There’s a quiet shift happening in the market—and today I’m going to show you how to tap it for further gains. (And I’ll reveal a closed-end fund paying a safe 6.9% dividend, too).

What’s more, this simple move will help insulate your nest egg from a flare-up in the trade war (still very much on the table despite chatter about a “Phase One” deal with China) and other overseas dangers that could take investors by surprise—especially those who simply buy an S&P 500 index fund and hope for gains.

It starts with a pattern that’s emerged in the latest earnings numbers. Let’s dive into that now, beginning with a figure that could easily mislead you.

A Divided Market

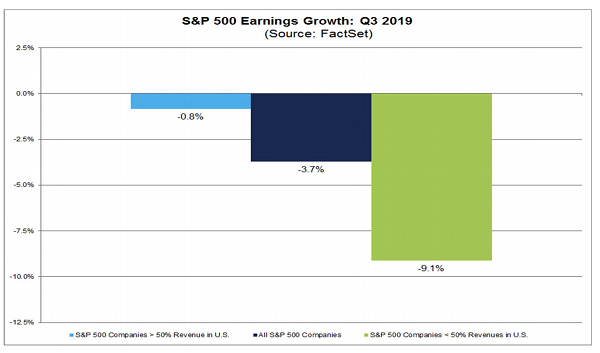

That number is 3.7%, and it’s how much S&P 500 profits (of the three-quarters of companies that have reported so far) have fallen, year over year, in the third quarter.

There are two reasons for this decline.

The first: earnings soared 25.9% in the third quarter of 2018.

Obviously, that’s a tough bar to clear, so a decline was to be expected, since earnings at that time were growing on top of already strong profits the year before.

(Note that this 25.9% profit rise was happening at a time when the market crashed, which is why I urged readers to keep buying during that dip).

The other reason is something no one talks about: many of the earnings declines are happening at companies that rely on markets outside the US.

The difference is stark.

Overseas Firms Drag Down Profits

With the trade war, this shouldn’t be a surprise; tariffs and other tensions are slowing sales abroad, with revenues down 2% for S&P 500 firms with most of their sales outside the US.

With the trade war, this shouldn’t be a surprise; tariffs and other tensions are slowing sales abroad, with revenues down 2% for S&P 500 firms with most of their sales outside the US.

This is a crucial point because it reaffirms that the overall earnings decline isn’t a sign of a recession—and it isn’t reason to sell out of stocks, even if the market is up 24% for 2019. In fact, now is a great time to buy—so long as you do so selectively. (This is where that 6.9%-yielding fund I mentioned off the top comes in. We’re almost there.)

Here’s why I think so.

While sales for companies that rely on foreign markets are down, US companies that get more than half of their sales domestically are seeing sales rise 4.6% in the quarter, and earnings are about flat from last year’s incredible growth. In other words, domestic firms are doing just fine.

The Bottom Line: The Risk of Indexing

So far, 2019 has been a year of correcting a big mistake. At the end of last year, investors sold so furiously that we saw the first bear market since the financial crisis.

That was a mistake, which is why 2019 has seen stocks rise 24%, even as earnings declined; investors realized they oversold and they’re coming back to stocks. But if you’re fully in the market now, what you’re invested in is going to matter more than ever.

The Sector Story

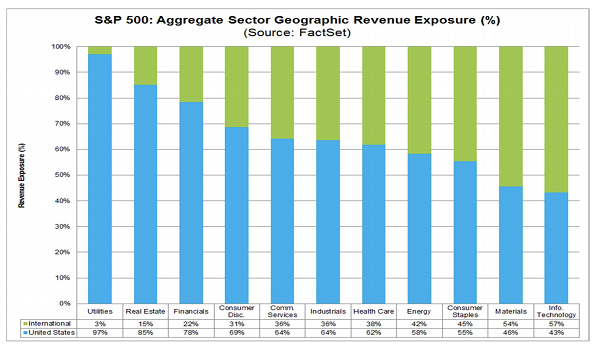

Since exposure to geographies varies widely from sector to sector, buying into the right sector now to avoid further global earnings declines is essential.

Since exposure to geographies varies widely from sector to sector, buying into the right sector now to avoid further global earnings declines is essential.

Getting into utilities, where there’s little trade-related risk, would be wise, while tech could be riskier, since companies like Apple (AAPL) depend on a good relationship with China. These risks should be reflected in tech stocks’ prices, but they aren’t.

Tech Investors Overlook Overseas Worries

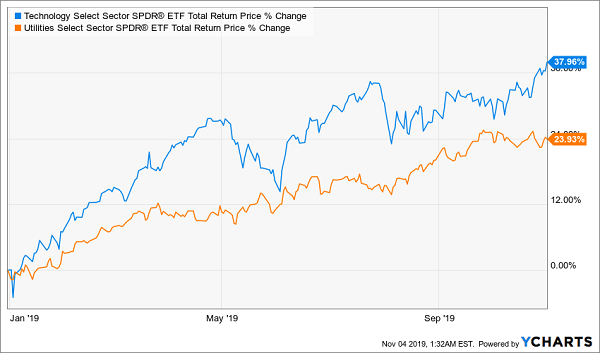

While utilities have almost no exposure to trade risks, they’re up less than the broader market and far less than tech stocks: the Technology Select Sector SPDR (XLK) is up over 50% more than the Utilities Select Sector SPDR (XLU) in 2019, despite the former’s earnings suffering from the trade war, while the latter’s earnings are safer than ever, thanks to a strong American economy.

While utilities have almost no exposure to trade risks, they’re up less than the broader market and far less than tech stocks: the Technology Select Sector SPDR (XLK) is up over 50% more than the Utilities Select Sector SPDR (XLU) in 2019, despite the former’s earnings suffering from the trade war, while the latter’s earnings are safer than ever, thanks to a strong American economy.

This kind of market mistake is something you can jump on in a couple ways: the easy one would be to buy an index fund like XLU. With a 3.1% dividend, it pays much more than the S&P 500 average yield of 1.8%.

But if you’re like me, you prefer to get a lot more of your return in the form of dividends. So if you’re looking to bulk up your portfolio’s utility holdings, you should consider an actively managed closed-end fund (CEF) like the Cohen & Steers Infrastructure Fund (UTF) which pays a rich 6.8% dividend yield.

However you proceed, it’ll pay to be more selective—in terms of both sector and geography—in the coming months. And you’ll put yourself in an even better situation (with higher dividends) if you go with a CEF with a flexible mandate and top-notch management.

— Michael Foster

4 CEFs Perfect for a Nervous Market (Yields Up to 10.7%) [sponsor]

There’s only one small problem with utility CEFs—bargains are thin on the ground in the sector. Other investors have caught on to utilities’ appeal and have driven most of these funds’ valuations (known in the CEF world as the discount to net asset value, or NAV) way up.

But don’t worry—I’m not going to leave you hanging. Because I’ve got 4 other CEFs that are ripe for buying right now. They have 2 critical strengths that help them crush stocks in any market weather:

- Big dividends: I’m talking an 8.8% average yield. Income like that is crucial because you can sail through any market and collect your big cash payouts without having to sell a single share.

- Big discounts: Each of these 4 funds trades at a serious discount to NAV. The bottom line: I’m expecting 20%+ price upside from each one in 2020—and that’s before you include their huge 8.7% payouts!

And when I say these CEFs pay big dividends, I’m not kidding. Consider the 4th fund on my list: it yields an incredible 10.7% now, and its payout has skyrocketed 150% in the past decade!

A Rare 10.7% Dividend That Soars

That’s the kind of income you can find in the CEF market, and full details on all 4 of these bargain-priced income plays are waiting for you now. Click here and I’ll give you names, ticker symbols, dividend histories and everything I have on each of these 4 cash-rich CEFs.

That’s the kind of income you can find in the CEF market, and full details on all 4 of these bargain-priced income plays are waiting for you now. Click here and I’ll give you names, ticker symbols, dividend histories and everything I have on each of these 4 cash-rich CEFs.

Source: Contrarian Outlook