Qualcomm (QCOM), an embattled tech giant, has seen its share of drama over the years. Most recently, the company’s stock has sold off 30% since early September 2018, causing its dividend yield to soar to a record high near 5%.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Let’s take a look at Qualcomm’s latest slump to review if anything appears to have changed with its dividend safety profile or long-term outlook.

Legal Risks Drive Qualcomm’s High Yield

Many semiconductor stocks have experienced some weakness due to fears of a cyclical industry downturn in 2019, as well as worries over slowing smartphone sales made worse by the U.S.-China trade war.

But while these factors may have contributed to Qualcomm’s weakness, the biggest reason for the stock’s fall in recent months is the legal risk to the firm’s Qualcomm Technology Licensing (QTL) business.

Thanks to over 130,000 current and pending patents (mostly in 3G and 4G technology), Qualcomm’s licensing segment has historically accounted for just 20% of sales but about 80% of company-wide profits and cash flow.

With a near monopoly on 3G and 4G chips, this business has historically enjoyed royalties of 3% to 5% of a smartphone’s wholesale price.

Since there is very little overhead needed for accepting royalties, operating margins in QTL have generally run about 85% (prior to recent legal issues).

Trouble began brewing for QTL several years ago when various regulators and customers began accusing Qualcomm of antitrust practices over its so-called “no license, no chips” policy.

Since Qualcomm controlled the technology essential to allowing smartphones to work on worldwide networks (baseband processors), the firm was accused of abusing its position of power, forcing customers to pay royalties if they wanted its processors at all, refusing to license its patented technology to competitors, and charging excessive royalty rates in general.

Basically, Qualcomm faced allegations of using its monopoly-like position to harm competition, embroiling the firm in numerous legal fights with customers as well as regulators.

Qualcomm faced significant fines from regulators in China, South Korea, Taiwan, and the EU with further fines likely coming from U.S. regulators. In all countries except America, Qualcomm has settled for a grand total of $3.8 billion. China also ruled that Qualcomm’s royalty could only be applied to 65% of a phone’s wholesale price.

The company is appealing the $1.2 billion EU fine and remains locked in a two-year battle with Apple (AAPL) over $7 billion of royalties that the iPhone maker has withheld due to what it claims are monopolistic licensing practices.

However, none of that is new information. What’s likely the cause of Qualcomm’s most recent struggles is the firm’s current Federal Trade Commission (FTC) antitrust trial, which wrapped up at the end of January 2019 and has the company and investors waiting for a ruling.

Investment manager Kerrisdale Capital recently released a short reportclaiming that the outcome of the trial could be utterly disastrous for Qualcomm, and that its QTL business was “teetering on the brink of disaster” and “living on borrowed time.”

Kerrisdale’s report claims that U.S. regulators may force Qualcomm to totally change its licensing practices to line up with industry norms under the fair, reasonable, and non-discriminatory, or FRAND, practices. What would that potentially mean for Qualcomm in a worst-case scenario?

“It could realistically cut Qualcomm’s licensing revenue, earnings power, and stock price in half.” – Kerrisdale Capital

That’s why the asset manager has shorted Qualcomm with a $21 price target (representing about a 60% decline from recent prices).

Why is Kerrisdale so convinced that Qualcomm is facing disaster in this latest trial? Largely because of transcripts from the case that include such apparently damning quotes as this from Qualcomm employees:

“We absolutely cannot give a chip supplier a full license to our IP with pass-through rights to his customers as that would have the potential of severely impacting our subscriber licensing program.”

Judge Lucy Koh issued a preliminary ruling in November 2018 stating that Qualcomm should change its licensing practices. However, we don’t yet know how exactly the company will have to adjust its business model and what kind of impact such an action will have on the high-margin royalty fees it generates.

What is clear is that Qualcomm’s fundamentals have deteriorated in recent years, driven in large part by the firm’s dispute with Apple. A major hit to the economics of Qualcomm’s QTL segment would stress the business even further.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

What is management saying about the trial? During the proceedings, Qualcomm brought out several industry experts that it believed debunked the FTC’s case. Here’s what Qualcomm’s CEO Steve Mollenkopf told analysts on the firm’s most recent conference call:

“We believe that the FTC’s case is based on a flawed antitrust theory and that it failed to meet its burden of proof for its claims…Over the course of 2019 we will reach a resolution on the key outstanding issues in our disputes with Apple through settlement or litigation and we are prepared for both (trial) outcomes.”

Most likely, given the preliminary ruling from Judge Koh in November 2018, Qualcomm will end up settling the case (possibly after an appeal) as it has settled all previous cases with regulators.

“With respect to settlement talks with the FTC, as you might imagine, we have been engaged with them for some time. We continue to be engaged. And if we think that we can find a resolution we would take that to try to remove this risk off the table.” – Qualcomm CEO Steve Mollenkopf

With the stakes so high for Qualcomm over this trial, let’s take a look at the implications for the firm’s dividend.

Is Qualcomm’s Dividend Still Safe?

It’s important to remember that trials are long and it’s easy to cherry-pick key transcript quotes out of context to make alarming claims, as certain short sellers have apparently done.

Not all analysts think that Qualcomm’s QTL business is doomed. Here’s what Morningstar senior equity analyst Abhinav Davuluri has said about the FTC trial and Qualcomm’s legal fight with Apple:

“After reviewing transcripts of the closing arguments and the trial itself, we reiterate our view that we expect Qualcomm to maintain its licensing business model. CEO Steve Mollenkopf also noted that management expects to reach a resolution with Apple through settlement or litigation in 2019 as additional court rulings in the U.S., China, and Germany come to fruition.”

But what if the worst-case scenario occurs and Qualcomm loses the trial in a way that devastates its QTL business model? In that scenario, the company has said it would appeal such a ruling and seek a less damaging settlement with the FTC (something along the lines of China’s settlement). The result would be lower QTL revenues and margins, but not likely the 50+% decline that Kerrisdale is predicting.

Qualcomm’s cash position is currently $10.4 billion even after completing about $22 billion of its previously announced $30 billion buyback plan, which was conceived after the firm’s proposed merger with NXP Semiconductors was killed by Chinese regulators in 2018.

The company’s cash position is likely large enough to fund the rest of the buyback (which management has continued to pursue due to its confidence in the future of QTL) as well as repay debt maturing this year.

However, Qualcomm’s cash would probably not be enough to allow the company to continue supporting the current dividend (about $3.5 billion per year), finish the buyback (nearly $8 billion), and sustain its 15-year dividend growth streak if its QTL cash flow falls by a significant amount.

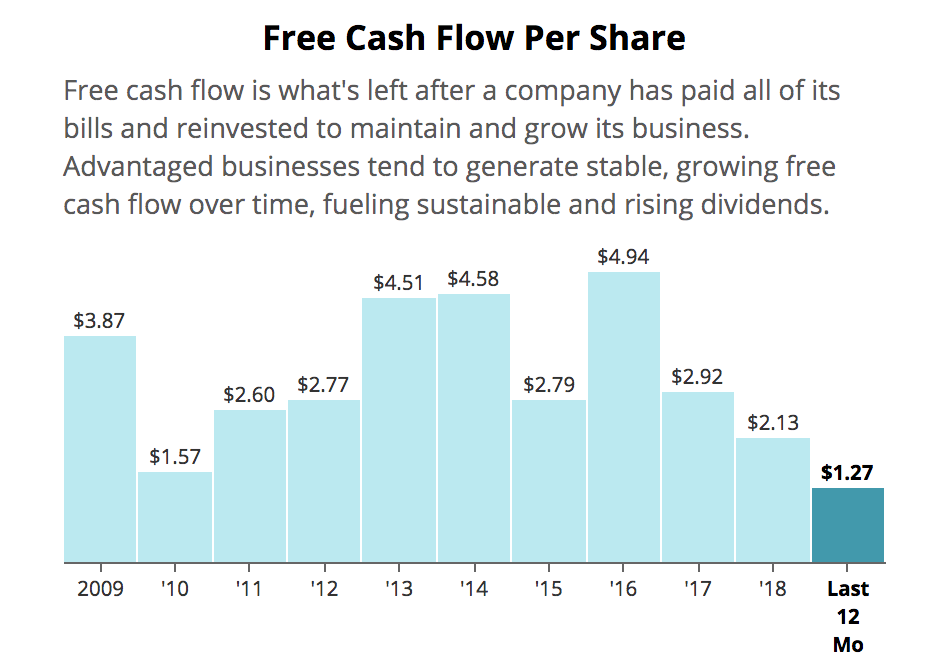

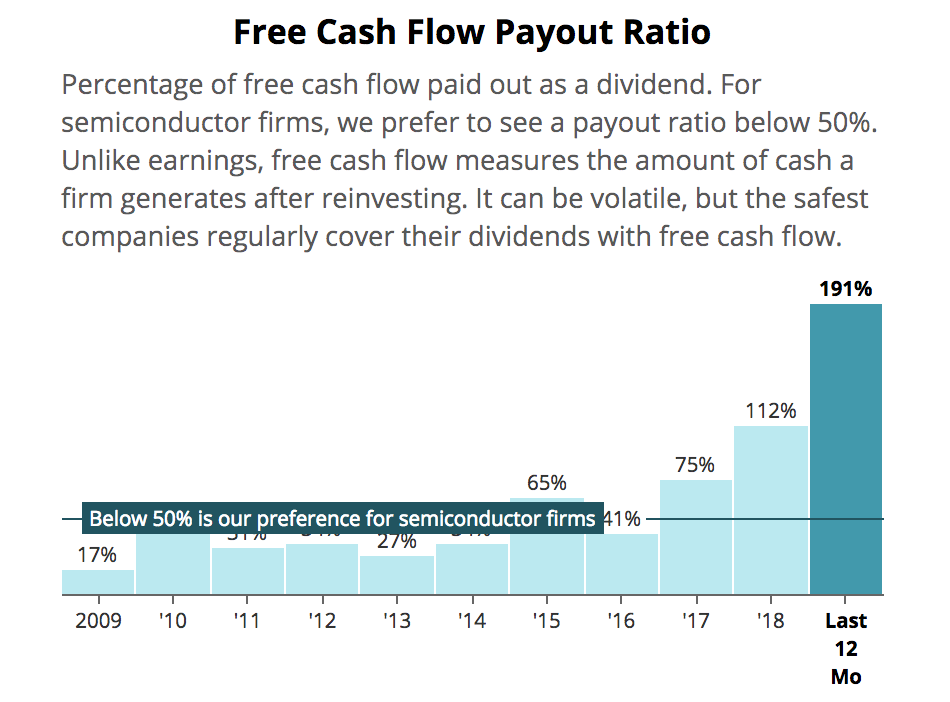

After all, due largely to Apple withholding payments to the company, Qualcomm’s free cash flow payout ratio already exceeds 100%.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Thus, should Qualcomm end up losing its various trials this year, structurally changing the economics of its QTL business for the worse, then the dividend could be at risk of a cut. The firm’s free cash flow payout ratio is currently not covering the dividend, and its cash on hand has declined from $33.4 billion to $10.4 billion over the last year due mostly to share buybacks, reducing its financial flexibility.

Besides its strong balance sheet, one reason why Qualcomm has continued to pay its dividend at all, much less raise it 9% last year, is due to the fact that both management and analysts expect the company’s free cash flow per share to soar in 2019 and 2020 (by over 100% in the case of analysts).

Qualcomm’s expected improvement in free cash flow is due to a combination of factors including $1 billion in cost cutting that management plans to deliver in 2019, tax maneuvering, and backpay royalties from potentially Apple and other companies (Qualcomm claims Apple owes it $7 billion in unpaid royalties).

If analyst forecasts are correct (far from certain), then Qualcomm’s free cash flow payout ratio would fall to about 70% in 2019 and 54% in 2020 based on the firm’s current dividend rate. Combined with the company’s strong balance sheet (A- credit rating), Qualcomm’s dividend would likely remain safe if the worst-case scenario doesn’t unfold in the courts.

Overall, the risks to Qualcomm’s business model from this litigation result in a downgrade of the firm’s Dividend Safety Score from 65 (low end of “Safe”) to 50 (“Borderline Safe”) until more information is known. These are tricky situations to analyze, and investors who remain comfortable with the company’s complexities should make sure their positions are sized appropriately given the risks involved.

Should Qualcomm reach a favorable resolution with the FTC and Apple later this year, the firm’s dividend will very likely remain on solid ground. However, if its lucrative QTL segment is forced to change its ways and Apple continues withholding its royalty payments, then Qualcomm may need to reduce its dividend to a level that is more in line with its lower cash flow run rate going forward.

Concluding Thoughts

It’s understandable why investors are worried about QCOM’s QTL business model, which has historically accounted for about 80% of the firm’s profits.

If Qualcomm loses the FTC case (and its appeal) and its QTL licensing practices must be permanently abandoned (worst case scenario) or at least significantly diluted, then the company’s thesis would break and it could be forced to cut its dividend.

Given the binary nature and unpredictability of trial outcomes, including the possibility of a settlement with U.S. regulators, Qualcomm’s increasingly wide range of potential outcomes seems to make the stock a less ideal option for conservative income investors whose top priority is a safe dividend in all environments (and legal outcomes).

At the same time, Qualcomm remains confident that it will prevail in court. That’s why in 2019 management and analysts expect to see a permanent resolution to the firm’s legal woes that could not only result in a substantial infusion of cash (back payments on withheld royalties) but also the elimination of its biggest risk and stock price overhang (litigation damaging QTL’s economics).

As long as the worst-case scenario doesn’t actually occur, the company’s intellectual property, including a strong position in 5G wireless technology, means income investors will likely continue enjoying a safe and growing dividend going forward. However, as conservative investors our preference is to invest in simpler businesses whose futures don’t hinge on low-probability, high-severity events.

— Brian Bollinger

Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

Source: Simply Safe Dividends