These 39 stocks are supposed to hike their dividends soon. How many of these raises are still going to happen?

The first-quarter earnings season is approaching, and that typically means a weekly flow of companies announcing upgrades to their regular payouts.

Indeed, I’m about to show you 39 stocks, yielding up to 47.9%, that are on the schedule and expected to deliver dividend raises over the next couple of months.

However the sudden bear market has thrown a gigantic monkey wrench into this quarter’s dividend routine. Dividends are dropping like flies.

- Ford (F), which I warned about, has suspended its dividend.

- So has Buffett bet Occidental Petroleum (OXY), which I cautioned readers against in the same missive.

- Macy’s (M), which I previously said had cash issues, has put the kibosh on its quarterly payout.

- Boeing (BA), which has problems stacked on top of problems, dividend, too.

And that’s just a handful of names that have hacked away at their payouts in just the past couple of weeks.

It’s one thing to improve your dividend when everything the market is driving everyone’s stock higher and a go-go economy lets you effectively print profits. But doing it now? That’s a litmus test for quality.

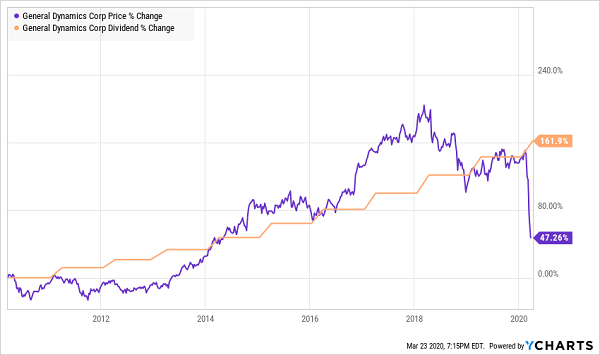

Consider General Dynamics (GD), a Dividend Aristocrat whose share price is typically tethered to its dividend, more or less:

General Dynamics’ Dividend “Magnet”

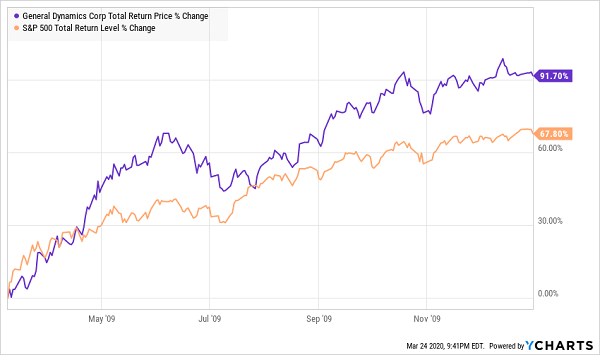

Sure, the right-side of many price vs. dividend charts look “broken” at the moment. But General Dynamics just announced an 8% increase to its payout. The last time the world emerged from a stock market crash like this, GD shined:

General Dynamics Rolled Post-2008

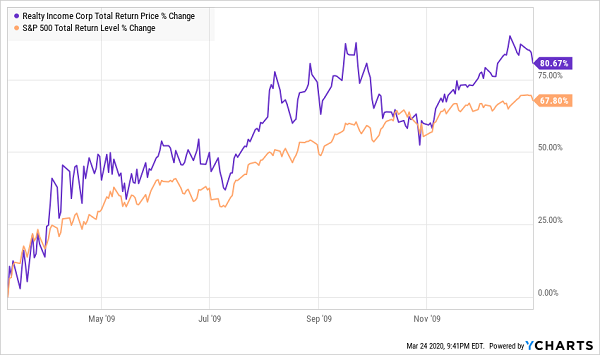

Realty Income (O) is another great example. The “Monthly Dividend Company” on March 17, well into the bear-market panic, announced its 90th consecutive dividend increase. Investors are hoping it’ll bounce back as strong in late 2020 as it did in 2009:

O Also Sailed Post-2008

(With tenants likely paying their rent late, I’m a bit worried about O this time around. And that’s not my only high yielding concern in this “early-recession” economy.)

Let’s look at 37 more dividend stocks we need to keep an eye on in the months ahead.

There is going to be economic fallout from the current sea-to-sea shutdown, and some payouts are going to be trimmed (or shelved altogether) in acts of management self-defense.

We’ll review the lot of “hopeful” dividend growers in four groups: Dividend Aristocrats, MLPs, REITs and other noteworthy stocks. Here we go.

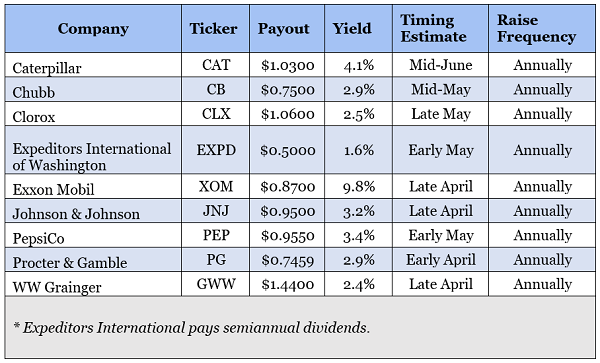

Dividend Aristocrats

It’s put-up-or-shut-up time for the Dividend Aristocrats, many of which have skated by with token upticks for years in the midst of a favorable global economy. Now, we get to see what these old dogs have left in the dividend tank.

Dividend Spotlight: If Exxon Mobil (XOM) follows other big-name stocks, such as Chevron (CVX), we might find out about its dividend’s fate before its anticipated announcement sometime in late April.

Exxon has been gutted by a one-two punch that nobody saw coming. First, the coronavirus outbreak gashed oil prices in the first couple months of the year, then Saudi Arabia pulled the rug out from under the energy market by discounting its oil sales after OPEC and Russia refused to play ball.

Exxon Mobil is indeed a Dividend Aristocrat, at 37 consecutive years of payout hikes. But XOM was already stretching to pay its dividend before disaster struck, and with oil below $25 per barrel, it and a lot of other energy companies are taking a long, hard look at their cash situations.

Indeed, Exxon recently announced that it is “looking to significantly reduce spending as a result of market conditions caused by the COVID-19 pandemic and commodity price decreases.” Unlike Chevron, which spared its dividend by cutting buybacks and capex, Exxon hasn’t repurchased shares in years, limiting its options.

Naturally, income investors will be waiting to hear about the future of this longstanding dividend.

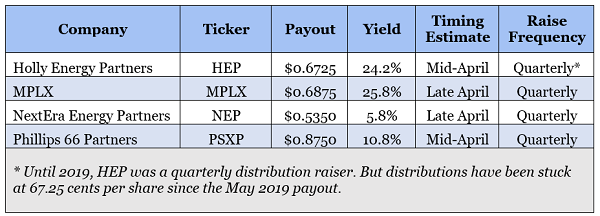

MLPs

The same energy woes that have pelted Exxon have also hammered the master limited partnership (MLP) space.

And something has to give.

MLPs typically extremely high yielders, but cratering energy prices have tanked their share-like “units” and have driven some of these yields to astronomical levels. Many of these companies increase their distributions on a quarterly basis, so we’ll very quickly find out who can hang when the going gets tough.

Dividend Spotlight: MPLX (MPLX) hardly stands alone, as several MLPs have been knocked into double-digit yields. In fact, I’m going to be checking out the investor relations pages of all these pipeline partnerships on a daily basis just to see whether these distributions can possibly survive.

That’s because MLPs are already started hacking away. DCP Midstream (MCP) and Targa Resources (TRGP) are among the first casualties of the energy dividend drain, and more could be on the way.

Interestingly, for a while, it seemed like MPLX could go the way of many other pipeline operators and be subsumed by its general partner, in this case Marathon Petroleum (MPC). But just about a week ago, the company concluded a strategic review of the business, and the special committee in charge of the review says they “believe in MPLX’s strategic focus on free cash flow generation, and distributions from our continued ownership of MPLX will remain an important, through-cycle source of cash for MPC.”

MPLX will announce its quarterly financial results on April 30. That will tell us a lot about the status of MPLX’s long-growing distribution—if it doesn’t announce something sooner.

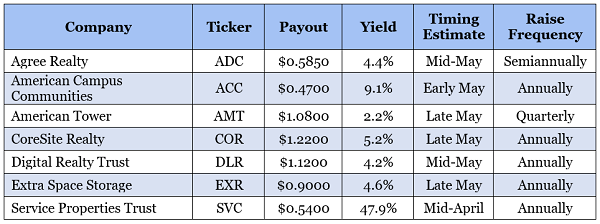

REITs

Real estate investment trusts (REITs) haven’t weathered the downturn well at all, with the Real Estate Select Sector SPDR Fund (XLRE) posting a -32% total return in the bear market, putting it in the bottom half of all sectors.

But REITs, collectively, landlord a diverse span of the economy. Some tenants are already suffering, while others are going to be just fine. Expect the next set of reports to separate the “haves” from the “all I have is IOUs”…

Dividend Spotlight: Extra Space Storage (EXR), one of several self-storage stocks, is at a fascinating crossroads. Its dividend growth has slowed down considerably over the past couple of years. But it’s not a bad defensive play, as it relies on storing existing stuff rather than buying new stuff.

Even a dividend increase on par with its sub-5% improvement last year would be a small vote of confidence. And something a little more robust would tell investors that it’s game on in this what so far has been a 27% dip in the bear market.

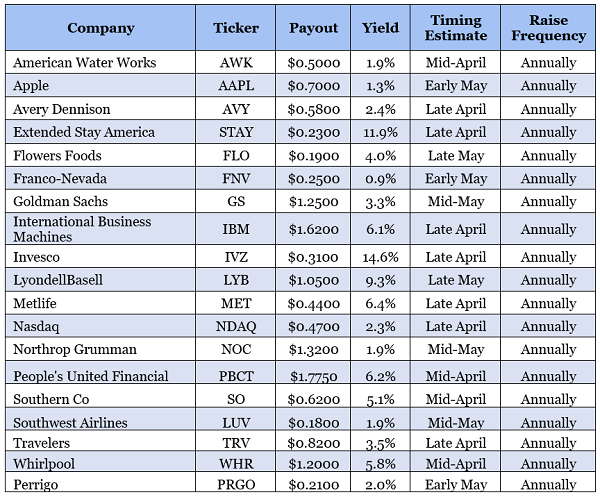

Noteworthy Stocks

Now, let me show you a laundry list of interesting stocks that hopefully, but not certainly, will announce their plans to dole out a little bit more to investors.

Dividend Spotlight: International Business Machines (IBM) should be an absolute bellwether stock for dividend raises. It needs one more hike to achieve Dividend Aristocracy. It has a good dividend payout ratio of around 61%, but surely that number will grow if IBM ratchets down its earnings expectations because of the coronavirus’ hit to the global economy.

I fully expect IBM to at least offer up a token increase to reach the 25-year mark, but if it doesn’t—all bets are off for a laundry list of other serial raisers.

Special mention goes to Southwest Airlines (LUV), which Bank of America says is “best-positioned” to weather this downturn. Be that as it may, Southwest signed an industry-wide letter promising that if they get bailed out, they won’t pay dividends anymore. That makes Southwest one of the most interesting stocks to watch for any sort of dividend announcement over the next month or two, though it’s very possible that announcement will be to mark the death of its payout.

— Brett Owens

5 “Recession-Resistant” Dividends Up to 13% [sponsor]

Just remember: Take token increases with a grain of salt, especially if it comes from the likes of down-and-out Exxon Mobil.

The company was already paying a “generous” dividend of nearly 5% back in January, and the bottom fell out anyway, with the stock plunging far, far faster than the rest of the market.

XOM Crushes Income-Seekers

A 52% drop! That’s a complete disaster: in just under three months, Exxon wiped out nearly 11 years of dividend payments!

Sure, other stocks got hammered, too, but Exxon was already paying much more in dividends than it brought in via cash flow ever before the panic hit! So even if XOM does manage to cobble together enough cash for a small hike to maintain its Dividend Aristocrat membership, you and I both know it’s doing so on extremely weak legs.

That’s not the way to invest in high yield. Chasing ludicrously high yields with no backbone is how you end up with other income disasters like Macy’s (M) and GameStop (GME), too, that finally capitulated and suspended their payouts, leaving retirees in the lurch.

With a recession on the way, you need safe, substantial dividends you can actually count on.

And you can find those in my “Recession-Resistant Dividends.”

You can buy just about any stock on the dip right now, but don’t get lured into “cheap” stocks when you should be buying values like these five monster yielders. Right now, they offer:

- Bargain valuations based on solid fundamentals that haven’t been rocked like the rest of the market.

- Massive (and growing!) dividends of up to 13%.

- Track records of cruising through previous meltdowns, making them the perfect buy-and-hold investments in the midst of this bear market.

Ask yourself this: How many sturdy investments do you know that will pay you nearly $50,000 in annual cash dividends on a half-million-dollar investment?

They’re uncommon. Actually, they’re downright rare. But sure enough, these five recession plays offer built-in upside, downside insurance and 9.4% average dividends.

These unicorn stocks are a “Goldilocks” scenario: They’re too small to draw interest from institutional investors or the traditional financial media giants. But they’re plenty liquid enough for you and I to get exactly the price we want, and not a penny more.

Don’t wait around while your current holdings start hemorrhaging their dividends and buybacks and give up even more ground. Do what’s right for your retirement and fund it with stocks paying an average 9.4% yield that will grow even larger over time.

Click here to get these five “Recession-Resistant Dividends,” including company names, stock tickers, buy-in prices and my in-depth business analysis—and protect your portfolio from Wall Street’s bout of wealth destruction!

Source: Contrarian Outlook