I am sure that you are aware that over the years, there have been numerous instances of illegal insider trading. Insiders, or people who have access to confidential information about a company, have used this information to profit at the expense of uninformed investors.

For example, if an insider knows about pending news that will make the stock price increase, they can buy it from those who do not know.

If the news is bad and will make the stock fall, the insider can conversely sell to investors who don’t have access to this information.

Fortunately for us outsiders, the SEC has created rules and regulations to prevent this type of illicit activity.

One of them is that the insiders must inform the public when they make a transaction in their stock.

In other words, we can find out if the insiders believe that it is a good time to invest in their company.

There are many reasons why an insider would be motivated or may need to sell their stock. Maybe they are buying a home or paying a college tuition. But an insider will only buy their stock one reason. Money. They believe that the price will go up and they will profit.

These seven companies are on my radar screen due to the insider buying that has recently occurred.

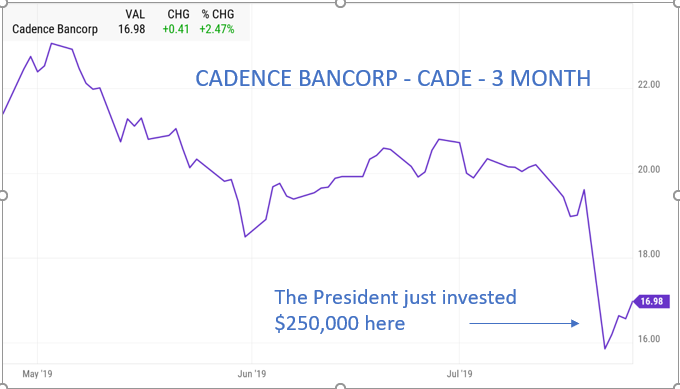

Stocks With Insider Buying: Cadence Bancorp (CADE)

Cadence Bancorp (NYSE:CADE) is a holding company that offers a wide range of banking services.

Over the past few months, the price of CADE stock has dropped from $22 to current levels around $17. This could have something to do with the fact that JP Morgan recently cut the price target by $2 to $22.50.

Samuel Tortrici is the president and chief operating officer of Cadence. He must believe that the stock is a good value at these levels. He just invested $250,000 of his personal funds when he paid $16.72 for 15,000 shares.

The fundamentals seem attractive. The trailing price-to-earnings ratio is 10x, which is well below the industry average of 14%. It is also growing its earnings at 10%, which is above the industry average of 7.1%.

Right now, 10 Wall Street firms follow Cadence. Four of them have buy ratings on it and the other six have it rated as a hold. The average price target is $19.30, which is about 13% higher than current levels.

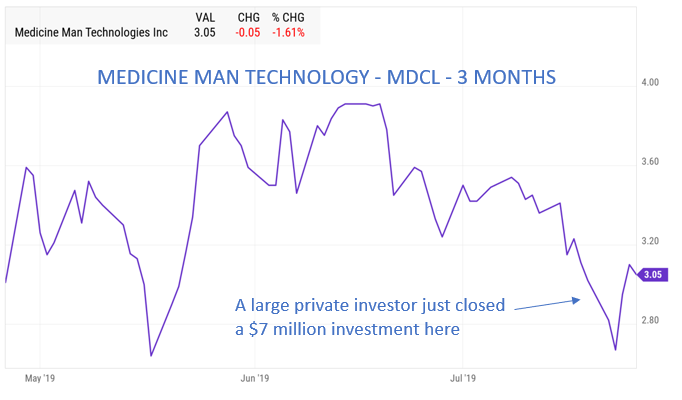

Medicine Man Technologies Inc (MDCL)

Medicine Man Technologies (OTCMKTS:MDCL) grows and sells medical and recreational cannabis. And there has been significant insider buying of MDCL stock.

Dye Capital Management is a private equity firm that has a significant position in MDCL. The company just announced that it has invested an additional $7 million.

The managing general partner of Dye Capital, Justin Dye, will become the chairman of the board. Dye has extensive experience and is highly regarded in the industry.

When a private equity firm increases an investment in a company, it may be a very bullish signal. The private equity firm has extensive knowledge of the company because it is already part owner of it. It knows the management, the industry and the issues that the company is facing.

A private equity firm is the ultimate insider and its increased investment is a major sign of confidence.

CNX Resources (CNX)

CNX Resources (NYSE:CNX) is an oil and gas company that operates primarily in the Appalachian Basin. Like most other companies in the natural gas industry, CNX has seen its share price decline due to the drop in natural gas prices. A year ago, CNX stock was trading around $15 per share. The most recent close was $7.82.

Bernard Lanigan is a director of CNX. He must believe that the stock is about to rebound because he just made a significant purchase. He bought 200,000 shares at a price of $6.39. Nothing says confidence like a $1.3 million investment!

Wall Street seems to agree that the stock is undervalued. Currently, 12 firms follow CNX and the average target price is $11.44. This is 36% above current levels.

Brown & Brown (BRO)

Brown & Brown (NYSE:BRO) is an insurance agency and brokerage.

BRO stock has had an impressive run this year. Since January, it has gained about 33%.

Wall Street seems to think that this rally is over. While 13 firms follow Brown and Brown, the average rating is hold and the average price target is $34.10. This is $2 below current prices.

H. Palmer Proctor is a director of the BRO stock. He must disagree with these highly paid but often wrong Wall Street analysts.

Proctor just paid $35.96 for 5,000 shares. This an investment of $180,000. I think that it is probably safe to say that he believes the rally will continue.

TriState Capital Holdings Inc (TSC)

TriState Capital Holdings (NASDAQ:TSC) is a bank holding company that provides services to middle-market companies, institutions and high-net-worth clients. And over the past three months, the price of TSC stock has dropped by more than 10%.

James Dolan is a director of TriState. He must believe that this selloff if overdone because he recently invested $100,000 when he bought 5,000 share at $19.77 on July 19.

He must be happy with his decision to buy. The most recent close was $21.07, which means that he has already made over $6,000. Not bad for just one week.

Wall Street likes TriState as well. Of the six firms that follow it, the average rating is overweight and the average price target is $25.50. That is over 20% higher than current levels.

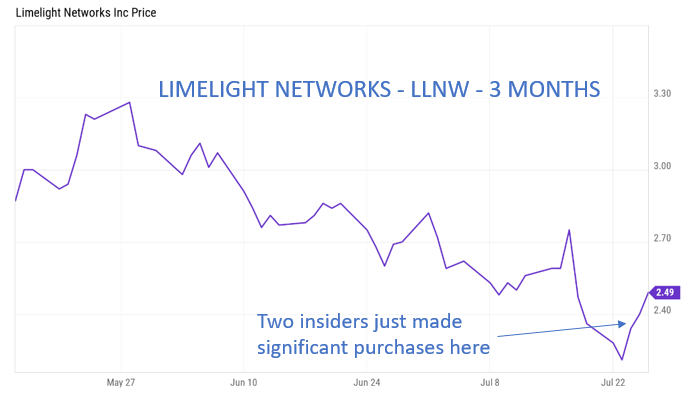

Limelight Networks (LLNW)

Limelight Networks (NYSE:LLNW) provides content delivery network services.

Over the past two months, the price of LLNW stock has dropped for $3.30 to current levels around $2.50.

Thomas Marth is a senior vice president of sales at Limelight, and Sajid Malhotra is the chief financial officer of the company. Both of these insiders wanted to take advantage of the stock’s weakness. They each just purchased $50,000 worth of shares.

Of the six Wall Street firms that follow Limelight, four of them have buy ratings on it and the average target price is $3.30. If LLNW stock did trade back up to this level, it would be an appreciation of over 30%.

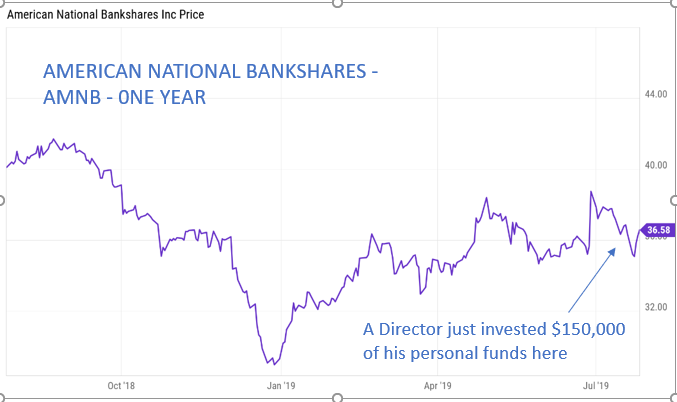

American National Bankshares Inc (AMNB)

American National Bankshares Inc (NASDAQ:AMNB) is a one bank holding company that provides a variety of banking and trust services.

Like most other companies, the price of AMNB stock saw a large selloff at the end of last year and has since been recovering.

The company just had a very good earnings report. Earnings were 87 cents per share versus estimates of 69 cents. Revenue was almost $25 million, up from the prior years quarter of $18.35 million.

Franklin Maddux is a director of American National. He must believe that these positive trends will continue. Mr. Maddux just made a personal investment of $150,000 when he paid $35 for 4,282 shares.

— Mark Putrino

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place