You’re probably familiar with Expedia (NASDAQ:EXPE), particularly Expedia.com, a site through which you can book flights, hotels, rental cars and more.

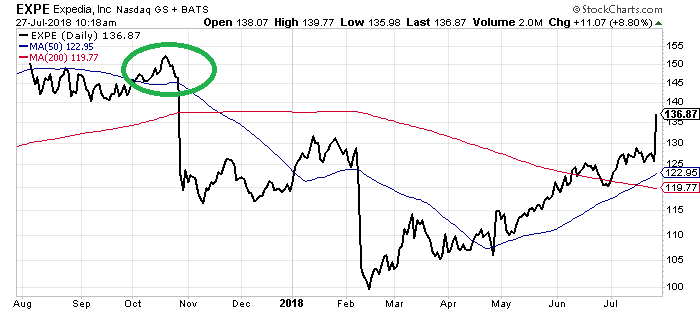

The stock got absolutely crushed back in February, taking a 15% one-day hit after reporting first-quarter earnings.

Since then, it has been trending steadily higher.

It quickly rallied from $100 to $110 to recapture its 200-day moving average (the red line on the chart below), and from there continued momentum allowed it to climb back to its 50-day average (the blue line), which it confirmed as support in late June.

That pushed the stock back above where it was trading before the meltdown.

EXPE spent the next couple of weeks consolidating between $125 and $129.50, but I suspected it was setting up for another rally. Earnings out after the close on July 26 was exactly the catalyst we needed.

Strong Earnings Drive Gains for EXPE

I had been keeping a very close eye on this stock ahead of its report, as EXPE stock’s earnings history has been mixed recently — it missed estimates in three of the trailing four quarters, with an average positive surprise of 2.45%. Last quarter, though, Expedia reported an earnings surprise of 43.8% to the upside.

In the second quarter, EXPE hit it out of the park, as adjusted earnings of $1.38 a share easily beat the Street’s expected $0.89. Revenue gained 11% to $2.88 billion, which was in-line with estimates, while gross booking increased 13% to $25.9 billion.

The stock soared more than 9.5% the following morning, and I couldn’t be more thrilled with the post-earnings reaction. The chart looks great, and the shares are now trading at prices not seen since last October.

Thanks to the big breakout, I see the current trend taking the stock back up to the $145 range, which is still below the 52-week high of $161 from last July.

— Charles Payne

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place