Clorox (CLX) started in 1913 when five businessmen invested $100 each to start manufacturing and selling one product, Clorox bleach. Impressively, the company remained a one-product business for its first 56 years. Today, Clorox has over 8,500 employees, sells its products in more than 100 countries, and generates over $6 billion in annual sales.

The company boasts a brand portfolio spanning numerous product categories including home care, laundry, charcoal, food, water filtration, cat litter, and more. Some of the company’s famous brands are Clorox, Pine-Sol (household cleaner), Glad (plastic wrap, trash bags), Kingsford (charcoal for grilling), Hidden Valley (salad dressing), Brita (water filters), and Burt’s Bees (skin care).

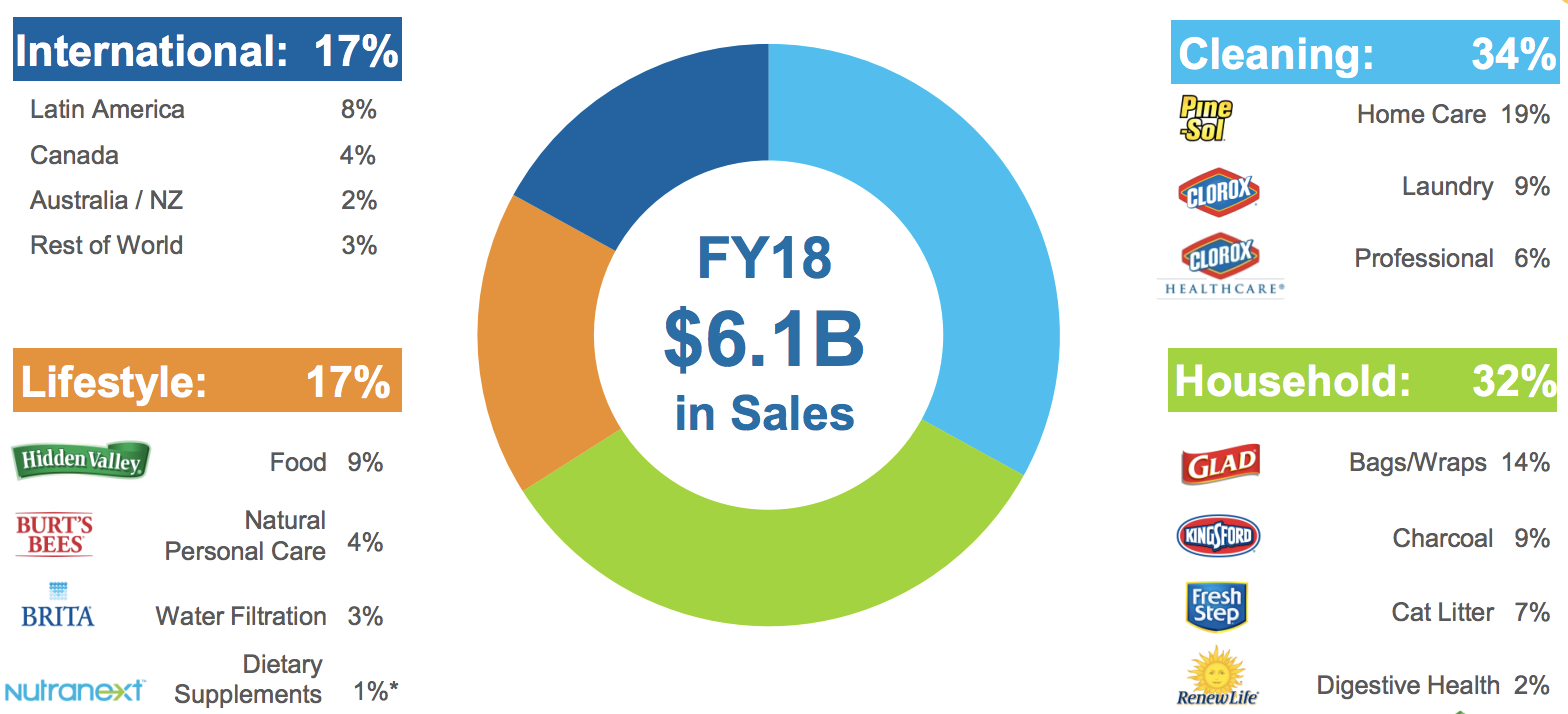

As seen below, Clorox generates 34% of its sales from cleaning products, 32% from household products, and 17% from lifestyle products. About 83% of sales are from the U.S., with international countries accounting for the remaining 17%. About half of the firm’s foreign sales are in fast-growing emerging markets in Latin America.

As seen below, Clorox generates 34% of its sales from cleaning products, 32% from household products, and 17% from lifestyle products. About 83% of sales are from the U.S., with international countries accounting for the remaining 17%. About half of the firm’s foreign sales are in fast-growing emerging markets in Latin America.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

Clorox has raised its dividend for 41 consecutive years, meaning it’s a dividend aristocrat and set to likely become a dividend king in 2027.

Business Analysis

As a large consumer products company, Clorox’s primary competitive advantages are its strong portfolio of brands, shelf space with retailers, marketing expertise, and product innovation.

With the Clorox brand dating back more than 100 years, Clorox has benefited from being one of the first brands in consumers’ minds for most of its key product categories. In fact, management estimates that Clorox branded cleaners are found in 90% of U.S. households. When you walk down the aisle of your favorite retailer and see Clorox’s main household brands, you know they will deliver quality and get the job done.

Overall, Clorox has more than 20% market share in its addressable markets and is around three times the size of its next largest branded competitor. The company focuses on attaining large market shares in mid-sized product categories, which also helps it avoid going head-to-head as much with giants such as Procter & Gamble (PG).

For example, Clorox dominates in areas that historically larger consumer staples giants don’t want to compete including:

- Bleach (60% U.S. market share)

- Charcoal (73% U.S. market share)

- Disinfecting Wipes (53% U.S. market share)

- Toilet Bowl Cleaners (42% U.S. market share)

This niche focus has helped Clorox become an industry leader around the world with No. 1 or No. 2 market share products accounting for 80% of its sales.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

The non-food consumer products space also tends to be very sticky and generally less subject to change. According to IRI Market Advantage, 85% of American household needs are consistently filled with the same 150 items, and 60% to 80% of new product launches fail.

In other words, Clorox maintains a durable and sticky market position, and new entrants tend to struggle to win over consumers who are happy with incumbents’ offerings.

However, to ensure it stays relevant, the company is constantly conducting consumer research to help it launch innovative products and sharpen its marketing campaigns.

Clorox routinely invests around 12% of sales back into advertising and new product development, or about $700 million annually.

Smaller competitors and new entrants don’t have the financial firepower to build up their brand recognition with consumers and retailers, and Clorox’s spending has been very effective.

While many large consumer staples companies have struggled to grow in recent years, Clorox’s product innovation has continued driving 2% to 3% incremental sales growth over the past decade.

In 2018 management estimates that new products drove 3% incremental sales growth, achieving the firm’s long-term goal and representing 100% of the company’s total growth. In 2018 Forbes ranked Clorox the 77th most innovative company in the world, which is rather impressive for such a mature, large and well-established company.

Simply put, management isn’t resting on its laurels but has been doing an excellent job delivering innovative in-demand products that consumers value.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

Clorox’s extensive distribution networks around the world are another major strength. Clorox can expand the types of products under its brands or acquire new products and sell them throughout the world very efficiently. In contrast, upstart rivals typically can’t afford the slotting fees that retailers charge to try out or maintain new products.

For example, in 2017 the company launched an all-natural makeup line under its Burt’s Bees brand, expanding into a major new product category (cosmetics) with appealing long-term growth potential. Since consumers are already very familiar with the Burt’s Bees brand, Clorox can more easily grow its business in new areas.

Management is also known for making bolt-on acquisitions. While most of its deals are smaller in size, some of Clorox’s notable deals include Burt’s Bees (acquired in 2007 for $925 million), a manufacturer of natural personal care products; Renew Life (acquired in 2016 for $290 million), the No. 1 brand of probiotics in the natural channel; and Nutranext (acquired in 2018 for $700 million), a fast-growing dietary supplement company.

These deals all gave the company new platforms in fast-growing, higher-margin consumer-product categories. Clorox can continue taking share in these areas by leveraging its extensive distribution networks, large advertising budget, and significant R&D spending.

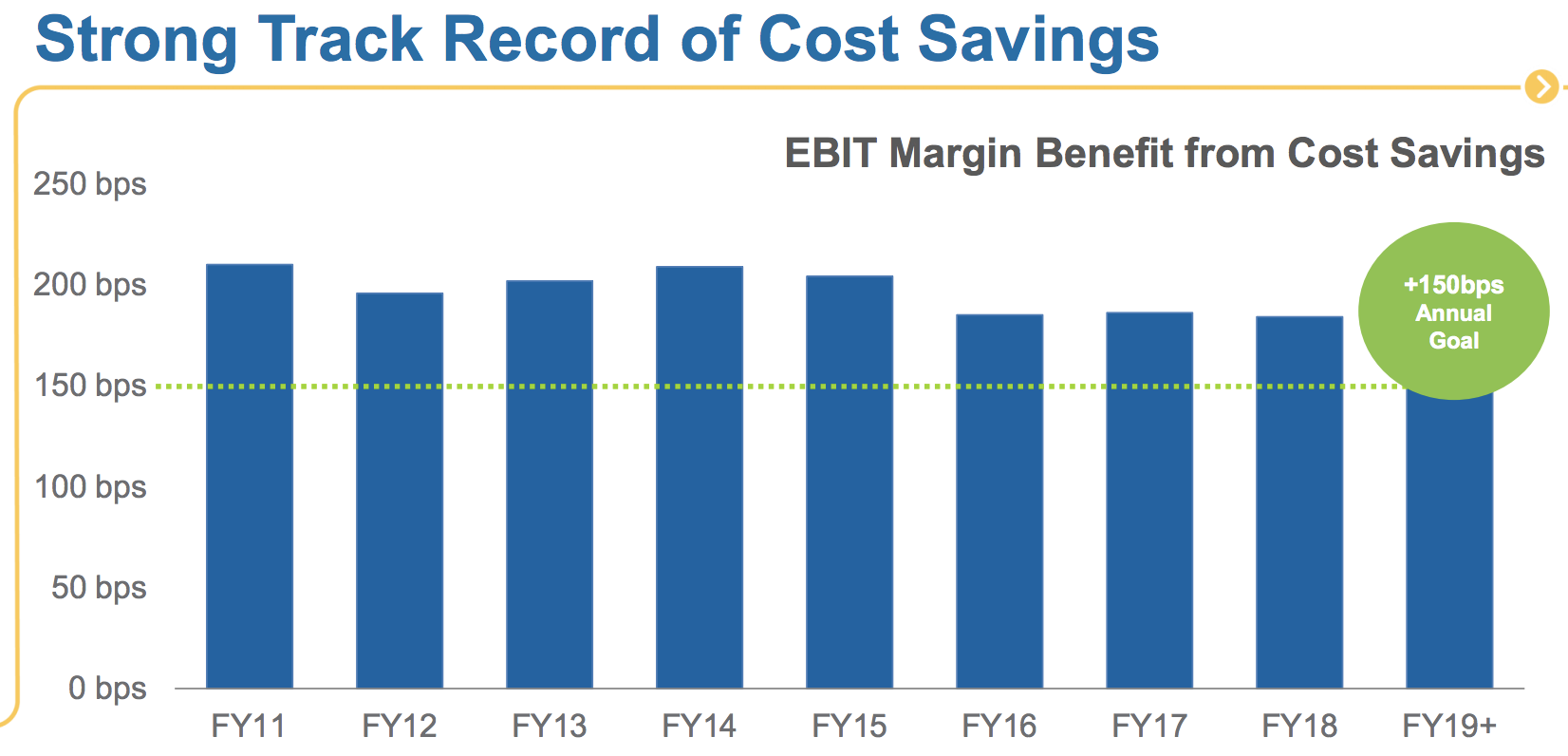

Finally, Clorox’s vertical integration and efficiency initiatives help keep its product costs very competitive. The company’s cost-savings program has delivered about $100 million or more in annual savings since 2003, contributing at least 150 basis points of annual operating margin benefit for more than a decade.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

Management continues to see opportunities for further margin improvement as well. One lever the company frequently pulls is leveraging its brands pricing power. Not only does this help grow profits, but the ability to raise prices also helps mitigate input cost inflation.

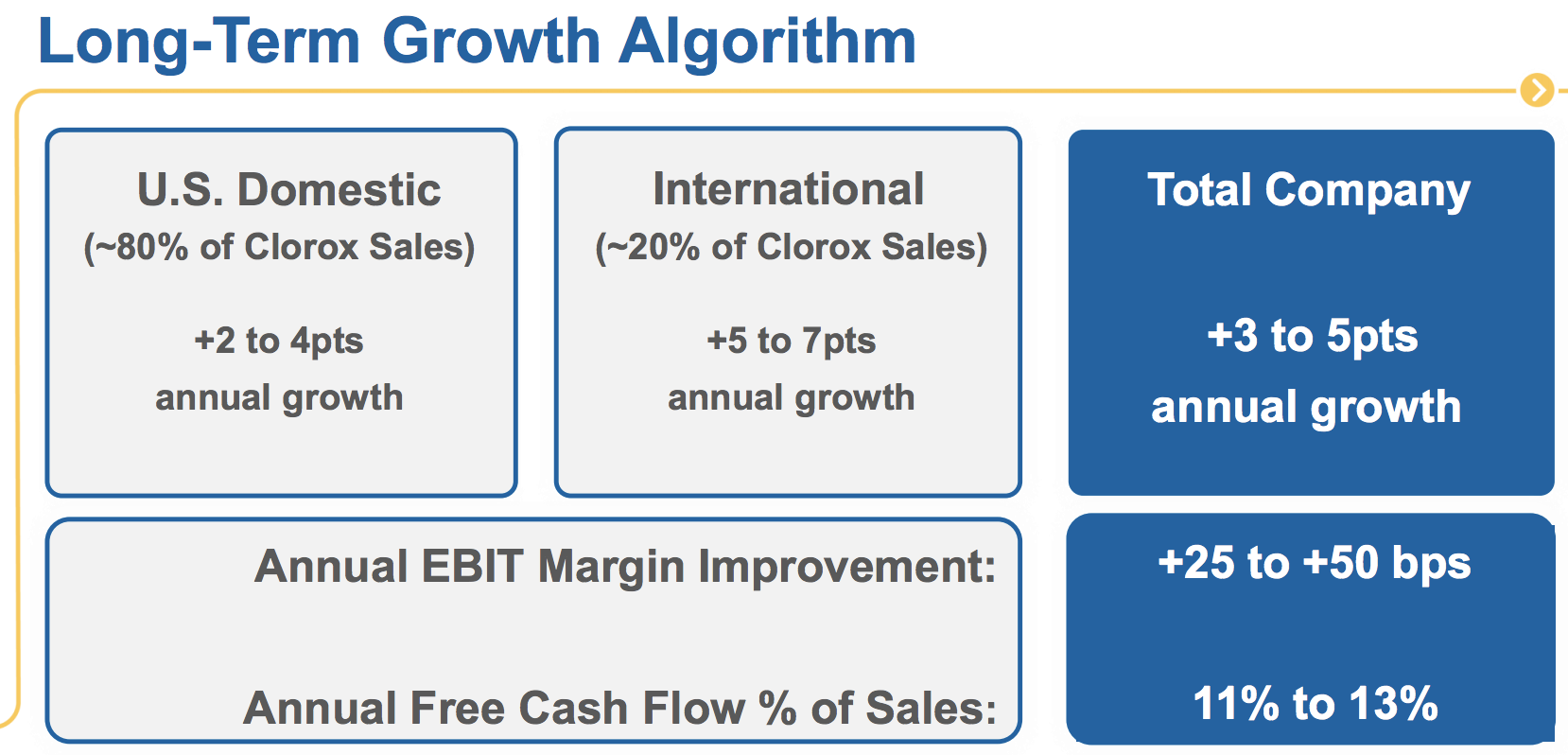

Overall, the company expects to grow its sales by 3% to 5% per year and improve EBIT margins by 25 to 50 basis points per year, resulting in a very healthy free cash flow margin of at least 11%.

Emerging markets are an important part of the company’s growth goal, so it’s worth noting that Clorox’s business is strong in these regions as well with over 80% of its brands ranked No. 1 or No. 2 in their respective markets.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

With strong brands, extensive distribution channels, relevant marketing campaigns, leading market share positions, and large and fragmented markets, Clorox appears to have plenty of opportunities ahead of it.

If management can deliver on its growth targets, then the company’s 3% to 5% sales growth could translate into at least mid-single-digit EPS and dividend growth over the long term, making Clorox an appealing choice for conservative dividend growth investors.

That being said, like any company, Clorox faces several risks that could make it challenging for management to achieve the firm’s long-term growth objectives.

Key Risks

Perhaps one of the biggest uncertainties surrounding Clorox’s business is whether or not the company can continue growing while maintaining such a high level of profitability.

Clorox’s operating margin hit an all-time high in 2017 and remains around 18% today. The company’s profitability has benefited from solid market share gains, excellent pricing power, continuous cost-savings initiatives, and occasional tailwinds from lower raw material costs.

However, recently input costs have been rising, which likely means that Clorox’s margins are likely to come under some pressure. Cost cutting is expected to help manage and improve margins over time but can’t offset short-term commodity headwinds.

Normally Clorox responds to rising input costs with price hikes but that might be harder to do in the future. For example, Walmart (WMT) accounts for about 25% of the firm’s sales, and Clorox’s top five retail clients make up almost 50% of revenue.

Walmart, Target (TGT), and Costco (COST) are in a battle with Amazon (AMZN) for online sales. While all three are now doing well, thus far their digital sales growth has come at the expense of margins. With so much of its sales concentrated at a handful of retail giants, Clorox could see more pushback on its higher prices than it has in the past.

Meanwhile, achieving the firm’s 3% to 5% top lines sales growth goals might be difficult given that Clorox is already so dominant in so many lucrative mid-sized product markets.

The company’s attempts to diversify into new growth markets has wisely avoided large consumer staples products dominated by Procter & Gamble, instead focusing in healthcare and lifestyle brands where margins are higher.

However, Clorox’s attempts to grow that side of the business have been mostly through M&A. While those bolt-on acquisitions have paid off so far, fast-growing healthcare brands come with a risk of overpaying.

Thus far Clorox has remained disciplined with M&A, forgoing expensive and debt-funded mega-deals. However, the risk is that if the company fails to achieve its modest long-term growth goals, then it might feel pressure to make larger and riskier acquisitions in the future.

Private label is always a threat as well. Consumers are getting smarter about how they shop and what products they can trust. Information is more available than ever before thanks to the internet. Clorox has noted that private label products have historically accounted for about 20% to 30% of the market. If more consumers trade down, demand for Clorox’s higher-priced branded goods could slow.

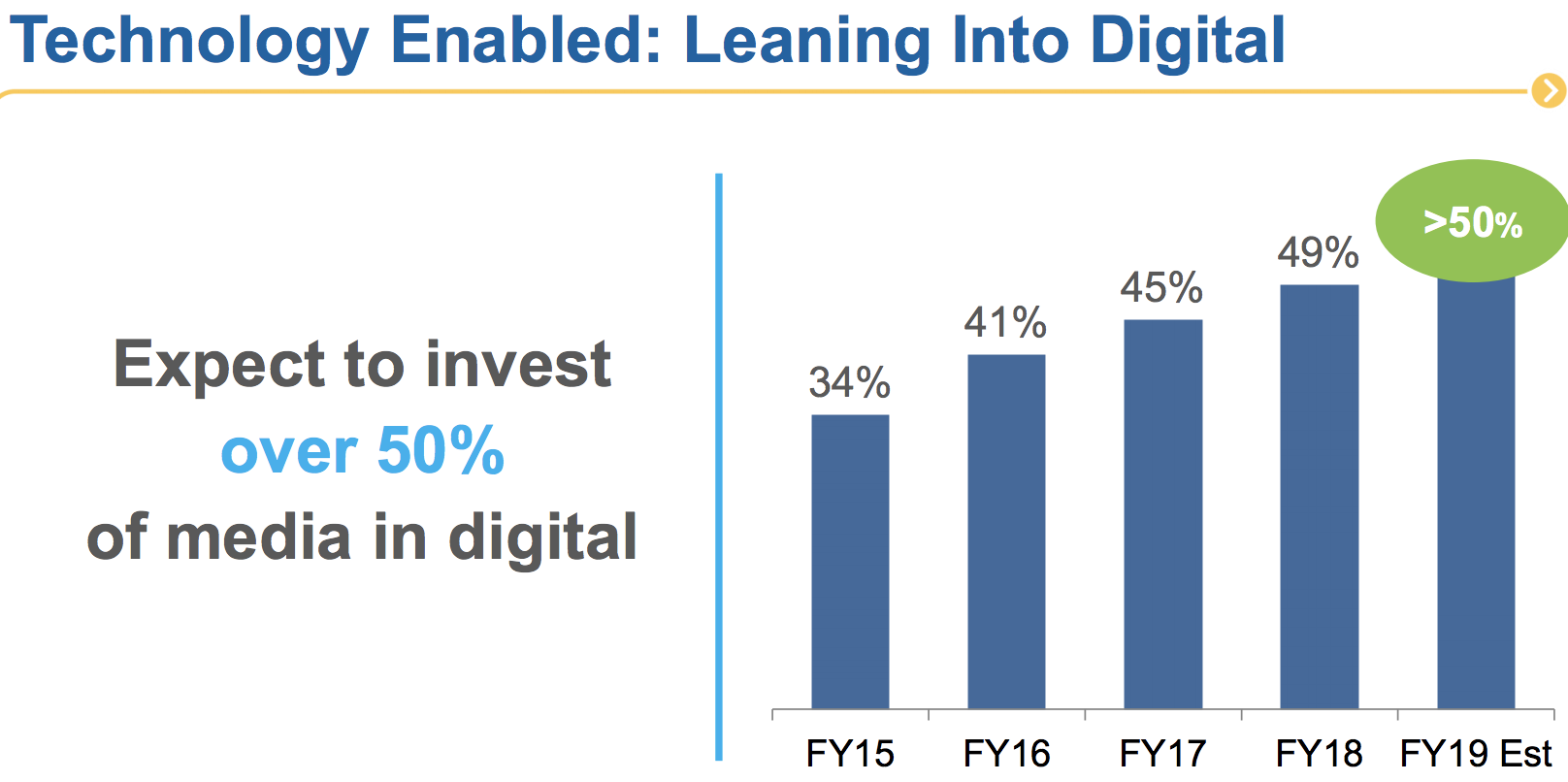

To help minimize this risk of shifting consumer preferences, Clorox has aggressively spent a growing share of its advertising on digital media to target younger consumers such as Millennials and Generation Z.

In 2019 Clorox will spend over half of its ad budget on digital marketing, as it continues its drive to increase its branding power with today’s consumers.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

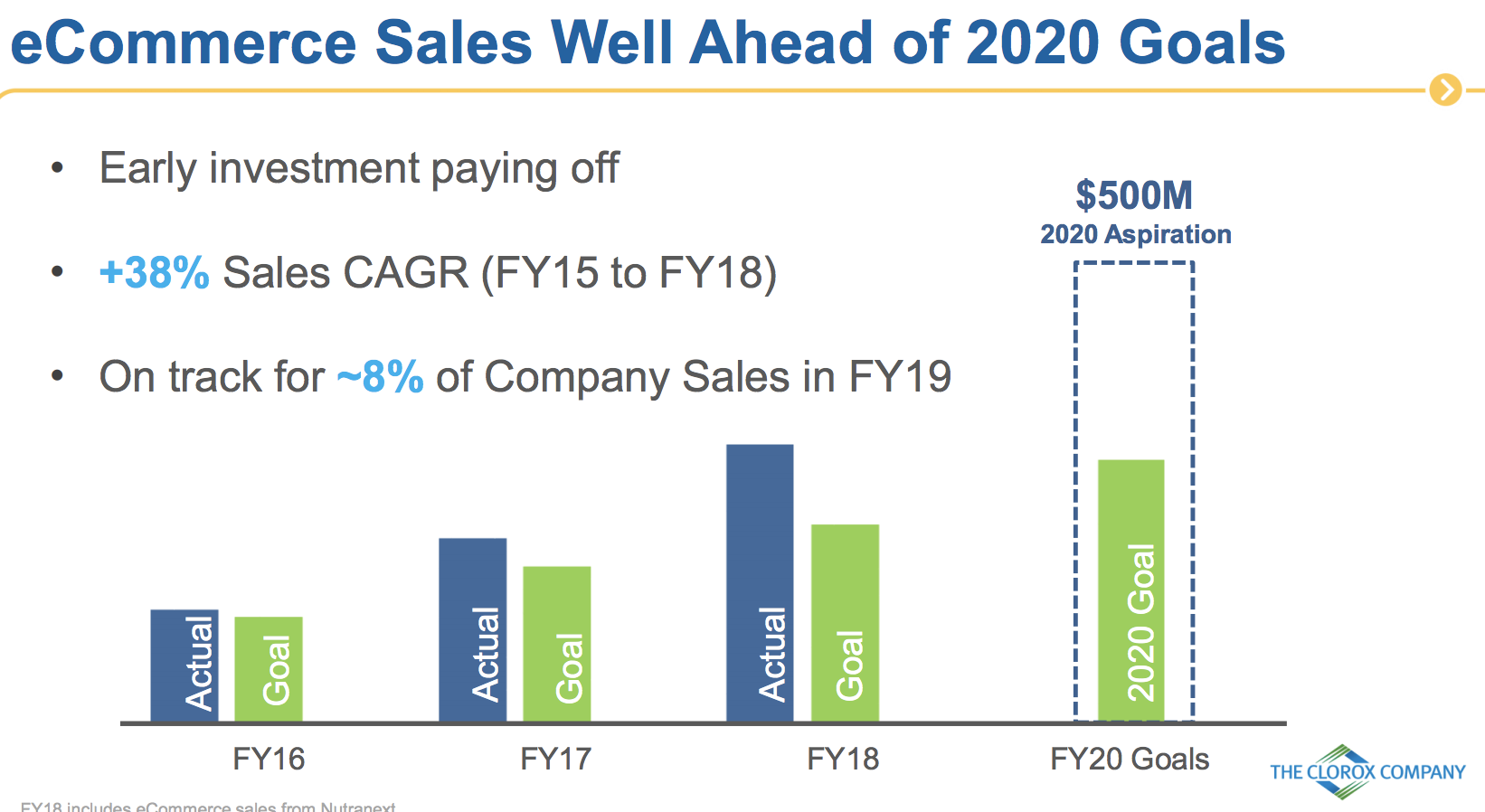

Clorox’s digital marketing appears to be working with e-commerce sales up 45% in 2018, hitting 6% of sales. That’s actually an acceleration from the 38% annual digital sales growth Clorox recorded between 2015 and 2018.

Management expects strong online sales growth to continue with about 8% of 2019 revenue coming from e-commerce, ahead of its goal of generating $500 million (or 8%) of revenue from digital sources by 2020.

Source: Clorox Investor Presentation

Source: Clorox Investor Presentation

Success in digital is important because e-commerce has historically been the way that upstart brands win market share from entrenched incumbents like Clorox.

Fortunately, it’s worth noting that the consumer-packaged-goods industry is also a fairly mature market. With low growth rates, large incumbents can quickly find themselves treading water – some brands are growing, others are shrinking. This is what P&G has struggled with for years until more recently.

While Clorox is much smaller than P&G ($6 billion in sales versus $67 billion), it’s possible that some of its larger product categories eventually find themselves in similar situations, especially considering the company’s concentration in the slower-growing U.S. market (83% of revenue).

For now, Clorox is holding its ground fairly well. The company continues putting up low-single digit sales growth across its portfolio and has done a nice job expanding into adjacent product categories and geographies while delivering effective marketing campaigns.

However, investors need to realize that this business is unlikely to grow its earnings and dividend at much more than a mid-single-digit pace over the long term.

Closing Thoughts on Clorox

Few companies have been as reliable as Clorox. The business generates excellent free cash flow, sells recession-resistant products and has reliably increased its dividend every year since 1977.

Thanks to management’s continuous investments in advertising, R&D, and strategic bolt-on acquisitions, Clorox’s brands have withstood the test of time and seem likely to remain core household purchases for many years to come.

While private label products, relations with large customers such as Walmart, shifting consumer preferences, and mature product categories will always remain threats, there isn’t much to dislike about Clorox’s fundamentals. The company represents one of the best-managed and most profitable blue-chip names in the defensive consumer products industry.

— Brian Bollinger

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Simply Safe Dividends