If you want to clobber the stock market – and double your money every two or three years – then buying companies with accelerating dividends is an absolute must.

And I’ve got good news for you: there’s never been a better time to buy them.

That’s because dividend growth is on a sugar high: research firm IHS Markit recently predicted that global dividends would jump 10% this year—a new record.

What’s more, if you’re looking to grow your nest egg fast, you’re in luck, because accelerating dividends are the beating heart of my personal 3-step system for banking 12% annual returns for life.

I’ll tell you all about this safe, simple approach, and why that 12% number is vital, in just a moment. First, let’s talk about why I’m so focused on an accelerating payout.

Getting a fatter income stream is an obvious reason, but it’s just the start. Because as I wrote in December, a rising payout acts like a lever on a company’s share price, prying it higher and higher with every single dividend hike.

The pattern is plain as day in this chart of NextEra Energy (NEE), a supposedly “boring” utility that’s been quietly sending its shareholders bigger and bigger dividend checks over the past five years.

Look at how NEE’s stock has jumped with each and every dividend hike NextEra has delivered—and how its latest monster payout hikes have magnified those gains:

Bigger Dividend Hike, Fatter Share Price Pop

NextEra just delivered a 13% dividend hike earlier this year. But you and I can do even better.

We’ll start by looking at each part of my 3-step “accelerating dividend strategy,” designed to uncover the stocks that will deliver that 12% annual return we’re craving.

Why 12%? That’s because, as I show you in my in-depth investment report, “The Simple (and Safe) Way to Earn 12% Every Year From Stocks,” it’s enough to double your portfolio every 6 years and throw off a dividend stream that’s 3 times larger than the experts say you need in retirement.

That’s more than good enough for a risk-averse dividend fan like me. So let’s get going, starting with…

Step 1: Build Your Own High Yields

Plenty of dividend hounds simply run out and find the stock paying a high current dividend yield (6%, 7%, 8% and more) and call it a day.

But that can be a recipe for disaster.

Take telecom provider CenturyLink (CTL), which is getting a lot of headlines these days because of its ridiculous 12.3% yield. But that’s entirely because, as I told you back in November, the shares have been walloped (as you calculate dividend yield by dividing the annual payout into the current share price). Check out how the dividend yield has risen as the share price has dropped through the floor.

CTL: The “Dividend Trap” Is Set

This is a textbook example of why you’re often safer with a lower-yielding stock that grows the yield on your initial buy over time.

Let’s again consider NextEra for a moment, if you’d bought that stock five years ago, you’d be pocketing a nice 5.5% on your original buy today, thanks to the company’s accelerating payouts. That’s more than double NEE’s current yield of 2.8%.

Or better yet, you could go with a stock like Lam Research (LRCX), which dropped a fat 120% dividend hike on shareholders in March and has plenty of room for even bigger raises, thanks to another misunderstood measure (2, actually) I’ll show you now.

Step 2: Know Your Ratios

If you’ve been buying dividend stocks for a while, you probably know about the payout ratio. You calculate it by dividing the total amount of dividends paid out by the company’s last 12 months of net income.

If the result comes out to, say, 50% or less, you’ve got a safe dividend that’s likely to grow. As you get climb closer to 100%, the noose around the payout gets tighter.

Simple, right?

Problem is, earnings are an accounting creation and can be easily manipulated to overstate cash flow generation. But they can, at times, understate it, too.

Right now, for example, Lam has a net income–based payout ratio of 15.9%. That sounds great, but it doesn’t tell the whole story, because the company’s free cash flow payout ratio clocks in at a minuscule 12.3%!

Why the difference?

Because free cash flow (FCF) tells you how much cash a company is generating once it’s paid the cost of maintaining and growing its business. You calculate it by subtracting capital expenditures from cash flow from operating activities.

The bottom line is that FCF is a much better snapshot of how much cash a company is truly making. And while Lam gets a fantastic grade on both ratios, its higher net income–based payout ratio masks its even-higher dividend-growing power. And that’s why I expect more massive payout hikes out of this stock for years to come.

By the way, this is precisely the opposite of the almost certain payout cut our long-suffering CenturyLink investors can expect. That company’s FCF payout ratio is 128%—so it’s paying out way more in dividends than it generates in FCF.

Step 3: Buy Growth Instead of “Bond Proxies”

Lazy financial writers like to say that higher bond yields will hurt dividend stocks. This blanket statement may sound reasonable, but it’ll cost you money if you take it at face value.

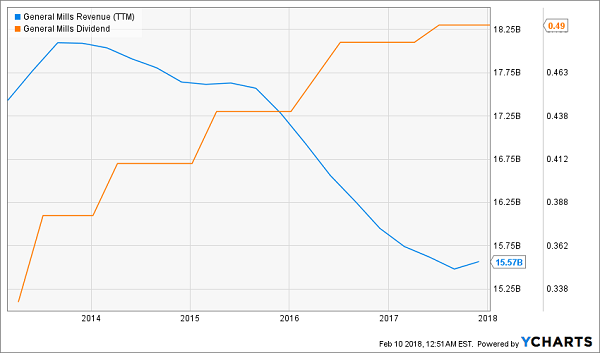

Pundits have called sleepy dividend stocks like General Mills (GIS) “bond proxies” in recent times. GIS has paid 3% (more or less) over the last three years. That compared favorably with the 10-year Treasury note, which paid 2% (more or less) over that time period.

So, the story goes, investors had been buying stocks like GIS instead of safe bonds like Treasuries to scrape an extra 1% or so. But with Treasuries rallying to 3%, these same investors have “demanded” a higher yield from GIS. It now pays 4.6%, which means its stock price has dropped as the Treasury’s price has risen:

Bonds and Their Proxies: Like Oil and Water

This is a waste of time. It begs the question:

Who the heck was buying GIS for an extra stinking percent per year? Not contrarian income seekers.

Green Giant peas? Cheerios? Seriously? This company dominates food staples of yesterday. GIS is behind the curve on every current food trend. The numbers don’t lie – it’s been evident in the firm’s slowing dividend growth and falling revenue:

Beware the Slowing Dividend

What does GIS have to do with dividend growth tomorrow? Not much.

Remember, share prices tend to move higher with their payouts. So there’s a simple way to maximize our returns and hedge against higher interest rates: Buy the dividends that are growing the fastest.

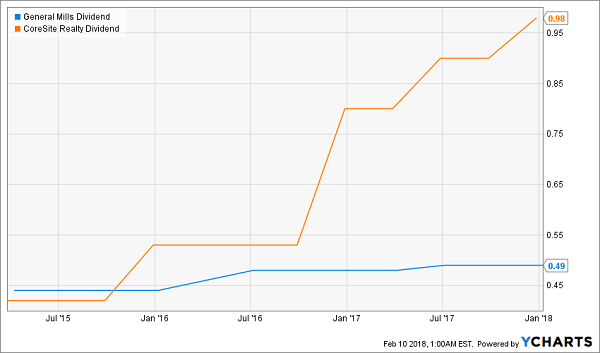

Let’s take internet landlord CoreSite (COR). Its dividend has “lapped” GIS over the last three years. No matter how much trash the bond market talks, it will never catch this runaway yield:

Proxy? Please.

When Hidden Yields subscribers bought CoreSite on my recommendation in March 2016, it paid a $0.53 quarterly dividend. That was a 3.1% starting yield for us based on our purchase price.

In less than two years, the firm has nearly doubled its dividend. It now pays $0.98 per quarter, which means we’re earning more than 5.8% on our initial capital.

Plus as our income stream was rising, other investors were bidding up the price of our shares to keep pace with the increasing yields.

This combination of rising dividends and capital appreciation is what earned us 73% total returns in just 26 months – with no active trading beyond our initial purchase.

CoreSite Cooks the Bond Proxies

The 10-year’s yield is up about 1% since we bought CoreSite. Our stock gains haven’t been slowed by the bond bully because our dividend simply outran it.

— Brett Owens

7 More Buys to Double Your Nest Egg Fast [sponsor]

Of course, you can use the 3 steps I just showed you yourself, by using an online stock screener and poring over corporate earnings reports on your own.

But it can take hours to run an analysis like that on just a handful of stocks (and of course, you’ll also want to take a peek at dividend, earnings and FCF history, as well as valuation measures like price to book value and price to free cash flow).

Plenty of folks (myself included) love the challenge! But if you’d rather just cut to the chase and start pocketing your 12% annual return for life now, I’ve got you covered there, too.

Because my team and I have discovered 7 stocks set to deliver that steady 12% yearly return. All 7 boast an explosive mix of accelerating dividends, timely buybacks, strong current dividends and absurdly low valuations that just can’t last.

Here’s a glance at 3 of the 7 dividend-growth plays I’ll reveal when you click here:

- The US company that’s cashing in on surging Chinese water demand. This is one of the most boring businesses you’ll find—making water heaters—but its dividend hikes are anything but: the payout has soared 167% in just 4 years! And there are far bigger payout hikes to come!

- The 800% Dividend Grower. This unsung company has boosted its dividend eightfold since a new management team took over just 5 years ago! This stock is a complete no-brainer for anyone looking to get bigger and bigger dividend checks from here out.

- And a “double threat” income-and-growth stock that rose more than 250% the last time it was anywhere near as cheap as it is now!

All you have to do is CLICK HERE NOW and I’ll give you all the research I have (in plain, easy-to-follow English) on these 7 bargain “dividend accelerators,” including their names, ticker symbols, buy-under prices and more.

Source: Contrarian Outlook