JPMorgan Chase (JPM) is one of the world’s oldest banking institutions, tracing its roots back to 1799. Today it’s the largest bank in the nation, with over 5,100 branches, 16,000 ATMs, and $2.6 trillion in assets. JPMorgan operates in over 100 markets, although about 80% of its revenues are generated in the U.S.

The bank has four major business segments:

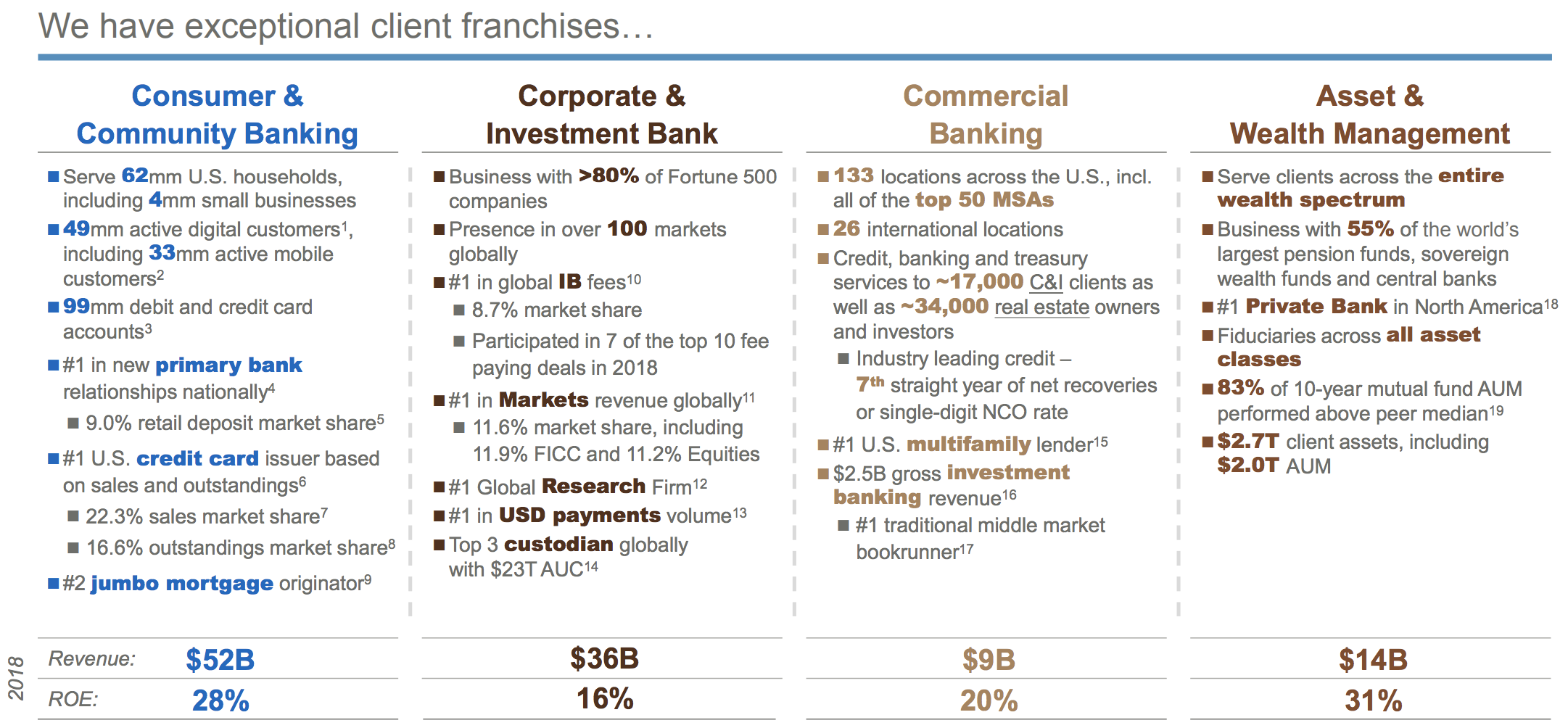

- Consumer & Community Banking (47% of 2018 revenue): traditional consumer and small business banking services including checking and savings accounts, small business loans, home mortgages, credit cards, auto loans, home equity loans, and personal loans.

- Corporate & Investment Banking (32% of revenue): helps companies raise debt and equity capital, advises on corporate strategies (turnarounds, mergers & acquisitions), provides treasury services to the U.S. government (selling Treasury bonds), investment research, and prime brokerage services (clearinghouse of stock and bond markets). This segment also services as a fund custodian for asset managers, insurance companies, and public and private investment funds.

- Asset & Wealth Management (13% of revenue): provides wealth management services across various asset classes including equities, fixed income, alternatives (hedge funds, private equity funds), and money market funds. This segment provides retirement services to large individual accounts, as well as trusts and estates.

- Commercial Banking (8% of revenue): provides lending, investment banking, and asset management services to corporations, municipalities, financial institutions, and nonprofit entities. It also finances commercial real estate development.

While JPMorgan was forced by regulators to accept a bailout (which it didn’t actually need) and cut its dividend during the Financial Crisis, the bank’s dividend track record during normal recessions is far better with the bank maintaining its dividend during the 2001 downturn. However, the bank did cut its dividend during the 1990 recession which was also linked to crashing real estate prices (mostly on the West Coast).

Business Analysis

During the financial crisis large banks, long believed to be low-risk stocks, proved to be anything but.

However, JPMorgan Chase, thanks to its more conservative banking culture, largely avoided the subprime mortgage meltdown and managed to remain profitable.

That’s something that only one other major U.S. bank was able to do (Wells Fargo).

Today banking regulations have become far more stringent, thanks to the passage of the Dodd-Frank law and Basel III international banking accords.

These regulations eliminated proprietary trading and significantly raised capital requirements on banks, effectively limiting how much leverage they could use to generate profits from their various businesses.

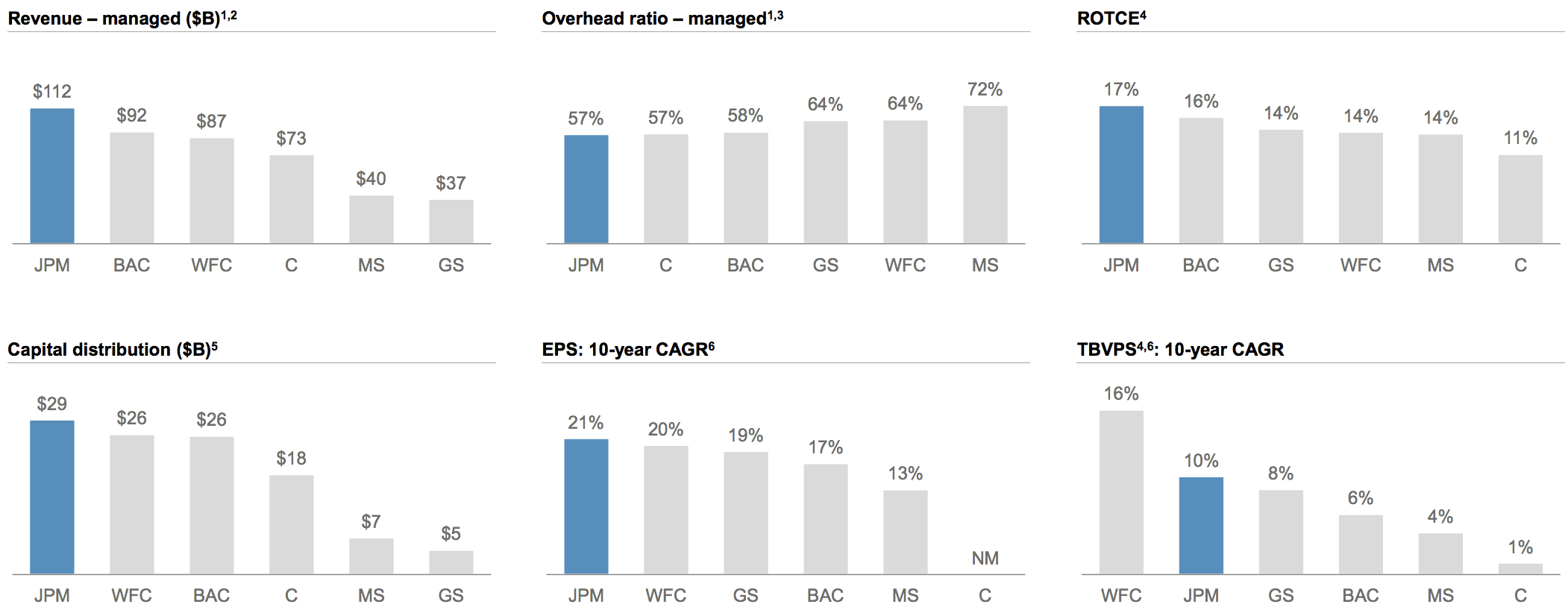

Despite these constraints, JPMorgan Chase has managed to return to not just record profitability but also deliver some of the fastest earnings and book value per share growth of any large bank. Meanwhile, thanks to its scale and ongoing cost-cutting efforts, JPMorgan’s efficiency ratio (operating costs divided revenues) and return on equity lead the industry.

Source: JPMorgan Investor Presentation

Source: JPMorgan Investor Presentation

JPMorgan’s success over the past decade was made possible in large part by its great management team, led by legendary CEO Jamie Dimon. Mr. Dimon has been CEO for 15 years and has not just guided the bank through massive expansion (while largely avoiding the sub-prime mortgage disaster) but also built a financial empire with leading market share and scale in all of its business segments.

As you can see, the company is the dominant player in global investment banking, credit card issuances, and wealth management. And the company continues to gain market share in nearly all of its business segments.

Source: JPMorgan Investor Presentation

Source: JPMorgan Investor Presentation

By offering its customers, including consumers, small businesses, and large corporations, a one-stop shop for all of their financial needs, JPMorgan is better able to create higher switching costs and sell additional products to existing customers. This is why JPMorgan is able to generate far more non-interest fees than most other banks, further helping to diversify its income stream and long-term growth opportunities.

However, as the financial crisis showed, no matter how profitable a bank’s operations are in the short term, high profits and strong market share positions are meaningless if the bank’s balance sheet is a dangerous mix of potentially toxic assets that can bankrupt the institution during an economic downturn.

Fortunately, JPMorgan has proven to be one of the most conservative banks in the world. For example, the Federal Reserve sets a minimum common equity tier 1, or CET1, ratio for large Global Strategically Important Banks, or GSIBs (too big to fail).

CET1 is the ratio of a bank’s retained earnings and common equity over its risk-adjusted assets. This ratio is set to a level that the Fed estimates would keep the bank solvent even during a worse global economic downturn than what happened in 2008-2009.

JPMorgan minimum CET1 is currently set at 10.5%. However, the bank’s CET1 ratio finished 2018 at 12%, and management plans to maintain the company’s CET1 in a conservative range of 11% to 12%, demonstrating a dedication to what the firm calls its “fortress balance sheet.”

JPMorgan’s financial conservatism is also evident when reviewing results of the Federal Reserve’s annual stress test for major banks. This is done to simulate a historically “normal” recession as well as a very severe downturn (worse than the Great Recession) to estimate how loan losses will affect a bank’s capital ratios during an economic downturn.

The stress test’s goal is to make sure that, even at the bottom of a severe recession, a bank’s CET1 ratio does not fall below 4.5% and its supplementary leverage ratio remains above 3%. Those are levels regulators believe can keep a bank solvent and avoid another bailout.

Under even worse conditions than seen in 2007-2009, the 2018 stress test pegged JPMorgan’s estimated minimum CET1 ratio at 8.0% and its SLR at 5.1%. That’s well above the regulatory minimums and highlights how safe the bank’s lending practices are, at least according to the Federal Reserve. This makes the chances of another dividend cut relatively low, even during another financial crisis.

The bank’s strong balance sheet is why Standard & Poor’s gives JPMorgan an A- credit rating. JPMorgan says its medium-term goals include maintaining its current capital ratios as well as its current level of profitability, suggesting it should remain a financially strong business for the foreseeable future.

As a result, JPMorgan’s dividend, with its stable 30% payout ratio, is likely to remain safe during a recession, though it may be frozen as it was back in 2001. During normal economic times the dividend is likely to grow in line with earnings since management wants to maintain the current payout ratio.

Overall, among U.S. mega banks, JPMorgan is arguably one of the best in the market. Its strong competitive advantages across all its major business lines, combined with one of the safest balance sheets in the industry and its low cost structure, mean impressive earnings and dividend growth is likely to continue. Importantly, this growth comes with relatively less risk compared to JPMorgan’s peers during the next economic slowdown.

Key Risks

While JPMorgan Chase is arguably the highest quality big bank in America, there are still some risks that might make it unsuitable for certain investors.

For one thing, like all global banks, JPMorgan’s finances are incredibly complex, effectively making it a “black box” that might hide some nasty surprises which may not become evident for years.

Another thing to consider is that the very large size of the bank could also work against it in the future. For one thing, the Federal Reserve, which regulates all U.S. banks, isn’t likely to allow it to grow through acquisitions as it has in the past.

This is because JPMorgan is in the top tier of GSIBs, meaning that it has extra regulatory scrutiny compared to smaller rivals. As a result, it faces higher capital requirements which effectively put a cap on how high its profitability can get.

JPMorgan’s large size (and conservatism) also means it is more difficult for the firm to generate fast sales and earnings growth rates. Over time management believes the bank can grow its revenue by about 3% annually. Thanks to cost-cutting efforts and share buybacks, JPMorgan has potential to generate high single-digit earnings and dividend growth over time. While that’s still healthy growth, it’s a far cry from the 20+% pace investors have enjoyed in recent years.

Finally, investors should note that all global banks’ earnings are volatile and sensitive to the underlying health of the U.S. and global economies. Eventually a recession will cause JPMorgan’s earnings to fall significantly as new loan demand declines, defaults rise, and dealmaking slows. The bank’s most profitable segment (wealth & asset management) is also prone to wild swings in fortune based on the fickle nature of equity and bond markets around the world.

The good news is that while bank stocks will probably underperform in a recession, their long-term earnings power shouldn’t be affected, nor will their survival likely be threatened. That’s because banks are also much better capitalized than they have ever been as a result of new regulations. Here is what Buffett said about banks in a 2013 interview:

“The banks will not get this country in trouble, I guarantee it. The capital ratios are huge, the excesses on the asset side have been largely cleared out. Our banking system is in the best shape in recent memory.”

But while Buffett might be confident about the survival of American big banks, they are still volatile stocks. In December of 2018, for example, growing fears of a recession coming in 2019 caused bank stocks, even blue-chips like JPMorgan, to dive over 20% in a matter of weeks.

While dividend growth investors wanting exposure to banking are likely making a fundamentally sound choice with JPMorgan, it’s very important to keep in mind the cyclical and volatile nature of this bank’s earnings and stock price.

Closing Thoughts on JPMorgan Chase

JPMorgan is arguably the highest quality large bank in America. The company’s highly conservative banking culture means that despite its massive size and complexity, it was able to work through the financial crisis largely unscathed and remained profitable the entire time.

Management is also impressive. Jamie Dimon has created a corporate culture that balances fast growth in attractive global markets with a strong underwriting discipline and a focus on maintaining one of the safest balance sheets of any major bank in the world.

Combined with its massive economies of scale and large base of low-cost deposits, JPMorgan has been able to continue winning market share and cutting costs to become the most profitable big bank in America. In addition, the bank’s cash return policies have proven very friendly to shareholders, resulting in strong dividend growth.

That being said, banking is a highly complex and cyclical industry, one that isn’t for everyone. No major bank is likely to be able to offer the kind of generous dividend growth over time that many investors want. JPMorgan’s payout is likely to remain safe during a future recession and grow modestly over time. However, the pace of growth is going to be variable, especially during recessions when the bank might freeze the current dividend as it has in previous downturns.

Thus anyone interested in owning JPMorgan needs to be comfortable with its risk profile and size their position accordingly.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends