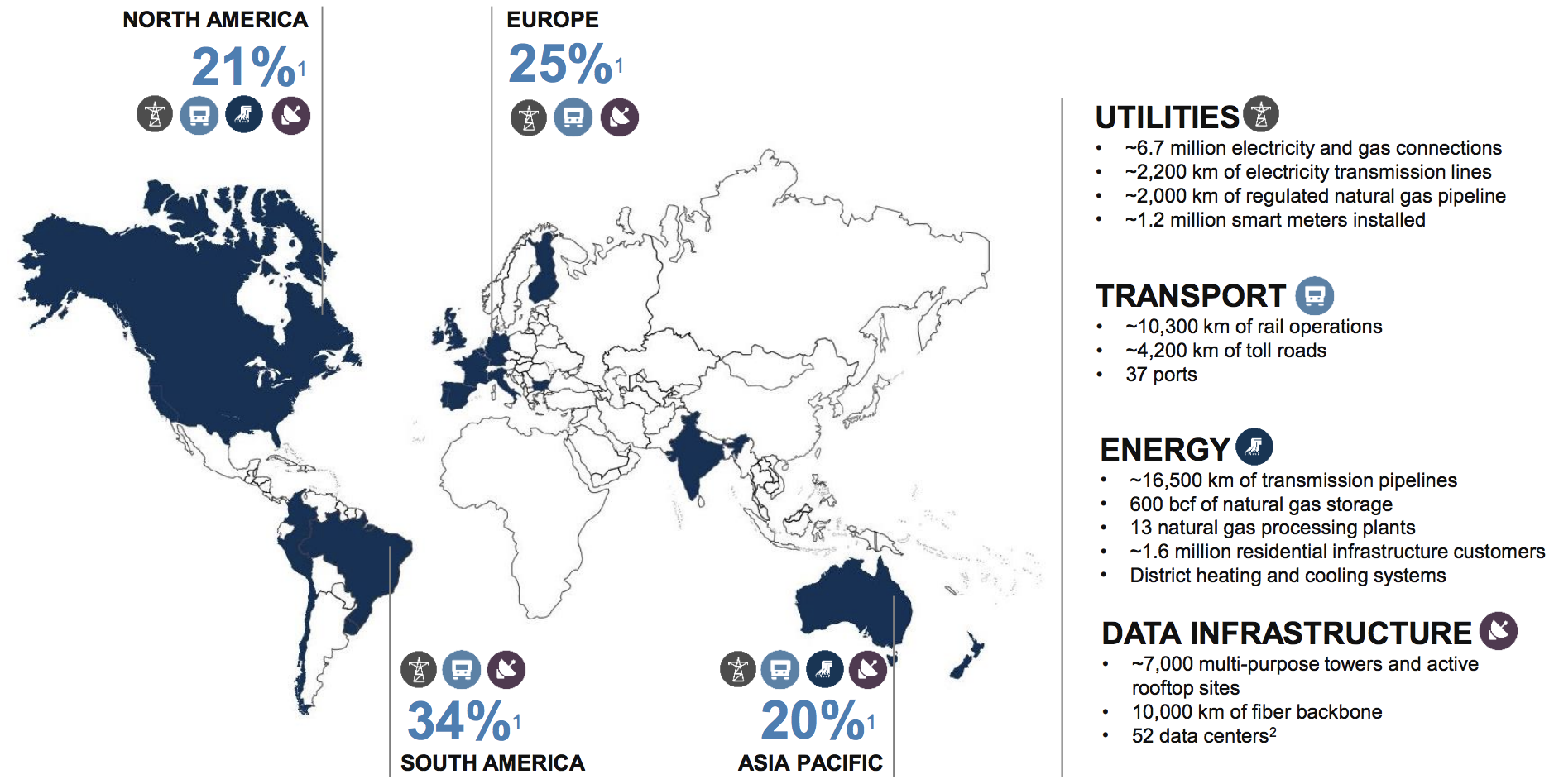

Brookfield Infrastructure Partners L.P. (BIP) is one of the fastest growing and most diversified utilities in the world. In fact, the limited partnership (a corporate structure similar to that of a Master Limited Partnership) owns dozens of infrastructure assets located across five continents.

Some examples of the partnership’s assets include electrical transmission lines, railroads, toll roads, natural gas pipelines, global ports, telecom towers, data centers, water infrastructure, and fiber optic lines.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

As Brookfield points out, it essentially owns “critical and diverse infrastructure networks over which energy, water, goods, people and data flow or are stored.” These are generally hard-to-replicate assets that earn predictable returns.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

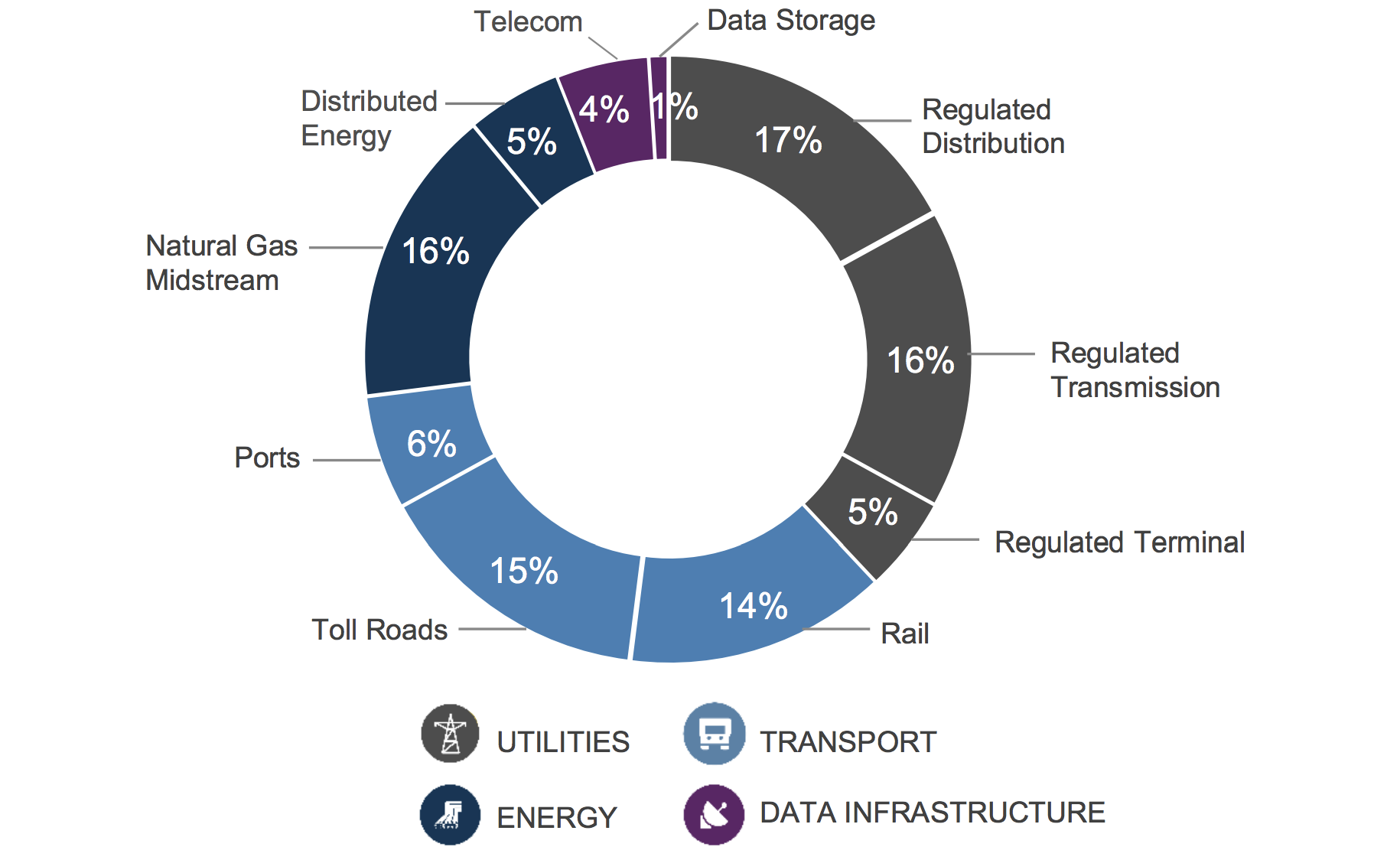

Brookfield Infrastructure’s healthy diversification by business segment (no business unit is more than 20% of cash flow) and geography helps to ensure very stable cash flows to protect the safety and growth of its distribution.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

Even better, 95% of the firm’s cash flow is either derived in regulated industries or secured by long-term, fixed-rate contracts. In addition, 75% of its cash flow has escalators indexed to inflation, and 60% has no volume risk.

The assets Brookfield Infrastructure owns generally require little maintenance costs as well. As a result, the firm has enjoyed an average adjusted EBITDA margin in excess of 50% over the last five years.

Brookfield Infrastructure has grown its distribution every year since its IPO in 2008. Management’s guidance calls for 5% to 9% annual long-term distribution growth, which supports the partnership’s plan to deliver 12% to 15% annual total returns for investors.

Business Analysis

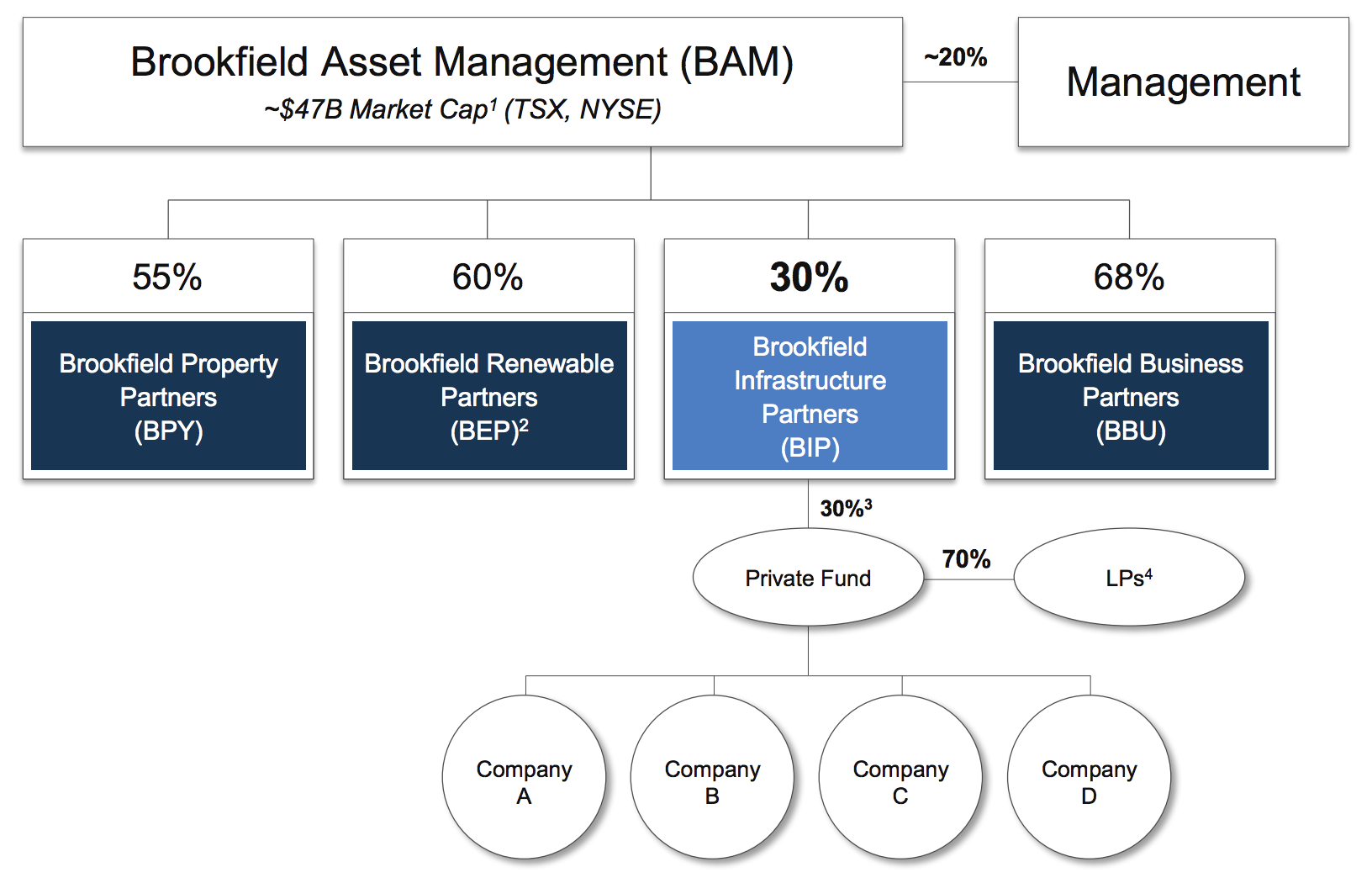

Brookfield Infrastructure Partners is structured as a limited partnership that’s sponsored by Brookfield Asset Management (BAM), the world’s oldest (120-year history) and largest (over $300 billion in assets under management) real estate, utility, infrastructure, and private equity investment firm.

Brookfield Asset Management owns 30% of the LP’s units and its incentive distribution rights, or IDRs. The IDRs mean that 15% of distributions above $0.203 per quarter, and 25% of distributions above $0.22 per quarter, are paid to the sponsor (Brookfield Asset Management).

These payments are in addition to the 1.25% of assets that Brookfield Asset Management takes as its base fee.

In exchange, Brookfield Infrastructure investors gain access to one of the world’s most experienced management teams that oversees the firm and can source profitable infrastructure deals around the world.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

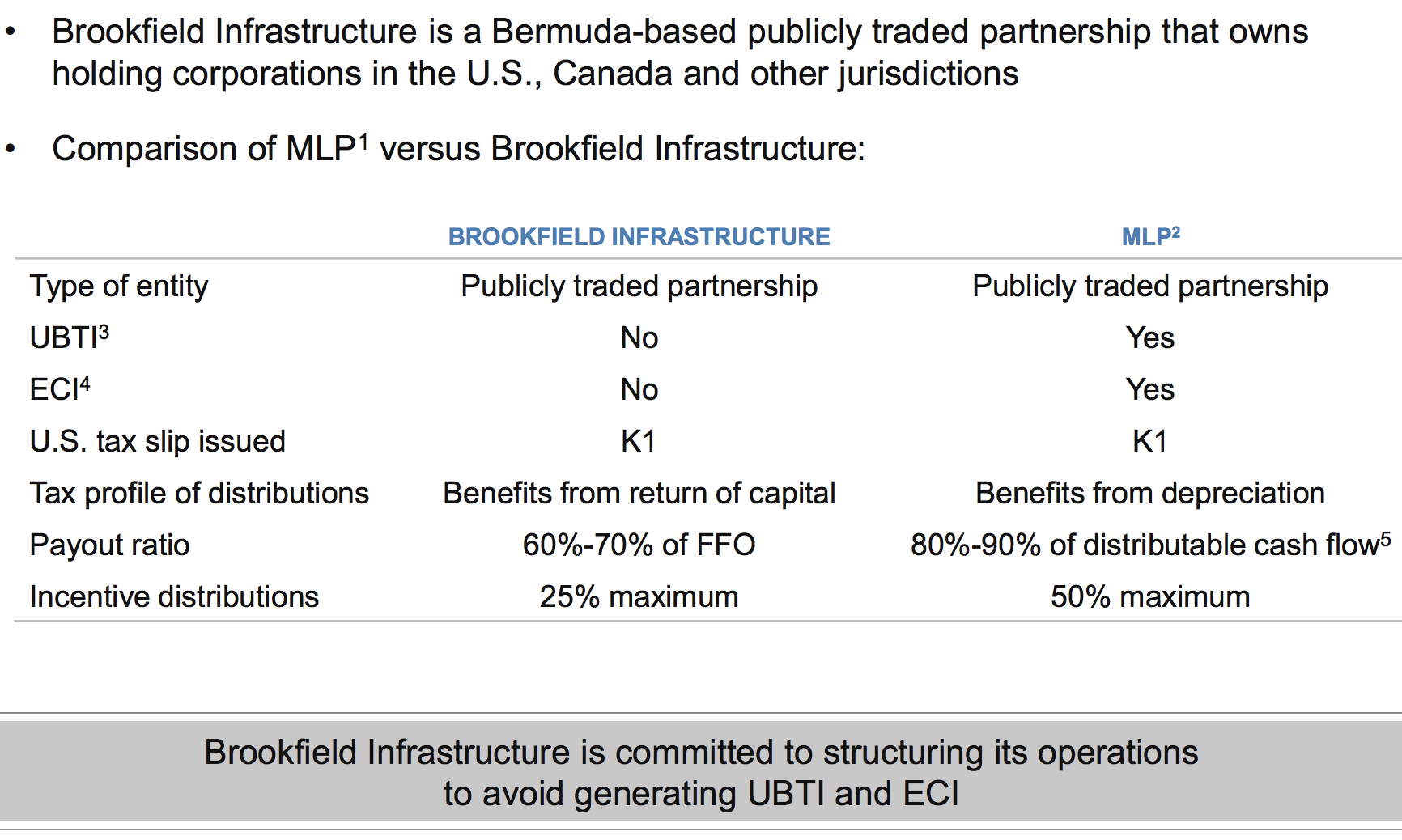

However, keep in mind that while Brookfield Infrastructure is structured much like an MLP, there are several important differences.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

For example, the LP is designed to specifically not generate unrelated business taxable income, or UBTI. This makes the stock suitable for owning in retirement accounts such as IRAs. However, the downside to its double pass-through structure (an LP whose assets are themselves LPs) is that Brookfield’s tax complexity is greater than the typical MLPs (see risk section).

Besides tax differences, it’s worth noting that while some MLPs have incentive distribution rights that top out at 50%, Brookfield Infrastructure’s are half as large. As a result, unitholders benefit from keeping 75% of all marginal adjusted funds from operations, or AFFO (similar to free cash flow for LPs).

The lower IDRs also result in a lower cost of capital, which helps make Brookfield Infrastructure’s investments more profitable. Several factors support the firm’s favorable cost of capital.

First, management is very disciplined about how fast it grows the distribution, making sure to retain about 35% of operating cash flow so that the LP can invest in future growth.

In contrast, many MLPs retain just 10% to 20% of cash flow and are thus more dependent on debt and equity markets for growth capital. The more internally generated cash flow an LP retains, the lower its cost of capital and the more profitable its investments.

Brookfield Infrastructure also enjoys access to relatively low borrowing costs, which are the second reason for its low cost of capital and high profitability. This is thanks to the conservative nature of its balance sheet which is actually much safer than its headline leverage ratio might indicate.

Brookfield Infrastructure is well-known for its use of non-recourse debt, which makes up 85% of the LP’s debt load. Non-recourse debt is held at the asset level, meaning these bonds are like mortgages used to acquire income-producing investments such as toll roads. The cash flow these assets produce then services and eventually repays the debt.

In the event of something going wrong (like cash flow disruption leading to a default), Brookfield Infrastructure’s creditors can only get the asset but can’t go after its overall cash flow.

Basically, the firm has built a shield around its cash flow that helps support the safety of its distribution. About 90% of Brookfield Infrastructure’s debt also has fixed rates, with an average duration of 8 years. The relatively long duration and fixed rate nature of its bonds minimize interest rate risk to its business model.

The partnership’s use of non-recourse debt, combined with its association with Brookfield Asset Management, helps explain why the LP has a strong BBB+ credit rating, which management says it plans to retain in the future.

Despite its attractive financial profile, investors should note that Brookfield Infrastructure does not have a self-funded business model like some MLPs. The firm’s units outstanding have increased by nearly 5% annually over the past five years to help finance growth opportunities.

Going forward, however, management has said it plans to use capital recycling (selling around $1 billion per year in older assets at profitable terms) to minimize the firm’s use of equity and retain relatively constant debt ratios. In other words, Brookfield Infrastructure plans to adapt an increasingly self-funding business model that reduces its dependence on capital markets to fund its growth.

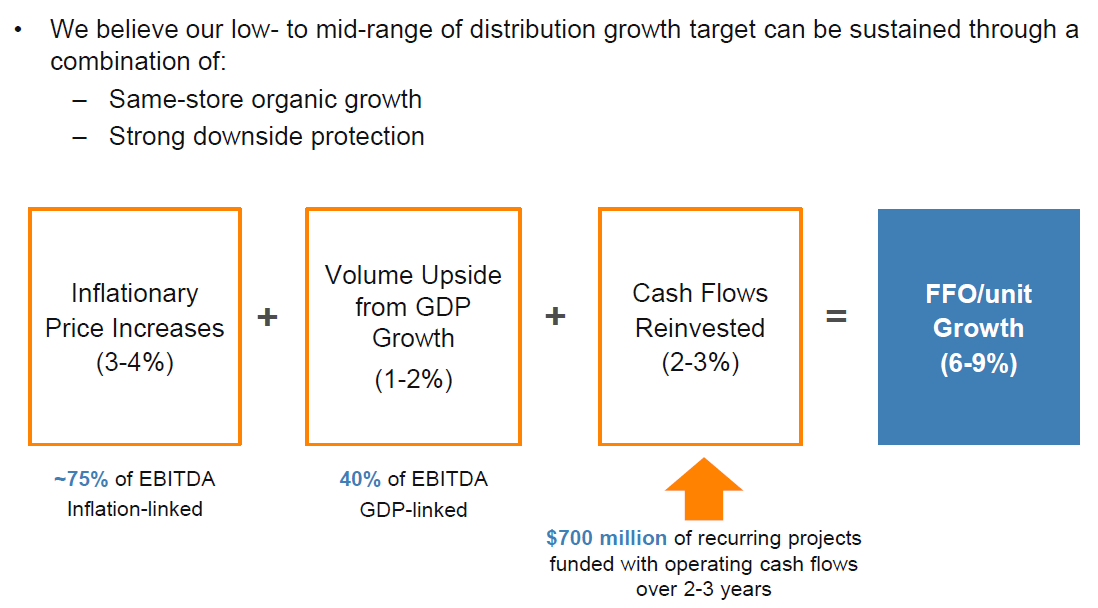

Speaking of growth, the firm appears to have an abundance of long-term opportunities it can take advantage of. Brookfield Infrastructure expects to invest about $700 million annually over the next few years in growth projects.

Combined with inflationary price increases and GDP growth, the firm believes this will translate into 6% to 9% annual growth in cash flow per unit over the long-term. Management expects to grow Brookfield Infrastructure’s distribution at a similar pace, 5% to 9% per year.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

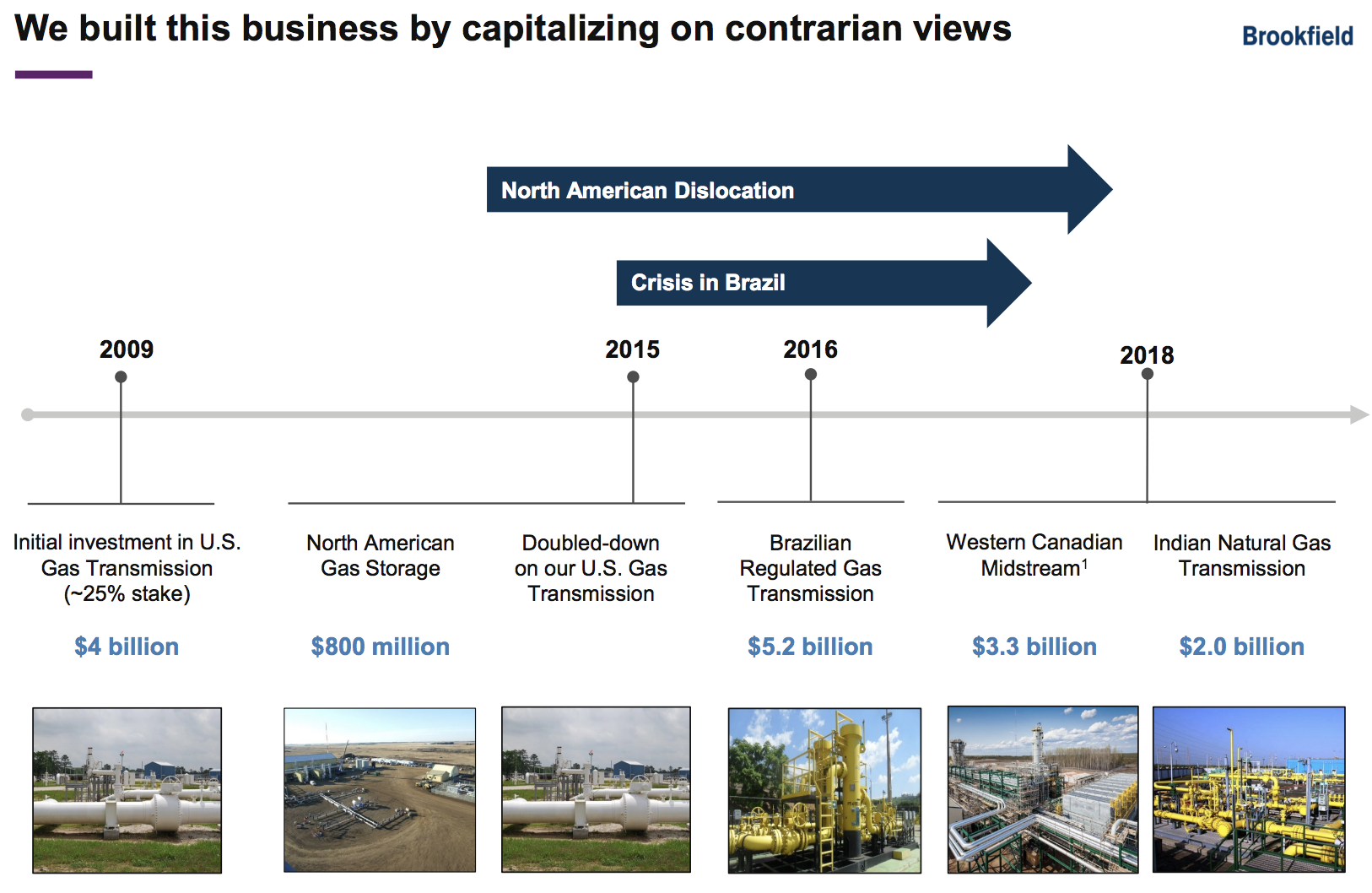

Brookfield Infrastructure’s organic growth potential is also augmented by management’s strong track record of executing larger asset acquisitions. Over the last five years the firm has plowed more than $7 billion into M&A and large-scale expansions, helping drive double-digit cash flow per unit growth over time.

The partnership’s primary goal is to opportunistically buy mispriced assets. For example, the North American midstream industry has been in a multiyear bear market, which is one reason why Brookfield Infrastructure has targeted that space.

In 2015 Brookfield had invested just $500 million into midstream assets which generated 5% of its operating cash flow. By the end of 2018, its midstream investments had increased to $3.2 billion and represented 20% of cash flow.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

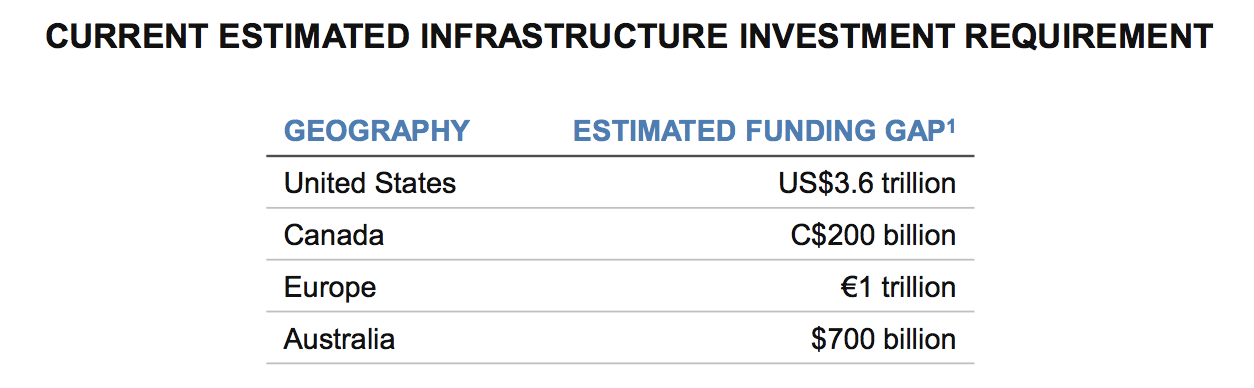

While management is optimistic about the need for new midstream infrastructure around the world, the scale of Brookfield Infrastructure’s total potential addressable market is staggering.

By 2025 infrastructure investments required in the U.S., Canada, European Union, and Australia will total $5.4 trillion, according to data from Standard & Poor’s and PricewaterhouseCoopers. This creates a large investment opportunity for the firm to supply a portion of the capital necessary to upgrade developed economy infrastructure.

Source: Brookfield Infrastructure Investor Presentation

Source: Brookfield Infrastructure Investor Presentation

The story is similar in emerging markets. Management estimates that between 2018 and 2030 about $36 trillion in worldwide infrastructure investments will be needed to keep up with a rising global population and fast-growing economies like China and India.

For context, Brookfield Infrastructure’s total invested capital since its IPO has been $8.2 billion, highlighting just how large and long its potential growth runway could be.

Simply put, global infrastructure is one of the largest secular themes income investors can take part in, and Brookfield Infrastructure has exposure to many parts of the market around the world.

Overall, Brookfield Infrastructure is a highly diversified, well-managed, and fast-growing utility with a generous payout. The firm’s global scope means it’s likely capable of generating mid-single-digit income growth and healthy total returns for years to come.

However, as promising as Brookfield Infrastructure may be, there are still some risks to keep in mind before investing.

Key Risks

There are two things to consider with Brookfield Infrastructure’s distribution that might turn off some income investors.

First, due to the way the LP is structured, it does issue a K1 form because most of the payout is considered a return of capital by the IRS. This means that you don’t get taxed on this portion of the distribution, but rather it deducts from your cost basis and you pay capital gains on it later when you sell your units.

Some investors prefer to not deal with the added tax complexity of K1 forms, though they generally only take a few minutes to account for using Turbotax.

However, as alluded to earlier, Brookfield’s double LP structure (designed to avoid UBTI and make it safe for retirement accounts) also comes with a drawback.

Specifically, investors are responsible for their share of its taxable income, which is taxed at marginal income tax rates. This means that unlike regular MLPs, where almost all of the distribution is tax-deferred, only some of Brookfield’s is (thus your cost basis reduction will be less than the full distribution payments).

As to the risks specific to the partnership, there are several to keep in mind. For one thing, Brookfield Infrastructure’s international scope means that there is foreign currency risk. The LP does use two-year hedging to mitigate this, but 30% of cash flow is effectively unhedged Brazilian Reals with 70% being in U.S. dollars.

If the U.S. dollar appreciates significantly against the Real, then the firm’s reported cash flow growth in these countries would decline. Should management need to access that cash, which seems unlikely given the partnership’s healthy liquidity, it would be converted into fewer U.S. dollars.

Next, some of Brookfield Infrastructure’s investments in various emerging markets could be at risk of nationalization. After all, South America has a history of political upheaval and populist governments seizing foreign-owned assets. Meanwhile, countries like India are notorious for their complex regulations that make doing business much harder.

The risks are highest during times of economic distress when local politicians can often make foreign-owned infrastructure a scapegoat for high costs of essential utility and transportation services. The good news is that few companies have better experience than Brookfield Infrastructure in operating in potentially treacherous and volatile political environments.

Investors also need to realize that Brookfield Infrastructure’s impressive past growth, including double-digit payout increases since its IPO, may not be repeated. The firm’s impressive historical results were driven by the LP’s faster growth off a much smaller asset base and supported by aggressive equity issuances that management says it wants to minimize in the future.

Now that Brookfield is resorting to more frequent asset sales to fund its growth, its overall cash flow per unit growth rate could slow and become lumpier, depending on the timing of when asset sales and acquisitions close.

One final short-term risk to consider is that Brookfield Infrastructure’s increased use of asset sales as a form of financing will expose its growth plans to more global macroeconomic risks. While the cash flow supporting Brookfield Infrastructure’s distribution remains quite secure and relatively recession-resistant, the price it can obtain for asset sales will be a function of global financial markets.

During any future economic downturn credit market distress is likely to result in all asset values declining, which might result in Brookfield Infrastructure being unable to fully execute on its growth plans. Similarly, credit market conditions are likely to tighten which could limit how much debt it can obtain at long-term and reasonable rates.

Basically, while Brookfield Infrastructure’s plan to move to a semi-self-funding business model will reduce risk compared to its past, the firm’s underlying business model will always be relatively exposed to global macroeconomic and credit market conditions. Therefore, it’s important that the firm maintains a strong balance sheet.

The good news is that Brookfield Infrastructure went public in 2008, so management has lived through a severe recession and financial crisis. In a milder future recession, the partnership’s distribution seems likely to remain safe, though the growth rate might dip to the lower end of management’s long-term guidance.

Closing Thoughts on Brookfield Infrastructure Partners

For a utility, Brookfield Infrastructure Partners appears to offer some of the best cash flow diversification and long-term growth potential.

The partnership’s experienced management team, access to low-cost capital, and deal flow provided by Brookfield Asset Management mean that this utility is likely to continue offering a generous payout with solid growth prospects in the years ahead.

Given the world’s need to improve and expand its infrastructure across markets ranging from pipelines to data centers, it’s not hard to believe that Brookfield Infrastructure can be a larger and more profitable business a decade from now.

As long as you’re comfortable with the LP corporate structure and the inherent tax complexity that comes with it, Brookfield Infrastructure could be a reasonable long-term high-yield income investment to consider, especially as it plans to rely less on fickle equity markets to fund its future growth.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends