Volatility, as you no doubt have noticed, has returned. It’s returned in commanding fashion.

CBOE Volatility Index (VIX), a go-to measure of expected stock market volatility, hit a 10-month high last week. The VIX has more than doubled in price since early December.

Volatility, per se, holds scant interest to most individual stock investors. In this market, the downside holds sway.

Despite being the month most associated with giving, December has been mostly associated with taking. The S&P 500 has lost 15% of its value over the past three weeks.

More investors are concerned that the trend in motion will stay in motion.

The American Association of Individual Investors’ (AAII) sentiment survey shows that bearish sentiment, at 47.3%, holds near a five-year high.

Bearish sentiment is hardly unreasonable against a backdrop of an escalating trade war, a flattening yield curve, and an extended federal government shutdown and stock market volatility. Economic growth is perceived as more uncertain today than any time over the past eight years.

What’s an investor to do?

The answer depends on your investment strategy.

My strategy focuses on income, dividends in particular. I play the long game with dividend stocks. As long as my high-yield dividend stocks continue to maintain their high yield (no dividend cuts), I’ll stay the course.

A similar directive oversees my dividend-growth stocks. If my dividend-growth stocks continue to grow their dividends (annually), I’ll stay the course.

My strategy of staying the course is hardly without reason.

High-yield dividends have historically outperformed most other stocks in a down market. Data gleaned from Standard & Poor’s and analyzed by Federated Investors show that high-yield dividend stocks generated a 4.4% average positive return from January 1926 through December 2017 when markets were down. The average loss was 14%.

The resilience of high-yield dividend stocks is attributable in part to a cash return. The reality of cash-in-hand, as opposed to unrealized speculation of a future price, helps to cushion the downside when the market is broadly trending lower. Dividend stocks display more stability than non-dividend-paying stocks, whose return is predicated solely on price.

We can do even more. Dividend growth has historically one-upped high yield.

Ned Davis Research data show that dividend-growth stocks offer the highest returns with the lowest volatility. Dividend-growth stocks beat not only other dividend stocks, they beat all stocks.

Dividend-growth stocks produced a 10.1% average annual return from 1972 through 2018. The return was higher than with all dividend payers (9.3%), dividend payers with no change (7.5%), non-dividend payers (2.8%), and dividend cutters (-0.3%). Dividend growers produced the highest return with the least volatility.

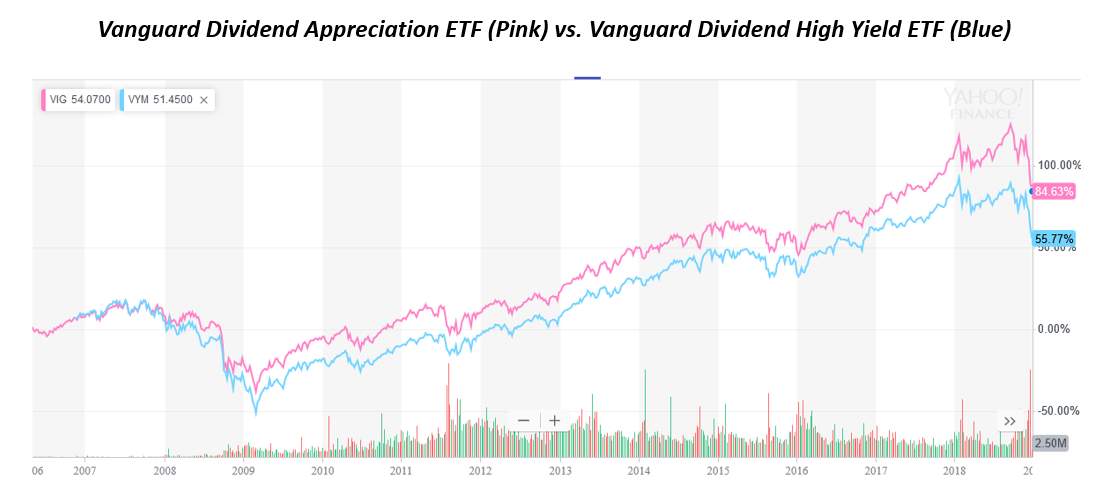

If we overlay the Vanguard Dividend Appreciation ETF (NYSE: VIG) with the Vanguard High Dividend Yield ETF (NYSE: VYM), a parallel pattern emerges. The difference is that we see more of the upside and less of the downside from the Vanguard Dividend Appreciation ETF.

The Vanguard ETFs serve as proxies. I prefer to build dividend portfolios with individual securities. Higher yield is on offer from the high-yield side. More dividend growth is on offer from the dividend-growth side.

Don’t let stock market volatility bring you down. The right dividend stocks will help keep you aloft.

— Steve Mauzy

Source: Wyatt Investment Research