Founded in 1911, Eaton (ETN) is an industrial conglomerate that provides a wide range of energy-efficient products and systems. The company’s solutions help customers manage power across electrical, hydraulic, and mechanical applications. Eaton operates in five main business segments:

- Electrical Products (33% of sales, 36% of profits): consists of electrical components, industrial components, residential products, single phase power quality, emergency lighting, fire detection, wiring devices, structural support systems, circuit protection, and lighting products.

- Electrical Systems & Services (28% of sales, 25% of profits): power distribution and assemblies, hazardous duty electrical equipment, explosion-proof instrumentation, utility power distribution, power reliability equipment. The markets for these segments are industrial, institutional, governmental, utility, commercial, residential and information technology.

- Vehicle (16% of sales, 17% of profits): supplies drivetrain and powertrain systems and components used in cars, trucks, and agricultural vehicles. Key products include transmissions, clutches, engine valves, and superchargers.

- Hydraulics (13% of sales, 10% of profits): sells components and systems such as pumps, motors, valves, and controls that are used in industrial and mobile equipment. Key end markets are oil and gas, agriculture, construction, and mining.

- Aerospace (9% of sales, 11% of profits): sells fuel, hydraulics, and pneumatic systems used in commercial and military aircraft. Products include pumps, motors, controls, sensing products, hose fittings, and more.

By geography, the U.S. is Eaton’s largest market accounting for 56% of sales, followed by Europe (21%), Asia-Pacific (12%), Latin America (7%), and Canada (4%).

Eaton also has a substantial aftermarket business (approximately 20% of total sales) that provides recurring revenue and more stable cash flow.

Aftermarket revenue usually carries high margins and consists of parts, repairs, maintenance, and digital services for equipment sold to customers.

Eaton has paid dividends on its shares every year since 1923 and has grown its dividend each year since 2010.

Business Analysis

Analyzing industrial conglomerates like Eaton is challenging since these businesses often sell thousands of products and touch hundreds of end markets around the world. A lot of trust must be placed in management to keep the company’s sprawling operations running efficiently and focused on the most profitable opportunities.

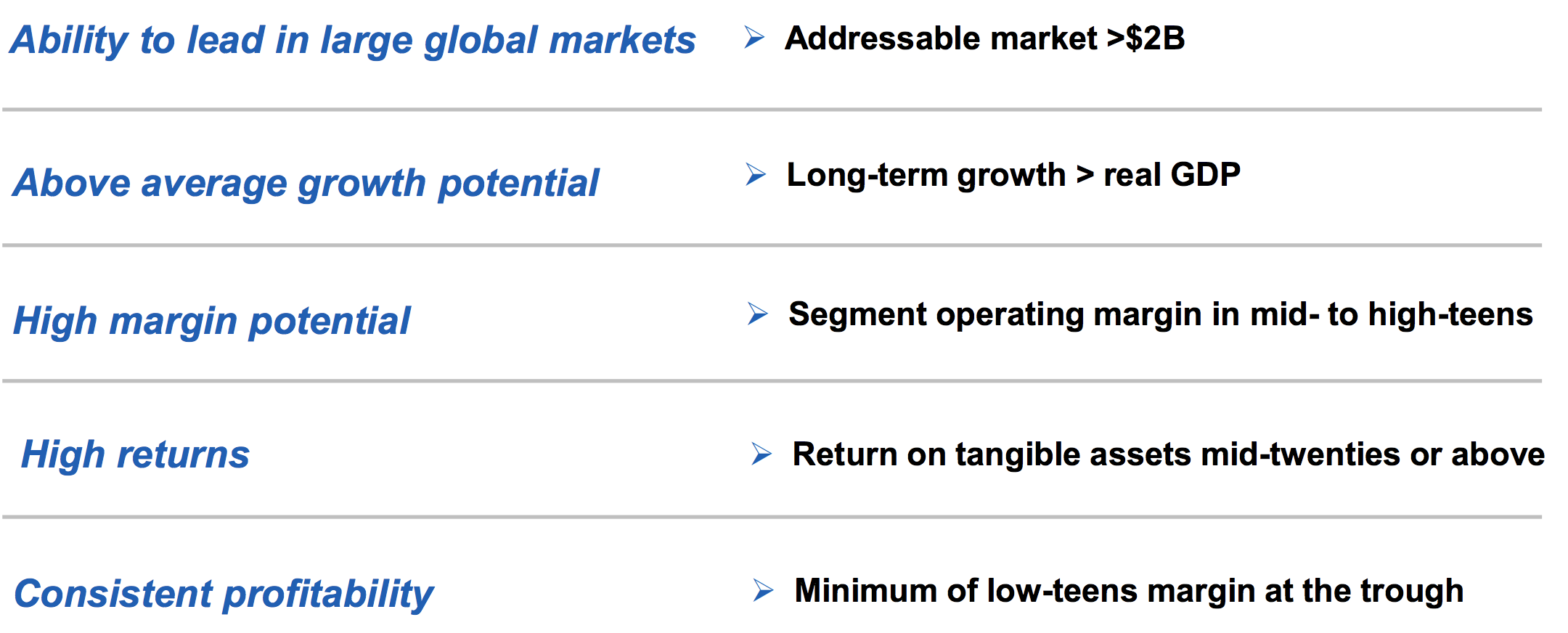

Eaton has excelled on this front for decades. As you can see, management focuses on owning businesses that operate in large markets with above-average growth rates, high margins, and stable profitability over the course of an economic cycle.

Source: Eaton Investor Presentation

Source: Eaton Investor Presentation

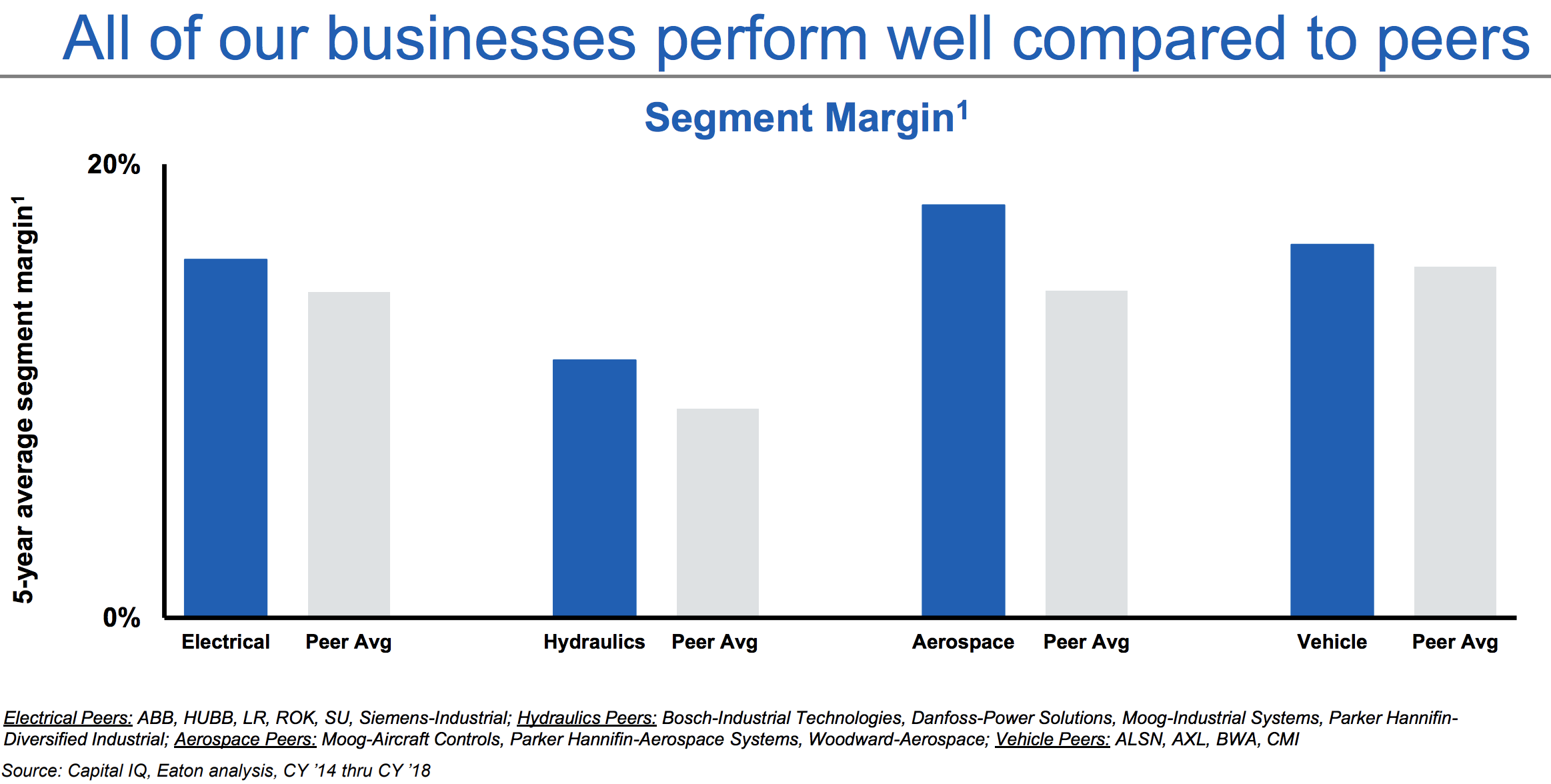

Thanks to strategic acquisitions, periodic restructurings, and continuous performance improvements, Eaton’s business lines enjoy higher margins than their peers.

Source: Eaton Investor Presentation

Source: Eaton Investor Presentation

Eaton enjoys several competitive advantages besides management’s capital allocation skill. First, with more than $20 billion in annual revenue and operations in over 50 countries, the company has meaningful purchasing power and can source its inputs in bulk from the cheapest sources. This helps Eaton maintain a lower manufacturing cost structure than most of its smaller rivals.

In addition, Eaton has a network of thousands of channel partners that sell its products. The company has spent more than 100 years building up this network, and it’s one that rival upstarts can’t easily replicate to achieve global scale.

The other major advantage Eaton has is that its products represent a “sticky” ecosystem for its end customers. For example, Eaton builds mission critical components for complex industrial machines, including parts used in heavy duty trucks, aircraft, and industrial construction markets.

Reliability is of paramount importance in these industries, since downtime and breakdowns can be extremely costly and disruptive to businesses. With an operational history spanning more than a century, Eaton has earned the trust of its customers when it comes to delivering solutions that work.

Another benefit Eaton enjoys is that as its installed customer base expands it can sell more aftermarket products and services. Since aftermarket revenue tends to carry much higher margins, Eaton can price some of its upfront equipment sales at levels that make it difficult for smaller competitors to earn a profit (a lot of the money is made in equipment support and services).

Smaller rivals also lack the network needed to service multinational customers, who demand timely service and maximum uptime. Simply put, Eaton’s aftermarket business helps the company maintain stickier customer relationships and retain its reputation for quality.

Aftermarket revenue also represents a far less volatile stream of income which supports Eaton’s results during economic downturns. In fact, management expects the company to hold its EPS and free cash flow flat in a recession, when its end markets are expected to decline by 3% to 4%. This cash flow stability, plus management’s financial conservatism, have helped the business pay dividends since 1923.

Going forward, Eaton’s business seems likely to achieve organic growth that’s at least in line with global GDP growth. The company’s sheer size and diversification make it harder for Eaton to grow much faster than the global economy, but the continued electrification of many industrial markets serves as a nice tailwind.

Management will supplement the firm’s underlying growth with acquisitions, too. Eaton has acquired more than 65 businesses since 2000, focusing again on high-margin companies operating in large and relatively fast-growing markets.

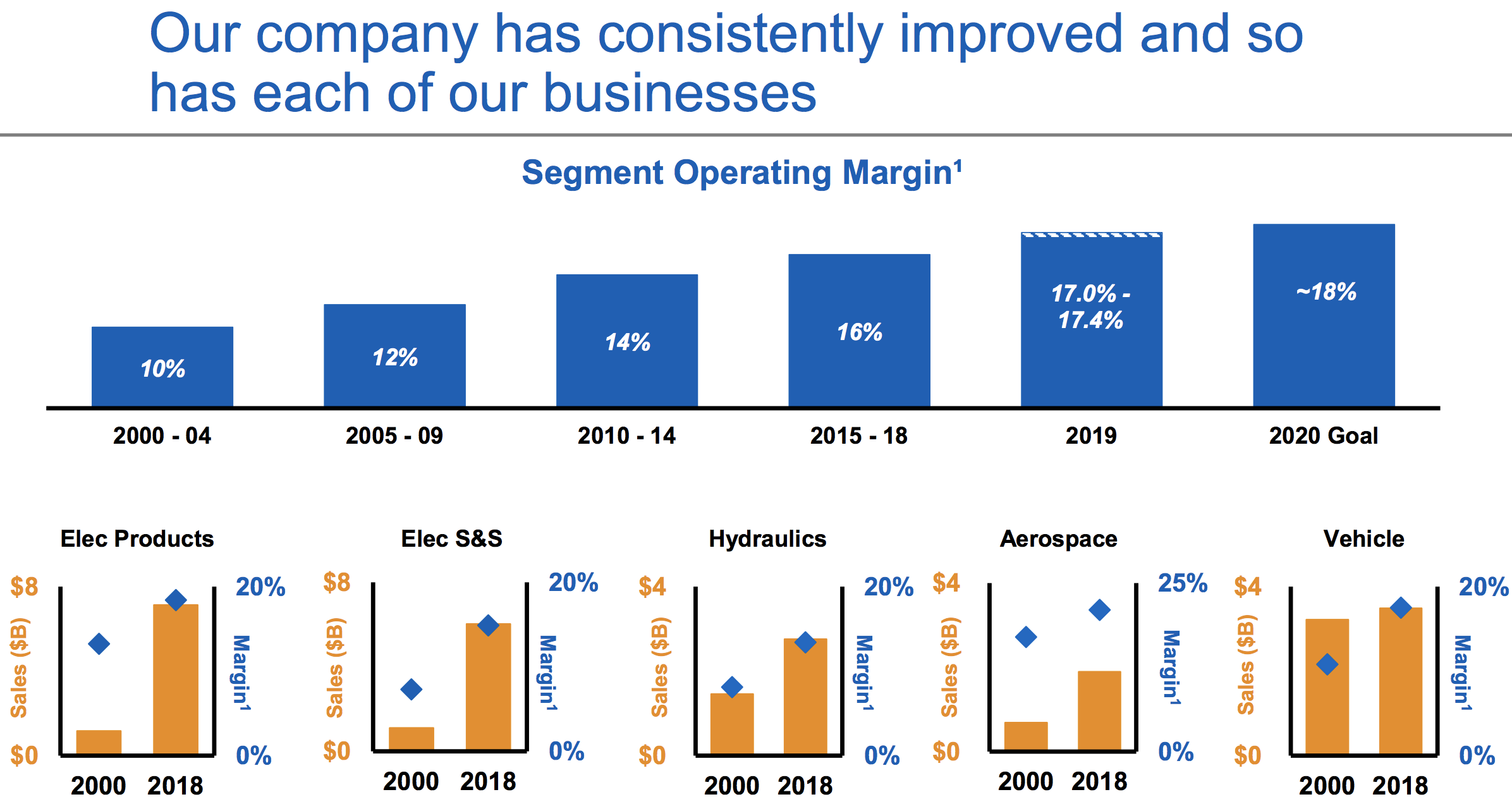

When combined with ongoing productivity improvements, continued efforts to improve its business mix, greater scale, and cost structure optimization work, Eaton’s profitability seems likely to continue edging higher as well, just like it has done for the last two decades.

Source: Eaton Investor Presentation

Source: Eaton Investor Presentation

Overall, Eaton represents a well-managed industrial conglomerate and possesses a number of durable competitive advantages. The company’s long operating history has allowed it to develop highly profitable and sticky relationships with customers who are most focused on reliability of mission critical components.

When combined with Eaton’s large installed base, which results in a high-margin aftermarket business, the business looks like a solid dividend growth investment for the future.

That being said, Eaton still faces its fair share of risks and potential future problems.

Key Risks

Since Eaton is incorporated in Ireland, U.S. investors are subject to a 20% withholding tax on dividends. Fortunately, U.S. shareholders are entitled to an exemption from dividend withholding taxes if they maintain an IRS Form W-9 on file with their broker.

Regarding company-specific risks, there are several. First, despite its large aftermarket business, Eaton’s operations are cyclical and tied to the health of the global economy and the industries in which it operates.

For example, much of the firm’s hydraulics business services the mining, oil, and gas industries. When commodity prices plunged in 2015 and 2016, this segment’s sales fell more than 25%. Investors holding the stock need to maintain a long-term outlook and have a stomach for some volatility.

Fluctuating foreign currency exchange rates and input cost volatility can also affect Eaton’s short-term results. However, these macro issues seem unlikely to impact the company’s long-term earnings power.

Instead, Eaton’s biggest risk is probably management’s ability to continue making wise capital allocation decisions. Besides the organizational complexities that come with running a conglomerate, the company plans to remain active on the M&A front.

While Eaton’s track record with acquisitions is generally good, and its standards for new purchases are high, every acquisition comes with execution risk. Eaton will have to avoid overpaying for an acquisition, and then successfully integrate the new company’s products, supply chains, and culture into its own.

Overall, Eaton’s business diversification, long operating history, healthy cash flow generation, strong balance sheet, and presence in slow-changing markets reduce its risk profile.

Closing Thoughts on Eaton

Eaton is a quality business that seems likely to remain relevant for many years to come. The company’s moat is driven by its long-standing market positions, extensive product portfolio, vast distribution channels, sizable aftermarket business, and leading power management technologies.

When combined with management’s disciplined approach to acquisitions, plans to win market share in critical industries of the future, and successful restructuring, Eaton seems very likely to continue delivering safe and growing dividends for many years to come.

For dividend investors seeking a secure income investment with decent long-term growth prospects, Eaton may be an interesting industrials candidate as part of a well-diversified dividend portfolio.

— Brian Bollinger

Sponsored Link: Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends