Founded in 1920, PPL (PPL) is a pure-play regulated gas and electricity utility serving 7.9 million customers in the United Kingdom (U.K.), 1.4 million in Pennsylvania, and 1.3 million in Kentucky.

The majority of PPL’s earnings are generated in the U.K., where regulators have historically allowed for superior returns on equity compared to most U.S. utilities. Here’s how the firm’s profits break out by region:

- U.K.: 53% of total earnings

- Pennsylvania: 24%

- Kentucky: 23%

PPL has paid consecutive quarterly dividends since 1946 and raised its payout 17 times in the last 18 years.

Management has committed to steady dividend growth but removed its previous long-term dividend growth rate guidance of 4% to an undetermined level. The change is due to management’s desire to moderately lower PPL’s payout ratio below 70% to a level more in line with peers, as well as perhaps some concerns about the evolving regulatory environment in the U.K. (more on that later).

Business Analysis

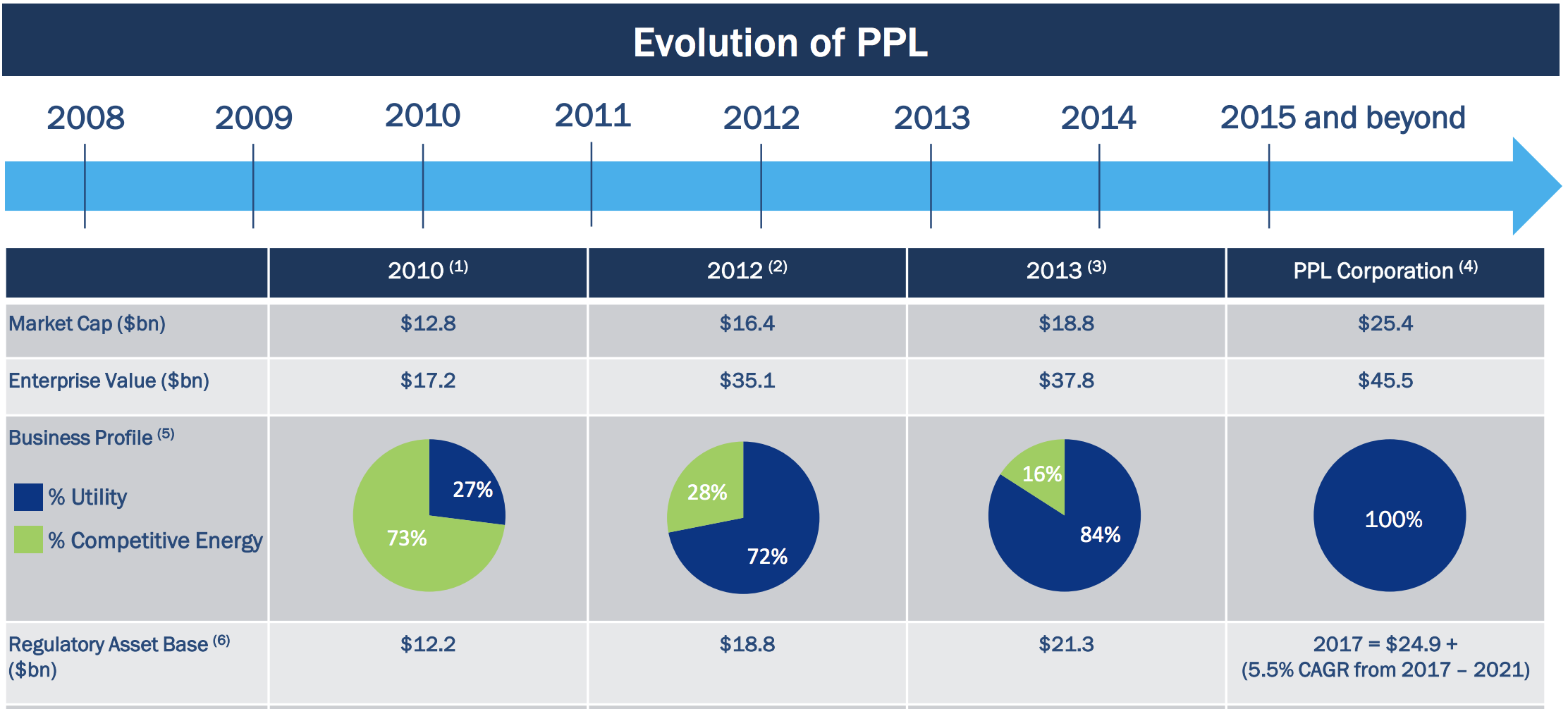

PPL has transformed its business mix over the past decade to reduce its earnings volatility and improve its return profile.

Through a series of strategic divestitures and acquisitions (most notably PPL’s $5.7 billion acquisition of the U.K.’s second-largest electricity distributor in 2011), the company shed its exposure to the highly competitive power generation business and increased its mix of regulated utility revenue from 27% of company-wide sales in 2010 to 100% by 2017.

Source: PPL Investor Presentation

Source: PPL Investor Presentation

Regulated utilities are essentially monopolies because they have exclusive rights to sell electricity and/or gas in their service territories. To protect customers from price gouging and ensure they have continuous access to reliable service, state regulators determine what a utility can invest in and how profitable its operations can be.

When evaluating a regulated utility, it’s therefore very important to get comfortable with the regulatory frameworks it operates under.

Allowed rates of return can vary significantly from one state to the next as each regulatory body operates independently. Other important factors are the demographics of a service territory (population and business growth drive power demand) and a company’s growth projects, which need to be delivered on time and on budget.

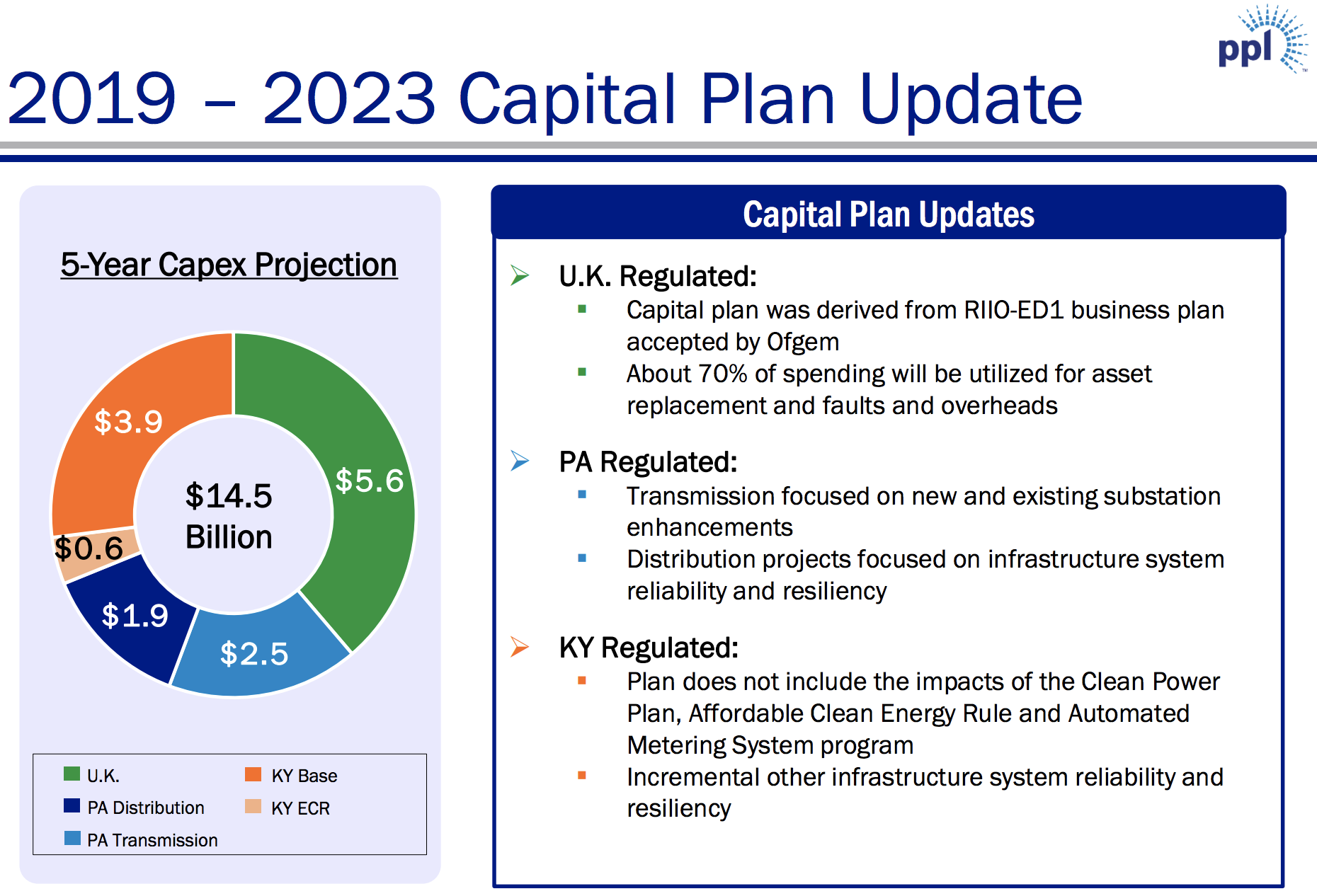

PPL’s confidence in its service territories and regulator relationships is demonstrated by its plans to invest $14.5 billion between 2019 and 2023.

Source: PPL Investor Presentation

Source: PPL Investor Presentation

About 60% of the firm’s planned capital outlays will go towards its Kentucky and Pennsylvania operations, which should help diversify PPL’s business and reduce future regulatory uncertainty over time.

In Pennsylvania, PPL’s permitted return on equity is 11.4%, one of the highest of any utility in the country. Kentucky’s regulatory environment is constructive as well. While PPL is only allowed a 9.7% return on equity today, which is about in line with the nationwide average for regulated utilities, the company has filed a rate case which effectively requests a 10.4% return on equity. If approved, the higher rate would go into effect in May 2019.

The rest of PPL’s spending, about $5.6 billion, will take place in the U.K., the utility’s largest source of earnings. PPL expects its U.K. regulated segment to generate a strong return on equity between 13% and 15% through 2020. For context, most U.S. regulated utilities earn about a 10% return on equity, showing just how profitable PPL’s U.K. business is.

However, PPL’s sensitivity to changes in regulatory frameworks and capital market conditions will be elevated during this aggressive investment phase. Fortunately, about 70% of its planned capital expenditures have minimal regulatory lag (earns a return in six months or less), and 80% of spending allows for a return within 12 months or less.

In other words, the company can pass on the cost of its new investments fairly quickly to customers. Under the proposed changes to the U.K.’s regulatory framework, this timely pass-through provision would remain in effect as well.

The current U.K. regulatory framework in effect has set base revenues through 2023, providing solid visibility through at least that time given that Ofgem (the key U.K. regulator) has stated it won’t be changing the rates PPL earns until then. PPL also believes it has some levers to pull with its planning process to mitigate lower allowed returns after 2023 should that occur.

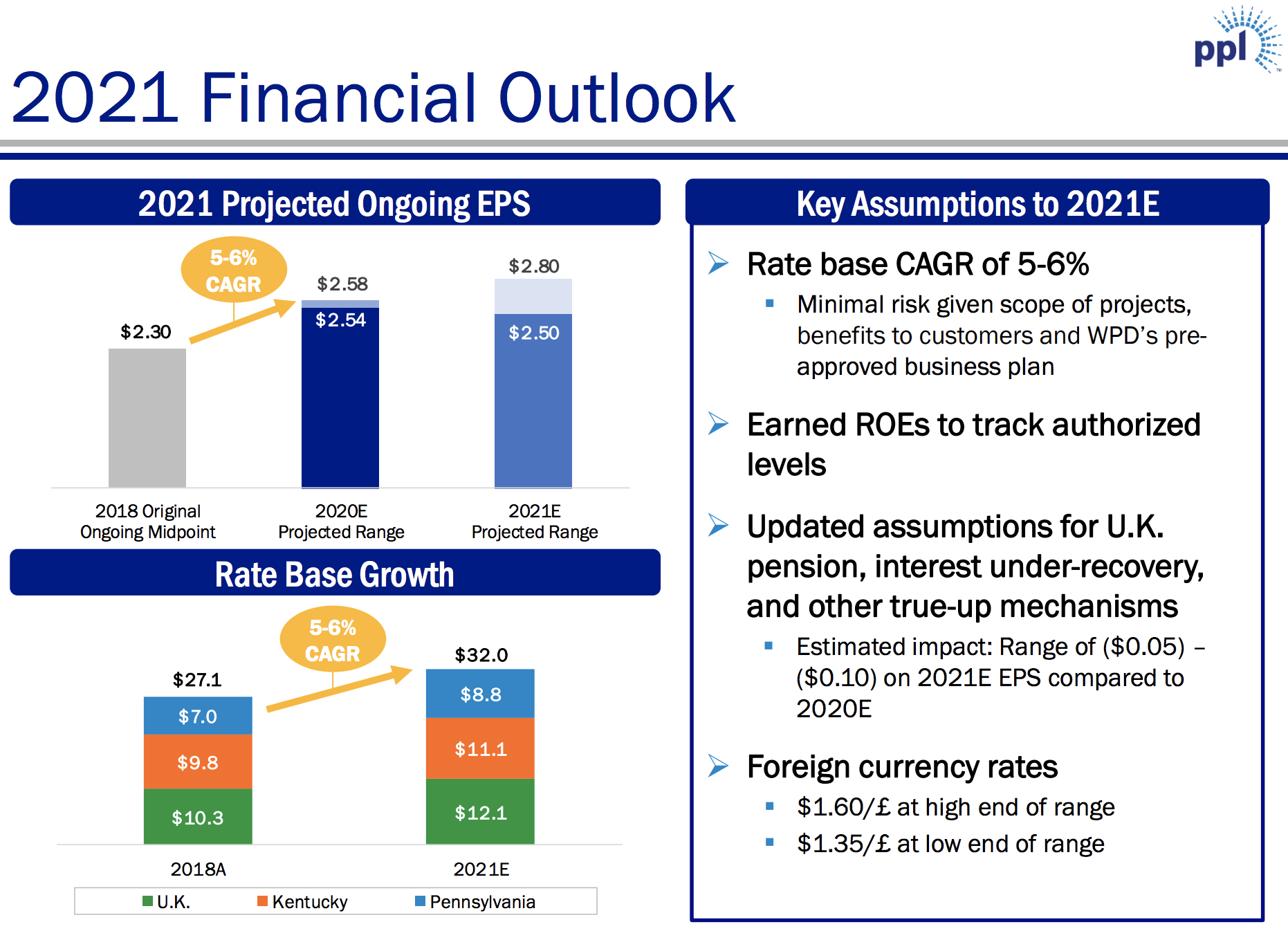

Overall, the company expects these investments to compound its rate base and earnings per share at a low to mid-single-digit pace over the next few years.

Source: PPL Investor Presentation

Source: PPL Investor Presentation

Besides benefiting from investing in regulated projects with predictable returns, PPL also enjoys a strong credit rating (A- from S&P), which provides it with some additional financial flexibility. As long as management is able to achieve its guidance, dividend investors are likely looking at low single-digit dividend increases over the next few years.

It’s also worth noting that management recently changed PPL’s long-term dividend growth guidance. Specifically, the company previously expected 4% annual dividend increases but now plans to grow the dividend annually via a “Commitment to Annual Dividend Increases”. In February 2019, PPL raised its dividend just 0.6%, suggesting the pace of future growth could remain lackluster.

Source: PPL Investor Presentation

Overall, PPL appears to be a durable business that has generated predictable earnings, operates in geographies with historically supportive regulatory bodies, and is poised for modest long-term growth in the years ahead. Management has also shown a commitment to raising the utility’s dividend steadily over time and will likely continue to do so, albeit at a much slower rate than in recent years.

However, investors considering PPL need to realize that this regulated utility faces some unique long-term risks related to its U.K. operations.

Key Risks

While PPL’s steady regulated cash flow and commitment to its dividend make it look appealing for conservative income growth investors, there are several risks to keep in mind. First, as with all regulated utilities, there is political risk because a utility’s profits comes directly out of the pockets of its customers.

Populist political attacks against “greedy utility monopolies,” especially during economic downturns, could sour regulatory relationships between PPL and its regulators, especially in the U.K. where PPL’s allowed return on equity is among the highest in the industry.

PPL’s U.K. utilities currently operate under a regulatory framework that runs through 2023, providing a predictable rate of return on its projects. But it should be noted that among the regulated utilities we cover, few face the kind of long-term regulatory uncertainty that PPL does.

For example, in 2018 Ofgem (the U.K.’s energy regulator) considered holding a mid-period review of the current price control in place for electricity distribution, which is PPL’s biggest earnings driver. To help with its decision of whether or not to conduct a mid-period review, during their consultation with various stakeholders in the industry regulators included an evaluation of resetting profitability targets for the country’s utility networks.

The fact that this option was included as part of the mid-period review’s consideration really spooked investors. After all, its intention was to cut network revenues by more than $850 million in an effort to reduce costs for consumers at the expense of utility shareholders. Here’s what the regulator stated:

“Returns across companies have been higher than we expected and do not reflect the low level of risk these companies face… But if companies profit from other factors (such as forecasting errors), then nobody benefits, other than shareholders… This will be a tougher price control for network companies.”

At the time, Ofgem proposed reducing PPL’s cost of equity range (the amount utilities pay their shareholders) between 3% and 5%. As Ofgem explained, “This is the lowest rate ever proposed for energy network price controls in Britain.” Ofgem also proposed to refine how it sets the cost of debt so that consumers continue to benefit from the fall in interest rates rather than the utilities.

Fortunately, in April 2018, Ofgem announced it would not hold a mid-period review, keeping the current framework (including price controls for electricity distribution) in place through early 2023.

But in December 2018, Ofgem issued a new proposal related to its price controls that will run from 2021 to 2026 for gas distribution, gas transmission, and electricity transmission operators. The regulator’s stated goal is to save consumers around $8.2 billion in 2021 and beyond, and a final ruling is expected in December 2020.

As some investors feared, Ofgem’s proposals would set the baseline returns (cost of equity) at 4%, about 50% lower than the previous price controls. In other words, the returns equity investors would enjoy on projects would be cut in half, with more money going back in consumers’ pockets instead.

The good news is that this proposal technically does not affect PPL’s business, which is involved in electricity distribution. The regulatory framework PPL operates under continues to remain in effect until early 2023. However, investors are worried that Ofgem will take a similarly hard stance with price controls for utilities such as PPL when it begins its consultation in 2020.

In other words, beyond 2023, PPL’s core electricity distribution business in the U.K., which accounts for over half of it earnings, could face much lower profitability. Management is naturally optimistic that regulators will provide incentives for the best-run operators like PPL and also provide a more supportive framework for electricity distribution given the importance of electrification initiatives in the U.K., but uncertainty looms for now.

As a result, PPL’s stock price has struggled. That could create some of its own growth challenges for the utility which, like its peers, must issue new shares to fund part of its growth plans. Over the past five years, PPL has increased its share count by 1.4% annually, but its pace of equity issuances has ramped up steadily:

- $432 million equity issuances in 2017

- $689 million in 2018

- $1.15 billion estimated for 2019

As long as PPL’s share price remains weak, resulting in a higher number of shares needing to be sold, that rising dilution will likely mean smaller dividend growth in the future. Should the share price fall low enough, then the company might not be able to grow the dividend at all.

That’s because a lower share price means a higher cost of equity, which could force the company to depend more on tapping debt markets to fund its long-term growth projects. While PPL has a strong A- credit rating, if the utility is unable to access equity markets at profitable levels, then it might have to borrow more.

The end result could be increased pressure on its ability to maintain its strong credit rating, potentially rising interest costs, and long-term earnings growth which could miss management’s guidance. The dividend would likely remain on solid ground, but its growth outlook would dim.

Given the increasingly hostile U.K. regulatory environment (not to mention the possibility of large currency headwinds surrounding Brexit), it’s far from guaranteed that PPL will be able to deliver even 2% to 3% dividend growth necessary to keep up with inflation.

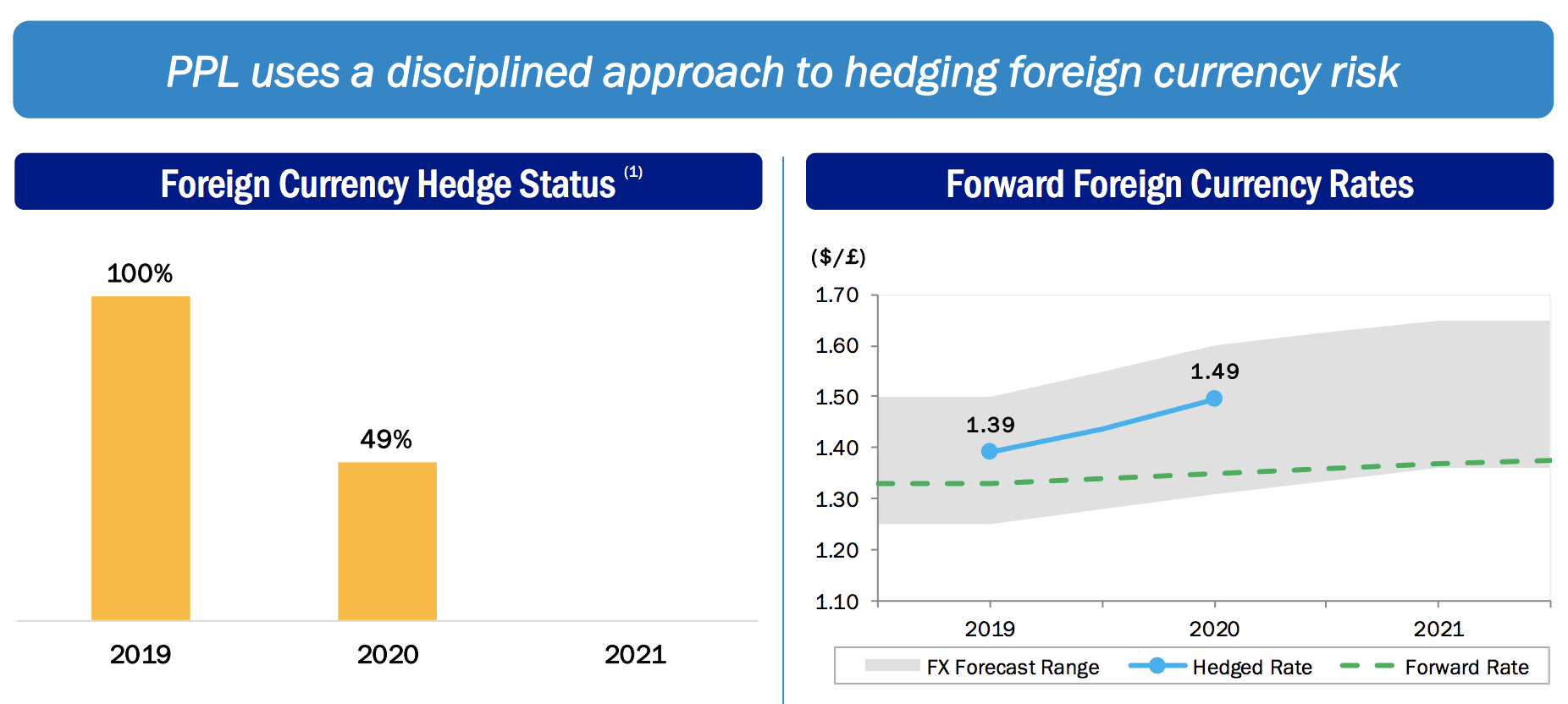

Brexit is another risk factor to consider. PPL pays its dividends in U.S. dollars, which means it needs to minimize its cash flow sensitivity to currency fluctuations between the dollar and the pound.

The utility is fully hedged in 2019 and halfway protected in 2020. However, management’s most recent guidance assumes the pound will strengthen somewhat in the future, which in the case of a hard Brexit seems very unlikely to happen.

Source: PPL Investor Presentation

Source: PPL Investor Presentation

Britain’s attempts to leave the European Union (EU) have been a mess. Prime Minister Theresa May had reached an agreement with the EU for an orderly transition, but this proposal was rejected by Parliament in early 2019. If nothing changes, a “hard Brexit” could take place in late March 2019, when the U.K. is officially slated to leave the EU.

Brexit could always be delayed by a few weeks or months. However, the EU said it wouldn’t agree to that unless it saw some clear plan forward that would actually address the core issues rather than just kick the can down the road.

The Bank of England has warned that a hard Brexit, in which no deal is reached before the U.K. leaves the EU and tariffs automatically go into place, could be worse than the Financial Crisis. For example, the bank estimated that GDP could fall by 8% in 2019 alone, and the unemployment rate could nearly double to 7.5%.

Should a hard Brexit happen, however unlikely that scenario might be, and the Bank of England’s economic forecasts prove accurate, then PPL might face several additional challenges:

- A crippled U.K. economy could put pressure on Ofgem to be even harsher with allowed returns on equity to achieve lower rates for consumers

- Higher interest rates in the U.K. would mean much higher borrowing costs for PPL, raising its cost of capital

- The pound could crash, causing U.S. dollar dividends to become more costly for the company and potentially require PPL to freeze the payout entirely

- Should a hard Brexit coincide with an overall global recession (or prove worse than expected), then these challenges might potentially even require a dividend cut

It’s important to note that a hard Brexit wouldn’t immediately impact PPL, due to it having hedged 100% of its currency exposure in 2019 at an attractive exchange rate. The utility’s hedges in 2020 account for just half of its exposure, but that should be partially offset by even more attractive rate management locked in.

However, in 2021 and beyond PPL is fully exposed to currency fluctuations, so a falling pound could hurt the company’s ability to pay generous U.S. dollar-denominated dividends.

What are the odds of a hard Brexit? In the current complex regulatory and legal environment, it’s impossible to know. Analyst estimates range anywhere from a 10% to 50% probability, and there’s also a decent chance the U.K. remains in the EU. Only time will tell.

The bottom line is that PPL’s dividend is safe for now, and we will know a lot more within the next year or two. However, the firm’s future growth prospects are ultimately in the hands of powerful forces that management has no control over (Ofgem’s yet-to-be-determined regulatory framework for 2023 and beyond; Brexit; capital market conditions in the U.K. and U.S.).

Income investors interested in PPL must realize that this pure-play regulated utility, despite its recession-resistant business model, possesses some unique risks that could hurt its business in future years.

Closing Thoughts on PPL

Thanks to their steadier margins, predictable cash flow, and defensive qualities, regulated utilities often make for attractive income investments. From an improved business mix consisting purely of regulated activities to its generous yield and diversified growth plans, there is certainly a lot to like about PPL.

However, the company is not your bread-and-butter U.S. regulated utility. The U.K. accounts for over half of PPL’s profits and is facing unprecedented economic and political uncertainty, especially with the potential for a hard Brexit in 2019.

While the current regulatory framework in place for PPL appears favorable and provides nice visibility through 2023, these situations should still be approached with greater caution.

Based on what we know today, PPL still seems like a reasonable source of current income. We plan to hold our shares (less than 3% of our Conservative Retirees portfolio’s value) until more is known about the business climate in the next year or two. In the quarters ahead, management will certainly be discussing the regulatory environment and PPL’s mitigation plans with investors, hopefully providing us with more clarity on how to proceed.

Should PPL’s situation look increasingly dire, or its valuation revert to more normal levels, we would consider moving onto another utility with less regulatory risk. After all, regulated utilities are expected to serve as a ballast in conservative dividend portfolios, providing stable returns and predictable, growing income.

PPL could certainly continue meeting those objectives like it has for decades, but the dynamic regulatory and political climate in the U.K. makes the firm’s long-term outlook cloudier for now.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends