The fear raging through stock market investors pushes us to make irrational decisions. Fear-based selling almost always shows up in hindsight as a bad decision.

For subscribers to my income stock focused newsletters, including the Dividend Hunter, I teach an investment strategy that helps you avoid fear selling and naturally pushes investors to buy low and if they want to sell, to sell high.

I know it’s a novel concept.

Here is how the strategy plays out. If you are investing in higher-yield, dividend-paying stocks, measure your results by how much dividend income you earn. U.S. based companies pay dividends either monthly or quarterly, so set up a quarterly dividend income tracking system.

(If you don’t have one or don’t want to learn Excel be sure to check out the dividend tracking and forecasting tool I developed for my readers.)

I have a couple of phrases that I regularly use when communicating my readers:

- I can’t predict which way the stock market will go in short to intermediate term. The current, very unexpected stock market decline gives proof to that statement. What I can control and accurately predict is how much income my stock portfolio will produce this quarter and the next quarter, and the next, etc.

- If your dividend income is stable to growing, quarter over quarter, your income stocks are performing as desired. It should not be a concern if the market values turn lower.

My point is that when stocks get cheap, I want to buy more shares and give myself a dividend income raise. Almost all companies have reported 2019 fourth-quarter results. The good dividend payers reported good to great results for 2019, and management guidance is for continued solid business results in 2020.

Last week the stock market was truly ugly. The fear, negative news reporting, and steeply declining share prices make it tough to put in stock buy orders. Yet history shows us these are the times when investors get the opportunity to make money.

In the case of income stocks, you can buy shares with great yields compared to what you would earn at the peak of a bull market. I don’t think this market decline will be as deep as the 20% drop in the final four months of 2018. The recovery from that decline took about three months.

Inside of this current market sell-off, I am excited to be able to pick up high-quality dividend stocks “on-sale.” Buying now will average down your cost basis and average up your portfolio yield. The stocks to buy are the ones with stable businesses and the ability to continue to pay and grow their dividends. Here are three to consider.

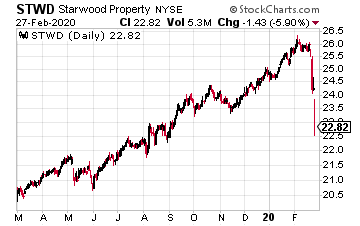

Starwood Property Trust (STWD) is a commercial finance REIT.

Starwood Property Trust (STWD) is a commercial finance REIT.

The company makes commercial mortgage loans. It also owns a servicing company and has a book of infrastructure project loans.

I like this line from Chairman and CEO Barry Sternlicht on the company’s fourth-quarter earnings call: “We have no impact from Coronavirus. I mean that is not a risk for our firm in any way, shape, or form.”

The current market sell-off has pushed the STWD yield up to almost 8.5%.

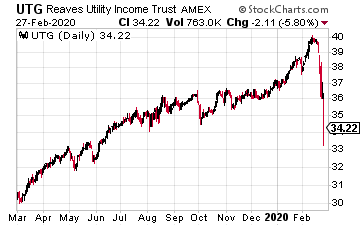

The Reaves Utility Income Fund (UTG) is a closed-end fund that invests in utility and conservative infrastructure stocks.

The Reaves Utility Income Fund (UTG) is a closed-end fund that invests in utility and conservative infrastructure stocks.

The fund has paid a stable and growing monthly dividend since it launched in April 2004. The UTG shares usually yield around 5.5%.

The recent drop in the share value has the yield up to 6.3%.

Buy now, and earn a nice dividend every month.

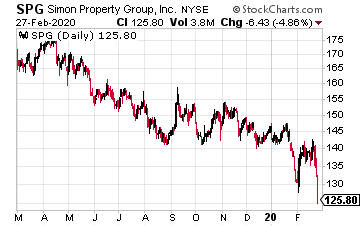

Simon Property Group (SPG) is one of the largest REIT by market cap. Simon owns an operates Class A shopping centers and outlet malls. The SPG dividend has increased by over 300% since 2010.

Simon Property Group (SPG) is one of the largest REIT by market cap. Simon owns an operates Class A shopping centers and outlet malls. The SPG dividend has increased by over 300% since 2010.

Over the last few years, dividend growth has been 5% to 8% per year. The shares are now priced 32% below the 52-week high.

The current yield is 6.7%.

Buying shares of SPG under $130 now will make you feel like the smartest investor ever a few years in the future.

Starting today you can stop worrying about the market and instead fundamentally transform your income stream from a string of near misses to a steady, reliable flow of income right into your bank account.

— Tim Plaehn

MAG-7 Stocks Are Dead—Here's What Killed Them [sponsor]The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley