I listened to a Fortune 500 CEO speak recently about his parents, who had grown up during the Great Depression. He said one of the many lasting impacts of that experience was that they always kept a fully-stocked pantry at home.

Last week, I wrote about some of the lasting changes that will be brought about by COVID-19.

As we shelter in place, one of the few places we’re allowed to venture to is the grocery store.

While it’s a little less convenient to go to the store than it was pre-COVID-19, we are blessed to still have mostly stocked shelves.

As the kids say these days, having to settle for Heinz ketchup instead of Del Monte is definitely a “first-world problem.”

But, the psychological fear of not having access to food and other necessities has been brought home by this crisis, driving shoppers around the world to make sure they have full pantries. It is not known whether the virus—which is predicted to subside in the next few months—will return in the fall, meaning we may see a continuation or repeat of this change in psychology.

Coronavirus-fueled buying habits will not be reversed quickly once the novel coronavirus is in the rearview mirror, and, the companies currently benefiting from this change in consumer behavior should continue to benefit for many months, if not years, after the virus subsides.

These three megabrand companies should be major beneficiaries of this behavioral change.

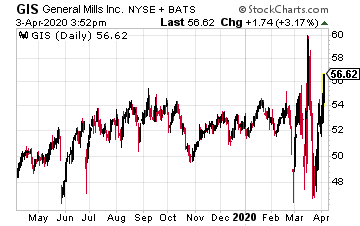

General Mills (GIS) makes a variety of food staples that can be found in pantries and refrigerators around the world.

General Mills (GIS) makes a variety of food staples that can be found in pantries and refrigerators around the world.

The iconic food producer is probably best known for its cereal brands, such as Cheerios, but, it also owns Pillsbury, Bisquick, and Betty Crocker in the baking aisle, as well as Green Giant in the vegetable space and Annie’s, which provides a variety of dinner kits,

Jeff Harmening, General Mills CEO, recently stated the company has seen double digit increases in its home food market in China in the past few months, and is looking for similar numbers in the U.S. as COVID-19 essentially shuts down restaurants.

Harmening said the initial onset of the virus saw an increase in customer purchases of long shelf-life items. But, after the first four weeks of the virus onset, the increase in demand has become systemic, and can be seen across all of the company’s brands and products.

General Mills had sales of $4.2 billion in its latest quarterly release, with a slight decline in organic volume, which was offset by higher prices and sales of premium products. Over the prior nine months the company had an operating profit of $2.1 billion, which was an 18% increase year-over-year. While the stock has traded with much higher volatility since the coronavirus crisis, it is now essentially where it was prior to the crisis, trading around $52 with a PE of just over 15.

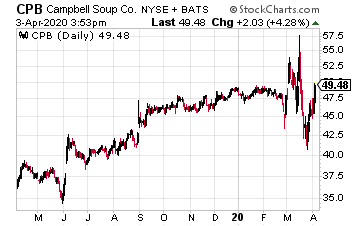

Campbell Soup Company’s (CPB) stock had been on an upward trend throughout much of 2019 and 2020, even before COVID-19 reared its head.

Campbell Soup Company’s (CPB) stock had been on an upward trend throughout much of 2019 and 2020, even before COVID-19 reared its head.

The stock had risen from the low $30s to the mid-$40s, where it was trading at the start of the coronavirus outbreak.

There are few, if any, more stable comfort foods to stock a pantry with than soup, and Campbell’s has been a dominant player in the soup category for decades.

The company has recently made substantial progress on deleveraging its balance sheet, and the recent bump in demand should further this work. Campbell’s CEO Mark Clouse, in their quarterly earnings report, said earlier last month, “I am very pleased with our successful deleveraging in the quarter, resulting in a much-improved leverage ratio. We are able to make important incremental investments in the business in the second half while increasing adjusted EPS guidance for the year.”

Adjusted earnings per share increased 11% year-over-year in the quarter to $0.72 per share. This was on adjusted EBIT of $756 million. Campbell’s currently trades at a PE of 35 and has a 3% dividend.

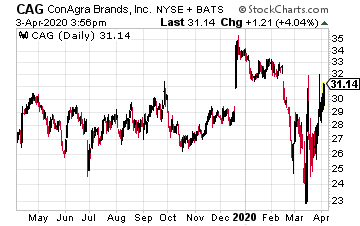

In a recent television interview, Conagra Brands (CAG) CEO, Sean Connolly, referring to the company’s Chef Boyardee brand, said, “People are having flashbacks to their childhood”. And, Conagra is benefiting in the form of accelerated sales.

In a recent television interview, Conagra Brands (CAG) CEO, Sean Connolly, referring to the company’s Chef Boyardee brand, said, “People are having flashbacks to their childhood”. And, Conagra is benefiting in the form of accelerated sales.

Conagra has an excellent portfolio for “pantry stocking,” with a combination of well known brand names in the canned, frozen, and snack food categories.

Echoing the sentiments of many grocery store suppliers, Connolly stated: “We’re selling everything we can make. Times like these call for extraordinary resiliency. We’re running flat out to keep our food coming and I’m incredibly proud of our team as they navigate these challenging times.”

After recovering from the general market slump of late 2018, Conagra stock has traded relatively flat through 2019 and into 2020. The company reduced debt by $450 million in its latest quarter, while achieving sales of $2.6 billion. The company reported they were seeing a 50% increase in retail sales due to coronavirus, more than offsetting losses in their restaurant supply unit.

— Eddy Elfenbein

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley