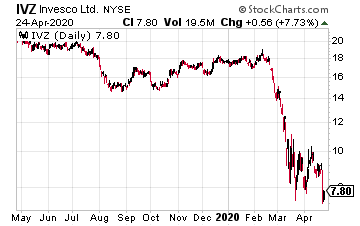

Asset and fund management companies are reporting falling assets under management. With the stock market crashing, it is logical that AUM will drop. Since asset management fees are a percentage of AUM, revenues for this business sector will tumble.

On April 23, Invesco, Ltd. (IVZ) announced a 50% dividend cut. Before the reduction, IVZ was priced to yield over 13%.

On April 23, Invesco, Ltd. (IVZ) announced a 50% dividend cut. Before the reduction, IVZ was priced to yield over 13%.

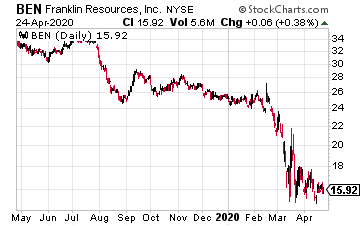

Here are two more asset management companies that may follow Invesco’s lead.

Ben Franklin Resources (BEN) just increased its dividend by 3.8% in December. BEN yields 6.7%, and the dividend has grown for 23 straight years.

However, the dividend payout ratio was a high 55% on net income before the COVID-19 effect on profits.

However, the dividend payout ratio was a high 55% on net income before the COVID-19 effect on profits.

It is a toss of the coin whether this asset management company will cut the next dividend to be announced in June.

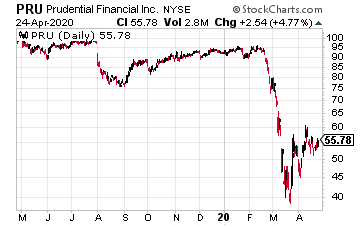

Prudential Financial (PRU) faces the double challenge of being a company with $1.24 trillion in assets under management and trillions of dollars of outstanding life insurance death benefit.

It is impossible to predict how much the COVID-19 pandemic will hurt the Prudential balance sheet. Currently, PRU yields 8.2%.

It is impossible to predict how much the COVID-19 pandemic will hurt the Prudential balance sheet. Currently, PRU yields 8.2%.

The next dividend announcement will be in mid-May.

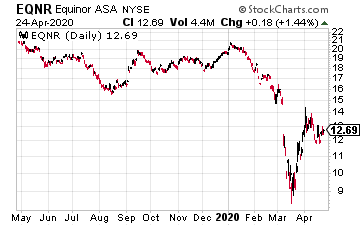

The major, diversified energy companies have been steady and reliable dividend growth stocks.

The major, diversified energy companies have been steady and reliable dividend growth stocks.

That has changed with a dividend reduction announced by Norway’s Equinor (EQNR).

The company slashed the dividend by 67%.

Here are three more oil majors that may choose to conserve cash.

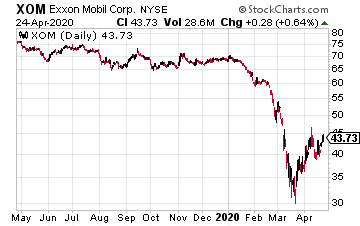

Exxon Mobil Corp (XOM) is priced to yield over 8%. In early April, Exxon announced it reduced its 2020 capital spending plans by 30% and lowered cash operating expenses by 15%.

Exxon Mobil Corp (XOM) is priced to yield over 8%. In early April, Exxon announced it reduced its 2020 capital spending plans by 30% and lowered cash operating expenses by 15%.

The dividend payout ratio was over 100% before the price of crude oil crashed. Exxon Mobil may be forced to end its 37-year streak of dividend growth.

The yield for Royal Dutch Shell plc (RDS.A, RDS.B) is up to almost 11%. In recent months Shell has announced the suspension of several projects and has shut down or reduced production at its U.S. refineries.

The current RDS dividend rate was at 92% of the 2019 basic earnings per share. Profits will crash in 2020, putting the dividend at risk. Shell’s next scheduled dividend announcement is in early May.

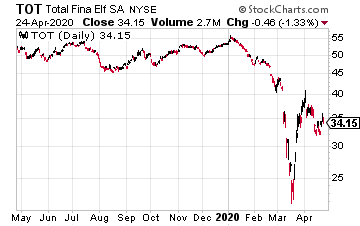

Total S.A. (TOT) now yields 8.5%. In February, Total gave dividend guidance of 5% to 6% growth per year. That was before the COVID-19 crisis produced tremendous demand destruction for crude oil and refined products.

Total S.A. (TOT) now yields 8.5%. In February, Total gave dividend guidance of 5% to 6% growth per year. That was before the COVID-19 crisis produced tremendous demand destruction for crude oil and refined products.

The Total dividend rate is about 50% of 2019 earnings per share.

This is a company that may elect to cut the dividend to preserve cash.

The next dividend will be announced near the end of this month.

— Tim Plaehn

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley