It seems as if the world has gone haywire. Politicians on both sides of the aisle are spending taxpayer dollars (and future generations’ taxpayer dollars) like drunken sailors.

Let me correct myself: Washington politicians make drunken sailors look like Ebenezer Scrooge.

In 2019, the U.S. deficit will top $1 trillion, a new record. It has grown a mind-blowing 23% so far this year.

The president wants interest rates to be cut. This isn’t because of any need to lower rates (after all, he constantly talks about our “record” economy), but because it will help him get reelected.

Who cares about the asset bubble it will create or the massive burden our children and grandchildren will be left with? That’s for the next guy or gal who occupies the White House to worry about.

Unemployment is at its lowest level in decades, consumer sentiment is at 18-year highs and GDP grew 3.1% in the first quarter.

Unbelievably, Fed Chair Jerome Powell, a very sharp seven-year veteran of the Federal Reserve who is reportedly worth nine figures, is going along with this insane plan. And so is Congress, Republicans and Democrats alike.

I can’t help but wonder whether, if we had a citizenry that was educated on how money works, most of these bozos in Washington would be voted out and have to work a real job (maybe for the first time in their lives).

I’m talking about you, Marco Rubio and Bernie Sanders (and many others).

The problem is that financial literacy has not been taught in schools or universities until just the past few years. And many of the programs used are awful. It’s not that the lessons they teach are wrong – they’re good lessons. The problem is that the content is boring.

I watched my high schooler’s mandatory online financial literacy course (it was maybe a total of eight hours), and it was a joke. C-SPAN marathons are more engaging.

A basic economics course should be mandatory in high school, as should a personal finance class that teaches how to balance a checkbook (even an online checkbook) and how compound interest works, along with consumer skills.

In fact, if you want to teach your kids or grandkids (or even yourself) just one financial skill that will make all the difference in life, it should be understanding compound interest.

So many consumers jump at cheap credit card offers. I once signed up for a credit card in college because they gave away king-sized Reese’s Peanut Butter Cups.

(To be fair, I would have done nearly anything for the peanut butter cups. They were king-sized, after all.)

But those credit cards got a lot of people in trouble as the debt piled up, and even those who diligently paid their minimum balances due every month fell further and further behind as the interest compounded.

On the flip side, those who invested young and let their money compound are now so far ahead of their peers it’s ridiculous.

Compound interest is when the interest you earn earns interest.

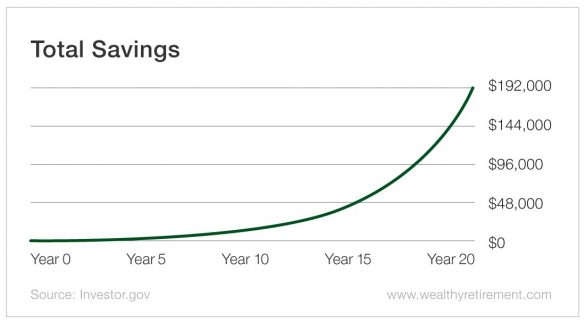

If you started with $1,000 and earned 10%, you’d earn $100 in interest and now have $1,100. However, the next year, because you’re starting with $100 more, you’d earn $110, giving you a total of $1,210.

It may not sound like much, but it adds up. At the end of 10 years, your annual interest payment would be $236. After 20 years, the annual interest would be $612, and after 30 years, the annual interest would be nearly $54,000!

That’s not a typo. That’s the power of compounding. And the total nest egg from a one-time $1,000 investment would be nearly $200,000.

Here’s another way to look at it…

An investor who invests $5,000 at 25 years old and continues to invest $2,500 until age 65 will have invested a total of $200,000. If she earns 7% per year, she will finish with nearly $609,000.

A similar investor waits until age 35 to begin investing, but in order to play catch-up, he invests twice as much. He starts with a $10,000 initial investment and adds $10,000 to it each year. At age 65, he has invested a total of $300,000, yet he winds up with $581,000.

The person who waits has to invest $100,000 more just to get close to the total of the first investor.

It is my great hope that this generation of students will be taught some basic financial skills that will help dig them out of the holes we’ve created for them.

Good investing,

Marc

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Wealthy Retirement