Founded in 1940, McDonald’s (MCD) is the world’s largest quick-serve restaurant chain, with about 37,000 locations in more than 100 countries. Approximately 93% of its locations are franchised, meaning the stores are owned and operated by independent business owners. The company’s goal is to eventually have 95% of its stores franchised.

Under a typical franchise arrangement, McDonald’s owns the land and building or secures a long-term lease for the restaurant location, and the franchisee pays for equipment, signs, seating, and décor.

The company believes that ownership of real estate, combined with the co-investment by franchisees, enables it to achieve restaurant performance levels that are among the highest in the industry.

Franchisees are responsible for reinvesting capital in their businesses over time, but McDonald’s frequently co-invests with them to help improve their restaurants and operating systems to maintain the company’s brand value.

A typical franchise term is 20 years and requires franchisees to meet rigorous standards, helping assure consistency and high quality at all McDonald’s restaurants.

Franchisees contribute to McDonald’s revenue through the payment of rent and royalties based upon a percent of sales (typically 4%), with specified minimum rent payments, along with initial fees paid upon the opening of a new restaurant or grant of a new franchise.

This structure enables McDonald’s to generate significant levels of cash flow while franchisees benefit from the company’s brand and marketing.

By geography, the business is very international; only 35% of McDonald’s operating income is derived in America. McDonald’s breaks down its stores by global geography:

- U.S. Market (37% of sales): same-store sales growing 2% to 3% a year

- International Lead Markets (36%): includes some of the largest, best resourced, and most established markets (most mature and developed countries); same-store sales growing 5% to 6% a year

- High Growth Markets (19%): relatively higher restaurant expansion and franchising potential, specifically eight key markets across Asia and Europe (China, Korea, Russia, Poland, Italy, Spain, the Netherlands and Switzerland); same-store sales growing 4% to 5% a year

- Foundational Markets (8%): largest and most diverse geographical segment spanning over 80 markets across parts of Asia, Europe, Middle East & Africa and Latin America; same-store sales growing 7% to 8% a year

With 44 consecutive years of dividend increases under its belt, McDonald’s is a dividend aristocrat and slated to become a dividend king in 2024.

Business Analysis

McDonald’s rise to success in the fast food industry was largely attributable to the company’s focus on convenience, consistency, and value, all tied together by its unique and successful franchising model.

Most notably, McDonald’s former president and chief executive Harry Sonneborn once said:

“We (McDonald’s) are not technically in the food business. We are in the real estate business. The only reason we sell fifteen-cent hamburgers is that they are the greatest producer of revenue, from which our tenants can pay us our rent.”

McDonald’s is one of the largest real estate owners in the world, having snapped up thousands of property locations along highways and within busy cities all around the world over the course of many decades. At the end of 2018 McDonald’s owned approximately 50% of the land and 80% of the buildings for restaurants in its markets.

The best part is McDonald’s locations are essentially financed by independent operators (the franchisees), who must pay an upfront fee to open a restaurant and send as much as 16% of their restaurant sales back to McDonald’s for rent under their long-term lease agreements, according to The Wall Street Journal.

Importantly, by taking a more supportive approach with its franchisees (co-investing, collecting a reasonable percentage of sales instead of forcing franchisees to buy overpriced supplies from the company, etc.), McDonald’s has done a great job maintaining consistency across its locations, whether they are owned by franchisees or the company itself.

When combined with some of the company’s unique productivity innovations, such as multiple drive-thru lanes and industrial-like assembly lines in the kitchen, McDonald’s was able to delight customers with fast service, consistently hot food, and predictable quality. The company’s simple, standardized menu and memorable marketing efforts further fueled its growth.

As McDonald’s gained significant scale and continued to maintain a rather basic menu, it could provide consumers with even more value in the form of cheap prices. McDonald’s is one of the largest purchasers of beef, chicken, and potatoes in the country, for example. As a result, it can exert meaningful pressure on its suppliers, resulting in lower food costs that can be passed on to its customers.

Despite McDonald’s focus on owning prime real estate locations, collecting lucrative rent payments from franchisees, and providing fast and consistent service, the restaurant fell on hard times in recent years. Specifically, the rise of fast-casual competitors, shifting consumer tastes for healthier food, and several managerial missteps at the company (declining service, more complicated menu, etc.) resulted in several years of flat or negative sales and earnings growth.

In 2015, new CEO Steve Easterbrook unveiled a bold three-part plan for revitalizing McDonald’s. The company refers to this as its “velocity growth plan”.

Part one was re-franchising 4,000 of its company-owned stores by the end of 2018, with an ultimate goal of 95% of its locations being franchisee-owned. At the end of 2018, franchised stores hit 93% of total store locations, up from 81% in 2015. This shift means that the company is selling its stores to independent businessmen and women and is, therefore, losing the vast majority of cash flow from these company-owned locations.

While this results in a temporary decline in revenue (down 8% in 2018), an increased mix of franchised locations, which are much less capital intensive than company-owned stores, will ultimately mean a far more profitable and free-cash-flow-rich company.

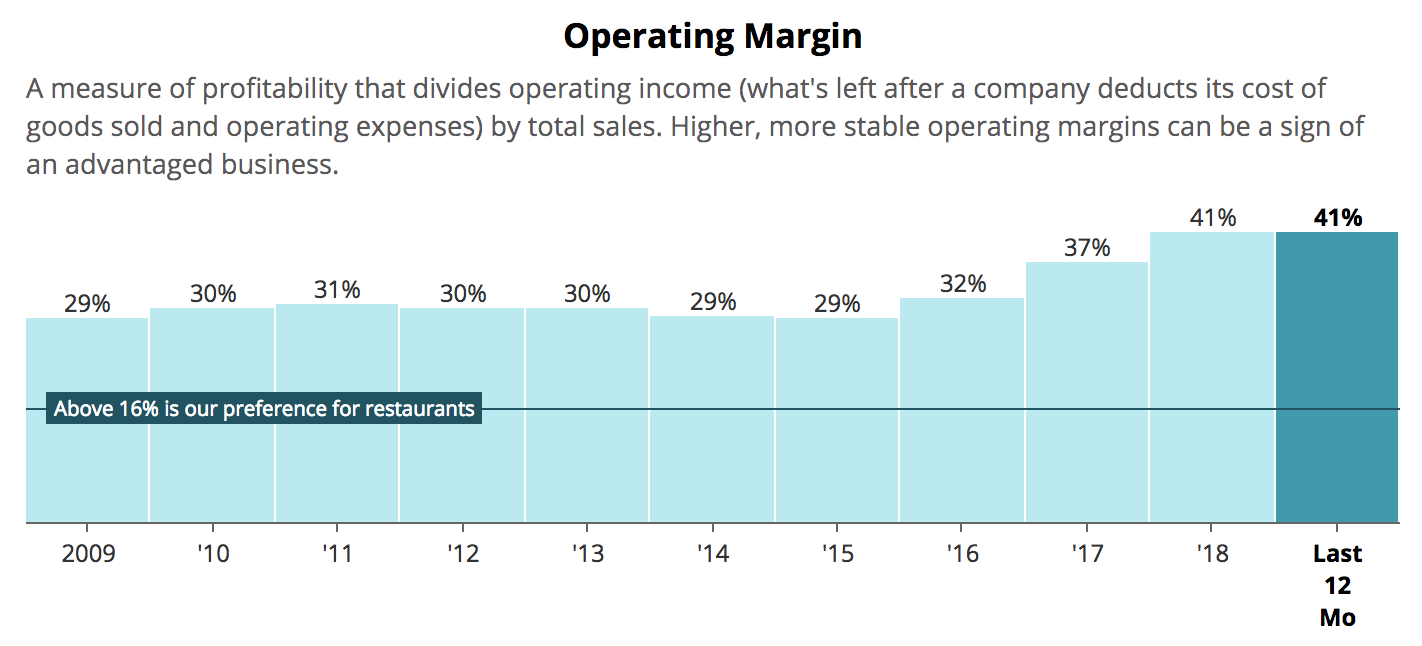

That’s because operating margins on franchised stores were 82% in 2018 compared to 17% for corporate-owned stores. This helped drive continued margin expansion and a 14% increase in free cash flow in 2018, despite the firm’s lower overall revenue.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

For franchised stores, McDonald’s is responsible only for advertising, brand awareness, and global business strategy, with the franchisees responsible for most of the actual costs of building, maintaining, operating, and upgrading its physical locations. The company expects that after re-franchising is complete, it will achieve $500 million a year in cost savings.

Step two of the turnaround plan was a major focus on improving its customer experience. This is exemplified by what management calls its “experience of the future,” or EOTF, which encompasses everything from self-ordering kiosks, ordering and payment via a mobile app, curbside pickup, as well as a much more modern store layout and appearance.

Source: McDonald’s

Source: McDonald’s

EOTF includes not only nicer stores and self-ordering kiosks (to further improve efficiency and throughput), but also a mobile app with over 20 million users that lets customers order before they go to the store (food is waiting for them when they arrive).

At the end of 2018 about half of the company’s global stores were EOTF-converted. About 50% of U.S. McDonald’s locations have also received the EOTF facelift, and the company expects that figure to hit close to 100% by the end of 2020.

McDonald’s expects to pay around 55% of the conversion cost, according to management. While the company is not contractually obligated to pay for most maintenance or capital expenditures on franchised locations, management has decided to in order to accelerate EOTF adoption and maintain healthy long-term relationships with its franchisees.

McDonald’s has also made big inroads into food delivery. For example, in 2017 it partnered with UberEats to test home delivery of food in 200 restaurants in three cities in Florida. According to CEO Steve Easterbrook, delivery orders tend to have high levels of repeat business and are usually 1.5 to 2 times larger than in-store orders.

By the end of 2018 delivery was available at over just over half of McDonald’s stores in over 20 countries. Key delivery markets such as the U.S., France, and the U.K. recorded double-digit sales growth via deliveries, according to the company’s 2018 annual report. This is helping drive McDonald’s industry-leading same-store sales growth in those regions and ensures the firm will remain relevant as consumer preferences evolve.

Finally, McDonald’s has spent the last few years experimenting with its menu, both on the high and low end. For example, it replaced frozen beef with fresh patties, in order to improve the quality of its food. In addition, McDonald’s has invested heavily into the McCafe brand, including rolling out premium coffees and ice beverages that it hopes will attract a higher-end clientele.

On the low end of the price spectrum, McDonald’s has had success with all-day breakfast. The company revamped its value menu as well, which offers $1, $2, and $3 food choices that cater to the company’s traditionally frugal core user base. The idea is to draw in more traffic with cheap offerings, then up-sell customers with pricier menu items once they are in the door.

McDonald’s has also streamlined its food preparation process to improve delivery time and provide hotter and fresher food (including rolling out fresh beef in 2018), which customer satisfaction surveys indicate are paying big dividends.

The overall results of the turnaround plan have been a success. For example, McDonald’s U.S. stores saw 2.5% same-store sales growth in 2018 (4.5% globally), operating margin slightly expanded to 42%, and adjusted EPS grew 18%.

These results met or exceeded management’s long-term average annual (constant currency) financial targets, which call for:

- Systemwide sales growth of 3% to 5%

- Operating margin in the mid-40% range

- Earnings per share growth in the high-single digits

- Return on incremental invested capital in the mid-20% range

If McDonald’s can continue to execute on its plans, then it should be able to achieve high-single digit (6% to 9%) annual dividend growth for the foreseeable future, making the company an appealing candidate for long-term dividend growth portfolios.

However, there is no guarantee that McDonald’s impressive turnaround can continue without some potential hiccups along the way.

Key Risks

McDonald’s turnaround under Steve Easterbrook has been impressive, but there are still numerous challenges facing the company.

For one thing, because of its global presence, McDonald’s has a lot of foreign currency exposure (65% of operating income); the company’s local sales and earnings can be greatly affected when converted to U.S. dollars for accounting purposes.

Negative currency effects can impact the company’s reported short-term growth rates, but fortunately volatile exchange rates seem unlikely to threaten the company’s long-term earnings power.

More fundamentally, a potential problem McDonald’s faces is its dependence on a franchise business model. While this strategy generates very high margins, it also comes with its own challenges. Specifically, many of the company’s franchisees are not necessarily thrilled by some of McDonald’s initiatives. This might make it harder for McDonald’s to grow its global store count (management plans 750 net store openings in 2019).

For example, revamping stores to meet the “experience of the future” model is a high cost that franchisees must pay for (even if the company picks up most of the tab). In addition, revamping the value menu, while boosting same-store sales by drawing more traffic, has some store operators worried about profitability. While low-cost food may attract more guests, franchisees may end up with lower profits unless those guests also then buy additional, higher-margin food and beverages (which is not guaranteed).

This brings us to one of McDonald’s biggest challenges – it’s rocky relationship with franchisees in recent years. According to a survey conducted in 2015 of the 3,000 or so franchise operators of McDonald’s U.S. locations, relations between McDonald’s and its franchisees were at an 11-year low.

The frequent changes to in-store initiatives and the menu, while necessary to find the optimal sales mix, also mean a great burden on local store operators. That’s especially true because in many U.S. states, minimum wage laws have been instituted that are significantly raising the labor costs (eventually up to $15 per hour per employee in some areas) on restaurants and thus pressuring profitability.

According to McDonald’s CFO Kevin Ozan, speaking at the JPMorgan Gaming, Lodging, Restaurant & Leisure Forum Conference, those same labor cost challenges are global:

“The challenge right now, as all of you know, and it isn’t just for us, obviously, is with record low unemployment, with increasing labor costs. Labor is probably our – not probably, is our biggest challenge right now in the U.S. But not only in the U.S., that’s around the world, because there’s generally pretty similar demographics or dynamics around the world as far as availability of labor, increasing cost of labor. And our business is a little bit higher labor-intensive than some.”

Rising commodity prices further eat into the profits earned by McDonald’s franchisees. This combination of rising costs has put financial pressure on franchisees who already need to pay for initiatives like EOTF and make rapid changes to their business model such as incorporating the mobile app and online delivery.

Fortunately, the average operator owns six to seven restaurants, which each generate about $360,000 of pre-debt cash flow, according to management. While that cash flow per restaurants figure is down about $30,000 since 2016 due to the higher investments McDonald’s has required, EOTF work is expected to be largely completed by the end of 2020.

In other words, pushback from store operators is hopefully peaking, and McDonald’s seems unlikely to experience a mass of defections with franchisees wanting to sell their stores. McDonald’s could always step up its share of spending if relations became increasingly fragile, too, maximizing the long-term value of its business.

Finally, it’s worth noting that while McDonald’s has nice potential to grow by opening new new stores in emerging markets, it faces the risk of changing consumer tastes across the globe.

Consumers are becoming increasingly health conscious, so McDonald’s core food offerings may prove less appealing in the years ahead. That could potentially limit its long-term growth in more saturated markets such as in the U.S. and Europe.

As a result, management could face increased pressure to continually evolve the menu in order to keep up customer traffic and keep same-store sales growing. However, frequent menu changes could further strain relations with franchisees, upon whom the company is becoming ever-more dependent for its cash flow.

Closing Thoughts on McDonald’s

McDonald’s has an impressive track record of delivering strong growth for many decades, both in the U.S. and overseas. As a result, the company has become a darling among dividend growth investors, and for good reason.

For one thing, McDonald’s is notably a dividend aristocrat that has delivered 44 consecutive annual dividend increases. More importantly, management’s turnaround strategy, now in its fourth year, does indeed seem to be delivering strong results. While there are numerous challenges that could potentially slow McDonald’s growth in the future, management’s goal of high-single-digit earnings and dividend growth appears to be reasonable and achievable.

When combined with the company’s valuable real estate portfolio and predictable stream of high-margin rent payments and royalty fees from its franchisees, McDonald’s appears to represent a fundamentally lower-risk dividend growth investment.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends