Texas Instruments (TXN) is one of the oldest tech businesses in the world, having been founded in 1930. Over the course of nearly 90 years, the company has proven itself to not only be remarkably adaptive but also a leading pioneer in the semiconductor industry.

In 1958, for example, Texas Instruments employee (and future Nobel Prize winner) Jack Kilby actually invented the first integrated circuit, which literally went on to transform the world.

Texas Instruments is now the world’s largest producer of analog and embedded chips with about 20% and 15% global market share, respectively.

Analog chips are used in nearly all electronic equipment to convert physical data about the real world, such as sound, pressure, temperature, humidity, and light, into digital information that computers can read.

Embedded chips (microcontrollers, processors, and connectivity products) serve as the brains behind a wide variety of modern electronics, ranging from electronic toothbrushes to automotive infotainment systems.

The company’s 15 chip manufacturing facilities produce more than 40,00 products that are sold to over 100,000 customers worldwide operating in many different industries, including:

- Industrial (36% of revenue)

- Consumer electronics (23%)

- Automotive (20%)

- Communication equipment (11%)

- Enterprise systems (7%)

- Other 3%

Analog chips are by far the company’s largest and most profitable business segment, bringing in 68% of revenue in 2018. However, embedded chips (23% of sales) have historically been the fastest growing category.

Texas Instruments also has numerous legacy businesses which it lumps into its “Other” segment (9% of sales). These are primarily non-core businesses selling products such as movie projectors and calculators that were revolutionized by the company’s innovations throughout the decades. However, this segment is less important as its products are largely in secular decline.

Texas Instruments has paid uninterrupted dividends since 1962 and grown its dividend for 15 consecutive years.

Business Analysis

Semiconductors are not traditionally thought of as a great arena for income investors due to the highly competitive, capital intensive, and cyclical nature of the industry.

However, Texas Instruments is one of the few industry leaders that has managed to prove itself over nearly a century of being able to turn these negative characteristics into sustainable advantages.

For example, in 2009 the company decided to sharply refocus its business by selling off its wireless division, which represented 20% of company-wide revenue and supplied chips used to connect cell phones to cellular networks.

Management’s decision to divest was driven by several reasons, including a fast product development cycle, growing competition (which was reducing margins), and concerns that growth would drastically slow in the future, resulting in further commoditization.

The company was then able to focus primarily on its greatest strengths, analog, and embedded chips. These faster-growing areas of the company have expanded from just 44% of total revenue in 2006 to around 90% today.

Equally importantly, management decided to optimize the company’s long-term profitability by directing most of its R&D spending into two industries in particular, automotive and industrial, which now represent 56% of company-wide sales (up from 42% in 2013).

A key reason for this strategic shift is the high cost required to design and build new chip manufacturing facilities. For example, in 2010 Texas Instruments completed a 300-millimeter wafer fab for analog manufacturing. This was the industry’s first and only such facility and reduced the company’s wafer cost by 40% compared to the process used by most of its competitors. However, it cost a whopping $8 billion to construct.

The key to good profitability in the semiconductor industry is being able to amortize these large construction and R&D costs over a long time period. However, wireless devices and consumer electronics (smartphones, tablets, PCs, etc.) have a short development cycle.

In other words, manufacturers of these products are constantly demanding new and improved chips, usually every year. Therefore, chip makers in these industries have to spend a lot to improve their offerings and don’t have much time to recoup these costs, resulting in lower margins.

However, in the automotive and industrial industries, development cycles are much longer because the overall pace of technological advancement is slower and the end products are expected to last for many years.

In addition, many automotive and industrial chips are mission critical. This means that the reliability of these chips is paramount to the effective and safe operations of vehicles and industrial equipment.

As a result, large chip makers like Texas Instruments can take their time designing the best possible chips to meet their customers’ needs and not worry so much about the price sensitivity or loyalty of their clients.

This is because auto and industrial clients usually are designing expensive and highly complex machines, such as a $30,000 car. For these customers, the cost of an individual chip (Texas Instrument’s average analog chip costs $1 and has a gross margin of 68%) is far less important than whether or not it works well and reliably over time.

Or to put it another way, Texas Instruments increasingly focused on the slower moving but critical parts of the global economy, where it has been able to carve out a highly profitable niche for itself.

Going forward, the automotive and industrial market segments are likely to provide excellent long-term growth, thanks to several major future economic trends.

This includes the internet of things, or IoT, in which an increasing number of devices, especially industrial equipment, cars, and infrastructure, will be connected to the internet to allow for real-time data gathering and analysis. This will help companies and governments to know exactly when and where critical hardware is deteriorating, becoming unsafe or inefficient, and in need of maintenance or replacing.

Texas Instruments’ dominance in analog and embedded chips positions it well to take advantage of this fast-growing industry of the future. Telecom company Ericsson estimates that by 2023 alone nearly 3.5 billion IoT devices will be connected to mobile networks (up from about 1 billion in 2018).

And the actual installed base of IoT devices, including for industrial uses, is expected to keep growing with an installed base of 125 billion by 2030 (up from 11.2 billion in 2018), according to DBS Bank based on estimates by Gartner, United Nations, and World Bank.

As a result, research firm IDC expects global spending on IoT will grow about 14% annually through 2022 to $1.2 trillion. In terms of hardware spending on manufacturing and automotive (the company’s core markets), by 2022 IDC estimates an addressable market of $150 billion. That’s compared to a total analog and embedded chip market of about $66 billion in 2017.

Another big opportunity for Texas Instruments is in autonomous vehicles. This doesn’t just mean driverless cars, but also drones and robots, all of which require substantial amounts of data gathering capabilities about the physical world to operate safely.

As this plays out, demand for chips to power this intelligence seems likely grow much faster than the auto market in general. In fact, electronics cost as a percentage of total car cost worldwide increased from 1% in 1950 and to 30% in 2010, with a rise to 50% expected by 2030, according to Statista.

Texas Instruments also intends to differentiate itself in power management and the efficiency of its chips. This is a critical feature of the IoT and automated future, which will require highly energy efficient chips that make it possible to connect so many products to the internet and each other.

Of course, to fully take advantage of this long potential growth runway, Texas Instruments will need to ensure it offers the best products to fit its client’s needs. Fortunately, this company is famous for its strong dedication to R&D (typically close to 10% of revenue) and has usually been at the cutting edge of pioneering new chip technology.

For example, today Texas Instruments’ Kilby Labs is creating about 500 new chip products per year and generated 1,300 patents in 2017. That just adds to the company’s 45,000 existing patents which give it some of the strongest intellectual property in its industry.

When combined with its very long-term customer relationships, as well as the sticky nature of its sales (high switching costs), this allows Texas Instruments to command very strong pricing power. For example, over the past decade, the company’s analog chip sales have been growing at 8% for the company, while its market share has been increasing by about 30 to 40 basis points per year, a trend management expects to continue.

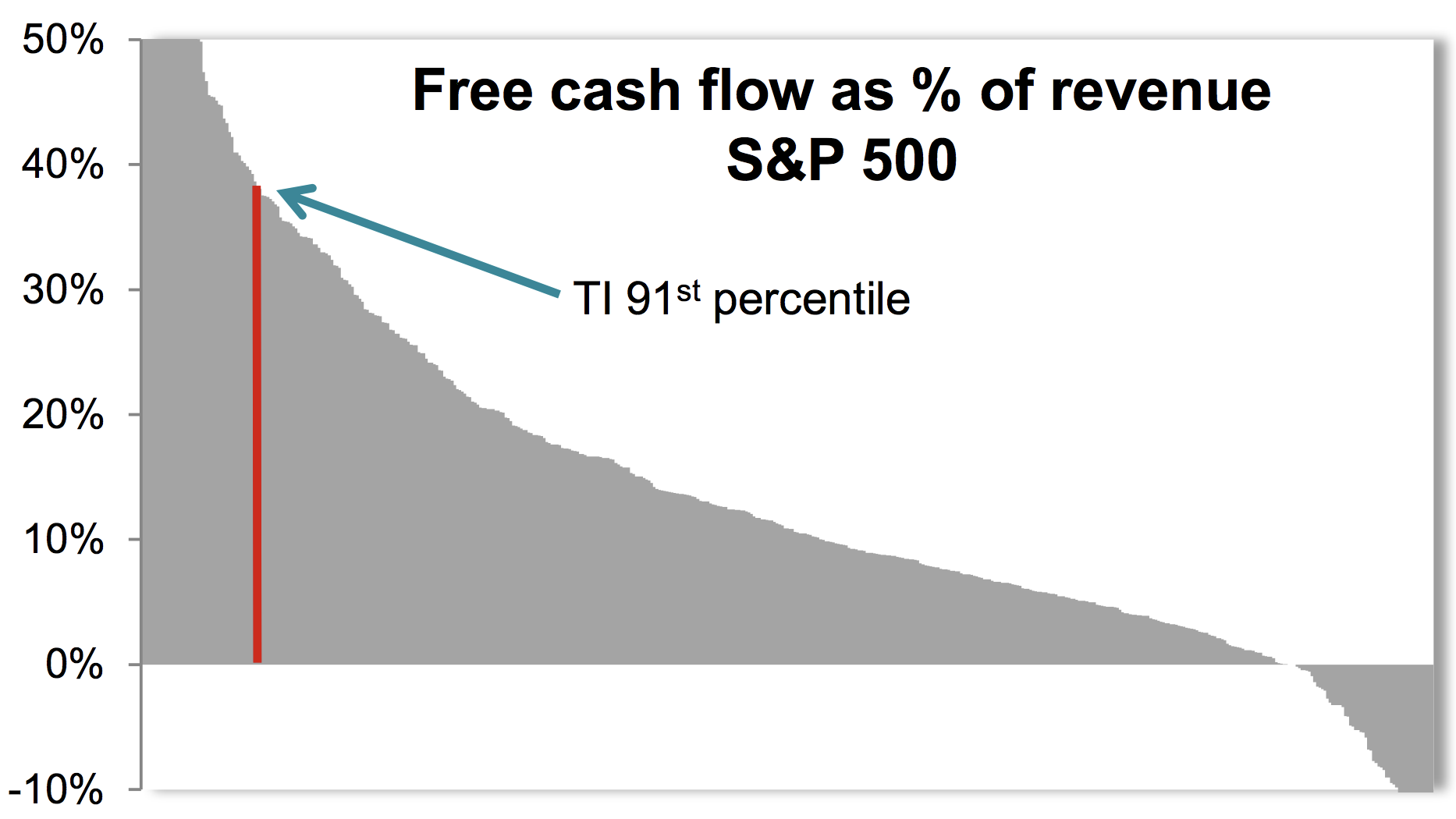

The ultimate result of its competitive advantages, including economies of scale and strong pricing power, is a free cash flow margin that sits near 40%, one of the highest levels of any S&P 500 company.

Source: Texas Instruments Capital Allocation Presentation

Source: Texas Instruments Capital Allocation Presentation

Such margins are further made possible by one of the company’s largest advantages, scale. For example, Texas Instruments commands the largest global sales force in its industry, one that most peers can’t afford to recreate. The company’s sales team is not just very good at winning new clients, but also maintaining strong contacts with existing ones that allow it to cross-sell products to existing customers.

There are many products to choose from since Texas Instruments maintains the broadest portfolio of analog chips and embedded processors in the industry. The breadth of the company’s portfolio helps it solve more needs than its competitors, giving it access to more customers and the ability to generate more sales per system.

The company also has the scale needed to efficiently manufacture most of its products in-house. By owning its own factories rather than outsourcing, Texas Instruments has more control over its supply chain to support its customers and can manufacture its products more cost-effectively than its smaller peers.

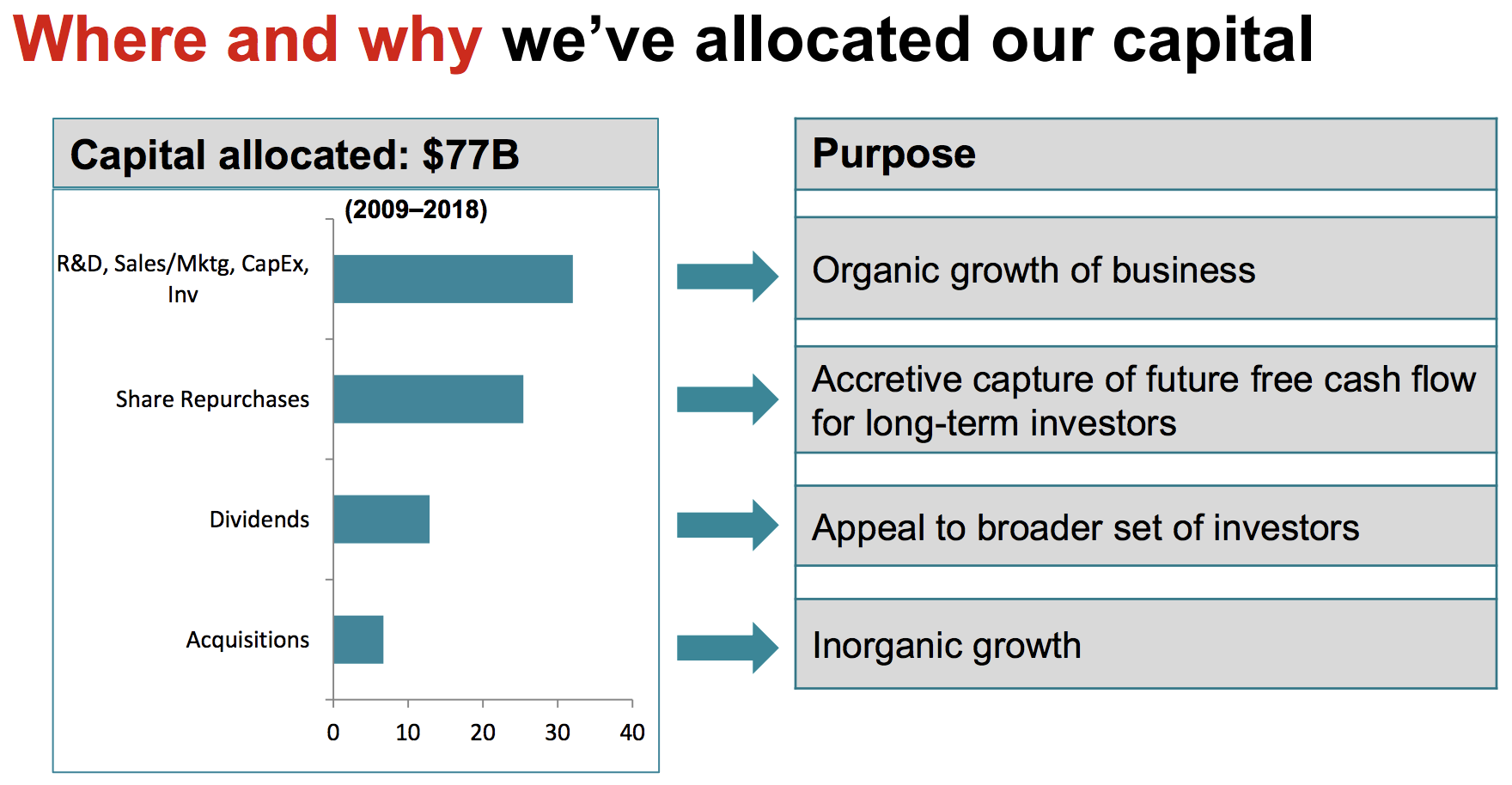

In addition to the attractive economics of its business model, Texas Instruments is run by some of the industry’s best capital allocators who target a 30% long-term free cash flow margin and avoid risky M&A deals. The company’s last big acquisition was National Semiconductor for $6.5 billion in 2011.

Rather than risk overpaying for a big deal, Texas Instruments is focused on efficient organic growth and aims to return 100% of free cash flow each year via buybacks and a fast-growing but safe dividend (management targets a 50% free cash flow payout ratio).

Source: Texas Instruments Capital Allocation Presentation

Source: Texas Instruments Capital Allocation Presentation

This more conservative growth strategy has allowed Texas Instruments to deliver about 12% annualized free cash flow per share growth over the past 14 years. About one third of that growth was driven by opportunistic buybacks which have reduced TXN’s shares outstanding by 45% since 2004.

Meanwhile, management is very conservative with debt as well. As a result Texas Instruments enjoys an A1 (A+ equivalent) credit rating from Moody’s. The combination of a healthy balance sheet, disciplined capital allocation, and strong long-term free cash flow growth is what has allowed Texas instruments to pay an uninterrupted dividend since 1962.

Overall, Texas Instruments appears to have a fundamentally solid business. The firm benefits from operating in slow-changing markets and uses its manufacturing, technology, and distribution advantages to protect its leading market share positions. When combined with its disciplined and shareholder-friendly culture, Texas Instruments is arguably one of the best dividend growth stocks in tech.

Key Risks

Despite its impressive business quality, there are several risks to keep in mind about Texas Instruments.

First, the semiconductor industry is highly cyclical, meaning that sales and earnings are volatile over time, even for time-tested operators like Texas Instruments. Sales of vehicles and industrial equipment tend to be very sensitive to the broader economy, for example, so the company’s short-term fortunes can remain largely out of management’s control at times.

In addition, while the company’s capital intensity is less than most rivals, the company still has a substantial amount of fixed costs associated with its manufacturing facilities. As a result, Texas Instruments’ profitability is also cyclical, ebbing and flowing along with volume growth.

While the stock can be impacted by unexpected shifts in demand and is therefore quite volatile, this really isn’t a risk that threatens the company’s long-term earning power.

Income investors should also note that management plans to increase capital expenditures in the coming years by about 50%. The end result will likely be lower free cash flow margins and slower dividend growth.

Texas Instruments has grown its dividend by 20% annually over the last decade thanks to a combination of strong free cash flow growth, buybacks, and its free cash flow payout ratio nearly doubling (from 22% in 2010 to 42% in 2018).

With the payout ratio now in management’s long-term target range of 40% to 60% (the upper end accounts for decreases in cash flow during industry downturns), investors should expect future dividend increases to more closely match long-term cash flow growth, which analysts expect will be around 8% to 10% per year.

And while Texas Instruments is the world’s leader in analog and embedded chips, the company still faces numerous large rivals in these highly fragmented and competitive industries, including:

- Maxim Integrated Products (MXIM) – analog chips

- Microchip Tech Inc. (MCHP) – microcontrollers

- Broadcom (AVGO) – connectivity chips

- Analog Devices (ADI) – analog chips

Texas Instruments will always face a large amount of pressure from competitors to continue to innovate and upgrade its product offerings. That competition ultimately means that there is a cap on how high the company’s profitability and margins can rise.

Investors need to realize that Texas Instruments’ strong margins could be near a short-term top. After all, a lot of the company’s recent margin expansion has been a result of past investments such as its 300-millimeter analog chip factory, as well as past opportunistic acquisitions of cheap manufacturing plants from bankrupt chipmakers. Now management is looking to invest in new plants, which will mean lower free cash flow in the short term.

More importantly, the semiconductor industry constantly faces technological change and intense pricing competition. It is also very mature, potentially making longer-term growth more difficult.

While Texas Instruments focuses on products and markets characterized by a much slower pace of change and longer product cycles, the very nature of technological innovation is unpredictable. The company’s financial strength and diversification by customer, end market, and product help combat this risk, but it’s worth remaining aware of.

A final long-term risk to consider is Texas Instruments’ decision to do most of its manufacturing in-house. Rather than outsource the production of its chips like many of its peers do, Texas Instruments maintains multi-billion dollar manufacturing facilities to gain cost advantages.

If the market were to experience a technological shift that makes in-house production less attractive, Texas Instruments could be stuck with a number of costly and inefficient assets.

Overall, aside from the industry’s expected cyclicality, there don’t appear to be many fundamental risks to the company’s long-term future because of its conservatism and diversification.

Closing Thoughts on Texas Instruments

The semiconductor industry is not one that’s generally known for great dividend stocks. After all, it is very capital intensive and highly competitive, and many chipmakers suffer from cyclical sales, profits, and cash flow.

However, Texas Instruments has proven itself to be a standout. The company dominates its slower-changing markets, maintains significant manufacturing advantages, focuses on generating consistent free cash flow, possesses strong intellectual property, and presumably has plenty of room to continue moderately growing thanks to the Internet of Things and its large, fragmented markets.

With more than 50 years of uninterrupted dividends and a fundamentally sound business model, Texas Instruments seems poised to continue rewarding shareholders with dividend growth for the foreseeable future. While investors can’t expect to see dividend growth continue at 20+%, the firm seems likely to be able to deliver close to 10% payout growth for the next few years at least.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends