Last year when I reviewed mortgage real estate investment trust (REIT) MFA Financial (NYSE: MFA), I said there was nothing to like about its 10.5% yield.

Today, the company’s yield is more than 11%, but not because the dividend increased.

The stock has fallen a bit since I wrote about it.

In last September’s analysis, I stated definitively the dividend was not safe.

To the company’s credit, the quarterly dividend has remained at $0.20 per share.

Has it gotten any better? Let’s take a look.

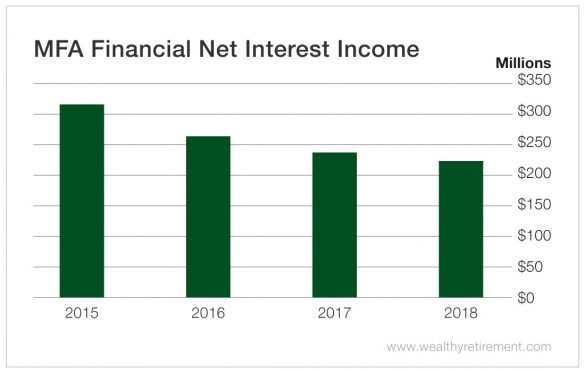

In February, management said it expects net interest income (NII) to increase in 2019, which would reverse several years of lower NII.

Mortgage REITs make money by borrowing funds at low short-term interest rates and lending it out at higher longer-term rates.

The difference, minus expenses, is NII. This is the best measure of cash flow for this type of business.

While management expects NII to increase in 2019, and while the first quarter’s NII was $62 million (a run rate of $248 million annually), the company will pay around $360 million in dividends over the course of the year if the $0.20 per share payout remains intact.

MFA Financial can’t afford that.

The company has not cut its dividend since 2013, but between 2010 and 2013, the quarterly dividend was lowered seven times.

The company has not cut its dividend since 2013, but between 2010 and 2013, the quarterly dividend was lowered seven times.

MFA Financial’s day-to-day business does not generate enough cash to pay its dividend. It needs to either borrow money, dip into its $77 million in cash or slash the payout.

I expect the latter. Although the stock is a bit cheaper and the yield is a little higher than when I first reviewed it 10 months ago, I still don’t think there’s much to like here.

Dividend Safety Rating: F

Good investing,

Marc

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Wealthy Retirement