Flowers Foods (FLO) was founded in 1919 and has grown to become the second-largest producer of packaged bakery foods in the country with over 40 operating bakeries.

The company primarily sells breads, buns, rolls, tortillas, and snack cakes, and some of its key brands include Nature’s Own (the number one bread in the U.S.), Tastykake, Wonder Bread, Whitewheat, Dave’s Killer Bread, and Canyon Bakehouse. Flowers Foods also bakes store-branded generic products.

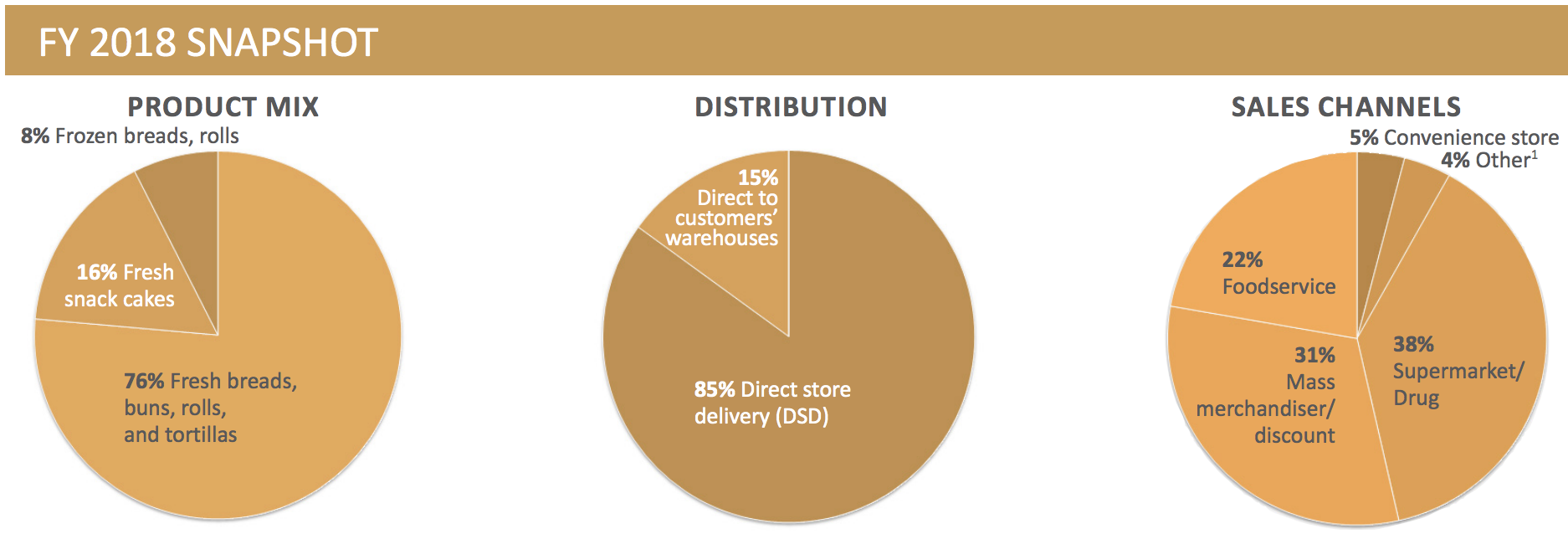

The vast majority of the company’s sales are in fresh breads and rolls, with snack foods and frozen products making up the rest of revenue.

Approximately 85% of Flowers’ sales last year were Direct Store Delivery, in which fresh products are delivered directly to customers (supermarkets, mass merchandisers, restaurants, etc.) via a network of independent distributors.

The remaining 15% of revenue is derived from Warehouse Distribution, which includes fresh and frozen products (snack cakes, frozen breads and rolls, etc.) that are shipped to customers’ warehouses nationwide.

This line of business serves mainly retail and foodservice customers.

Source: Flowers Foods Annual Report

Source: Flowers Foods Annual Report

Business Analysis

According to IRI panel data, 98.5% of U.S. households buy fresh packaged bread. A 2013 study by Willard Bishop concluded that bread is the most profitable item for grocers. In total, the U.S. bread market is a $36 billion mature industry.

Bread is important to U.S. consumers, and bread is Flowers’ focus. The products Flowers sell are going to remain relevant and in demand by practically every household in the country for many years to come. Industries with a slow pace of change tend to appeal to conservative dividend investors, and Flowers’ business certainly checks that box.

While there are seemingly few barriers to entry in the industry, Flowers derives several advantages from its longevity (the company is 100 years old).

Flowers has built up a large handful of brands with strong recognition over several decades. For example, the company’s Nature’s Own brand was introduced in 1977 and has built a reputation for quality by never using any artificial flavors, colors, or preservatives in its baked foods since inception. Nature’s Own is now a $1 billion brand that is number one in the U.S. in sales of both white and wheat loaves.

Often spending in excess of $30 million annually in advertising, Flowers defends its market share in part due to favorable brand recognition with consumers. Smaller rivals don’t have the budget to build up competitive brand awareness.

Retailers also have strong relationships with Flowers and only have so much shelf space for the categories that the company participates in. As long as Flowers’ baked foods continue selling, there is little incentive for retail customers to give shelf space to unproven new entrants in the market, especially given the relatively low level of differentiation in a category such as bread.

Since product differentiation is generally perceived to be lower, maintaining an efficient production and distribution system is particularly important. Over the past century, Flowers Foods has gained scale mostly by acquiring regional bakeries and baked goods brands.

Today the company is America’s second largest producer of packaged bakery goods (behind BBU, owner of Sara Lee) with annual revenue of $4 billion. Flowers’ scale provides several cost advantages.

The company enjoys economies of scale in purchasing its raw materials, mass producing its bakery foods, investing in efficient production facilities, and distributing its products.

Importantly, Flowers’ size has also helped it strategically locate production facilities near key markets, resulting in fresher products at the time of delivery and logistics cost savings. Many of its fresh products require frequent deliveries to keep store shelves well-stocked, which rewards suppliers with the densest and most convenient distribution networks.

Despite the company’s strong brands and economies of scale, its market is mature and has a very low growth profile. The baked goods market is also highly fragmented with nearly 50% composed of store brands and independent bakeries. As a result, Flowers has been consolidating the market for many years.

In fact, since its 1968 IPO, Flowers Foods has bought over 100 small regional companies, brands, and bakeries, largely in areas where it has not previously had much of a presence. Acquisitions have helped the company more than double annual sales since 2003 from $1.9 billion to $4.0 billion.

The largest player in the industry, Grupo Bimbo, has also helped consolidate the market. In 2011, it bought Sara Lee’s fresh bakery segment in North America. The three biggest players in the industry now account for over half of the market, which has encouraged more rational pricing.

Acquisitions have also helped Flowers enter faster-growing segments of the market. The company claims to have the leading position in the organic segment of fresh packaged breads thanks to its purchases of Dave’s Killer Bread and Alpine Valley Breads. In fact, organic fresh packaged breads now account for more than 15% of Flowers’ total revenue.

Looking ahead, Flowers plans to continue to make bolt-on acquisitions to meet changing consumer tastes (such as for natural and organic products) and grow its product line. Management is also investing in developing new products, which in the past led to the introduction of Nature’s Own, now America’s number one bread brand.

Furthermore, many of Flowers’ brands are still available only on a regional basis, leaving opportunity to expand to new markets. By building out a nationwide network of bakeries, distributors, and suppliers, the company’s baked goods can now reach 85% of the U.S. population, up from 35% in 2004.

Flowers also hopes to achieve stronger earnings growth through cost savings. For example, the company has invested in an automated shipping system, which is being rolled out to all of its bakeries.

The ultimate goal is for the company to achieve long-term sales growth of 3% to 4% per year, margin expansion, and long-term EPS growth of 8% to 10% annually.

If successful, the company should have no problem continuing to deliver consistent and healthy dividend growth. In fact, Flowers Foods has raised its dividend every year since 2002, and the company has potential to deliver at least mid-single digit annual dividend growth over the long term.

With that said, Flowers Foods has several challenges it faces that could cause it to miss management’s growth projections.

Key Risks

Growth hasn’t been as easy to come by for Flowers in recent years as it was a decade go, in part because of the increasingly competitive relationship between retailers and packaged food brands.

Flowers’ sales are relatively concentrated, with its top 10 customers comprising 50% of revenue. Walmart alone accounts for 20% of the company’s revenue.

Walmart is famous for “everyday low prices”, which causes it to squeeze suppliers like Flowers. The world’s largest retailer has also been increasingly focused on its own private label (store brand) products sold under the Great Value name. Walmart actually makes larger profits from its own private label goods than it does by selling branded goods such as Wonder Bread.

As a result, when it comes to pricing power with large customers like Walmart, Flowers Foods could itself in a relatively weak negotiating position unless its brands remain very strong. In the competitive retail world, even substantial cost cutting efforts can result in margins that go nowhere.

For instance, the company’s operating margin has basically remained the same for more than a decade. That’s despite enormous investments into automation and improved bakeries. In highly competitive, slow growing industries such as this, cost savings often need to be passed onto consumers.

More importantly, in a mature category such as bread, there is only so much market share available for the taking. Sales growth has slowed the past several years, and future growth could be challenging to come by without enough needle-moving acquisitions to make. The company might then feel pressure to enter adjacent markets to continue expanding, which would come with its own risks.

Evolving consumer tastes could also impact the company’s results over time. Consumers are increasingly moving away from gluten and desiring fresh, healthy foods over packaged items with questionable ingredients.

Fortunately, bread seems likely to remain a massive category, and investors don’t seem to be expecting much organic growth in the industry anyway, reducing the risk of expectations being missed.

Closing Thoughts on Flowers Foods

Flowers Foods may not be a household name, but many of its brands are. Over the past 100 years, the company has proven itself highly adaptable and capable of top and bottom line expansion through an acquisition-led growth strategy.

Despite some questions around future growth, Flowers’ core business model remains highly recession resistant, and its free cash flow is usually very stable.

The business should be capable of delivering safe and steadily growing dividends over the years ahead, even as many constituents in the consumer staples sector work to adapt their business models to a fresher, healthier world.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends