Stock prices do not always reflect reality. Stocks actually have a real value that underlies the price listed on the exchange. And we have good reason to believe one FANG stock is undervalued by the market right now.

In fact, once you see this chart, you’ll know why.

Whether or not a stock’s price reflects its actual value greatly depends on one factor: the public’s level of enthusiasm.

But there’s some good news to this gap between perception and reality. The gap actually creates opportunities for savvy investors.

Money Morning Technical Trading Specialist D.R. Barton, Jr., sees such a gap in Amazon.com Inc. (NASDAQ: AMZN) shares.

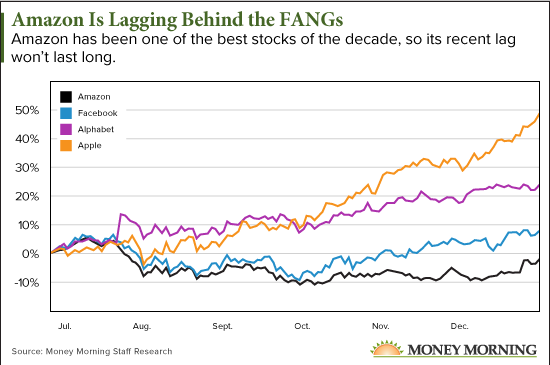

Amazon has been lagging its other big tech stocks for months. In fact, since peaking in July, when it briefly reached a $1 trillion market cap for the second time, it is down 7.1%. That’s even counting its late-December surge. Contrast that to the tech-heavy Nasdaq, up 10.1% over the same time span.

Take a look at how Amazon has fallen behind the FANGs over the last six months…

Amazon first topped the $1 trillion market cap mark in September 2018, when it traded at $2,039.51 per share. As of last week’s close, it traded at $1,874.97.

But here’s why that doesn’t reflect the actual value of Amazon stock.

Why Amazon Stock Is Undervalued Right Now

The reality gap for Amazon is the difference between the stock’s performance and how the company is executing its vision. And clearly, the company is competing above its stock’s performance.

In fact, D.R. says Amazon is delivering more packages than FedEx, UPS, and the U.S. Post Office combined. It went from zero deliveries to leading in just two years.

It’s part of why D.R. believed the lag in Amazon stock performance was a blip. In reality, he said, the company was firing on all cylinders.

That means Amazon is lagging the FANGs for no real reason. And that also means there’s upside for you.

Just after the Christmas break, on Dec. 26, Amazon shares jumped 4.4%. This followed a company report on its holiday shopping season success.

The company said it was “record-breaking,” selling billions of items. In fact, the company said deliveries to Prime subscribers nearly quadrupled from the same time in 2018.

But there is still plenty of room for gains, as the stock is still well off its highs and lags behind its high-tech cousins.

Of course, the high stock price can be a barrier for many average investors. But if you do not have the $187,497 needed to buy 100 shares at last week’s closing price, there is another way to ride this stallion.

How to Profit from Amazon Stock Without Buying a Single Share

By using options, you can benefit from Amazon’s success for a fraction of the cost. And there are many options strategies available for everyone, even if you have little – or no – experience trading them.

Here’s the simple explanation for how options can make you money.

Let’s say you buy an at-the-money call option on Amazon for $21. “At the money” means the strike, or exercise, price is about the same as the stock price. Because each option is good for 100 shares, the cost is $2,100, before commissions, if any.

That seems like a lot. But that money “controls” 100 shares of Amazon stock worth $187,497.

Let’s say Amazon stock moves higher by $100 per share. The value of your option would go up as well.

In this example, Amazon stock gained $100, or 5.3%. The Amazon option could gain 476.2%. And your risk is limited to the price you paid for the option, compared to owning 100 shares of AMZN.

Source: Money Morning