Next week I will be giving two presentations to investors at the Las Vegas MoneyShow as well as hosting a meet-up with my Dividend Hunter readers.

The MoneyShow folks have now been asking to come back for five years. Each year it is a great time, and I love to get in front of the investing public.

As the spring show is held in Las Vegas, I thought it would be appropriate to cover some gaming related income stocks.

When it comes to the choice between being a tenant or a landlord, I like being on the landlord side, collecting a rent check every month.

At the end of the day (quarter and year) that is what being an investor in real estate investment trusts (REITs) means.

Becoming a commercial property landlord through REIT ownership lets you become a first dollar investor in a wide range business types and industries.

The companies that lease from a REIT have a first dollar commitment to pay those rent checks. Yet often, a REIT will be able to participate in any positive business results produced by the tenant companies.

Gaming companies are a tough group of stocks to own. Profits swing wildly based on economic conditions and the tremendous competition in the areas that allow casino type gaming. Also, most of the gaming companies carry a large amount of debt. It costs a lot of money to build casinos!

It was the debt loads that pushed several publicly traded gaming companies to start to spin-off properties into REIT holding companies. The sponsored REITs gave the gaming companies a way to monetize assets and pay down debt. The gaming REITs are growth focused through the acquisition of additional properties to help support the growth of the sponsor gaming companies.

These three come to mind for your investment consideration.

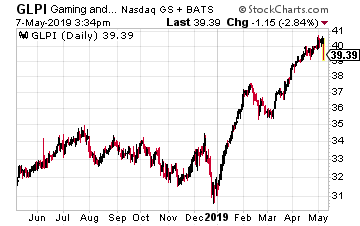

Gaming and Leisure Properties (GLPI) was the first gaming focused REIT when it was spun-out in 2013 by Penn National Gaming.

Gaming and Leisure Properties (GLPI) was the first gaming focused REIT when it was spun-out in 2013 by Penn National Gaming.

At that time the new REIT received 21 casino and racetrack properties. The company now owns 44 properties that are leased to and operated by Penn National Gaming, Casino Queen, Eldorado Resorts and Boyd Gaming.

In 2018 the company acquired five casinos from Tropicana Entertainment as the real estate part of the takeover of Tropicana by Eldorado Resorts. Of the three REITs here, GLPI is the most independent, with the ability to put together property and lease deals with a range of gaming companies. The REIT has an $8.7 billion market cap.

The dividend has grown by 5.6% per year over the past three years, and the GLPI shares yield 6.7%.

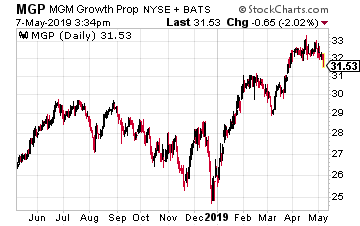

MGM Growth Properties LLC (MGP) was spun out in 2016 by MGM Resorts International. The initial REIT portfolio consisted of 10 MGM run properties, including seven on the Las Vegas strip. MGP now owns 14 properties all leased to MGM.

MGM Growth Properties LLC (MGP) was spun out in 2016 by MGM Resorts International. The initial REIT portfolio consisted of 10 MGM run properties, including seven on the Las Vegas strip. MGP now owns 14 properties all leased to MGM.

MGM Growth Properties has a triple-net master lease agreement with MGM Resorts which means all the REIT properties are on a single lease and the gaming company cannot single out one to close or not pay rent.

EBITDA from MGM coverage of the master lease payment is 6.2 times. The lease as a built in 1.8% rent escalator and MGP will also share profit growth at the casinos.

The MGP dividend has grown by 30% since the IPO and the shares yield 5.5%. MGP has a $9.2 billion market cap.

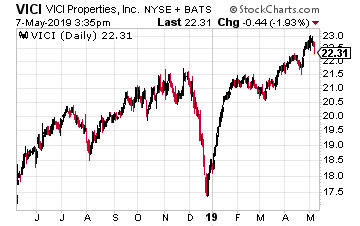

In October 2017 VICI Properties Inc. (VICI) was spun-off by Caesars Entertainment as part of the casino company’s bankruptcy reorganization.

In October 2017 VICI Properties Inc. (VICI) was spun-off by Caesars Entertainment as part of the casino company’s bankruptcy reorganization.

Initially VICI owned 19 Caesars managed properties and that number has grown to 23. VICI has a triple-net master lease arrangement. The REIT has call options or right of first offering on six additional Caesar properties with another seven targeted for likely acquisition. VICI has a lot of growth potential.

VICI’s current market cap is $9.4 billion. Only four full quarter dividends have been paid.

There has been one dividend increase of 9.5%. Current yield is 5.0%.

— Tim Plaehn

MAG-7 Stocks Are Dead—Here's What Killed Them [sponsor]The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley