The stock market is in a full-blown panic, which means it’s time for us contrarian income seekers to go shopping.

Few firms have been spared from the “flash-bear” we are experiencing. It may be an ominous sign for the rest of 2020, too.

So, if you are worried about the rest of the year, but you still need income from your investments, let’s consider some steady payers that are typically more stable than the broader market.

After all, when the markets begin to function properly again–and they will, no matter how shaky things seem at the moment–these are the types of dividend payers that we want in our portfolio (at cheap prices, too).

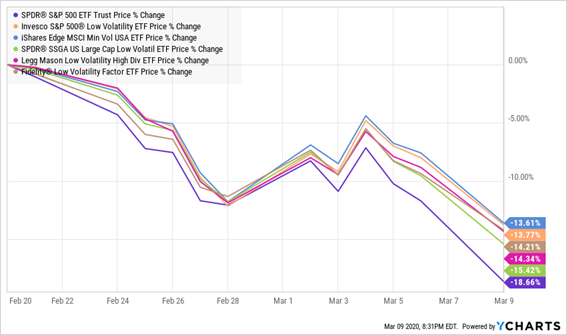

To find stability in the first place, we begin with low volatility. The simple ability to freak out less than the broader market will dampen the damage in a crash. Just look at the relative outperformance of a wide swath of “low-vol” funds.

The First Key Is Limiting Losses

Next, we require higher-than-average income. Treasury yields are well below 1%. The S&P 500 still only yields just a hair above 2%. Which means a yield of at least 4% should not only provide you with a decent baseline of income to pad against potential short-term losses, but also attract more income-starved investors if bond yields continue to bottom out.

Here, then, are three stocks that are standing tall amidst the sudden broader panic. Each of them is at least half as volatile as the S&P 500, yields 4% and has held up better than the market—a recipe for stability and success.

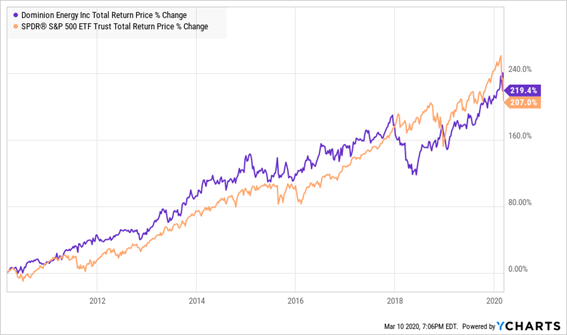

Dominion Energy (D)

Dividend Yield: 4.6%

3-Year Beta: 0.37

Utility stocks are never going to set the world on fire. But they’re the ultimate “widows and orphans” income plays. People will give up hundreds of expenditures before they let the lights and water go, and that reliability is exactly why investors swarm to them like a bug light when volatility comes a-knockin’.

Dominion Energy is one of the most geographically spread-out electric utilities in the nation, ranging from California to Connecticut, with another 16 states in between. All told, Dominion serves some 7 million customers.

While utilities are most beloved for the cash they spend on investors, Dominion is pumping a decent amount of money into growth at the moment. The company plans to spend $26 billion over five years to improve its technology, as well as invest in solar, wind and renewable nat-gas, with an end goal of achieving net zero emissions by 2050.

You won’t get a ton of growth out of that, mind you—about 5% in annual earnings expansion over the next five years. And you’ll pay through the nose for it at these prices, at a price/earnings-to-growth ratio of 4, which is well above a fairly priced 1. But that premium isn’t for Dominion’s growth. It’s for the high-yield protection.

It’s certainly too lofty for long-term buyers at current prices, and the yield isn’t quite what qualifies as “perfect” retirement income. But give credit where credit is due: Dominion has edged out the market over the long haul, with less drama and more income.

Market Performance, But With Utility Stability

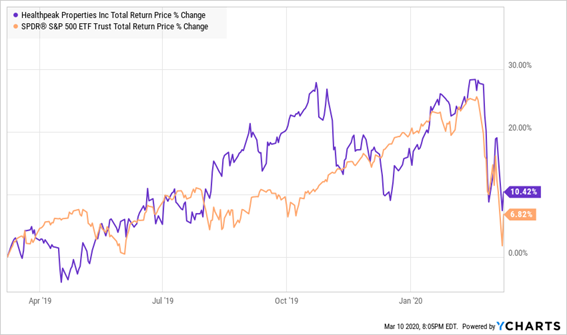

Healthpeak Properties (PEAK)

Dividend Yield: 5.0%

3-Year Beta: 0.19

Are you familiar with Healthpeak Properties (PEAK)? If not, don’t sweat it. You likely know it by its former name: HCP.

The company announced a number of changes late last year, including the change to the new moniker. It also announced a load of senior living deals, including an agreement to enter a joint venture and sell off a 46.5% interest in a 19-property portfolio managed by Brookdale Senior Living.

So, what’s left behind?

Healthpeak’s portfolio includes 665 properties spanning 10 million square feet of life sciences space, clustered around San Francisco, Boston and San Diego; 21 million square feet of medical office space; and 27,000 senior housing units.

In a bubble, the company’s operations were doing just fine. While it just announced a 3% decline in full-year adjusted funds from operations (FFO) for 2019, for the fourth quarter (its first full quarter operating as Healthpeak), FFO was up a penny per share. More encouraging was its forecast for full-year 2020 adjusted FFO of $1.77 to $1.83—growth no matter which way you slice it.

However, Healthpeak, while still well off its 52-week lows, has nonetheless sold off thanks to uncertainty concerning its senior living portfolio. That’s understandable given the novel coronavirus’s devastating toll on the elderly. “Health care REITs with sizable seniors housing portfolios could see pressure if the COVID-19 meaningfully impacts the elderly population,” RBC Capital Markets wrote in late February.

Senior living was already suffering from low occupancy levels, and the coronavirus has thrown a shroud of uncertainty into the space. Healthpeak’s diversification across other property types should help it weather the storm, but investors might be able to secure much better prices (and yields) on PEAK before this is through.

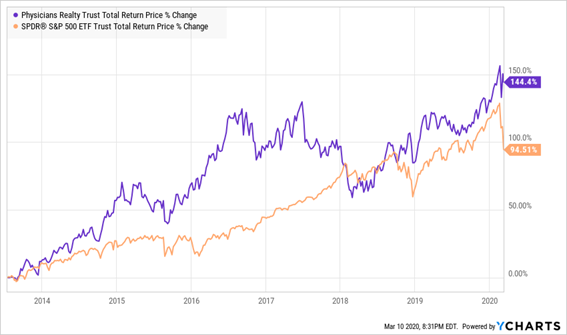

Physicians Realty Trust

Dividend Yield: 4.8%

3-Year Beta: 0.42

If you’re going to hold health care right now, Physicians Realty Trust (DOC) is much closer to the blend of medical properties you want to see. Its portfolio of 266 assets includes “stabilized medical office, physician group practice clinics, outpatient care, ambulatory surgery centers, specialized hospitals, rehabilitation facilities, and small specialized long-term acute care hospitals.” The vast majority of the business is in medical office buildings, though, which make up 95% of cash net operating income.

Those are properties that are simply going to be used today, tomorrow, the next few months and well past that.

Better still, these are entrenched tenants. Nearly 90% of its real estate is “health system affiliated,” which means Physicians Realty Trust is dealing with large, integrated operators instead of more vulnerable independent tenants. The company’s portfolio is 96% leased out as of last check.

DOC’s 2019 was nothing to scream home about, with normalized FFO tapering off 8.3% across the year, but it finished strong-ish, with slightly higher fourth-quarter funds from operations (albeit flat on a per-share basis).

Physicians Realty Trust is slow, it’s safe, and it has a decent yield. It’s also not only outperforming the S&P 500 by 10 percentage points over the past year, but clobbering the index over the long haul.

Physicians Realty Trust (DOC) Checks Out Just Fine

Like Dominion, though, DOC isn’t cheap, at 20 times FFO. Also, the dividend hasn’t budged in a couple of years. It’s a safe enough payout, at about 92% of FFO, but the lack of dividend growth is hardly ideal for a 4% yielder.

— Brett Owens

7%-8% Yields Still Exist in America’s Income Crisis [sponsor]

Of course, a 4% dividend sounds phenomenal right now, doesn’t it?

Heck, even the 2% on the S&P 500 sounds great when you wake up and realize that 10-year T-notes are yielding a fraction of a percent.

But even as Wall Street deals with one of the worst income droughts in American investing history, you can’t settle for insufficient yields that won’t get you to the retirement finish line.

And thanks to my “Perfect Income” portfolio … you don’t have to.

The stock market is going through vomit-inducing volatility right now, and many of 2020’s most popular dividend picks are already showing their warts. Consider Merck (MRK)—a popular pick among several “best-of” retirement lists. Despite a “safe” 3% yield and its place in a health-care sector that’s outperforming the market, this blue chip is neck-and-neck with the lurching index.

There’s nothing safe about that. And there’s nothing safe about the fact that Merck—and many popular income picks just like it—have been underperforming the market for years.

Even if you had a cool million dollars to plunk down right now, most blue chips would deliver only $25,000 to $30,000 on that nest egg. If you had half that amount to work with, your dividend income would only put you a couple thousand dollars over the federal poverty level.

That’s not safe. That’s retirement suicide.

The dividend-rich stocks in my “Perfect Income Portfolio” deliver the kind of income you need to be able to afford your mortgage, the bills, the healthcare costs, and all the extras that retirees have worked so hard to enjoy–without having to rely on once-in-a-generation bull runs to keep a batch of mediocre holdings afloat.

That’s because my readers are locking down most of those returns in cold, hard cash.

I frequently seek out feedback from my readers, who tell me they’re doubling, tripling, and occasionally even quadrupling the dividends they were generating from their old income portfolios. And they’re doing it without having to chase down complicated options strategies or swing-trade their way through this manic stock market.

This is buy-and-hold investing at its purest. I provide you with a set of tickers for under-covered, against-the-grain income plays that build real wealth over time. As long as the stock is below the buy-under price, you’re clear to pull the trigger.

That’s it. And I’ve got the receipts to back it up.

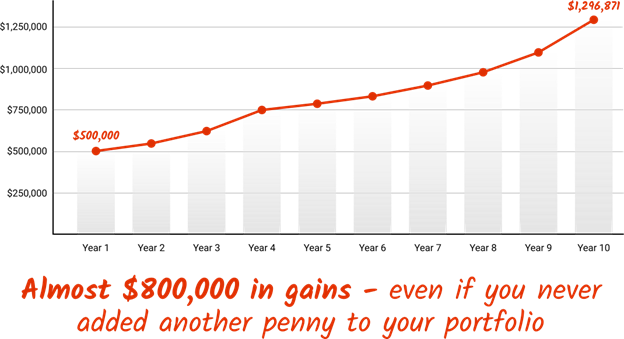

Check out this strategy’s past 10 years of returns, and you’ll see why I call it the “Perfect Income Portfolio.”

A high headline yield is the most vital part of any successful dividend strategy, but what makes this a “perfect” portfolio are all these other alpha-income traits:

- Safe, secure and steady income in the tens of thousands of dollars each year. That’s in cash—not just “paper gains.”

- A regular cash payout that’s more than enough to live on without drawing down a single cent from your savings or other assets.

- No high-risk investments that can wipe out decades of hard-earned money in a matter of weeks or months!

- No headaches figuring out options, spread-bets or day-trading.

- Simple setup, simple management. You don’t need to be glued to your screen all day to collect income. Go do things you enjoy. Your check’ll be in the mail, month after month.

If you’re frantically watching your 401(k) and IRA fretting about your yo-yo-ing net worth, stop. You don’t have to anymore. Instead, let me teach you more about this incredible strategy, including its dominant track record. In fact, I’ll let other investors tell you about the wealth they’ve built using my research service.

You can’t afford to wait another minute in this kind of market. Let me show you how to get 2x to 4x your current income with this simple, straightforward system. Click here to get a FREE copy of my Perfect Income Portfolio report, including tickers, buy-in prices, dividend yields, full analyses of each pick … and a few other bonuses!

Source: Contrarian Outlook