There is a tremendous appeal to owning shares of high-yield stocks. In a world where you are lucky if a bank account pays 2%, income stocks that pay 8%, 9%, or even 11% can be very attractive.

However, high-yield stocks are not a bank account or government bond.

Dividend cuts happen, and when they do, investors get the double pain of a reduced income stream and a steep drop in share prices.

If you want to build a high-yield income stream, the primary skill to acquire is how to separate the dangerous high-yield stocks from the more secure.

Dividend stock shares are prices to provide high dividend yields for a reason.

The market (as in the whole investing public that is buying or selling an individual stock) believes there is a chance the current dividend rate will be cut. The higher the yield, the more the market is pricing in the probability of a dividend reduction.

Now here’s the fun part. Whether the dividend reduction actually occurs is a binary outcome. Either it will be cut, or the company will continue to pay the current dividend rate. Many high-yield stocks continue to pay their dividends for years. The number of dividend cuts each year tends to be a small percentage of the high-yield universe.

Thus, the goal of the income stock investor is to own high-yield stocks with low probabilities of dividend cuts and avoid the ones where the potential of a dividend reduction is high. To do so, you need to understand how each company generates cash flow to pay dividends. Avoid those where the cash flow per share is at risk due to unreliable or suspect business operations or a fundamental flaw in the business model. Here are three high-yield stocks to sell or avoid.

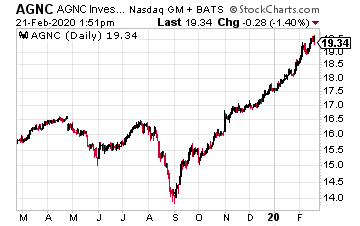

AGNC Investment Corp (AGNC) is the largest of a group of companies that own portfolios of government agency-backed mortgage-backed securities (MBS).

AGNC Investment Corp (AGNC) is the largest of a group of companies that own portfolios of government agency-backed mortgage-backed securities (MBS).

You will see these referred to as Freddie Mac, Fannie Mae, and Ginnie May mortgage-backed bonds.

The challenge for AGNC and all the agency MBS owning finance REITs is taking the 3.0% yield of the bonds up to a double-digit stock yield.

The step-up in yield is accomplished with large amounts of leverage. An agency MBS owning REIT will leverage its equity 5 to 10 times with borrowed money.

For the 2019 fourth quarter, AGNC reported leverage of 9.4 times book value. The problem with this amount of leverage is that a flattening of the yield curve can wipe out the net interest margin and the ability to continue paying dividends.

A steepening of the yield curve will result in falling prices in the MBS portfolio. The lenders providing the leverage can force the REIT to sell bonds at a loss to bring down the leverage.

These REITs are better for management compensation than they are for investors looking for stable dividend payments.

The AGNC dividend has shrunk by 22% over the last five years.

Ignore the 10% yield and sell.

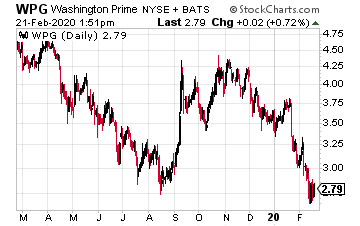

Washington Prime Group (WPG) is a shopping mall REIT on the wrong side of the shopping center great divide.

Washington Prime Group (WPG) is a shopping mall REIT on the wrong side of the shopping center great divide.

At one end are the REITs that own Class A malls, which are 95% plus occupied with successful retailers.

At the other end are the REITs that own malls with fading demographics anchored by declining retailers like Sears and JC Penny.

These second-tier malls will require millions in capital spending to make them again attractive to shoppers, and that spending may not do the trick.

Shoppers are fickle, and it may be impossible to draw them back to a failing mall.

It’s easy to tell the difference between the successful mall REITs and the trouble ones. The good REITs in this category have yields under 5%. The challenged ones have double-digit yields.

In the case of mall REITs, the high-yield is a true danger signal to sell and stay away.

WPG sits in its own universe with a yield of 37%.

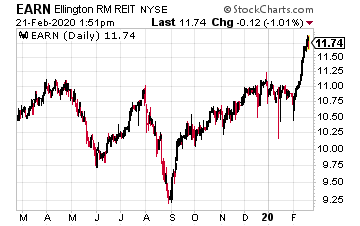

Ellington Residential Mortgage REIT (EARN) is another residential agency MBS owning finance REIT.

Ellington Residential Mortgage REIT (EARN) is another residential agency MBS owning finance REIT.

This company has many strikes against it.

First, it’s a very small-cap company with a $145 million market value.

This size makes Ellington very susceptible to be “taken down” by the large banks when interest rates get volatile.

This happened to many residential REITs during the 2007-2008 financial crisis.

Second, the company currently has a 7.6 to one leverage of its equity to support the high-yield.

Third, the net interest margin on the portfolio is just 1.00%. A one-quarter percent increase in short term rates would wipe out almost 25% of the spread, resulting in a big dividend cut.

Three strikes and you are out for EARN.

Not worth the 9.5% yield.

— Tim Plaehn

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley