The stock market is way up and ironically, that’s terrible news for us dividend investors. Yields are in the tank yet again. The S&P 500 pays a measly 1.9% today. If you have a million-dollar portfolio, that’s a lousy $19,000 per year in income. Pathetic.

Most people invest their money in index funds like those that mimic the S&P 500. We can do better – four-times better, to be specific – and raise our dividend income by 400% simply by selling these mainstream plays and buying bigger payouts that are better values.

Specifically we’re going to discuss stocks, bonds and funds that pay 7.3% to 8% instead of the broader market’s lame 1.9%.

That’s $73,000 to $80,000 in passive income on a million bucks, or up to $40,000 annually on $500,000. (Versus $19,000 and $9,500 per year – an easy choice.)

But first, let us show you the logical – but wrong – assumption that most mainstream dividend investors make. They look for “royalty” stocks like the Dividend Aristocrats (firms who have raised their payouts for 25 straight years and counting) and conclude that the growth of these surefire dividends will bail out a nest egg that isn’t quite what you’d always hoped for.

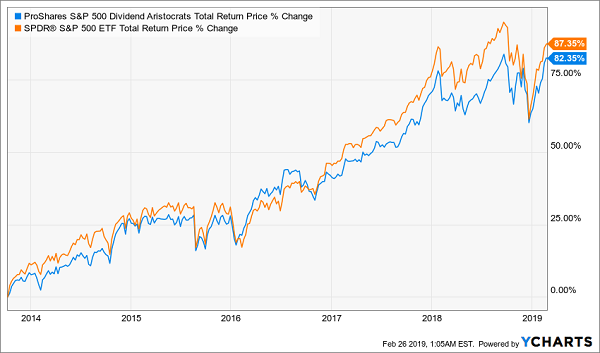

Problem is, a history of dividend increases doesn’t equate to outperformance. Just take a look at the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) since its inception in October 2013 – it’s actually trailing the S&P 500, and on a total-return basis, no less!

What Does a Runner-Up Crown Look Like?

And while I wouldn’t own each and every Dividend Aristocrat, a select few are actually truly worthy of the title. These are stocks that not only have storied histories, but more importantly bright futures. I’m talking about encouraging growth prospects, Amazon-proof business models and dividends that will keep climbing for years and decades to come.

Let’s grab a six pack of the best and worst Aristocrats to appreciate the vast difference.

Kimberly-Clark (KMB)

Dividend Yield: 3.5%

Kimberly-Clark (KMB) is a consumer-staples giant whose dirty diapers spread across 175 countries. Its brands are a who’s who of the personal-care and cleaning-products worlds, spanning Cottonelle toilet paper, Huggies diapers, Kleenex tissues, Kotex feminine products and Depend adult-care products.

Those brands have helped fund a long, long-standing payout 84 years and counting (2019 will be its 85th), as well as a streak of 46 consecutive annual hikes.

What’s not to love?

KMB is being picked at from the high and low ends. Well-to-do conscientious “mom-sumers” are moving away from traditional brands such as those under the Kimberly-Clark umbrella and toward companies such as Jessica Alba’s Honest Co. and its non-toxic baby products. (My two kids have only worn Honest diapers – and I don’t plan to petition my wife for a change!)

On the low end, “private-label” brands in grocery stores, and even Amazon.com’s (AMZN) AmazonBasics brand, are competing on price.

These forces have pulled on KMB shares, which have gained just about 11% over the past five years versus more than 50% for the S&P 500. And there’s little reason to believe things will get better soon. In January, Kimberly-Clark reported disappointing fourth-quarter profits (not good) and said that 2019 revenues would decline 1% to 2% (also not good), prompting earnings guidance with a midpoint ($6.60) that would fall a cent lower than 2018’s $6.61 in earnings (even worse). You can do better.

KMB Shares: Somebody Change That Diaper

General Dynamics (GD)

Dividend Yield: 2.2%

General Dynamics (GD) is one of the big names in defense, boasting products such as the Abrams tank, Hydra-70 rockets and navy subs built by Electric Boat. But it also has other arms, such as Gulfstream business aircraft, communications systems and various information technology systems and services.

It’s also the only Dividend Aristocrat to come from the defense industry. It’s a newbie to boot; GD joined the list of dividend-raisers in 2017, and it currently sports a streak of 26 consecutive annual payout hikes.

General Dynamics has lost quite a bit of altitude over the past year, shedding almost a quarter of its value. It’s not just a sentiment issue, though that certainly didn’t help – Democratic control of the house as well as the fourth quarter’s market-wide swoon weighed on GD. But so did margin troubles as the company started kicking a new submarine class into gear, as well as a pair of new business aircraft.

Still, GD finished 2018 with full-year revenue growth in all five of its business segments, leading to a 16.9% ramp-up in both sales and net income. Better still, the company is looking at mid-single-digit revenue growth for the next two years, as well as profits that should improve by 16% by the end of 2020.

That growth is coming at a decent price, with a forward P/E of 13 versus nearly 17 for the broader market. And dividend hikes are all but assured given GD’s lean payout ratio of about 33% of profits.

PepsiCo (PEP)

Dividend Yield: 3.2%

I’ll say this for PepsiCo (PEP) – it’s a much more diverse play than its rival Coca-Cola (KO), boasting a snacks business (including Lay’s, Cheetos, Cap’n Crunch, Cracker Jack, Grandma’s cookies, Aunt Jemima) to go with its beverages division (Pepsi, Sierra Mist, Mountain Dew, Lifewater, AMP Energy).

I’ll also say this: That diversity hasn’t meant much over the past few years.

Failing the Pepsi Stock Challenge

Sure, PepsiCo announced in February that it would make its 47th consecutive increase later this year with an annualized hike of 3%. But PepsiCo is facing a serious existential problem: increased health-consciousness. That’s driving people away from its sugary sodas, as well as its fatty, salty, carb-heavy (and delicious) snacks.

The company did manage to drive 3.7% sales growth in 2018, but only with the help of heavy advertising that’s expected to drive a decline in profits next year. Pepsi’s Q4 profit of $1.49 per share, meanwhile, only met Wall Street’s typically low-balled profit estimates. Meanwhile, you’re paying an above-market forward P/E of nearly 20 for an expected dip in earnings this year and a yield that is only about half a percentage point better than the T-note.

PepsiCo is far from a dying company, but that doesn’t mean its stock is doing you any favors.

People’s United Financial (PBCT)

Dividend Yield: 4.0%

Last summer, I analyzed People’s United Financial (PBCT) and pointed out that it was on the verge of Dividend Aristocracy. Well, it officially was invited into the ranks of the Aristocrats this year after notching its 25th year of dividend hikes in 2018.

And it still looks like one of the group’s crown jewels.

This mid-cap regional bank stock operates as People’s United Bank in the northeastern U.S. with roots going back to 1842, spanning 400 branches across Connecticut, New York, Massachusetts, Vermont, New Hampshire and Maine. Its operations are pretty typical too, providing retail banking services like checking and savings accounts, as well as commercial banking and wealth management products.

People’s United raced out of the financial crisis and never looked back, growing its top and bottom lines each year since 2014. Much of that is organic, but it’s also not afraid of doing some dealing. In late 2018, the company announced it would purchase BSB Bancorp (BLMT) for $327 million to bolster its positioning in the greater Boston area. The company also has the wind in its sails thanks to new Federal Reserve rules reducing some restrictions on community and regional banks that were put in after the financial crisis.

What does the future hold? More growth, says the analyst community. They’re banking on a 14% boost in the top line this year, filtering down to a 9% bump in profits. That should mean good things for PBCT’s payout, which is one of the most generous among the Aristocrats.

Johnson & Johnson (JNJ)

Dividend Yield: 2.6%

Johnson & Johnson (JNJ) is absolutely dividend royalty – a healthcare/consumer staples hybrid that has paid dividends since 1944 and increased them annually for the past 56 years. It has a laundry list of well-known brands, including Band-Aid bandages, Acuvue contact lenses, Neosporin ointments, Neutrogena skin care products, Nicorette nicotine-replacement products, Rembrant toothpaste, and I’m barely scraping the surface.

But right now is not the time to get involved with JNJ.

As I pointed out earlier this year:

J&J spent 2018 in court battling off cases related to claims that their baby powder contained asbestos and caused mesothelioma to a few people who were exposed to it. “We will continue to defend the safety of our product because it does not contain asbestos or cause mesothelioma,” the company said in May after losing a ruling in California.

But Reuters dropped a bombshell report in December saying that internal documents “show that the company’s powder was sometimes tainted with carcinogenic asbestos and that J&J kept that information from regulators and the public” for decades. JNJ tanked 13% in five trading days following Reuters’ report, and that very likely won’t be the last of it. Johnson & Johnson not only risks suffering a massive reputational hit to its consumer brands, but its legal path forward suddenly looks fraught with potholes.

JNJ Shares are Due for a Breather

Johnson & Johnson has rebounded this year, sure, but so has the rest of the market – and JNJ is lagging it. Maybe that’s because Johnson & Johnson has a completely opaque legal environment on the horizon.

Or maybe that’s because Wall Street is expecting the company’s sales to actually inch backward this year. Or maybe that’s because JNJ yields as much as the 10-year. Or maybe that’s because all of this can be yours for the price of the much growthier S&P 500.

I think you get the point.

Becton Dickinson (BDX)

Dividend Yield: 1.2%

Becton Dickinson (BDX) is in the oft-overlooked medical-device industry. Pharmaceuticals are well-known for their fatter dividends, while biotechs get play for their uber-growth. But medical devices, while decidedly unsexy, are in a sweet spot where they still boast mature enough businesses to support steady and growing dividends, but enough growth potential to be true dual-threat plays.

Becton Dickinson is an extremely diversified company whose offerings cover biosciences, diabetes care, genomics, infusion therapy, molecular diagnostics, surgical instruments and even software solutions. Its range only got wider near the end of 2017, when it finished swallowing up C.R. Bard, itself a med-tech company that specialized in vascular, surgical and oncology products, among others.

BDX has a fantastic growth ramp ahead, with analysts projecting five-year average profit growth of roughly 12%. Deutsche Bank analyst Dan Leonard initiated coverage on the stock in December, starting it at “Buy.” His bull case? “Keys to our view include BDX’s ability to leverage its global scale and footprint to improve international penetration of recently acquired products (esp. those from the C.R. Bard acquisition), the company’s opportunity for continued double-digit growth in emerging markets across its portfolio, a continued cadence of incremental product opportunities, and some modest share gain.”

The dividend, meanwhile, has grown by more than 7% annually over the past five years. And considering BDX is only paying out a quarter of its profits to maintain the 77-cent dividend, there’s all sorts of room for that to expand along with stock prices going forward.

— Brett Owens

Live Off Dividends Forever With This “Ultimate” Retirement Portfolio [sponsor]

Back to my earlier point. Dividend growth is one of the three core components to my “ultimate” retirement portfolio that will ensure you can tackle each and every one of your everyday needs with nothing but the dividends from your investments.

The Dividend Aristocrats have that … but they often lack the other two legs that make this portfolio so potent.

You see, to retire well, you need dividend growth … and substantial yields averaging 8% across the portfolio … and the ability to deliver capital gains to boot!

These Dividend Aristocrats don’t have all three qualities. But the “triple play” stocks in my 8%-yielding “No Withdrawal” retirement portfolio sure do.

The problem with the Dividend Aristocrats is how meager their collective payout is. The NOBL exchange-traded fund of Aristocrats delivers a surprisingly chintzy yield of 2.3% right now. That means a $500,000 portfolio would generate a mere $11,500 in annual income. I can’t stress this enough:

Your retirement income would be below the U.S. poverty line!

Worse still, many of these companies are well into the later innings of their growth cycles … if they’re growing at all. So not only are you forfeiting any hope of significant stock-price appreciation going forward, but you’re doing it to earn minimal dividends on your hard-fought nest egg.

If that has you sweating a little bit, good – it should! That kind of return will have you bleeding your nest egg dry to survive after just a few years off the job. You worked too hard for decades just to struggle financially in your golden years.

This is your wake-up call.

You need more than three times that income, plus dividend growth to beat back inflation, not to mention capital appreciation to keep building your nest egg. That’s not easy to find, but a handful of winners in this market have what it takes.

My “No Withdrawal” portfolio is an all-star cast of stocks that will deliver an average yield of 8% that will also grow your nest egg – an important aspect of retirement investing that most other strategies leave out. But if disaster strikes and you have to take a chunk out of your nest egg, you’re also taking a chunk out of your income potential.

This diversified set of picks features the best of several high-income assets. Of course, only a handful of stocks and funds meet my rigorous standards for this multipurpose strategy. But the result is an “ultimate” dividend portfolio that provides you with …

- An average 8% portfolio yield that includes a couple of double-digit payouts!

- The potential for 7% to 15% in annual capital gains

- Robust dividend growth that will keep up with (and beat) inflation

This portfolio will let you live off dividend income alone without ever touching your nest egg. You won’t have to worry about paying the mortgage or other monthly bills, nor will you have to wonder how you’ll survive if a financial disaster strikes.

Let me show you how to secure the comfortable retirement you’ve worked your tail off to enjoy. Click here and I’ll provide you with THREE special reports that show you how to build this “No Withdrawal” portfolio. You’ll get the names, tickers, buy prices and full analysis of their wealth-building potential – and it’s absolutely FREE!

Source: Contrarian Outlook