Investors are understandably nervous and justifiably skittish.

Earnings season starts Friday when two of the biggest “big banks” – JPMorgan Chase & Co. (NYSE:JPM) and Wells Fargo & Co. (NYSE:WFC) – kick things off with a look at their most recent results.

For the first time since Q2/2016, the narrative will shift from hypothetical, hard-to-quantify data – related to trade talks, U.S. economic data, and the E.U. – to real numbers.

Short-term volatility could be a real doozy, and unsuspecting investors may find themselves losing money hand over fist if conditions deteriorate as earnings season continues.

I don’t want that to happen to you, obviously.

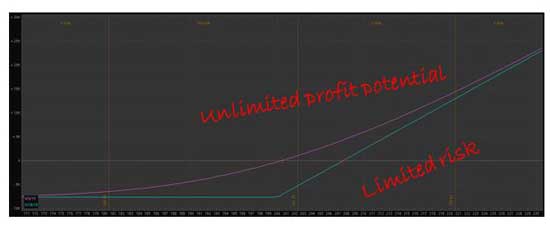

So let’s talk about a quick, easy move you can make ahead of Friday’s numbers that can limit or almost completely eliminate risk while still preserving the unlimited profit potential you deserve.

Here’s what you need to know.

Buying in to Build Your Fortune

Almost every investor who’s put money into the markets since last October has tried to anticipate short-term volatility… only to get separated from their money. In some cases, that’s a little. In others, a lot.

Frankly, how much money was lost doesn’t matter – they tried to pick a top or a bottom in stocks they loved, or indices they wanted to buy, only to watch ’em drop further, and their account statements turn from green to a sea of red. Or they bought into “expensive” stocks like The Boeing Co. (NYSE:BA), Apple Inc. (NasdaqGS:AAPL), or even Amazon.com Inc. (NasdaqGS:AMZN) and live in constant fear of a reversal that could turn their hard earned retirement dreams into the stuff of nightmares.

But, you’ve got to do it if you want to build your fortune… buy in, that is.

Market history shows very clearly, and beyond any shadow of a doubt, that the biggest profits go to those who wade in at the “worst” possible moment.

… Warren Buffett regularly buys into markets others fear, and specializes in companies where the prevailing wisdom is often wrong. And, he’s worth roughly $84.7 billion.

… The legendary Jim Rogers is noted for taking the opposite side of “the trade.” He and co-partner George Soros famously ran the Quantum Fund up a staggering 4,200% over the course of ten years versus only 47% from the S&P 500 by doing just that.

…The late Sir John Templeton famously bought $100 worth of each stock trading below $1 in the New York and American stock exchanges on the eve of WWII, selling them for nearly four times as much after four years. Every $10,000 invested with his Templeton Growth Fund (MUTF:TEPLX) since inception in 1952 would be worth $12,403,812.74 today.

But, how?

That’s the part most investors struggle with.

Limit Your Risk By “Getting Married”

They want to make the big money they know is possible, but they cannot afford the losses that come from making blind bets if the markets run against ’em.

I know you know what I’m talking about.

We’ve all been there at one point or another during the course of our investing lives… and that’s nothing to be ashamed about. You’re not alone.

Chances are you’ve bought a stock that you thought would continue higher, only to watch in horror as it immediately goes against you. Or, you’ve had a stop-loss in place, only to see a stock you own plow through that without your exit triggering at the price you want. (Many investors, for example, don’t realize that trailing stops limiting a certain price turn into market orders when they’re triggered.)

Today I want to help you put that fear aside with a simple, proven, and very easy to use Total Wealth Tactic called the “Married Put.”

Married puts are one of my favorite strategies because they offer an easy way to buy stocks without the fear of a decline that would otherwise hit home, especially when it comes to “expensive” shares.

Take Apple Inc. (NasdaqGS:AAPL), for example.

Morgan Stanley just followed my lead and announced that Apple’s move into healthcare could be triple the company’s smartphone market. The firm put a price tag on the possibility that’s $15 billion to as much as $313 billion on the upper end by 2027.

We’ve been talking about this for several years now, when Apple’s price was less than half of what it is today, giving readers in our paid sister services the opportunity to capture gains in excess of 100%.

Even so, there’s still plenty upside.

Shares are trading at $199.81, as I type Monday afternoon – up 1.43% on the day – which means that 100 shares will set you back $19,981 (excluding commissions). Every penny of which is at risk from the moment you open the trade.

To mitigate that, consider buying the AAPL May 17, 2019 $200 Put (AAPL190417P00200000) at the same time using the “Married Put.” It’s trading at $7.20 as I type.

If you’re not familiar with options, “puts” are essentially a bet that the underlying company – in this case Apple – is going to go down. You can buy put options for any number of reasons, but in this case we’re going to use them as “insurance.”

Options contracts are traded in something called “lots,” each of which represents the right, but not the obligation, to buy or sell 100 shares of their underlying asset at a specific price by a specific date.

Again, that’s Apple, for purposes of our discussion and, since the next earnings announcement is on April 30, I’m suggesting the May 24 options… so that you effectively have a “safety margin” that carries you beyond the announcement.

Here’s the part that I really like.

“Marrying” a put to the 100 shares of Apple you’ve purchased now limits your risk to $880.

$880… that’s the most you can lose if Apple disappoints in any way and shares get pummeled… and a 96.6% reduction in risk (from the entire $19,981 that would otherwise be in play if you don’t combine it with the put).

Three Ways to Profit Off of Apple

Here’s the cool part, though.

If Apple reports great numbers and goes your way – meaning as the pivot into medical services, devices and subscriptions accelerates – then you’ve got a few alternatives that other investors who have simply purchased shares don’t have:

- You can sell your Apple shares and collect profits while also selling the put at a small loss to recoup part of the money you paid when you established this trade. Or;

- You can sell a few of your Apple shares to recover the cost of the put and ride the rally higher while leaving the put to run as additional protection just in case traders have other ideas.

- You can repeat this process any time you like down the line.

Either way, the bottom line is that you now own a great company with HUGE profit potential even though shares are believed by many investors to be “expensive” right now.

And the best part – at least in my book anyway – is that you can sleep at night knowing you’ve cut risk to the bone yet still have all the profit potential you can handle.

That’s “worth” a lot in today’s turbulent markets.

Until next time,

Keith

Source: Total Wealth Research