Here we go again.

I spooled up my trading desk Wednesday morning and learned from the headlines screaming across my monitors that the “Great Bull” market is “dead,” according to Michael Hartnett.

You may know the name, you may not.

I did.

Hartnett is Chief Investment Strategist for Bank of America Merrill Lynch and a brilliant thinker.

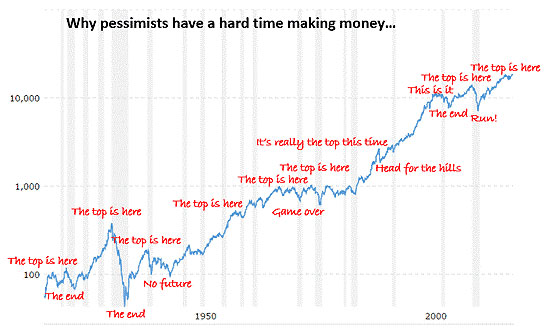

Still, we’ve heard this before…

A lot.

In fact, we’ve heard about the end of the bull market for over a decade from all sorts of folks like author Robert Kiyosaki, who claimed, in 2002, that a 2016 bull market crash would be the “worst market crash in history”… two years ago.

Researcher Harry Dent, who has famously been predicting a crash of epic proportions for years, doubled down in late 2017 with a prediction that the “biggest crash ever” is (probably) coming by 2020. This after predicting that the Dow would crash to 3,000 in 2013.

Former Reagan budget czar David Stockman has consistently warned of a “doozy” of a market crash because of a failure to rein in spending, tax cuts, or any number of other things. “Whistling past a graveyard” is what I think he said, even as he’s repeatedly called for a 50% market plunge.

Even “Bond King” Bill Gross of Janus has been “wrong and wrong badly.” And, mind you, that was according to his boss, Janus Henderson CEO Richard Weil in remarks to CNBC this past August.

All of whom have been dead wrong.

Is Hartnett?

I don’t think so.

He and I are almost completely aligned when it comes to what’s next… an era of lower returns, higher rates, and too much debt. Investors will have no choice but to brace for wildly different market conditions ahead, something you and I have discussed many times.

You know why just as well as I do.

The President continues to hammer China with trade tariffs and, in doing so, is taking a page straight out of his best-selling 1987 book, The Art of the Deal. Only China may not blink like the politicos think.

The Fed is “tightening” rates up by focusing on cyclical inflation, even as they ignore structural deflation. I think what they’re really doing is very simple… trying to raise rates fast enough and high enough that they get ahead of the next crisis and have room to lower them again.

Earnings are slowing, and that means a polarization of companies into groups that will “make it” and those that “won’t.” Banks stocks, for example, are already laggards, but they could break down completely if the relationship between their operations and higher rates/margins shatters.

The implication – at least according to the headlines – and the perma-bears who seem determined to be “right,” is that you’d better run for the hills and save what you have left while you still can.

I can’t think of a more expensive mistake.

I know the temptation to cash out and bury your money in a mattress or under a fencepost somewhere is very high. But that’s the wrong move.

Being “right” about a crash doesn’t matter.

Being “profitable” does.

In fact, any savvy investor using proper risk management can be completely wrong about market expectations and still be profitable.

There’s a big difference.

Every $10,000 invested in Alphabet Inc. (NasdaqGS:GOOGL) when it debuted is now worth $231,552.48.

Every $10,000 invested in Microsoft Corp. (NasdaqGS:MSFT) when it went public is now worth $2,795,330.55.

Every $10,000 invested in Amazon.com Inc. (NasdaqGS:AMZN) when it hit the markets is now worth $9,911,700.08.

The trick is NOT trying to time the markets by predicting when they might crash.

Instead, what you want to do is constantly manage expectations.

Right now, that means subtly changing your focus so that you and your money are lined up with the strongest growth on the planet and the companies making that happen.

Hartnett calls this focusing on “inequality, innovation and immortality,” and he has a clear bias towards technology disruptors, value stocks, and markets outside the United States.

Just like we do.

Why?

Because that’s where the big money is being made and will be made for decades to come, even if there is a correction or, worse, a recession.

Trade wars come and go.

So does inflation.

And earnings?… they’ll slow down, but they will not stop.

Take defense stocks, for example.

They line up nicely with War, Terrorism & Ugliness, one of the single most powerful of the Six Unstoppable Trends we follow. Global defense spending will hit $1.84 trillion next year, according to Statista, and is growing at a compound annual growth rate of 2.56% a year until 2022 – a “CAGR.” That doesn’t sound like much in percentage terms, but that 2.56% accounts for a jaw-dropping $91,324 a minute!

What’s more, companies like The Boeing Co. (NYSE:BA), Raytheon Co. (NYSE:RTN), Lockheed Martin Corp. (NYSE:LMT), and more, are powering to new, all-time highs. I’ve mentioned every single one of ’em during national media appearances in past weeks and in all of my paid publications.

Contrary to what most investors think about new highs being likely to reverse, the opposite is true. New highs are almost always a very, very powerful and extraordinarily bullish signal. It’s also one that tells you the markets are lining up with longer term trends you can’t afford to miss.

What’s more, this also tells you if there IS actually a correction, it’s a buying opportunity in light of the bigger picture. Even a broken watch is right twice a day – ultimately Kiyosaki, Stockman, and Dent will be, too.

I know you’re on board if you’ve been following my research for any length of time, and that’s terrific because it means you’re enjoying the tremendous profits that come with it.

If not, don’t worry.

I have you covered.

Right now, the best way to get on board with defense stocks like those I’ve just mentioned is the iShares U.S. Aerospace & Defense ETF (BATS:ITA). It’s up 16% year-to-date and has tacked on 23.26% over the past 12 months.

Top holdings include Boeing, United Technologies, and Lockheed Martin – all of which are likely to power far higher in the months ahead.

“Great Bull” or not.

Until next time,

Keith

Source: Total Wealth Research